[ad_1]

Investment Thesis

The Direxion Daily Junior Gold Miners Index Bull and Bear 3X Shares ETFs (JNUG/JDST) are two very effective ETFs that can juice a trader’s returns 3 times over on daily gold miner sentiments (especially when on the right side of the bet). Fundamental analysis reveals JNUG to be the better investment and fund inflows reflect a bullish view on the gold miners industry, which leans towards a position in JNUG. However, while these funds may be extremely effective for day traders, they are NOT suitable for long-term investors.

Introduction to the Fund

JNUG and JDST are ETFs that “seek daily investment results, before fees and expenses, of 300%, or 300% of the inverse (or opposite), of the performance of the MVIS Global Junior Gold Miners Index” (from the funds’ website). JNUG is the bullish fund (+3X) and JDST is the bearish fund (-3X). The associated index tracks companies which focus on gold and silver mining or hold assets related to these activities. As noted on the funds’ website, these funds are highly-leveraged and only designed to deliver their targeted return for a single day. The warning that I gave above bears repeating: these funds are NOT designed for long-term investors. The sole purpose of these funds is to allow traders to respond to changes in the underlying index and to magnify the gains (or losses) from the trader’s short-term outlook.

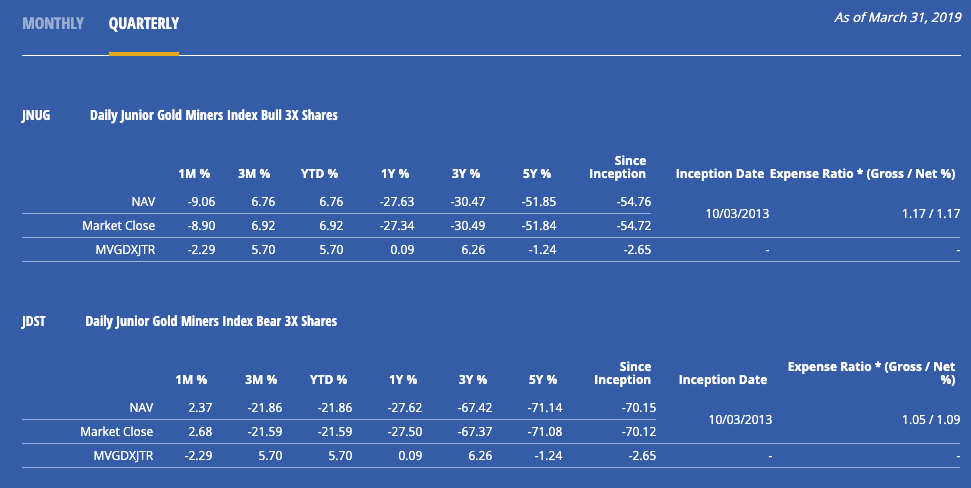

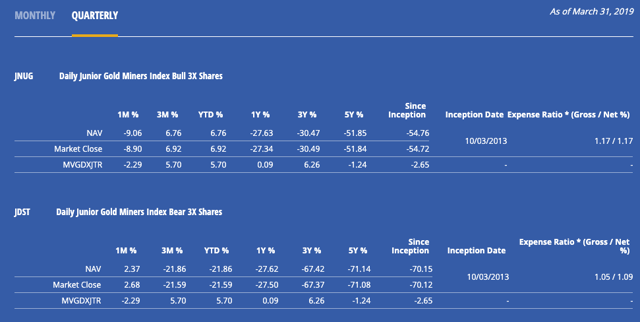

The funds were established on 10/03/2013 and will reach their 6th year of operations later this year. JDST carries a net expense ratio of 1.09%, with JNUG’s expense ratio slightly higher at 1.17%. As shown on the funds’ website, major holdings of the associated index include Kinross Gold (NYSE:KGC), Comp de Minas Buenaventura, and Evolution Mining (OTCPK:CAHPF) (OTC:EVMNY). The index is also heavily weighted towards Canadian equities at 50.26%, while Australian issues make up 23.91% of the index.

Performance & Distributions

As you can see below, the returns for these two funds are all over the map, and neither has been successful in tracking its index except over the past four months:

I note that because these funds are leveraged and only designed to track the daily performance of the benchmark index, tracking their long-term performance is difficult and I don’t give much credence to the information provided above.

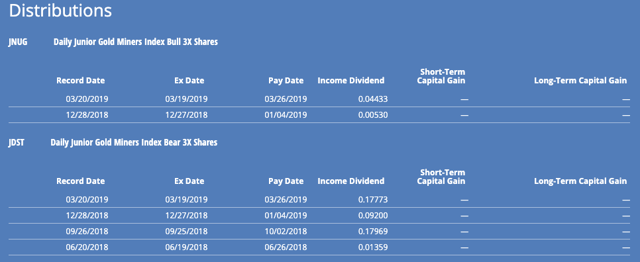

On a more positive note, both funds do pay dividends if you are lucky enough to be holding the fund on the record date:

JNUG has issued two dividends over the past year, totaling $0.04963. Based on JNUG’s most recent closing price of $6.84 on 05/03/2019, this fund has a distribution yield of 0.73%. As for JDST, the total of its last four dividends is $0.46301, resulting in a yield of 0.87% based on the most recent closing price of $52.92 on 05/03/2019.

Financial Statements

At this point, I have identified that these funds are only appropriate for day traders and extremely short-term market views. The next appropriate step is to review these funds’ financials, which are located on a unified annual report dated October 31, 2018. Major sections of the report are summarized below with page numbers in parenthesis.

Schedule of Investments (pp. 117-119)

Schedules for both funds show only holdings in gold-mining related ETFs and cash funds (which is typical of ETFs) and no other unusual holdings. Additionally, the second page of the report provides a schedule of the swap contracts that each fund holds.

Statements of Assets and Liabilities (p. 156)

JNUG is shown to be the bigger fund, with total assets of $893.6 million compared to JDST’s $78.4 million. This also indicates a relative bullish attitude towards the gold miners industry. Liabilities constitute between 20 and 30% of total assets for each fund, resulting in net assets of $635.8 million and $59.6 million for JNUG and JDST, respectively.

Statements of Operations (p. 171)

JNUG reports total investment income of $10 million to JDST’s $1.5 million. After expenses, consisting mostly of investment advisory fees, JNUG and JDST post net investment income of $2.8 million and $484,000, respectively. For every $1 of investment income, JNUG retains $0.27 and JDST retains $0.33, making the smaller fund slightly more operationally efficient than the larger.

However, the most important part of this statement is the bottom half. When including investment-related capital transactions and value changes, JNUG actually lost $463.6 million due to realized losses from swap contracts. JDST, on the other hand, grew its net assets by the $33.6 million in gains on its swap contracts.

Statements of Changes in Net Assets (p. 194)

As previously mentioned, JNUG lost money on its operations during the year covered on the financial statements. When this is the case, this statement regarding net assets is useful because it points out sources of additional funds and other possible areas of concern. In JNUG’s case, the loss on operations was offset by a net increase of $347.6 million from investor contributions. This resulted in a total decrease to net assets of only $116 million this year.

JDST’s schedule reflects almost the exact opposite scenario, but it also a decrease in net assets. It reports positive income from operations in the previous section but reports a net outflow of investor funds totaling $89.1 million, which results in a reduction of net assets totaling $55.6 million.

Financial Highlights (p. 211)

Finally, this section shows the changes to the NAV over the past five one-year periods. As I have mentioned in other review articles, this section is especially helpful in allowing investors to determine the source of fund distributions. Because these two funds are mostly for day trading, I am more concerned with the general direction of the NAV and any other transactions affecting NAV.

To briefly summarize, the schedule for both funds shows massive price swings in beginning NAV, as would be expected of a leveraged fund. JNUG begins its 2014 fiscal year at $612 and has valleys in the $15s and peaks in the $70s over the next several years. JDST follows a similar pattern, beginning the 2014 fiscal year at $34,152 (yes, thousand) and ending 2018 at $64.48. Clearly not viable long-term investments as we have already determined, but offering sharp price swings that can be advantageous if you are on the correct side of the trade.

Summary

Leveraged ETFs JNUG and JDST offer investors the opportunity to realize 3X the performance of the underlying gold miners index, JNUG providing bullish coverage and JDST serving as the bearish bet. The analysis shows that JNUG is the better fund on a relative basis, though both funds are best utilized when the position is bought and liquidated on the same day. While these funds may be extremely effective for traders and in short-term situations, due to their high expense ratios, extensive use of leverage, and whipsawing NAV prices, they are NOT suitable for long-term investors.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News