[ad_1]

DariaRen

The following data is derived from trading activity on the Tradeweb Markets institutional European- and U.S.-listed ETF platforms.

European-Listed ETFs

Total traded volume

Trading activity on the Tradeweb European ETF marketplace reached EUR43.5 billion in October, while the proportion of transactions processed via Tradeweb’s Automated Intelligent Execution (AiEX) tool rose to a record 84.9%.

Volume breakdown

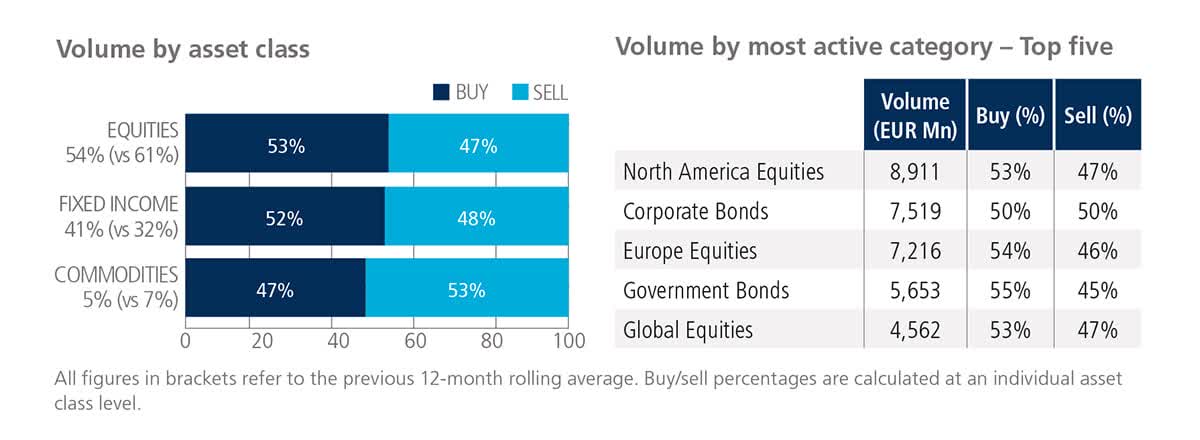

Commodity-based ETFs were the only asset class to see net selling in October, with ‘buys’ lagging ‘sells’ by six percentage points. Conversely, equity and fixed income products were mostly bought, and activity in the latter climbed to 41% of the overall traded volume, outperforming the previous 12-month rolling average by nine percentage points.

North America Equities was the most heavily-traded ETF category during the month, followed by Corporate Bonds and Europe Equities.

Top ten by traded notional volume

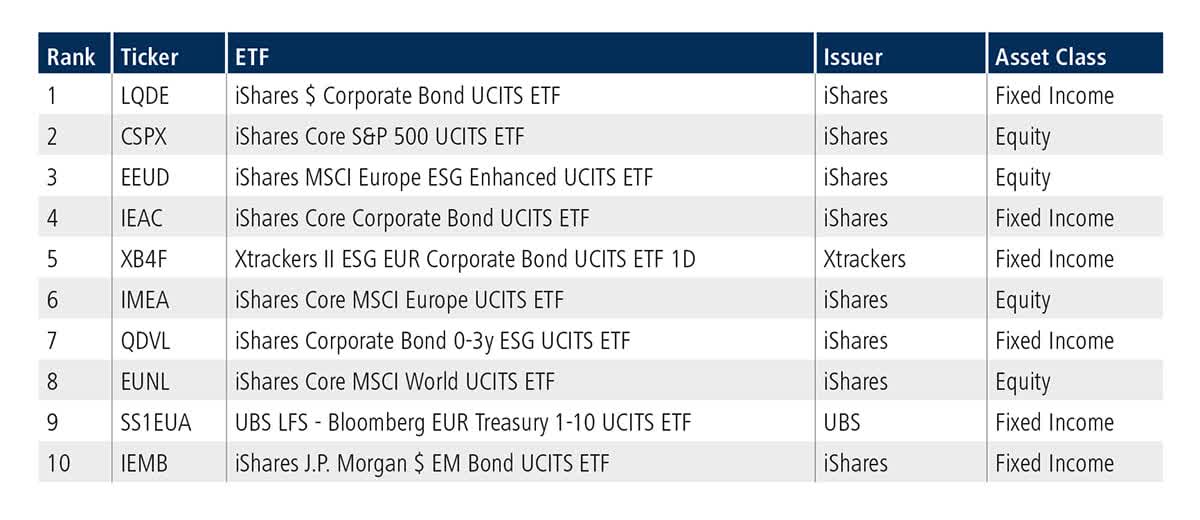

The iShares $ Corporate Bond UCITS ETF proved to be October’s most aggressively-traded fund on the platform, the first fixed income product to top the list since February 2021.

Adam Gould, head of equities at Tradeweb, said: “There were three ESG-focused products among October’s top ten by traded notional volume. As demand for sustainable investment solutions grows, we continue to witness an increasing number of issuers expanding their range of ETFs incorporating ESG considerations.”

U.S.-Listed ETFs

Total traded volume

Total consolidated U.S. ETF notional value traded in October 2022 was a record USD64.4 billion, beating the platform’s second-best performance in May 2022 by USD5 billion.

Volume breakdown

As a percentage of total notional value, equities accounted for 44% and fixed income for 48%, with the remainder comprising commodity and specialty ETFs.

Adam Gould, head of equities at Tradeweb, said: “October’s record-breaking trading activity on our U.S. ETF platform was largely driven by ongoing adoption of the request-for-quote (RFQ) protocol by our institutional clients. Trading ETFs electronically on Tradeweb offers buy-side investors efficient access to liquidity, competitive pricing, straight-through processing, post-trade analytics, and robust electronic audit trails for best execution.”

Top ten by traded notional volume

During October, 1,643 unique tickers traded on the Tradeweb U.S. ETF marketplace. The iShares iBoxx $ High Yield Corporate Bond ETF rose seven places from September to be ranked first, after last occupying the top spot in July 2022.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

[ad_2]

Source links Google News