[ad_1]

allanswart

Thesis

We updated in our previous article on the ProShares UltraPro QQQ ETF (NASDAQ:TQQQ) in late July that it had already bottomed in June. Therefore, we urged investors to capitalize on its near-term volatility to add exposure, helping them generate significant alpha moving ahead.

Notably, the TQQQ went on a remarkable 37% August rally following our article toward its August highs, driven by its 3x leverage. However, the rally fizzled as the market digested its summer gains. As a result, we are nearly back to where we were when we published our article in late July.

Despite the recent pessimism in the market, we are confident another fantastic opportunity to add exposure to the TQQQ has arrived, as it closes in on oversold zones, coupled with constructive price action. Therefore, we exhort investors to parse its bottoming process and layer in accordingly, taking advantage of the recent pullback.

We reiterate our Buy rating on the TQQQ.

August’s Rally Was Undone Post-Jackson Hole

Fed Chair Jerome Powell’s hawkish address at Jackson Hole in late August triggered the recent rampage as the market parsed the Fed’s steadfast determination to battle high inflation decisively. As a result, the market has continued to price in a high likelihood of another 75 bps rate hike, which has increased markedly to an 84% probability (as of September 8).

Therefore, we surmise the current pullback is healthy, as the market digested the overbought froth of the TQQQ’s momentum from its summer rally. Consequently, we observed that much of its overbought momentum has dissipated, setting up the TQQQ for a potential bottom.

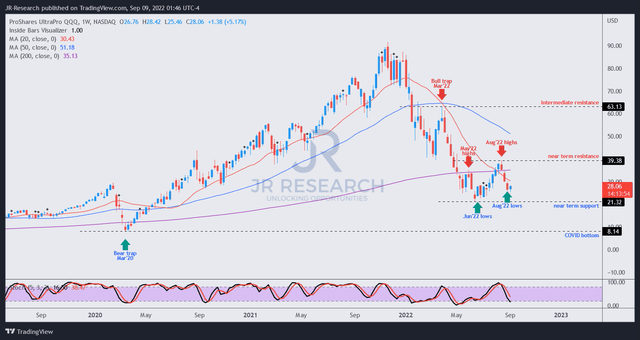

TQQQ price chart (weekly) (TradingView)

As seen above, the TQQQ is attempting to bottom out above its lows in June. Therefore, the price structure is constructive of a higher-low base, fundamental for recovering its medium-term uptrend. Furthermore, before its recent pullback, TQQQ managed to form a higher high in August (above May’s highs).

Therefore, the opportunity for the TQQQ to form its bottom is timely, as its momentum indicator closes in on oversold zones. The price action seen in the TQQQ this week has also been positive, as buying upside returned to undergird the lows from August last week.

As a result, we believe that the opportunity to add the TQQQ aggressively has emerged again. If the TQQQ can demonstrate its resilience and reject further selling downside, it will be highly constructive toward decisively retaking its 20-week moving average (red line). Regaining control of the 20-week moving average and staying above it is fundamental to its first decisive step in resuming its medium-term bullish bias.

Underlying Headwinds Could Be Less Menacing

Disparate opinions on the direction of the economy have surfaced as economists and strategists provide their views on whether we could be heading to a full-blown recession or not.

Despite that, Goldman Sachs’ revised forecast suggests that the upcoming September FOMC could be the final “unusually large” rate hike of 75 bps implemented before we see a 50 bps cadence moving ahead.

Furthermore, Fundstrat updated in late August that specific sectors of the economy have experienced deflation, suggesting that CPI numbers could cool further moving ahead.

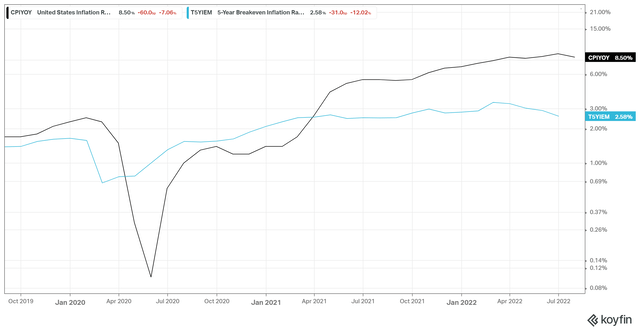

US CPI change % and 5Y breakeven inflation rate % (koyfin)

Nobel laureate Paul Krugman believes the Fed remains in control of its narrative to “wrestle inflation under control” without leading to a surge in unemployment. He highlighted:

The medium-term inflation expectations haven’t sprung up, despite inflation hitting a 40-year high this summer. If expectations remain stable, there will be no need for a period of above-normal unemployment. – Insider

As seen above, the 5Y breakeven inflation rate remains relatively stable at 2.58% in July and has also fallen from its March highs. Therefore, if the US CPI numbers could cool further in August, the Fed’s less aggressive hike cadence moving forward is expected to be a tailwind for the TQQQ.

We believe the market has been positioning for that possibility as the TQQQ attempts to bottom above its June lows. Moreover, further weakness in the oil market has lent further credence to a lower CPI number in August and even September moving ahead, as the market focuses on the potential for additional demand destruction.

Moreover, the energy crisis seems to have peaked in Europe, as the EU political leaders could potentially intervene in the natural gas market. As a result, Europe could institute price caps to curb further appreciation in the natural gas market, which has caused mayhem for Europe’s economy.

As a result, we surmise that several potential upside catalysts could lift buying sentiments in the TQQQ further, despite worsening macro headwinds.

Is TQQQ ETF A Buy, Sell, Or Hold?

We reiterate our Buy rating on the TQQQ.

We deduce that the deep pullback from its August highs has presented investors with another excellent opportunity to add more exposure aggressively.

Furthermore, we presented several potential upside surprises that could lift buying sentiments further in the TQQQ moving ahead.

Also, TQQQ’s price action suggests that it could be forming a bottoming process, supported by oversold momentum indicators.

[ad_2]

Source links Google News