[ad_1]

Surendra Sharma/iStock via Getty Images

The ProShares UltraPro QQQ ETF (TQQQ) is a leveraged ETF that attempts to correlate to three times the daily performance of the Nasdaq 100 Index (NDX), which itself is most frequently allocated into through the Invesco QQQ ETF (QQQ). This ETF looks like a dangerous long term investment, but a possible intraday allocation. Further, they actually offer options on this 3x ETF, which can make for some pretty interesting Friday speculations.

TQQQ’s 3x leverage correlation to the underlying index is based upon daily NAV results. This means that the leverage must be recalculated on a daily NAV basis. The compounding of daily returns may result in returns that differ from the Index. ProShares explains that “returns over periods other than one day will likely differ in amount and possibly direction from the target return for the same period.”

In this current heavy churn, one could see how the index may go nowhere over a week or two, but a triple leveraged strategy could lose several percent each week. If you could imagine a situation where the index goes up 2% on the first day, and then down 2% on the second, the index goes virtually nowhere (down 0.04%), the ETF would have to be buying expensive options that would then immediately lose value, and this decay would itself be multiples of the move to the index.

There is almost no reason to hold TQQQ for longer than a day unless you are reasonably certain the following day will be a positive one. Sure, most of them are positive over the longer term, but not necessarily next week. I imagine some people hold TQQQ longer, but only because they rode a hot streak and are constantly reducing their remaining investment into the ETF. They may be selling covered calls too. That is a house money holding.

There is actually a rich options market for TQQQ, including weekly options. I think it is often a great sellers market, and especially when implied volatility is high, which it is at the moment. Last week, on the 24th, I sold a $45 strike weekly put for $0.94 that always appeared destined to expire worthless, and which was worth half as much the following day.

There are also times at which TQQQ and its options provide an investor with the opportunity to magnify Nasdaq 100 exposure for a specific amount of cash, and a measured total risk. This could be a way press the bet on a position that you think has momentum, or it could be a way to maintain some measure of exposure to the index if you are cashing out of an existing stake.

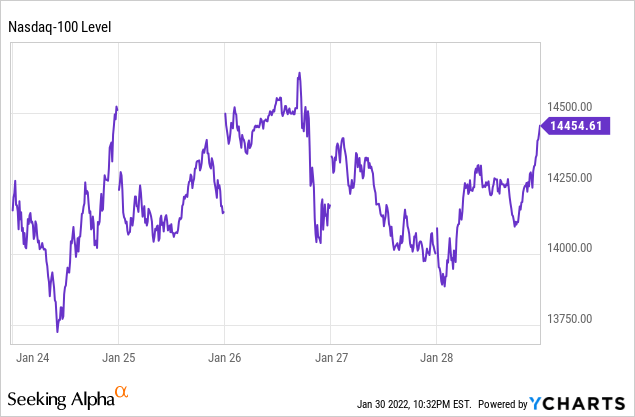

Over the last few weeks, there have been violent moves in the market from day to day, and also within each day. Below is a chart of the Nasdaq 100’s performance last week, which shows a sort of up one day down the next choppiness.

It also shows that on most of the days last week, the index made a rather violent move towards the close. On Monday and Friday, the Index had a strong last hour, while the Nasdaq 100 sharply declined within the last hour on Tuesday and Wednesday. One really had to pay attention to which direction the wind was blowing.

If buying calls or puts on TQQQ, such options are probably best held, at the most, for a day or two, and probably often intraday. The options are usually rather expensive, due to all that leverage, and especially at the moment, due to all that volatility. Nonetheless, all these wild market swings make people do things like raise cash, yet want targeted exposure in the case of a reversal.

Alternatively, an investor may maintain an existing long term index position, but buy some TQQQ puts as insurance. These puts are generally quite expensive, so such a strategy is probably best suited for the day, or a presumed risky overnight.

Conclusion

In a high volatility market that is seeing declining or sideways action, I do not want to be a holder of leveraged equity stakes like this. Nonetheless, TQQQ and its rich options market allow for the over-invested to attempt some hedges, as well as reasonable short term directional bets for those with high cash on the sidelines.

TQQQ’s risks make it best suited as an intraday or overnight directional bet, or a tool for hedging a temporarily lopsided portfolio. The only good reason to hold TQQQ over a longer time frame appears to be if it becomes clear we are entering a low volatility period of rising equity valuations. If that happens, please let me know. Until then, be sure to remember to hold onto your TQQQ shares no longer than you can keep a bunch of bananas at your desired ripeness.

[ad_2]

Source links Google News