[ad_1]

Country-specific exchange-traded funds are a great way for investors to take a position on local market equity return factors. While many of the world’s largest foreign companies trade on U.S. exchanges as ADRs (American Depository Receipts), country-specific ETFs often provide investors unique exposure to a number of small-cap and less-liquid stocks not otherwise easily available for trading. Currency risk has an added importance for foreign stocks and country-specific ETFs. The return for an investor will be a combination of the local market security price performance along with the change in the foreign exchange rate against the dollar. This article looks at the performance of some of the most important country-specific ETFs and the global macro themes that are driving these returns.

iShares Country ETF Representation

(Source: iShares.com)

The data I’m looking at includes only the “primary” iShares ETF for each country. Other fund managers offer competing country-specific ETFs, but iShares, owned by BlackRock Inc. (NYSE:BLK), is the largest provider. In most cases, the iShares product is the largest and most liquid ETF for each market, but not always. Other companies like WisdomTree Investment (NASDAQ:WETF) and Invesco Ltd. (IVZ) offer similar and competing ETF products.

Of note, iShares offers a small-cap version of the country ETFs for some markets which are not included in the list below. Separately, it also offers other foreign stock ETFs products, including currency-hedged versions of the MSCI indexes, equity factor-based portfolios (value/growth), and regional baskets (Asia/ Europe) etc. The term “capped” in the ETF name signifies that the construction methodology caps the largest holding so that no single issuer exceeds a certain weighting. In some cases, the ETFs that are otherwise “un-capped” may have concentrated exposure above 30% to a single company.

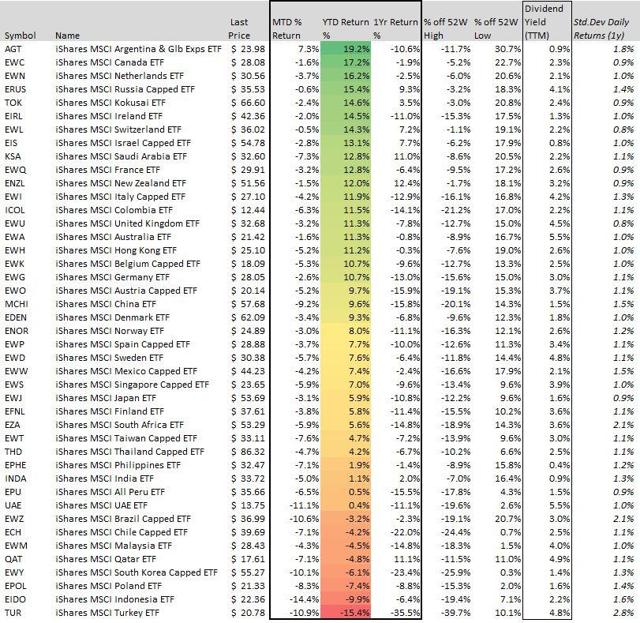

YTD Performance

The data shows that out of 43 country ETFs, 35 have a positive return YTD. This is consistent with the broad global rally in equities this year following a historically volatile Q4 that had most stocks worldwide in a bear market. On the other hand, looking at returns over a 1-year period, 35 of the country ETFs are still posting a negative return. The performance this year can otherwise be explained as a rebound from the depressed levels in late 2018. Curiously, every ETF in this group is down from its 52-week high on average 13%. The average trailing twelve-month dividend yield for the group is 2.8%.

iShares Country ETF Metrics

(Source: Data by YCharts, Table by author)

The iShares MSCI Argentina and Global Exposure ETF (AGT) is the best-performing country ETF this year, up 19.2%. Argentine stocks have been extremely volatile over the past year based on weak macroeconomic conditions, including a collapsing currency since early 2018. Indeed, the ETF is still down 26% from its high in early 2018, when it reached $38 per share. AGT carries something of a “secret weapon” that is its 31% weighting in MercadoLibre (NASDAQ:MELI). Headquartered in Buenos Aires, it’s the largest e-commerce platform in all of Latin America and makes the majority of its revenues outside of Argentina. The stock is up a spectacular 96% YTD on better-than-expected earnings and a growing payments processing business. The country as a whole, however, remains in a recession under high inflation and will continue to be a speculative play for both bulls and bears.

At the other end of the spectrum, the iShares MSCI Turkey ETF (TUR) is the worst-performing country-specific equity ETF, down 15.4% YTD and down 35% over the past year. Turkey has weak economic fundamentals between high inflation, a looming recession, a wide fiscal deficit, and political instability. The Turkish lira is down 26% over the past year. Unlike Argentina, Turkey hasn’t had a big single stock winner to support its equity market. I previously wrote about the country’s macro outlook here.

Month to date, global equity performance has been negative based on the resurgence of U.S.-China trade dispute uncertainties. 42 out of the 43 country ETFs are down in May, with the iShares MSCI Indonesia ETF (EIDO) as the biggest loser, down 14.4%. Asia regions stocks overall have been weak given growing concerns of slowing global growth trade connections with China. The iShares South Korea Capped ETF (EWY) is down 10.1% in May, as the country’s macro outlook has deteriorated following a weaker-than-expected Q1 GDP print showing the weakest growth since 2009. Check out my article on Korea’s macro outlook here. Also notable is the iShares MSCI Brazil Capped ETF (EWZ), down 10.6% in May, which has erased the previous YTD gains. The country’s new President has had a rough transition attempting to pass needed reforms, while economic growth has shuddered. More concerning is the Brazilian real currency, which is approaching its all-time low and may signal a deeper pullback of investor sentiment in the country.

One of the trends I’m seeing is that of a strong U.S. dollar – driven by the relative outperformance of the U.S. economy relative to the world – weighing on global markets. Emerging markets, in particular, are seeing renewed weakness amidst the U.S.-China trade dispute, and regional currencies remain especially vulnerable to higher risk aversion. Commodity prices are also an important risk factor to monitor.

Conclusion

Despite the apparently strong performance in global equity markets year to date, the more recent weakness this month should serve as a warning and could just be the beginning of higher volatility going forward. In April, the International Monetary Fund updated its 2019 global outlook seeing slowing generalized growth, with all major advanced economies, including the U.S., and most major emerging market economies seeing deterioration in their outlook. A trending stronger U.S. dollar should continue to weight on the returns of foreign stocks. The outlook for foreign stocks has risks tilted to the downside, in my opinion.

Disclosure: I am/we are long EWZ. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News