[ad_1]

wildpixel/iStock via Getty Images

2022 started with a considerable rise in interest rates. As measured by the ETF (BND), the bond market fell by around 10% during the first months of this year. Generally speaking, short-term interest rates are still below the inflation rate, but this may change as the Federal Reserve plans to hike the discount rate up to 3% by year-end. Long-term real interest rates, that is, rates after inflation, have also risen from below -1% to just over 0%. This “real” interest rate measure can be found by looking at Treasury inflation-indexed bonds such as those in the ETF (NYSEARCA:TIP), which has declined by around 7.5% so far.

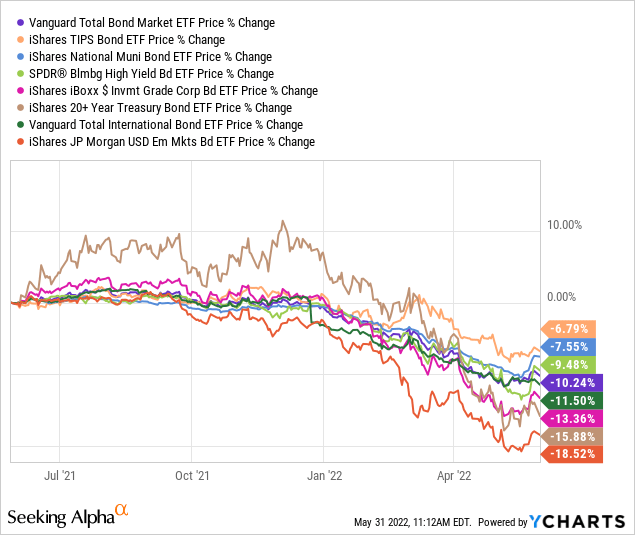

The bond bear market has struck virtually all fixed-rate bonds, including Treasuries, international sovereign, corporate, municipal, and even inflation-indexed bonds. There is some discrepancy with lower-rated and long-term bonds faring worse, but almost all are down by at least 8% to 15% – relatively significant losses for the “safe” bond market. See below:

The 40-year bond bull market is likely dead with interest rates and inflation rising. In fact, the recent drop in bonds has been the largest since 1842. The decline was relatively easy to predict given the abnormally low-interest rates in 2020 and 2021 compared to skyrocketing inflation. Earlier last year, I wrote “BND: The Great Bond Crash May Only Be Beginning,” “BND: Tapering May Cause Earthquakes In The Bond Market,” and some others which described that issue and how bonds were likely to decline as the Federal Reserve ended Q.E. Generally speaking, the bond market is not a free market since the U.S Federal Reserve, Treasury, and foreign peers control most of the market and usually forewarn their intentions.

I still do not see any solid bullish opportunity in most of the bond markets. While interest rates have risen, the bond market’s inflation expectation measure (currently 2.6%) seems far below the actual likely inflation rate over the coming years. If the market readjusts its inflation outlook to better fit the sharp acceleration in commodities, most bonds may see another significant decline. However, with real yields now reaching positive territory and the global economy reentering a slowdown, inflation-indexed Treasury bonds, such as those of TIP, may be a much better opportunity.

Why Inflation Will Most Likely Rise Higher

Inflation-indexed bonds are similar to standard U.S Treasury bonds, but they are indexed to the consumer price index. As the CPI rises, inflation-indexed bond funds like (TIP) pay the gain and pay a much lower yield instead of that. Technically speaking, the net return of a “normal” Treasury bond and an inflation-indexed Treasury bond should be the same as long as the bond market is correctly pricing for inflation.

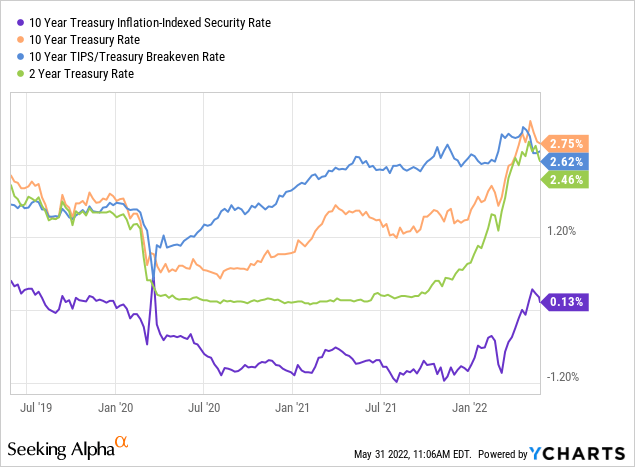

The bond market’s expectation for inflation can be measured by subtracting the yield of a standard Treasury bond from its inflation-indexed counterpart. For example, an ordinary 10-year Treasury bond pays a 2.75% rate today, while an inflation-indexed one pays 0.13%. The 2.62% difference is the expected average inflation rate over the next decade. These measures have risen this year, but the more recent extremely sharp rise in short-term Treasury rates (a measure that tracks the Federal Reserve’s predicted rate hikes) has slowed inflation expectations. In other words, the bond market is currently expecting that the Federal Reserve’s impending rate hikes (and similar actions) will stop inflation.

See the data below:

The current year-over-year CPI inflation rate is 8.3%, so aggressive measures must be taken to get that down to 2.6%. In my view, a 2.5% to 3% short-term interest rate is not high enough to stop it. While President Biden recently released his plan to contain inflation, I do not believe these points or measures relate to the core causes of inflation. The Federal Reserve may need to take more aggressive steps, but, based on research, today’s inflation is mainly driven by accelerating energy prices. This acceleration stems primarily from years of underinvestment in the sector, making it impossible to maintain energy production levels. However, the ban on Russian oil has undoubtedly exacerbated the issue.

For more information regarding the energy market factor, sees “XLE: Windfall Profit Tax Risk Overrides Bullish Oil Scenario” or “USO: Why Crude Oil May Be On The Verge Of An Even Larger Breakout.” However, the bottom line is that the only possible successful way to stop inflation is to either dramatically increase investments in fossil fuels or to aggressively crash the economy to drive demand for energy low enough that the shortage ends before inventories run dry.

The latter is, in my view, far more likely as, even if the government stimulates the energy sector, it would likely be over a year before energy production rises to meet today’s high consumption level. This outcome could be achieved through aggressive interest rate hikes and Q.T. in a similar fashion to Paul Volcker, but the Federal Reserve is still unsure about pursuing that approach. Considering deliberately crashing the economy would likely be highly politically futile, I believe it is more likely that the Federal Reserve continues to take a “more dovish than necessary” approach.

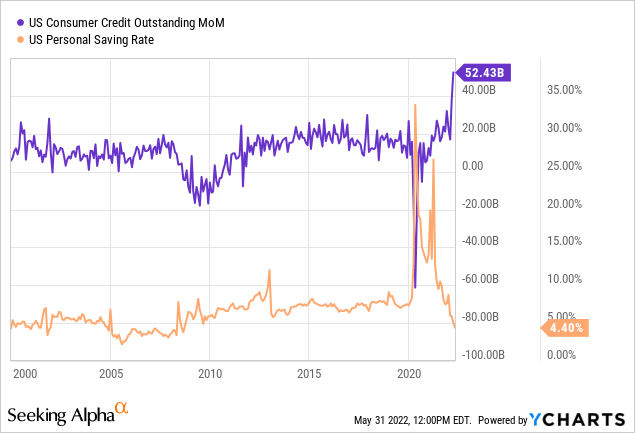

Instead, looking at the energy and food markets, prices will rise so high that the economy crashes on its own as people are forced to reduce spending. Indeed, we are already seeing this trend today as high prices have resulted in severe declines in personal savings levels and significant increases in consumer credit. See below:

This data tells us that many Americans are now unable to save money and use credit to offset. Of course, this situation cannot be sustained long before people are forced to reduce spending dramatically. Thus, the economy is seeing a decline in GDP and most other forward economic indicators. Still, I do not believe these declines are not yet significant enough to cause inflation due to the magnitude of the shortages.

Why ‘Real’ Interest Rates May Be Peaking

The core economic issue today is relatively simple, since 2020, there has been a broad decline in the amount of stuff to buy, but no decline in demand for those goods and services, so prices rise. Considering the U.S government (and most foreign governments) do not have the power nor will to force companies to make more goods and services, the only way to stop prices from rising is for demand to decline. Many people are reducing savings and increasing credit card usage to maintain consumption levels, but this cannot last long since prices will rise until consumption reaches supply.

So, in my view, either the Federal Reserve takes even more aggressive measures to stop inflation, or consumer debt levels (and shortages) rise to such an extent that it is literally impossible for many to buy certain goods. The latter, demand destruction, the alternative, is already at play and, as it accelerates, should cause inflation to rise quite a bit higher than the previous 8.3%. I believe this will come with another significant spike higher in crude oil, gasoline, and natural gas prices.

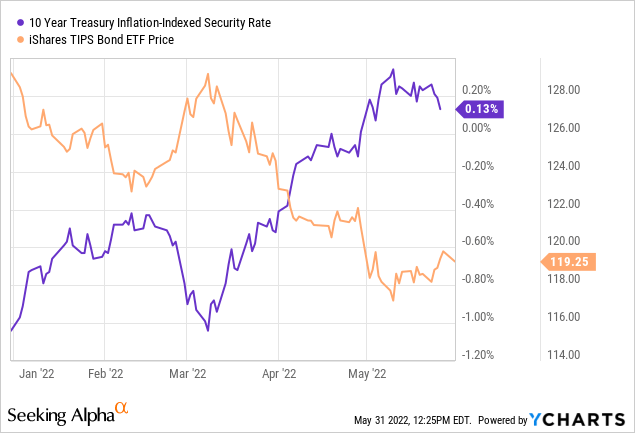

Once more people realize that inflation may not have peaked, the bond market’s inflation expectation rate may rise above its current plateau. It is currently at around 2.6%, down from about 3% last month. Personally, I would not be surprised to see it rise to the 4%+ level. However, considering the Federal Reserve is openly careful about pushing rates up too high, I do not expect bond rates to grow as quickly. In other words, I expect the inflation outlook to increase well above today’s medium-term interest rates, so “real interest rates” should decline, perhaps back to the -1% level. If this occurs, the ETF TIP (which tracks inflation-indexed rates) may bump back to the $124 to $130 range. See below:

Of course, if bonds do see significant losses, then TIP may struggle to rebound. However, as long as the economy is slowing due to rising inflation (demand destruction) and not due to increasing rates, the fundamental outlook for TIP is strong.

The Bottom Line

In today’s stagflationary economy, investors looking to preserve capital would be wise to mitigate exposure to inflation and a slowing economy. Next to more speculative assets like crude oil futures (USO) and gold (GLD), inflation-indexed bonds such as TIP may be the best bet. I was somewhat cautious on TIP late last year as it seemed the end of Q.E. would result in a rise in real interest rates. We have now seen that play out, and, considering the Federal Reserve has now made it clear it will not be too aggressive in stopping inflation, real rates may be on the verge of another dive lower.

For investors interested in TIP, it should be noted that its TTM dividend yield is a largely meaningless measure since its yield tracks CPI inflation and real rates. If CPI inflation is 2%, then TIP delivers around 2%. If CPI inflation rises to 15%, TIP delivers about 15%. Of course, it also pays a small yield from the bonds that is nearly zero today. If that real yield rises, then TIP may decline. However, for now, a decline in real yields seems more likely, which would benefit the fund’s price (but slightly lower its yield). The ETF has a maturity of 7.7 years, so it closely tracks the 10-year inflation-indexed Treasury bond rate. Overall, I am moderately bullish on the fund and believe it is one of the bond market’s last “safer” areas for more risk-averse investors.

[ad_2]

Source links Google News