[ad_1]

Richard Drury/DigitalVision via Getty Images

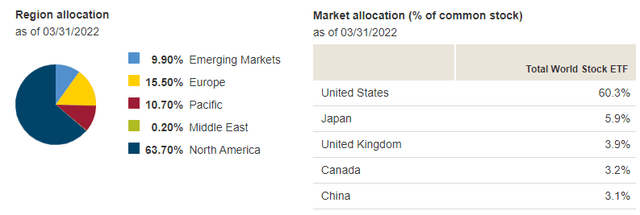

I often suggest investors pick a single equity ETF and just call it a day. That fund is the Vanguard Total World Stock ETF (NYSEARCA:VT). This globally-allocated product comes at a dirt-cheap expense ratio of just seven basis points, according to Vanguard. It’s a market-cap-weighted fund based on the world stock market. That means 64% is in shares from North America (primarily the U.S.) while roughly 30% is in foreign developed markets – namely Japan and the U.K. Ten percent is in Emerging Markets with a sizable chunk in Chinese equities.

VT: What’s In It?

Vanguard

Amid so many macro risks to consider right now, should you put money to work in the global stock market today? I say yes. Considering that the U.S. stock market is near bear market territory and international markets have fared far worse, I assert today’s valuations are attractive setups for long-term investors. You might even get an intermediate-term recovery that could pay off handsomely.

Finding Value

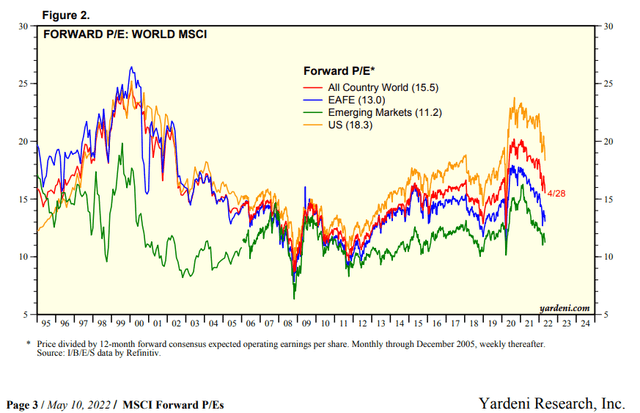

Consider that global price-to-earnings multiples are downright cheap. That goes for many ex-U.S. markets as well as small- and mid-cap domestic indices. According to great charts from Ed Yardeni, the All-Country World Index (which VT for all intents and purposes tracks) sports a reasonable forward P/E ratio of 15.5-times as of April 28. That valuation has turned even cheaper as of May 11 considering that global equities have fallen several percentage points to kick off May.

Valuations Spanning The Globe

Yardeni.com

The EAFE (Europe, Australasia, and the Far East) index (EFA) is cheaper at just 13.0 times next year’s forecast earnings. Of course, the “E” in the P/E ratio is never a sure thing. Many pundits feel earnings estimates may drop over the coming months for various regions, namely Europe (VGK) as that continent endures sharp inflation and immediate geopolitical turmoil caused by Putin’s invasion of Ukraine.

Emerging Markets (VWO) trade at just 11.2-time earnings estimates. That’s historically exceptionally low and not far from the cheapest reading in about a decade. Meanwhile, the U.S. trades at a relatively lofty 18.3-times earnings. But consider that domestic “SMID” caps (VXF) are quite cheap as illustrated below.

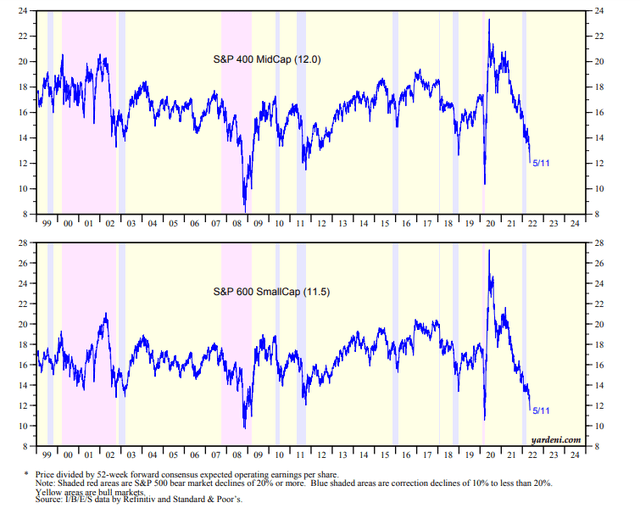

U.S. Mid- And Small-Caps Attractively Priced

Yardeni.com

The S&P 400 MidCap Index (IVOO) and the S&P 600 SmallCap Index (VIOO) are venturing closer to extremely cheap levels. We’ll see how earnings arrive as 2022 presses on, but long-term investors should jump at the chance to own these inexpensive areas of the market. VT holds all of them. But what does the technical picture of VT look like? Is there more room to the downside? Chart time.

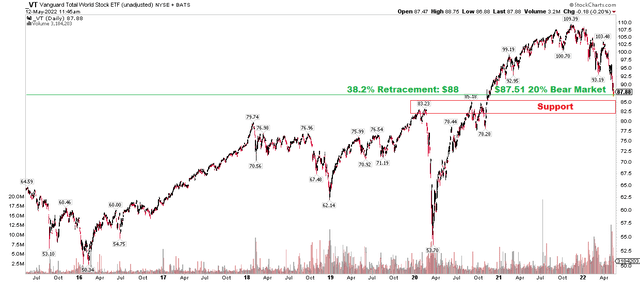

The Technical Take: VT Approaches Support

Stockcharts.com

I see support just below where are right now. The psychologically important 20% bear market threshold is close to the last tick while the 38.2% Fibonacci retracement point has confluence there. Moreover, there’s historical support at prior resistance between $83 and $85. Technicians call this the polarity principle – what was once resistance should be future support. That’s the hope for the bulls at least.

The Bottom Line

Vanguard Total World Stock ETF looks good here for long-term investors seeking exposure to all global stocks. Sometimes keeping a portfolio simple is the approach you can most likely stick with through the good times and the troubled times (like right now). Attractive valuations, low cost, and price falling into support warrants a bullish view.

[ad_2]

Source links Google News