[ad_1]

Justin Sullivan/Getty Images News

Water scarcity has been, and continues to be, a growing global problem. Population and economic growth, increasing pollution, and global warming, have all exacerbated the planet’s ability to supply us with adequate volumes of potable water. Technology is increasingly being used to help alleviate the shortfall. In the Middle East, countries are building large-scale salt-water reverse osmosis (“SWRO”) facilities to obtain significant volumes of potable water for their citizens. In many countries, including the U.S., technology is being used to treat gray-water in order to reuse the precious commodity. However, the World Water Development Report is forecasting a global water crisis within the next couple of decades. That being the case, investors who want to benefit from this trend should consider allocating some capital to the First Trust Water ETF (NYSEARCA:FIW).

Investment Thesis

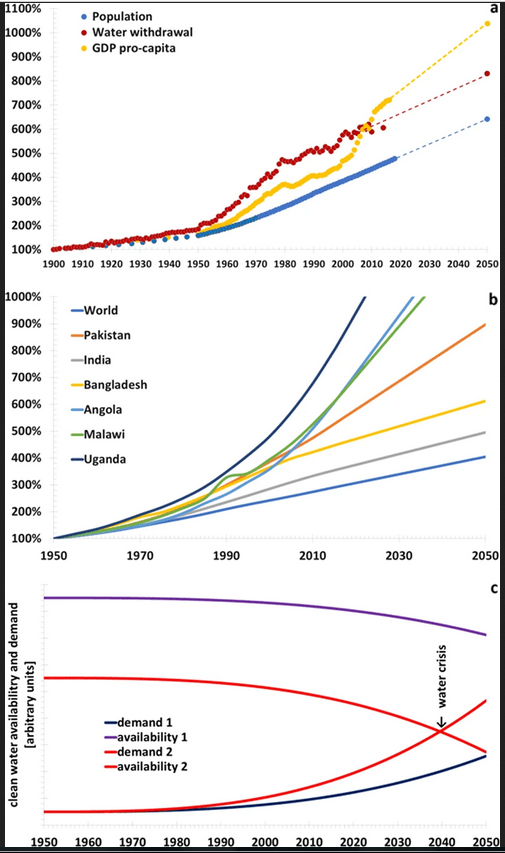

As they say, a picture is worth a thousand words. Sorry for the rather large graphic below, but along with the commentary in the Nature.com article it came from (Reassessing The Projections of the World Water Development Report), I believe it is an easy way to portray to investors the scope of the global water scarcity problem:

The Global Water Scarcity Problem (Nature.com)

Notes for the three graphics (a, b, and c) are taken directly from the article previously referenced:

a Water withdrawal, GDP pro-capita, and world population. The water withdrawal data to 2014 is from.71 The GPD pro-capita data to 2016 is from.73 The population data to 2018 is from.72

b The population of the world and selected countries of Asia and Africa. The data to 2018 is from ref. 72 The values for 2050 are obtained by linear extrapolations from recent years.

c Graphical concept of water scarcity, resulting from a more than linear growing demand and a similarly more than a linear reduction of clean water availability

Long-story short, increasing population and economic growth, global warming, and pollution are all putting strains on the planet’s available water supply – which in itself is falling. The end-result is the forecast shown in figure c, which shows that global water demand is expected to exceed global supply sometime around the year 2040.

Americans are certainly not immune to the problem. Many of you probably know that the “megadrought” in the U.S. southwest has led to Lake Powell falling to the lowest level since the Glen Canyon Dam was built. Lake Powell is the second largest reservoir in the U.S. Lake Mead is the largest, and it too is also at record lows.

For a more detailed and up-to-date report on global groundwater reserves, read the UN Water Development Report 2022.

So let’s take a closer look at the First Trust Water ETF to see how it is investing in companies that are working to solve the world’s water crisis.

Top-10 Holdings

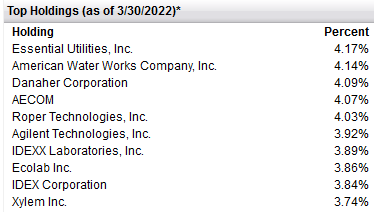

The top-10 holdings of the FIW ETF are shown below and equate to what I consider to be a well-diversified portfolio of 36 companies:

FIW ETF Top-10 Holdings (First Trust)

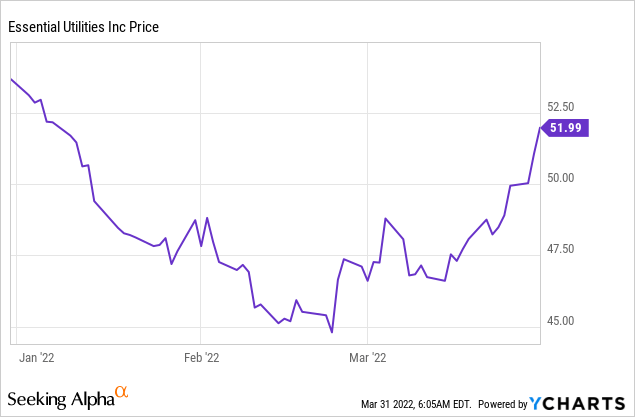

With a 4.2% weight, the #1 holding is Essential Utilities (WTRG). WTRG is a regulated utility company that provides ~5 million customers across multiple states with commercial and water services, wastewater treatment, and other services. WTRG yields 2% and the stock has rocketed higher off a recent low in February:

American Water Works (AWK) is the #2 holding with a 4.1% weight. AWK serves ~3.4 million customers in 1,700 communities across 14 states. In addition to residential customers, AWK also provides water services to industrial companies in the mining, manufacturing, and public sectors. AWK currently trades with a forward P/E=37x and yields 1.45%.

The #6 holding is Agilent Technologies (A) with a 3.9% weight. Agilent provides application solutions and technology in the life sciences, diagnostics, and chemical markets. These include liquid chromatography & mass spectrometry systems, and other laboratory systems to analyze and monitor water quality. Despite a beat in its most recent quarterly report, Agilent has fallen from $177 in September to close Wednesday at $135 and change.

Ecolab (ECL) is the #8 holding with a 3.9% weight. ECL is a big global player in the industry (market cap $52 billion) and provides water hygiene, treatment, and processes to the food & beverage, transportation, chemicals, metals & mining, and various other industries. The company also provides cleaning, sanitizing, and water management products to the healthcare, personal care, and pharmaceutical industries – among others. The stock is down 20% YTD despite announcing a $500 million share buyback plan earlier this month (~1.1% of its market-cap). CEO Christophe Beck commented:

We believe the recent stock market decline results in a very attractive opportunity in Ecolab shares. We are very pleased with our strong financial position and cash flows which allow us to both repurchase shares at what we see as attractive prices as well as continue to invest in our business and to deleverage our balance sheet.

The #10 holding with a 3.7% weight is Xylem (XYL), a company that designs, manufactures, and services water, wastewater, and water infrastructure solutions for the global market. The company also makes wastewater pumps, control systems, filtration solutions, and biological treatment equipment for the water industry. Like Ecolab, Xylem has also had a “valuation reset” and is down 24% YTD. The stock currently trades at a forward P/E=33.7x and yields 1.36%.

Some valuation metrics for the overall FIW portfolio:

- 30-day SEC yield: 0.68%

- P/E = 27.9x

- Price-to-book: 3.9x

- Price-to-sales: 2.6x

- Price-to-cash-flow: 18.6x

As can be seen, while some investors might want to see more income from a “water ETF” (i.e., thinking “utilities”), the yield on FIW is only 0.68%. That being the case, this ETF is much more oriented toward capital appreciation than it is for income.

Despite being down 8.8% YTD, given the multiples above, I don’t consider the FIW ETF to be particularly “cheap” or a value play. It appears to be valued more-or-less in line with the broad market.

Performance

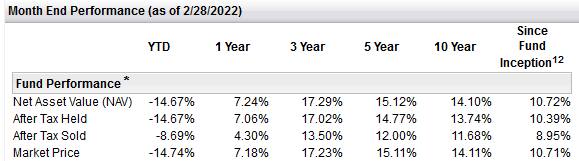

The FIW ETF’s long-term performance track-record is shown below:

FIW ETF Performance (First Trust)

As can be seen, the FIW ETF has had a dreadful 2022 so far (down 14.7%). However, that could represent an opportunity for investors considering the fund has an admirable 14.1% average annual return over the past decade.

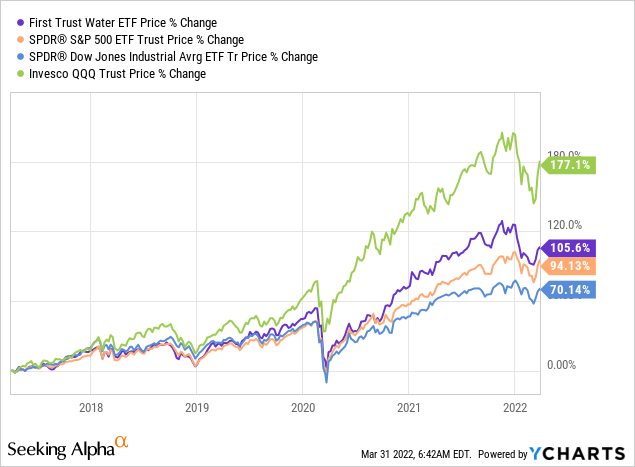

The graphic below compares the FIW ETF’s 5-year performance with that of the major market averages as represented by the SPY, DIA, and QQQ ETFs:

As can be seen, the FIW ETF has outperformed the S&P500 and DJIA over the past 5-years, and that was even more the case at the start of the year before it sold-off harder than both the major averages. Not surprisingly, the triple Qs have significantly outperformed all chosen comparisons.

Risks

The risks for the FIW ETF are those of the market in general these days: potential pandemic impacts of factory shut-downs and on global economic growth, a rising interest rate environment, and massive geopolitical risks as a result of Putin invading Ukraine and the resulting sanctions placed on Russia by the United States and its Democratic allies. Higher oil prices could well lead the U.S. and the world into recession.

Upside risks include higher spending on water infrastructure in the U.S. due to President Biden’s bipartisan infrastructure bill.

FIW’s expense ratio is relatively high (0.54%), but not obscenely so given its relatively strong long-term performance track record.

Summary & Conclusion

The FIW has had a difficult start to 2022. However, the fund has a strong long-term performance track record and I believe the weakness in the fund represents an opportunity for investors to take advantage of market volatility and buy on dips. I wouldn’t go “all-in” at once, but would scale in over a period of weeks or even months until you have reached your desired allocation level. I am bullish on the long-term trends of companies working to solve the global water scarcity problems. After all, water is more vital and essential to human life than is oil (or data).

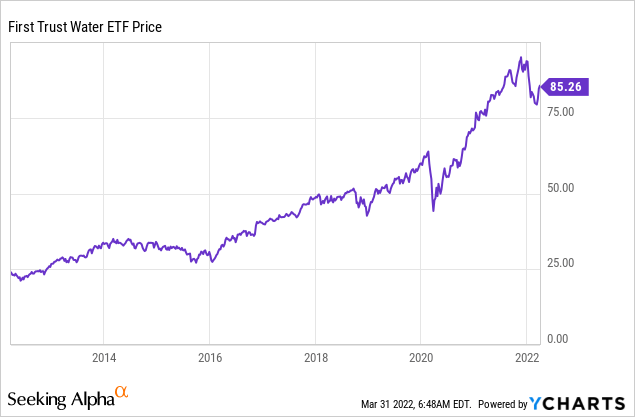

I’ll end with a 10-year chart of the FIW ETF:

[ad_2]

Source links Google News