[ad_1]

chonticha wat/iStock via Getty Images

The US dollar is the world’s reserve currency as it has been the fiat foreign exchange instrument of the world’s leading economy. The requirements for a reserve currency are political and economic stability.

The dollar is not the world’s oldest means of exchange, nor is it the asset that central banks and governments hold as a reserve asset classified as a foreign currency. Gold owns that distinction. For thousands of years, gold has been the means of exchange that symbolizes stability and a store of value. In 2022, countries worldwide validate gold’s role in the financial system as a reserve asset. Over the past years, central banks, monetary authorities, and governments have only increased their holdings.

Since the US dollar is the leader of the fiat currencies, a strong dollar typically weighs on gold, while a weaker dollar often supports the precious metal’s price. However, that could be changing. The world’s leading gold mining stocks often outperform gold’s price on the upside and underperform when gold moves lower. Junior gold mining stocks tend to provide even more leverage than the senior miners. The Direxion Daily Junior Gold Miners Index Bull 2X Shares ETF (NYSEARCA:JNUG) is a short-term trading instrument that behaves like gold on steroids when gold’s price moves appreciably higher.

The dollar index is near a multi-year high, but it is a mirage

The dollar index has been rallying since early 2021.

Weekly chart of the US dollar index (CQG)

The weekly chart highlights the dollar index’s ascent from a low of 89.165 during the first week of 2021 to a high of 99.425 during the week of March 7, an 11.5% gain. The dollar index has made higher lows and higher highs over the past fifteen months and was at the 98.822 level on March 25, not far below the recent high.

The bullish trend in the dollar index reflects the price action against other world reserve currencies. The dollar index includes the euro, Japanese yen, British pound, Canadian dollar, Swedish Krona, and Swiss franc. The index has a 57.6% exposure to the euro currency, the second-leading reserve foreign exchange instrument.

The index only represents the US dollar’s performance against those currencies and is a mirage as it does not reflect the overall purchasing power of fiat foreign exchange instruments. Fiat currencies derive value from the full faith and credit of the governments that issue the legal tender. Rising commodity prices and increasing costs for all goods and services suggest that all currencies are losing value as inflation erodes the purchasing power of the foreign exchange asset class.

Three reasons why the dollar is not what it once was

The dollar became the world’s reserve currency after World War II. The British pound held that position during the 19th century and the first half of the 20th century. While the US dollar has been the leading foreign exchange tool for over three-quarters of a century, it could be losing ground for three reasons:

- China is nipping on the US’s heels as its economy grows faster and should surpass the US economy. China is on the verge of issuing a digital yuan, while the US is only exploring the technological advantages of a digital dollar. China has embraced fintech, while the US is behind the curve.

- Geopolitical tensions have led to a bifurcation of power bases. On February 4, 2022, the Chinese and Russian leaders shook hands on a “no-limits” understanding for support. China is the world’s leading commodity consumer, while Russia is a raw materials supermarket to the world. Russia’s invasion of Ukraine, sanctions on Russia, and retaliatory measures have led to mistrust between the US and China, who will avoid the dollar, limiting its position as a reserve currency.

- Over the past weeks, Nigeria and Saudi Arabia have indicated that they will sell petroleum to China for yuan. As the world’s reserve currency, the dollar has long been the benchmark pricing mechanism for most raw materials. Saudi Arabia, the world’s leading producer, is the central bank of oil. Moreover, Russia provides Europe with the majority of its energy requirements. President Putin has told European consumers that they will need to buy oil and gas in rubles, meaning they will need to exchange euros and dollars for rubles to access energy commodities.

The dollar derives its value from economic and political stability. As the world has become a lot more turbulent in 2022, the death of globalism could decrease the dollar’s role in the worldwide financial system.

Gold is likely to benefit from the dollar’s slow descent

Long before the pound and the dollar were reserve currencies, gold was the ultimate means of exchange. The Bible’s old testament has over four hundred references to gold, which are synonymous with money.

Over the past decades, a strong dollar led to weaker gold prices and vice versa. In 1999, the Bank of England decided that gold was a barbarous relic of years gone by and decided to sell half the country’s reserves. The Chancellor of the Exchequer, Gordon Brown, believed that holding dollars and other fiat currencies provided more liquidity and safety than gold. The United Kingdom auctioned off around three hundred tons of the precious metal, sending the price to a low of $252.50 per ounce.

Quarterly chart of COMEX gold futures (CQG)

As the chart highlights, the 1999 low, nicknamed the “Brown Bottom,” was a turning point for gold. Central banks and governments worldwide did not follow the UK, and the price of gold at over the $1950 level at the end of last week was over 7.7 times higher.

Gordon Brown went on to be the UK’s Prime Minister after his work to sell off half of the country’s golden treasure trove. The Peter Principle states that rise to their level of incompetence. In the former Prime Minister’s case, he may have proven that two levels of incompetence are possible as he had one of the shortest tenures as Prime Minister in half a century, from 2007 through 2010.

Meanwhile, central banks, governments, and monetary authorities worldwide continue to validate gold’s role in the global financial system. They hold the metal as an integral part of foreign exchange holdings.

Mining stocks tend to outperform gold on the upside, and junior mining stocks tend to outperform the seniors

The decline of the dollar and gold’s role in the worldwide financial system has supported the metal’s price since the turn of this century. China is the world’s leading producer, and Russia is third. The geopolitical bifurcation supports gold’s future role in the global economy.

While the most direct route for investing in gold is through the physical market for bars and coins, many ETFs and gold derivatives move higher and lower with the precious metal’s price.

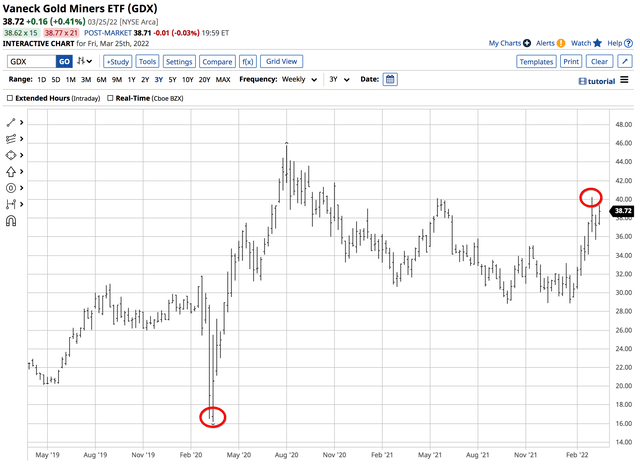

While governments can increase the fiat money supply to their heart’s content, the only way to increase the gold stock is to extract more from the earth’s crust. Gold mining companies provide leveraged exposure to gold as they invest massive capital to produce the precious metal. The leading gold mining shares outperformed the metal during the rally that took gold 43.3% higher from $1450.90 in March 2020 to the most recent high of $2078.80 in March 2022. The VanEck Vectors Gold Miners ETF (GDX) owns a portfolio of the leading gold mining companies. At $38.72 per share on March 25, GDX had over $12.3 billion in assets under management. The ETF trades an average of over 31.2 million shares each day and charges a 0.51% management fee.

Chart of GDX ETF product (Barchart)

The chart shows that GDX rose from $16.18 to $40.26 per share or 148.8% over the same period.

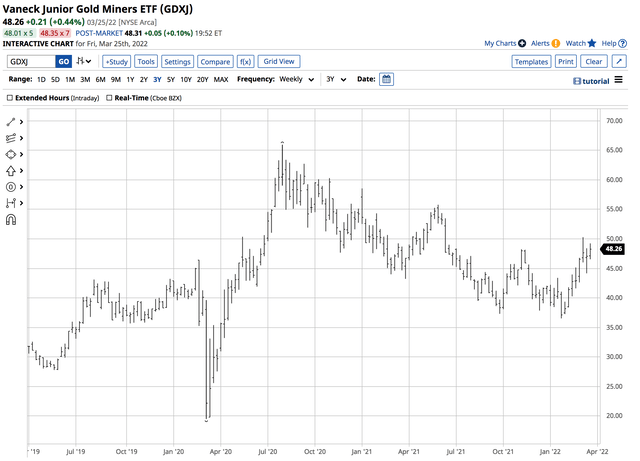

Junior gold mining companies that explore for gold are even more speculative, often outperforming the leading gold miners during bullish periods. The VanEck Vectors Junior Gold Miners ETF (GDXJ) owns a portfolio of the top junior mining companies. At $48.26 per share, GDXJ had over $5.146 billion in assets under management. The ETF trades an average of over 9.57 million shares each day and charges a 0.52% management fee.

Chart of GDXJ ETF product (Barchart)

GDXJ rose from a low of $19.52 to a high of $50.29 per share or 157.6% from March 2020 through March 2022.

While GDX tends to outperform gold on the upside and underperform on the downside, GDXJ magnifies the performance.

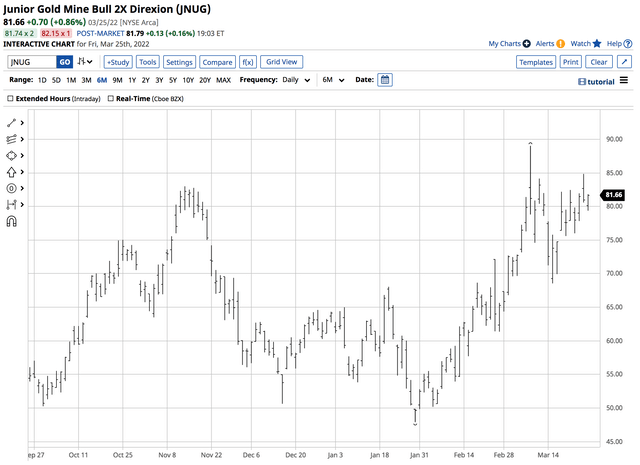

JNUG acts like junior gold mining stocks on steroids – A short-term trading product

Gold’s bull market recently took the metal’s price to a new all-time high. Technical and fundamental factors continue to point to higher highs. The Direxion Daily Junior Gold Miners Index Bull 2X Shares ETF (JNUG) is a short-term product that tracks and magnifies the GDXJ, performing like GDXJ on steroids. The leverage comes at a price, which is time decay, as GDXJ uses options to create the gearing. At $81.66 per share, JNUG had over $472.781 million in assets under management. The product trades an average of over one million shares each day and charges a 1.08% management fee.

The most recent significant rally in COMEX April gold futures in 2022 took the price from $1780.60 on January 28 to a high of $2078.80 on March 8 or 16.75% higher. Over the period, GDX rose 39.5%, and GDXJ moved 37.6% higher.

Meanwhile, in 2020, GDXJ outperformed GDX, moving 237.8% higher, while GDX rallied 182.9% from the March 2020 low to the August 2020 high. If gold is going to take off on the upside, the JNUG product could offer a turbocharged return for short-term traders and investors.

Chart of JNUG Product (Barchart)

From January 28 through March 8, JNUG rose from $47.92 to $89.02 per share or 85.77%. In 2020, JNUG rose from $33.20 to $191.17 per share from March through August or 475.8%.

Timing is everything with leveraged products. JNUG is a trading tool for market participants that believe gold is just beginning the next leg higher in a bull market that has been making higher lows and higher highs for more than two decades. The decline of the US dollar as the world’s currency is bullish for gold.

[ad_2]

Source links Google News