[ad_1]

DNY59

It’s pretty difficult to avoid the value in the hard-hit Technology Select Sector SPDR ETF (NYSEARCA:XLK) when hopes are rising over the end of the bear trend due to increasing odds about the Fed’s pivot. Other factors such as robust earnings, investors’ confidence in risky assets, and a sharp drop in valuations suggest the tech stocks have either bottomed out or there is limited downside left. Additionally, it appears that high rates, a slowdown in the economy, and panic selling have already been priced into the sector’s performance. Therefore, I believe now is one of the best times for bold investors to invest in tech-focused ETFs for hefty returns over the long term.

The Downside Risk Is Limited

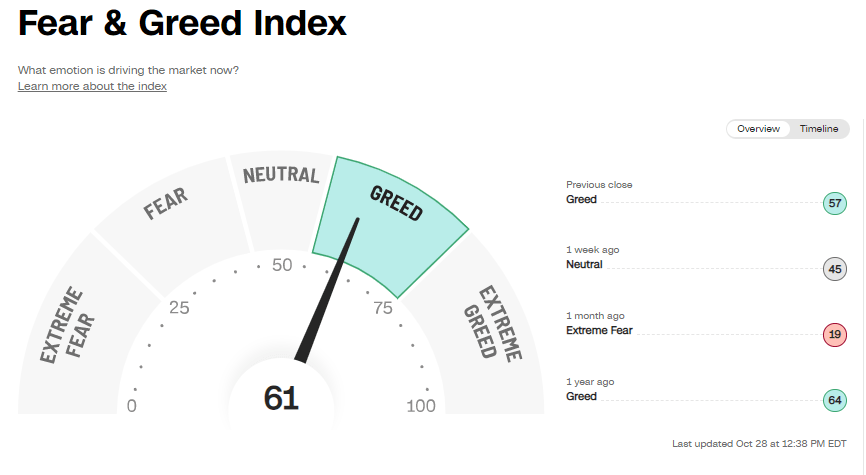

CNN.com

US stocks suffered an exceptional sell-off in the first half of 2022, which continued into the third quarter and reached fresh year-to-date lows at the beginning of the fourth quarter. However, after hitting new lows in mid-October, investors’ sentiments improved dramatically in the following weeks amid optimism over the Fed’s pivot. This is also reflected in CNN’s Fear & Greed index. It moved from an extreme fear level a month ago to a neutral range last week, and then to a greed level this week. It is likely that tech stocks could start recovering at a faster pace once investors see signs of ease in the Fed’s interest rate hike spree, which could happen after the November meeting. The growth rate may fall to 0.25 to 0.50 bps in December before reaching a terminal level of 4.60% in 2023.

It also appears that the Fed has been under immense pressure over its rate hike policy, which may force them to reconsider its aggressive stance. This is because the rate hike policy has so far failed to significantly tame inflation, which is currently hovering around 8%. Meanwhile, the strategy has already significantly dented the US economy and increased the risk of a recession in 2023. According to The New York Times, President Biden met with economists and policymakers last week to assess the likelihood of a UK-style meltdown or 2008-style financial stress due to the aggressive rate hike policy. Prominent Wall Street names like Cathie Wood, Elon Musk, and many others have also expressed concerns over the Fed’s tightening policies and the possibility of a deflationary burst. Cathie’s point about the deflationary burst is worth considering. According to her, energy and agriculture prices are increasing because of the Russian invasion, and the Fed should not raise rates to control them. The prices of the rest of the commodities group fell substantially from their recent highs due to demand destruction. Also, she warned that ballooning retail inventories could cause negative inflation.

Why XLK Is Best To Ride The Potential Rally?

When markets are likely to face uncertainty or bearish trends, it’s prudent to bet on low-beta stocks, but these stocks do not work well during a recovery phase. Ahead of the recovery phase, it might be prudent to invest in high-quality growth stocks or ETFs. The SPDR Technology Select Sector ETF is one of the best high-beta ETFs that can help investors make considerable gains during the recovery phase and generate solid returns over the long term.

I’m favoring Technology Select Sector over communication or consumer cyclical ETFs because the latter are more sensitive to economic conditions. To date, the S&P 500 communication sector is down around 40% and the consumer cyclical sector is down close to 30%. The products and services they offer are not among the essential items and their demand falls when people have less disposable income. For instance, Amazon (AMZN), the largest consumer cyclical stock, lost nearly 40% of its market cap in the past twelve months due to slowing economic growth and high inflation. The company missed third-quarter revenue estimates and anticipates fourth-quarter revenues between $140 billion and $148 billion, significantly lower than the consensus estimate of $155.37 billion. Also, operating income is expected to be between $0 and $4B, down from $24 billion last year. Similarly, several other key consumer cyclical companies like Alibaba (BABA), eBay (EBAY), Nike (NKE), and JD.com (JD) have warned about the economic slowdown and deteriorating financial performance.

Meanwhile, shares of mega-cap communication giants like Alphabet (GOOG) (GOOGL) and Meta Platforms (META) plummeted sharply after they reported lower-than-expected third-quarter results. The technology sector, and in particular the Technology Select Sector SPDR ETF, however, has shown resilience against the headwinds.

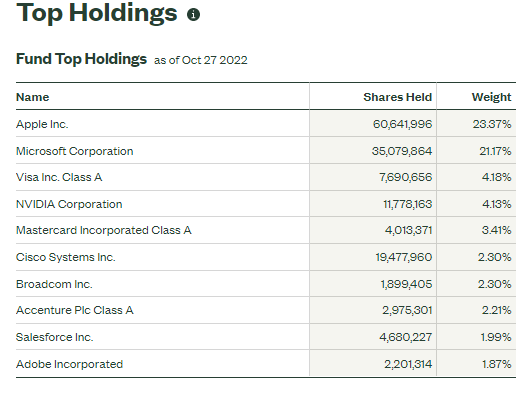

XLK’s Top 10 Stocks (ssga.com)

While XLK’s portfolio consists of 79 stocks, its performance is driven by its top 10 holdings, which represent 67% of the portfolio. Surprisingly, the financial numbers of tech companies continue to grow despite headwinds. Apple (AAPL), for instance, has topped September quarter revenue and earnings estimates. In addition, the company posted 9% year-over-year growth in revenue while its earnings per share jumped to $1.27 from $1.24 in the year-ago period. Market analysts believe Apple has the potential to sustain high single-digit revenue growth and mid-single-digit earnings growth for years.

Microsoft (MSFT), the second-largest stock in XLK’s portfolio, also exceeded revenue and earnings expectations. Its top line grew 11% year-over-year while operating income rose 17% from the year-ago period. XLK’s portfolio includes a number of software companies, which together make up around 32% of the overall portfolio. While software stocks have fallen sharply this year due to economic and interest rate volatility, their earnings have been resilient. I believe when the market recovers, their earnings resilience will help them bounce back sharply. Further, IT services companies are also showing strong revenue growth prospects despite volatility. In the September quarter, Visa (V) and Mastercard (MA), XLK’s fourth and fifth largest stock holdings, reported robust results. ServiceNow (NOW) and Accenture (ACN) are also among the IT Services companies that exceeded analyst expectations. On the negative side, semiconductor stocks, which make up 18% of the portfolio, could weigh on the overall performance. This is due to chip shipment restrictions to China along with slowing gaming and the PC market. Overall, the XLK portfolio has an expected average earnings growth rate of over 13%, which positions it well for a sharp rebound on market recovery.

Is It The Right Time To Buy?

After the energy sector, the information technology sector received the highest buy ratings from analysts, according to FactSet data. Sixty-two percent of analysts rated tech stocks as buys. Also, with a price-to-earnings ratio of around 20 and a forward price-to-earnings ratio of 17, tech stocks appear in a buy zone.

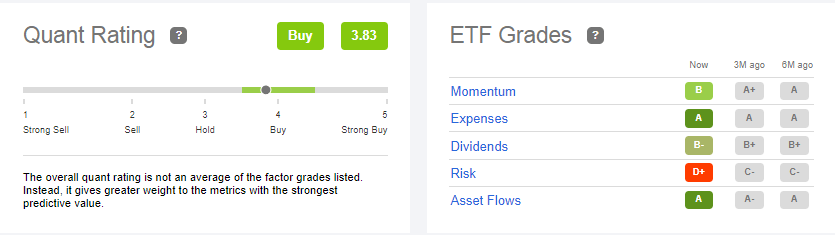

Quant Grade (Seeking Alpha)

Moreover, with a quant score of 3.83, Seeking Alpha’s quant system rated XLK as a buy. Apart from risk, the rest of the four quant factors received strong ratings. Asset flows and momentum scores indicate limited downside potential and increased investor confidence. XLK’s expenses ratio of just 0.11% also makes it a great long-term investment.

In Conclusion

The downside is limited from here since stocks have already priced in negative events, while the Fed pivot would help in enhancing investors’ confidence in high-beta ETFs like XLK. A significant increase in asset flows also indicates that investors are showing confidence in tech stocks. Furthermore, the robust earnings outlook not only supports valuations and share prices but also suggests that the sector may be able to withstand broader economic uncertainty. Overall, investors looking for long-term growth should take advantage of the dip in XLK price.

[ad_2]

Source links Google News