[ad_1]

Kriangsak Koopattanakij/iStock via Getty Images

This dividend ETF article series aims at evaluating products regarding the relative past performance of their strategies and quality metrics of their current portfolios. As holdings and their weights change over time, I may update reviews, usually no more than once a year.

TDV strategy and portfolio

The ProShares S&P Technology Dividend Aristocrats ETF (BATS:TDV) has been tracking the S&P Technology Dividend Aristocrats Index since 11/05/2019. It has 40 holdings, a 30-day SEC yield of 1.47% and a total expense ratio of 0.45%. Assets under management are still low (about $100M) and liquidity is thin.

As described by S&P Dow Jones Indices, to be eligible in the index a company must be in the GICS Information Technology sector or in one of three internet industries classified in the Communication Services sector. It must also have increased dividends every year for at least seven consecutive years and have a 6-month median daily volume above $1 million. The number of years of dividend increase may be reduced to 6, 5 or 4 years if less than 25 companies are eligible. The index is reconstituted annually and rebalanced quarterly with constituents in equal weight

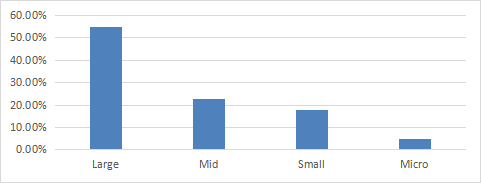

The fund invests exclusively in U.S. companies, in all size segments.

TDV size segments (chart: author; data: Fidelity)

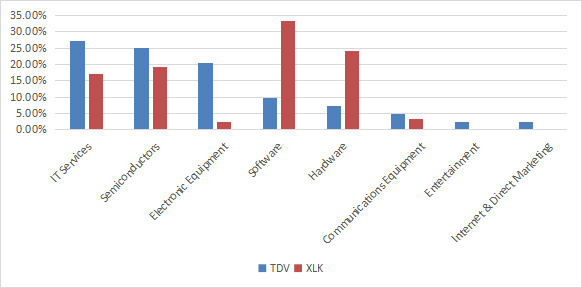

The three heaviest industries are IT services (27.3%), semiconductors (25%) and electronic equipment (20.6%). Other industries are below 10%. Compared with the S&P Technology Select Sector Index (XLK), TDV overweights a lot electronic equipment. It underweights software and hardware by a wide margin.

TDV industries (chart: author; data: Fidelity)

The top 10 holdings, listed in the next table with some fundamental ratios, represent 27.5% of asset value. The largest holding weighs 3.18%, so risks related to individual stocks are low.

|

Ticker |

Name |

Weight% |

EPS growth %TTM |

P/E TTM |

P/E fwd |

Yield% |

|

AVT |

Avnet Inc. |

3.18% |

231.10 |

8.85 |

6.85 |

2.22 |

|

LFUS |

Littelfuse Inc. |

3.00% |

109.09 |

19.24 |

15.77 |

0.80 |

|

GLW |

Corning Inc. |

2.74% |

-4.11 |

28.45 |

15.09 |

3.04 |

|

LRCX |

Lam Research Corp. |

2.73% |

35.06 |

15.38 |

15.46 |

1.22 |

|

POWI |

Power Integrations Inc. |

2.65% |

80.04 |

30.06 |

21.93 |

0.86 |

|

TEL |

TE Connectivity Ltd. |

2.65% |

134.48 |

16.55 |

17.53 |

1.79 |

|

ATVI |

Activision Blizzard Inc. |

2.64% |

6.54 |

24.61 |

25.89 |

0.60 |

|

ADI |

Analog Devices Inc. |

2.63% |

-15.96 |

50.03 |

18.74 |

1.92 |

|

AVGO |

Broadcom Inc. |

2.63% |

103.86 |

33.53 |

16.54 |

2.79 |

|

KLAC |

KLA Corp. |

2.60% |

72.92 |

16.32 |

16.09 |

1.25 |

Historical performance

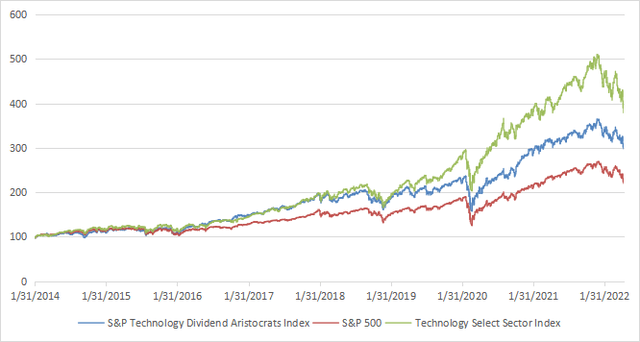

Price history is short: the underlying index was launched in October 2019 and the ETF about one month later. S&P Dow Jones Indices provides simulated data from 1/31/2014. The next chart compares TDV underlying index (in blue) with those of SPY (red) and XLK (green).

TDV, SPY and XLK underlying indexes since 2014 (Chart: author; data: S&P Dow Jones Indices)

Based on underlying indexes since 2014, TDV strategy (simulated) lags the sector benchmark and outperforms the broad market index.

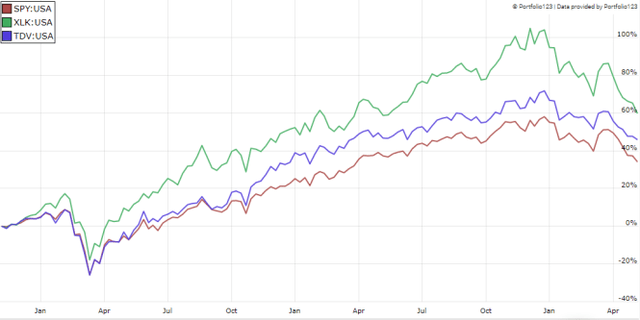

The next chart plots real relative performance since TDV inception. Once again, TDV is ranked between the two other index funds.

TDV vs SPY and XLK since inception (Portfolio123)

Comparing TDV with a reference strategy

In previous articles, I have shown how three factors may help cut the risk in a dividend portfolio: Return on Assets, Piotroski F-score, Altman Z-score, Payout Ratio.

The next table compares TDV since inception with a subset of the S&P 500: stocks with an above-average dividend yield, an above-average ROA, a good Altman Z-score, a good Piotroski F-score and a sustainable payout ratio. The subset is rebalanced quarterly to make it comparable to a passive index.

|

Total Return |

Annual.Return |

Drawdown |

Sharpe ratio |

Volatility |

|

|

TDV |

45.34% |

16.08% |

-34.62% |

0.97 |

18.74% |

|

Dividend & quality subset |

44.39% |

15.78% |

-34.65% |

0.86 |

18.80% |

Past performance is not a guarantee of future returns. Data Source: Portfolio123

TDV and this dividend quality benchmark have similar return and risk metrics on this period. However, ETF performance is real and the subset is hypothetical. My core portfolio holds 14 stocks selected in this subset (more info at the end of this post). Unlike TDV, it includes all sectors.

Scanning the current portfolio

TDV has a portfolio of 40 holdings. It is significantly cheaper than the sector benchmark XLK regarding the usual valuation ratios, as reported in the next table. The difference in price/sales ratio is especially impressive.

|

TDV |

XLK |

|

|

Price / Earnings TTM |

20.03 |

25.58 |

|

Price / Book |

4.78 |

8.42 |

|

Price / Sales |

2.22 |

6 |

|

Price / Cash Flow |

16.66 |

19.63 |

I have scanned TDV holdings with the quality metrics described in the previous paragraph. I consider that risky stocks are companies with at least 2 red flags among: bad Piotroski score, negative ROA, unsustainable payout ratio, bad or dubious Altman Z-score. With these assumptions, only 3 stocks out of 40 are risky and they weigh less than 7% of asset value, which is a good point.

Based on my calculation, TDV has a better aggregate ROA than XLK, but a lower aggregate Piotroski F-score. The difference in Altman Z-score is not very significant. In summary, quality is close to the benchmark.

|

TDV |

XLK |

|

|

Altman Z-score |

6.25 |

6.67 |

|

Piotroski F-score |

6.3 |

7.4 |

|

ROA% TTM |

13.41 |

12.06 |

Takeaway

TDV holds a portfolio with a minimum of 25 dividend growth stocks in the technology sector (currently 40). Industry weights are quite different from the sector benchmark XLK: the fund underweights hardware and software, and overweights IT services, semiconductors and electronic equipment. It follows an equal weight methodology, which is a guarantee against excessive exposure to individual stocks. TDV is more attractive than XLK regarding valuation, but quality is similar. The underlying index has underperformed XLK in a simulation starting in 2014, and also in the real world since inception (2019). However, it has outperformed the S&P 500 on both periods. TDV liquidity is quite low: caution and limit orders are recommended. For transparency, my equity investments are split between a passive ETF allocation (TDV is not part of it) and an actively managed stock portfolio, whose positions and trades are disclosed in Quantitative Risk & Value.

[ad_2]

Source links Google News