[ad_1]

wdstock

Investment Thesis

Long-time readers of mine will know my lack of fondness for the ProShares S&P 500 Dividend Aristocrats ETF (NOBL). Requiring 25 years of consecutive dividend increases is too strict, and for years, it has underperformed the broader market because it excluded top-quality Technology stocks like Apple (AAPL) and Microsoft (MSFT). Only legacy stocks like IBM (IBM) make the cut, and although the growth factor isn’t in favor today, most investors recognize a 5% allocation to the sector is insufficient.

ProShares has also recognized this with its November 2019 launch of the S&P Technology Dividend Aristocrats ETF (BATS:TDV). Instead of 25 years of consecutive dividend increases, TDV requires just seven, selecting companies as small as PetMed Express (PETS) and Cass Information Systems (CASS). The equal-weight strategy helps decrease the risk of an otherwise volatile sector, and I was surprised to learn how much less volatile and cheaper TDV is on a forward earnings basis compared to its peers. Therefore, I’ve decided to rate TDV as a buy, and I think conservative dividend investors can benefit from its approach.

ETF Overview

Strategy and Exposures

TDV’s strategy is refreshingly simple: select stocks from specific tech-related industries that have increased regular dividends for at least seven consecutive years. At a minimum, the Index must hold at least 25 securities, and in cases where that’s not possible, it will select companies with shorter dividend growth histories. However, with 40 holdings currently, that’s not an issue.

I say tech-related industries because technically, TDV holds two stocks from different sectors according to GICS standards:

- Communication Services: Activision Blizzard (ATVI)

- Consumer Discretionary: PetMed Express

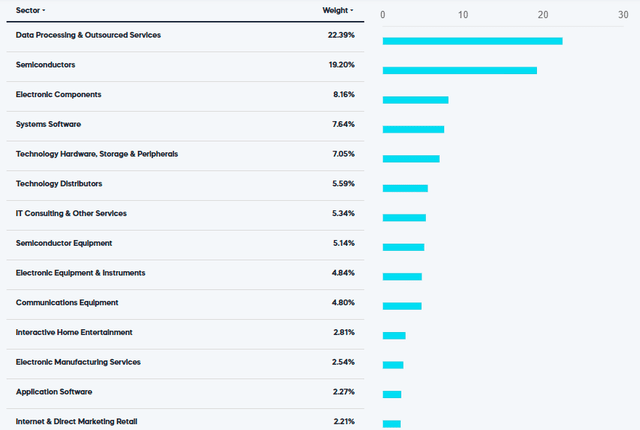

Otherwise, it’s a pure tech ETF with the following industry allocations:

ProShares

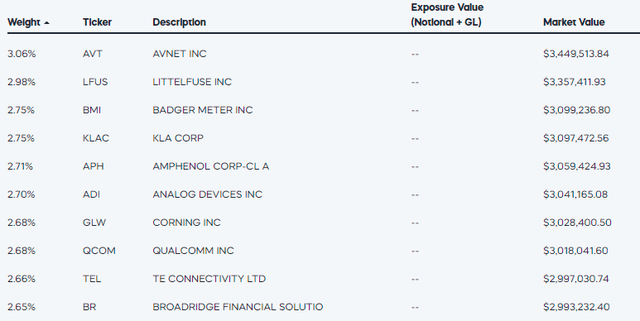

Data Processing & Outsourced Services includes names like Automatic Data Processing (ADP), Visa (V), and Mastercard (MA). There are a total of 10 Semiconductor and Semiconductor Equipment stocks, including Broadcom (AVGO), QUALCOMM (QCOM), Intel (INTC), and Texas Instruments (TXN). The top ten holdings list is below, but remember that since it’s an equal-weight ETF, these are merely the best performers since the last quarterly rebalance. The Index undergoes its annual reconstitution each January.

ProShares

Performance

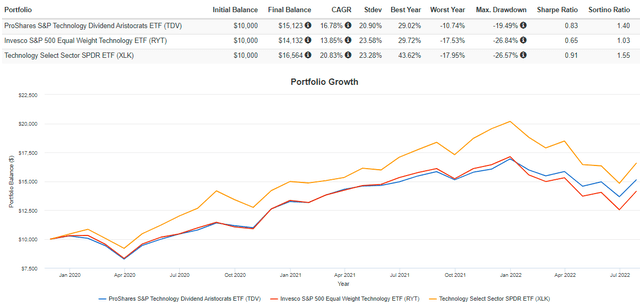

The following graph shows TDV’s performance against two other Technology ETFs: the Invesco S&P 500 Equal Weight Technology ETF (RYT) and the Technology Select Sector SPDR ETF (XLK). RYT is equal-weighted like TDV, while XLK is market-cap weighted and, therefore, is much more concentrated.

Portfolio Visualizer

Although the track record is short, TDV has shown itself to be a less-volatile ETF than these competitors. It experienced a 19.49% drawdown in Q1 2020, about 7% better than RYT and XLK, and has a 3% lower annualized standard deviation since its inception.

TDV has gained an annualized 16.78% compared to 13.85% and 20.83% for RYT and XLK. The latter pulled away in 2020 as mega-cap Tech stocks led broad-market indices to record highs, but in 2022, TDV is outperforming XLK by 7%. Certainly against RYT, TDV has shown itself to be a superior equal-weight Tech ETF.

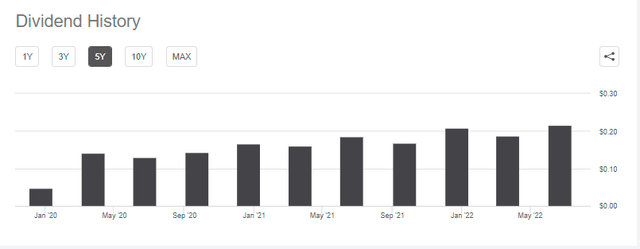

Dividends and Fees

TDV’s relatively high 0.45% expense ratio contributes to its paltry 1.31% trailing dividend yield. These figures imply a gross dividend yield of 1.76%. My calculations, shown later, put it at 1.95%, but it’s still nothing to get excited over. TDV pays quarterly, and distributions look to be around $0.20 per share each time.

Seeking Alpha

There are 33 U.S. Technology ETFs on the market, including industry-specific ones like the iShares Semiconductor ETF (SOXX). The average expense ratio is 0.43%, so TDV isn’t necessarily overly expensive, but we want fees to be as low as possible with a dividend fund. That’s because fees come directly out of distributions, and it’s tough selling a dividend ETF when the yield is so low. That’s why the key reason for owning TDV has to be its fundamentals, so that’s where I want to take this analysis next.

Fundamental Analysis

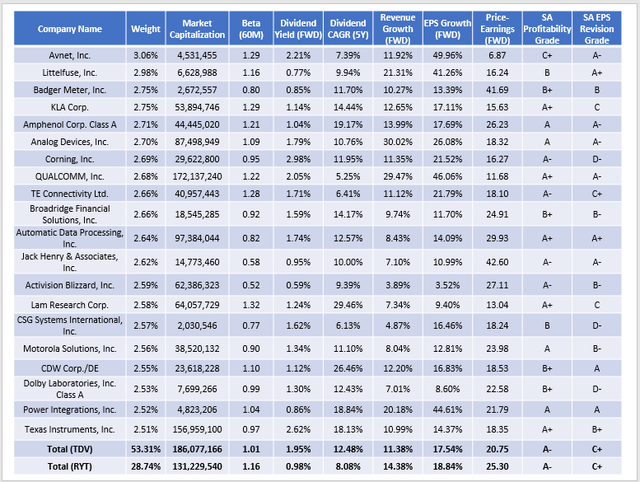

The table below highlights selected volatility, dividend, growth, valuation, and profitability metrics for TDV’s top 20 holdings compared to RYT, its equal-weight peer. We’ve established that TDV has been a better performer since December 2019. Now, let’s understand why.

The Sunday Investor

TDV has a weighted-average market capitalization of $186 billion, placing it in the middle of the range for Technology ETFs. RYT, in contrast, is one of the smallest at $131 billion. The largest size is intuitive considering the dividend growth requirement, as such companies tend to be better established and are generally safer investments. This safety is also reflected in the fund’s 1.01 five-year beta, which is the lowest among all Technology ETFs. RYT is 1.16, XLK is 1.12, and unless you want to go industry-specific with something like the Invesco Dynamic Software ETF (PSJ), that’s as low as it gets in this sector. I consider TDV’s low beta a competitive advantage, and one ProShares should market heavily to conservative investors.

TDV’s weighted-average gross dividend yield is 1.95% (1.50% after fees). Again, this is among the best in the sector, but solely because TDV only holds dividend-paying stocks. RYT’s 0.98% gross yield would nearly be the same, but only about half its holdings pay dividends. The same is true for dividend growth, and TDV’s 12.48% weighted-average growth over the last five years is impressive. Surprisingly, Technology has been an excellent source of growing dividends over the previous few years. Semiconductor stocks have risen at a 14.07% annual rate, and 13/40 constituents have earned an “A+” Dividend Growth Grade from Seeking Alpha. Many, like Apple, Microsoft, and Visa, are still years away from being included in NOBL, and that’s a lot of potential growth sacrificed to claim some arbitrary Dividend Aristocrat status.

Finally, I want to point out that TDV’s estimated revenue and earnings per share growth rates are just 3.00% and 1.30% lower than RYT’s, but it trades 4.55 points cheaper on a forward earnings basis (20.75 vs. 25.30). That’s three points cheaper than the SPDR S&P 500 ETF (SPY), and nearly eight points less than the Invesco QQQ ETF (QQQ). TDV is easily the cheapest broad-based Technology ETF on the market today. Since dividend investors are often value-oriented, it’s an excellent feature worth highlighting.

Investment Recommendation

TDV is a 40-stock fund covering 14 unique GICS industries in equal weight. The requirement for seven consecutive years of dividend increases isn’t too strict, allowing companies like Apple and Microsoft to ensure reasonable quality. I get the impression this relatively low limit was set to guarantee a minimum number of holdings, but regardless, the result is positive in my eyes.

TDV’s 1.31% dividend yield isn’t attractive and, therefore, isn’t a reason to buy. Further exacerbating this is the 0.45% expense ratio, which is more than what’s reasonable for a straightforward ETF. However, its fundamentals look great. Too often, conservative dividend investors have minimal exposure to Technology stocks in their portfolios and wind up underperforming in normal and bullish markets. TDV addresses that with its market-leading 1.01 five-year beta and 20.75 forward price-earnings ratio. It’s not overextended in any industry and doesn’t appear to sacrifice profitability compared to RYT, another equal-weight Technology ETF. Therefore, I’m rating TDV as a buy, and I look forward to seeing how it handles this uncertain market.

[ad_2]

Source links Google News