[ad_1]

Hiroshi Watanabe/DigitalVision via Getty Images

This dividend ETF article series aims at evaluating products regarding the relative past performance of their strategies and quality metrics of their current portfolios. As holdings and weights change over time, I post updated reviews when necessary.

TDIV strategy and portfolio

The First Trust NASDAQ Technology Dividend Index ETF (TDIV) has been tracking the NASDAQ Technology Dividend Index since 8/13/2012. Its distribution yield is about 1.76% and the total expense ratio is 0.5%.

As described on NASDAQ website, the index “includes up to 100 Technology and Telecommunications companies that pay a regular or common dividend”.

To be eligible, stocks must have at least $500 million in market capitalization, $1 million in 3-month average daily traded value, 0.5% in dividend yield, be listed on a US stock exchange and be classified in Technology or Telecommunications by the Industry Classification Benchmark. Companies are excluded if they have decreased the dividend per share in the past 12 months, entered into a definitive M/A agreement or filed for bankruptcy or similar protection. A maximum of 100 companies passing these rules are included in the Index: those with the highest dividend per share over the last 12 months. The index is reconstituted twice a year and rebalanced quarterly based on a modified dividend value-weighted methodology with weight limits and sector constraints (80% in technology, 20% in telecom).

The fund invests mostly in U.S. based companies (about 85%) and large caps (also 85%). The top 10 holdings, listed below, weigh 58% of asset value. The exposure to risks related to the top 5 names is quite high (7% to 9%). Other holdings are below 5%.

|

Ticker |

Name |

Weight |

EPS growth %TTM |

P/E TTM |

P/E fwd |

Yield% |

|

IBM |

International Business Machines Corp |

9.04% |

1.70 |

21.64 |

13.79 |

4.78 |

|

AVGO |

Broadcom Inc |

8.41% |

138.11 |

40.22 |

18.20 |

2.72 |

|

AAPL |

Apple Inc |

8.21% |

62.83 |

29.19 |

29.00 |

0.50 |

|

INTC |

Intel Corp |

7.76% |

-1.69 |

10.19 |

14.53 |

2.95 |

|

MSFT |

Microsoft Corp |

7.32% |

39.98 |

33.35 |

33.42 |

0.79 |

|

QCOM |

QUALCOMM Inc. |

4.02% |

73.94 |

23.91 |

16.83 |

1.45 |

|

TXN |

Texas Instruments Inc |

3.77% |

38.39 |

22.73 |

20.61 |

2.45 |

|

TSM |

Taiwan Semiconductor Manufacturing Co Ltd |

3.65% |

21.20 |

30.14 |

22.51 |

1.55 |

|

ORCL |

Oracle Corp |

3.51% |

4.42 |

23.96 |

17.12 |

1.55 |

|

ADI |

Analog Devices Inc |

2.40% |

12.31 |

45.83 |

22.34 |

1.63 |

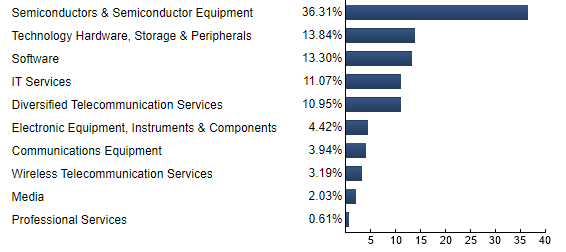

The heaviest industries are semiconductors (36.3%), followed by hardware (13.8%), software (13.3%), IT services (11.1%) and telecommunication (11%). Other industries are below 5%.

TDIV industries (chart by First Trust, ftportfolios.com)

Regarding valuation ratios, TDIV is a bit cheaper than the S&P 500 (SPY), and much cheaper than the sector benchmark (XLK). The difference in price-to-cash-flow is especially impressive (table below).

|

TDIV |

XLK |

SPY |

|

|

Price/Earnings TTM |

21.6 |

33.24 |

25.14 |

|

Price/Book |

3.96 |

10.87 |

4.59 |

|

Price/Sales |

2.7 |

7.74 |

3.21 |

|

Price/Cash Flow |

10.37 |

24.47 |

18.53 |

Data: Fidelity

TDIV is on par with the S&P 500 since inception in annualized return and very close to it in drawdown and volatility (standard deviation of monthly returns). It lags the sector benchmark by almost 6 percentage points in annualized return.

|

Total Return |

Annual Return |

Drawdown |

Sharpe ratio |

Volatility |

|

|

TDIV |

284.44% |

15.30% |

-31.60% |

1.01 |

14.59% |

|

SPY |

285.85% |

15.35% |

-33.72% |

1.1 |

13.26% |

|

XLK |

515.73% |

21.19% |

-31.15% |

1.27 |

15.72% |

Comparing TDIV with a reference strategy based on dividend and quality

In previous articles, I have shown how three factors may help cut the risk in a dividend portfolio: Return on Assets, Piotroski F-score, and Altman Z-score.

The next table compares TDIV since inception with a subset of the S&P 500: stocks with a dividend yield above the average of their respective indexes, an above-average ROA, a good Altman Z-score and a good Piotroski F-score. It is rebalanced annually to make it comparable with a passive index.

|

Total Return |

Annual Return |

Drawdown |

Sharpe ratio |

Volatility |

|

|

TDIV |

284.44% |

15.30% |

-31.60% |

1.01 |

14.59% |

|

Dividend & quality subset |

286.70% |

15.38% |

-35.87% |

1.03 |

14.29% |

Past performance is not a guarantee of future returns. Data Source: Portfolio123

TDIV is almost on par with the dividend and quality subset in total return and Sharpe ratio (risk-adjusted return), which is a very good point. TDIV return is real, whereas the subset performance is hypothetical. My core portfolio holds 14 stocks selected in this subset (more info at the end of this post).

Scanning TDIV with quality metrics

Among the 93 stocks held by the fund, 19 are risky stocks regarding my metrics. In my ETF reviews, risky stocks are companies with at least 2 red flags: bad Piotroski F-score, negative ROA, unsustainable payout ratio, bad or dubious Altman Z-score, excluding financials and real estate where these metrics are less relevant. Here, risky stocks weigh 14.5% of asset value, which is acceptable.

The weighted Piotroski F-score of the portfolio is similar to the S&P 500, but the ROA is much better, and the Altman Z-score is good too. According to these metrics, TDIV is superior to SPY in portfolio quality.

|

Aggregates |

Altman Z-score |

Piotroski F-score |

ROA% TTM |

|

TDIV |

4.84 |

6.5 |

13.02 |

|

SPY |

3.71 |

6.5 |

7.49 |

Takeaway

TDIV selects dividend stocks in technology and telecommunication. Regarding valuation ratios, it is cheaper than the sector benchmark and also than the S&P 500. TDIV also beats SPY in quality metrics. As for past performance, TDIV is on par with the broad index, but lags behind the sector benchmark. As of writing, TDIV is down -3.5% in one month vs. -6.7% for XLK: it is not surprising that quality brings a better resilience in this market correction. TDIV has only a 2-star rating at Morningstar. I don’t hold it, but I think it deserves better. For transparency, a dividend-oriented part of my equity investments is split between a passive ETF allocation and my actively managed Stability portfolio (14 stocks), disclosed and updated in Quantitative Risk & Value.

[ad_2]

Source links Google News