[ad_1]

cagkansayin/iStock via Getty Images

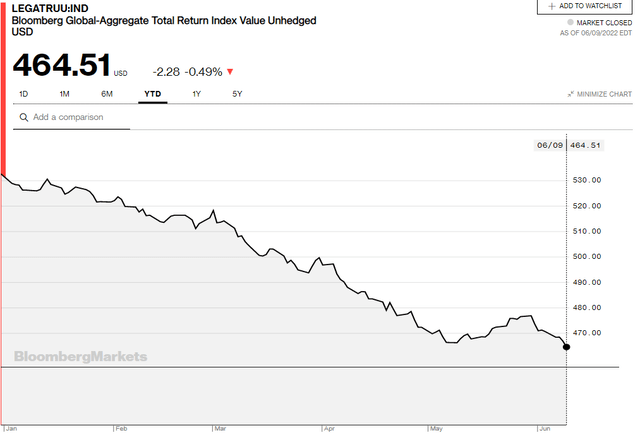

One of the few bright spots on the world’s debt map in recent months has been stocks of so-called “inverse” exchange-traded funds. The beginning of the normalization of the interest rate policy of the world’s leading central banks dealt a heavy blow to bonds. The market started to understand that it underestimated the hawkishness of the Fed and others in 2021. Total return indices of almost all segments of the global bond market are in the bold red zone since the beginning of the year.

Bloomberg Total Return Index performance (bloomberg.com)

In the current environment of rising interest rates, the ProShares UltraShort 20+ Year Treasury ETF (NYSEARCA:TBT) is showing spectacular growth. Although the main upside potential of its shares has already been realized, this ETF remains an excellent hedge against a further tightening of monetary conditions.

About the ETF

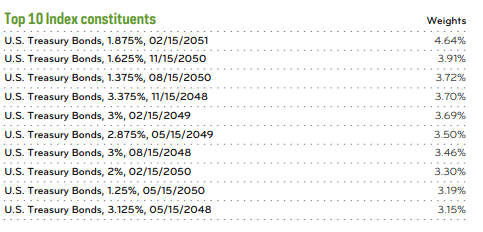

The ProShares UltraShort 20+ Year Treasury is a U.S. inverse leveraged ETF with an expected return equal to 2x the reverse daily growth of the ICE US Treasury 20+ Year Bond Index. This index includes public issues of US securities with a remaining maturity of more than twenty years and an outstanding par value of more than $300 million. TBT is the largest global inverse bond fund with $1.4 billion in assets under management. The liquidity of the fund’s shares is very high.

The index is rebalanced daily. This means that this ETF is aiming for a return that is twice the return of the underlying index in one day. Due to the addition of daily returns, holding periods of more than one day can result in returns that are significantly different from the return on the target index.

In order to achieve its investment goal of getting two times the reverse results in relation to the ICE U.S. index. Treasury 20+ Year Bond – the fund invests in swaps and futures that track this index. Swap agreements are concluded with counterparties that are among the world’s leading financial institutions like Societe Generale, Citibank, and Goldman Sachs.

The expense ratio is 0.9%.

Top 10 holdings (proshares.com)

US Treasury yields

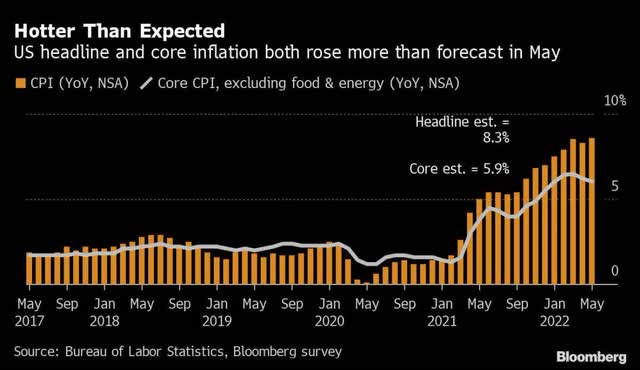

US Treasury yields are very sensitive to the Fed monetary policy. The main task for the central bank right now is to overcome inflation. So far, the FOMC believes that it is too early to talk about inflation peaking, given the ongoing global supply problems, conflict in Eastern Europe and lockdowns in China. However, a number of meeting participants noted that the latest monthly data may indicate that the overall price pressure may have ceased to intensify. The issue of inflation is important from the point of view that if it slows down in the future, the rate trajectory can be revised to a less aggressive one in order to support economic growth. On Friday, May CPI data was released that showed an 8.6% YoY increase compared to 8.3% in April.

CPI growth (bloomberg.com)

I think long-term Treasury yields should stabilize around the Fed’s rate neutral level since the market prices the rate at a wide range of 2.75%-3.75% in June 2023. In the short term, US Treasury yields may be at an elevated level relative to their equilibrium stable values. The neutral level implies that economic activity is neither growing nor declining. The estimate of the neutral rate is now at around 2.5%. However, taking into account inflation, which accelerated to 40-year highs, its upward adjustment cannot be ruled out. This will depend on whether the increased price pressure we are seeing now proves to be a long-term phenomenon or not.

U.S. 20 Year Treasury yield (cnbc.com)

Having said that, I believe that there is not much upside left in TBT.

TBT as a hedge

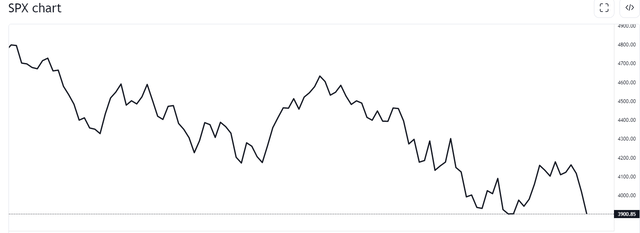

The ProShares UltraShort 20+ Year Treasury ETF has served as an excellent hedge so far in 2022. Following the Fed hawkishness, US Treasury yields began to rise resulting in the panic among the investors and S&P 500 massive drop.

SPX chart YTD (tradingview.com)

TBT has recently turned from a protective tool that insures an investor against falling US Treasury bonds into a real asset with a double-digit yield.

| YTD performance | YoY performance | |

| S&P 500 | -18.67% | -7.98% |

| Dow Jones | -14.19% | -8.95% |

| TBT | +51.13% | +38.49% |

Since the market’s biggest concern is rising rates that could lead to a slowdown in economic activity, it is logical to assume that the ETF will continue to act as an excellent hedge against a market fall.

Conclusion

By buying a stock in the inverse fund, an investor is actually taking a short position. In particular, investing in the ProShares UltraShort 20+ Year Treasury ETF shares can be viewed as a kind of “short” on long-term US Treasuries, and ultimately as a bet on the growth of long-term Treasury yields. Moreover, the shares of the fund allow not only to insure against falling prices of these assets but also to receive a multiplied income from this.

In the light of today’s events, the current level of 20-year US government bonds yield (slightly above the level of the neutral rate of 2.5%), as well as the phase of some consolidation in the Treasury market, in my opinion, quite reasonable. Meanwhile, the chances of seeing the normalization of yields in the sector, in my opinion, are very high.

Although I currently do not see significant fundamental upside potential for the ProShares UltraShort 20+ Year Treasury ETF shares, I believe that this investment vehicle provides a good hedge against both further tightening of monetary policy in the US and a possible revision by the market of the long-term neutral level of the rate in the light of observed inflationary dynamics.

I believe that TBT is a Hold right now.

[ad_2]

Source links Google News