[ad_1]

trekandshoot

Inflation-indexed Treasury bonds, such as those in the ETF (TIP), are becoming one of my favorite “risk-off” assets today. Inflation-indexed bonds are issued by the US Treasury and pay the change in CPI plus a yield, currently around 1.4%. As recently detailed in “TIP: US Dollar Liquidity Crisis Signals Bottom In Real Rates,” inflation-indexed bonds are a great way investors can benefit from the potential reversal in real interest rates (via appreciation) while also fully hedging against inflation.

I have not had a bullish view on short-term inflation-indexed Treasury bonds due to their greater exposure to the Federal Reserve’s tightening cycle and hawkish stance. However, in August, I signaled that short-term inflation-indexed bonds might likely be on the verge of bottoming. Since then, the iShares 0-5 Year Tips Bond ETF (NYSEARCA:STIP) has declined by around 4% but has held a steady bottom since mid-September, along with the broader bond market.

I believe inflation will continue to be a significant factor weighing on investor portfolios. While many believe the “war against inflation” has been won, this appears to be due to short-term fluctuations in energy prices, with it seeming likely that energy prices will continue to rise higher over the coming months due to a combination of government policy decisions (in the US and many other nations), and conservative drilling plans from oil producers. More information on this topic can be found in “USO: The Future Of Oil As The Strategic Petroleum Reserve Release Nears End.” To summarize, it appears wise for investors to continue to look for active low-risk hedges against inflation risks. Inflation-indexed bonds are potentially ideal due to their sovereign-grade risk status and high real yield. Even more, with the currency market experiencing a significant increase in volatility, I believe short-term inflation-indexed bonds like those in STIP may be due for solid appreciation over the coming weeks and months.

FX Market Volatility Boosts STIP

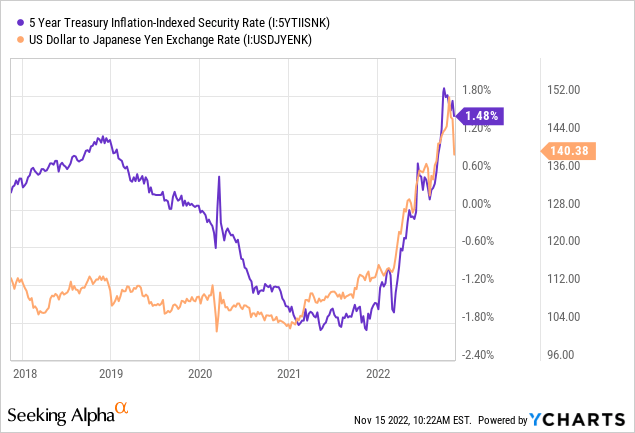

The chief factor benefiting bonds, particularly STIP, is the sharp rise in the US dollar which essentially forces the Federal Reserve to slow its interest rate hiking outlook or risk creating a currency collapse in developed countries such as Japan. This critical factor is illustrated in the strong correlation between the five-year inflation-indexed Treasury bond yield and the USD-JPY exchange rate:

Throughout 2022, the Federal Reserve has held a far more hawkish stance than most of its foreign peers. Japan’s BOJ maintains a negative interest rate, while Europe’s ECB is more than 2% below that of the US. Currency values fluctuate with changes in short-term interest rate outlooks. Since the US has faced much more rapid hikes, with a more hawkish tone, the value of the US dollar has appreciated tremendously against foreign peers. The trend became so extreme recently that the United Nations called on the Fed to halt interest-rate hikes.

Inflation is still rising in most of the world. The moderation in the US CPI is partly due to the decline in fuel, and other commodity prices, which were greatly aided by the rise in US dollar exchange rates. Accordingly, most central banks, particularly in countries with weakening currency values, are continuing or accelerating interest rate hikes. Given the strong possibility of a renewed oil shortage and the lack of a rise in unemployment, I do not believe the Federal Reserve or its peers will slow interest rate hikes soon. However, given the extreme increase in the US dollar’s value, I think the Federal Reserve will avoid hiking interest rates too far above the expected inflation rate.

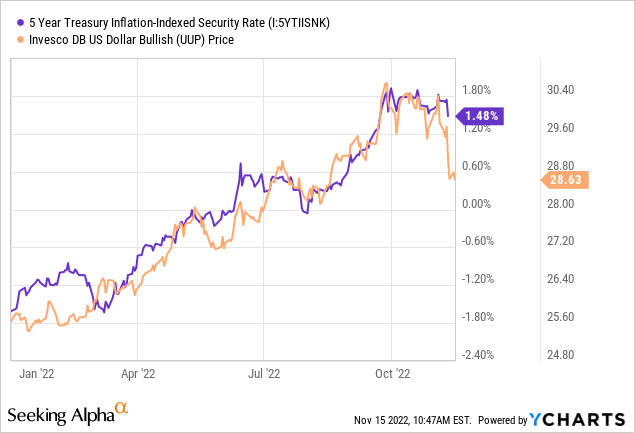

See the strong reversal in both inflation-indexed yields and the US dollar below:

It may be too early to definitively state that the US dollar’s bull market has ended. The dollar is still relatively high compared to most currencies, and US real interest rates are far above those in Europe and other countries. If the dollar rebounds from its latest shock and rises to new all-time highs, Japan and other nations may experience a currency crisis that I believe the Federal Reserve wishes to avoid. Accordingly, it appears to be an opportune time to bet on a decline in US real interest rates, a trend that could quickly reverse STIP’s depreciation this year.

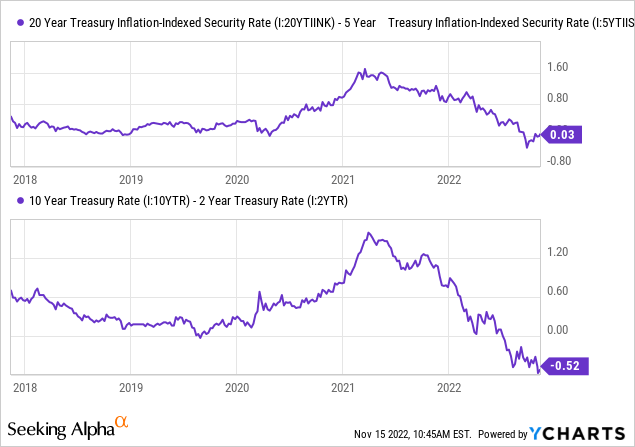

Further, if the economy slows enough, the yield curve may start to rise in reaction as the rate hike outlook shifts. At this point, it seems short-term inflation-indexed bonds have equal appreciation potential to their long-term counterparts. However, in the long run, the highly inverted yield curves will likely benefit short-term Treasuries disproportionately as the curve steepens. See below:

Both the traditional “10-2” yield curve and the “20-5 inflation-indexed” yield curve are at extreme historic lows and are not declining at the pace they were earlier this year. This shift indicates that the Federal Reserve is less likely to pursue interest rate hikes to two-to-five years from today. That said, two-year Treasury rates are still around 65 bps above the current rate, indicating another 50-75 bps hike is likely. In my view, there will likely be a “pivot” outlook shift that causes a rise in the yield curve, but not for 1-2 years. Even then, STIP (a 2.5-year average maturity fund) may see added immediate support as the medium-term segment of the yield curve falls compared to the long-term.

The Bottom Line

Overall, I am bullish on STIP and believe the fund is now likely to rise in value after falling for most of 2022. I was previously bearish on the ETF since it seemed likely that the Federal Reserve would need to become more hawkish to lower inflation. Seemingly, the central bank will need to maintain a hawkish approach due to continuing inflationary dynamics, but must become slightly less hawkish to avoid creating a currency crisis. It may take time for STIP to appreciate and likely rise faster if the economy slows more quickly (due to the “Fed pivot”) – making it a good hedge against stocks.

STIP is a better “pure play” bet on a Fed pivot since it does not depend on inflation declining, as does its non-inflation indexed peer (SHY) – STIP only needs the Fed’s rate outlook to fall relative to the inflation outlook. As such, STIP benefits if the inflation outlook increases or if the interest rate outlook decreases. Since I believe it is more likely the inflation outlook will increase relative to interest rates, STIP seems likely to appreciate 3-6% in value as shorter-term real rates fall back into negative territory.

STIP currently boasts a high real yield of ~2.4%, meaning it will pay that much over the CPI. For example, if inflation is 8% over the next year, STIP’s dividend would be around 10.4%. While the market does not expect inflation to remain that high, I believe it is likely due to energy market dynamics. Even if inflation falls to 2%, STIP’s yield would be around 4.4% which is very high given its relatively low volatility and, in my view, shallow downside risk.

On that note, the primary cause for continued declines in STIP would likely be a surprise increase in the Fed’s hawkish tone (seemingly unlikely given the US dollar’s situation) or a sharp rise in US default risk. The latter is hypothetically a non-issue due to the Federal Reserve’s emergency liquidity-supplying function, but it could occur over political strife regarding the debt ceiling. Given that those risks are relatively small compared to STIP’s high potential yield, I believe STIP is becoming a “no-brainer” low-risk option, far superior to money-market funds or savings accounts due to its direct inflation hedge.

[ad_2]

Source links Google News