[ad_1]

DNY59/iStock via Getty Images

Main Thesis/Background

The purpose of this article is to discuss the ProShares Ultra S&P 500 (SSO) as an investment option at its current market price. This is a fund I follow closely, but buy selectively, because it is a leveraged ETF that can be highly volatile. Specifically, it is designed to off a “return that is 2x the return of its underlying benchmark for a single day, as measured from one NAV calculation to the next”. This benchmark is the S&P 500, so SSO is a viable option for those who believe the S&P 500 is going to rise in the near term, and want to take an aggressive bet on that happening.

Due to this enhanced risk and potential for volatility, SSO is not a fund I buy lightly or recommend often. It is designed for investors who can withstand substantial losses, and who are willing to able to enter and exit trades in the very short-term. A a result, I am upfront here that this is not for everyone, but I do see an environment where large-cap stocks can rise in the coming months. As a result, I recently picked up SSO, and will use this review to discuss the pros and cons of doing so in the current market climate.

S&P 500 Is Right At Correction Territory

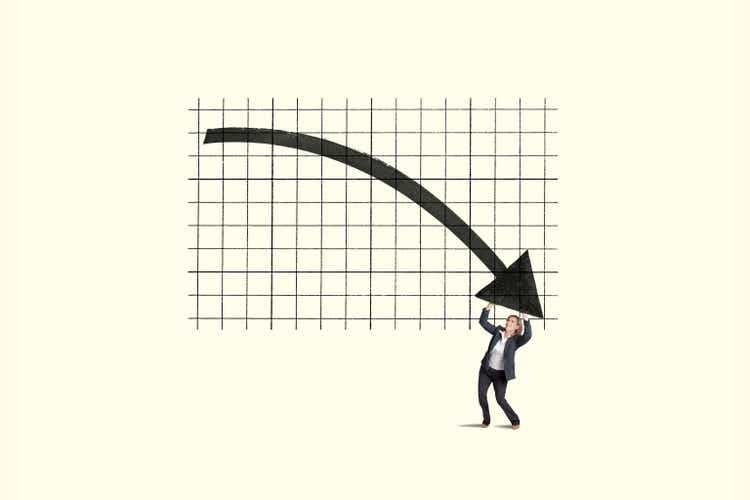

To begin, let us examine why one might want to get bullish on U.S. large-caps now. The primary reason, in my view, is that stocks are right around the defined “correction” territory – which is a drop off the high above 10% and below 20%. We right at that marker for the year, so the drop since January 1 is notable. With the S&P down over 10%, SSO has seen a drop close to 2x that, as expected:

YTD Performance (Google Finance)

Ultimately, this does not guarantee we will see a turnaround any time soon. But the conclusion I draw here is now is the time to start putting some cash to work. Stocks don’t often see 10% drops, so whether one is looking for some short-term trading gains or to build on to longer term positions, using these types of pullbacks or sell-offs as entry points is often a winning play. To me, I can’t see a drop of this nature and not put at least some cash to work, so that is what I am doing.

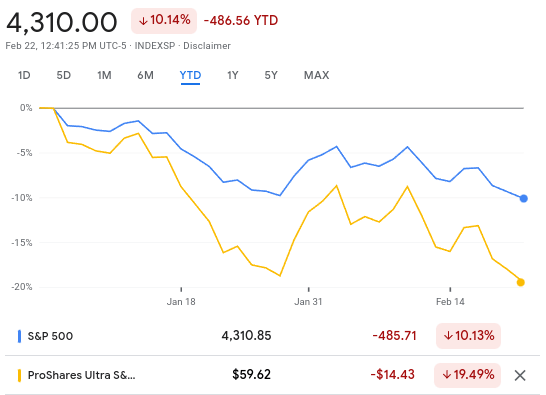

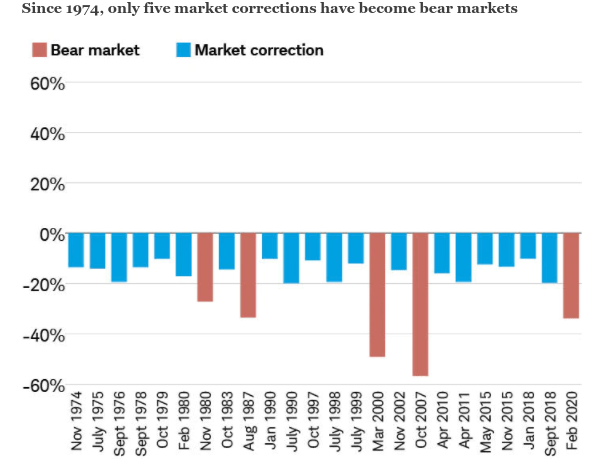

Of course, stocks can, and very well might, keep going down. Readers need to assess their own outlook, as well as risk tolerance, when deciding if now is an opportune time to buy. In fairness, this “almost” correction has been very short – we are only roughly 50-odd days in to the calendar year. If we look back at past correction/bear cycles, we see that the length of time varies considerably from peak to trough:

Historical Downtrends (Forbes)

This historical data provides support for why “timing” the market is so difficult. Dropping or corrective markets can be swift, medium length, or for months on end. They can spike after hitting a 10% drop, or fall in the bear market territory (which would indicate plenty of pain left in this cycle if that materializes). Therefore, it is difficult to predict what the next move will be, but investors can take comfort in knowing that buying during these time periods will typically result in above-average gains. I don’t imagine this time around will be any different – it is just a matter of when the bottom will hit – and nobody knows that for certain.

Why Use A Leveraged Option?

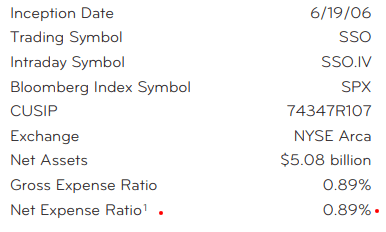

Now that I discussed the broader macro-picture, and why I like buying when stocks see double-digit sell-offs, let us discuss why SSO could be a good option. As I mentioned, this is a leveraged product, so it amplifies the potential returns, but also the risks. The leverage makes the fund more volatile, more risky, and more expensive than traditional holdings. Because of the interest and other expenses associated with leverage, SSO has an expense ration in the 1% range:

Fund Facts (ProShares)

Now, if the market turns around and SSO offers double the returns of a broad S&P 500 index fund, then that expense ratio is almost meaningless. But if SSO drops, the expense ratio hurts all the more. Importantly, while .89% might not seem too high compared to actively managed funds, we have to remember this is designed to simply track the S&P 500 – albeit by doubling the move. So, if one simply wants to invest in the S&P 500, they have a myriad of cheaper options. For example, this compares with an expense ratio of .03% for a traditional, passive S&P 500 ETF, such as the Vanguard S&P 500 ETF (VOO).

With this in mind, why not just buy twice as much VOO, rather than starting a position in SSO? The answer here lies on what makes sense for each individual. What I mean is, if one wants, for example, $50,000 worth of exposure to the S&P 500 and has $50,000 cash, then maybe simply putting that all in VOO makes more sense. In fact, I would probably advocate that.

But the benefits of SSO come in to play when the answer is not as simple. Let us use the same scenario – one wants $50,000 worth of S&P 500 exposure and has $50,000 cash. Maybe they could be well served putting it all in, but then they are left without cash. If this hypothetical investor wanted more cash on hand to buy if stocks drop further, they are out of luck. Or maybe they wanted $50,000 in S&P 500 but also wants to put cash in more tactical areas. In this case, they could buy $25,000 of SSO (generating 50k in exposure), and still have their $25,000 to use for other investments. Again, this comes down to the individual. In my case, I want to pump up my S&P 500 exposure, but I don’t want my cash balance to dwindle too much. Therefore, SSO makes sense.

Of course, there are other options as well. For those in cash-managed accounts, they probably have access to leverage. So, in the above examples, if one had used up all their cash to buy VOO, and the market kept dropping, it is not like they have to stay on the sidelines. Non-IRA accounts can use margin, which is a way to borrow and amplify a portfolio’s exposure, without using these leveraged products. This is perhaps a more simple way of doing it – it is essentially taking out a loan from your broker and using the loan to buy stocks. When you sell the stocks bought on margin, you keep the gains, and return the borrowed money to your broker, with interest.

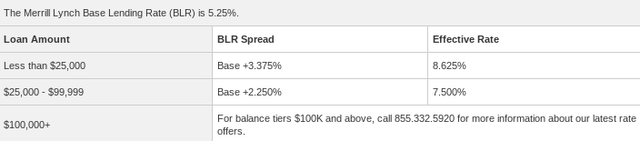

This may seem preferable to readers, but I would emphasize here why I avoid using margin, and prefer leveraged ETFs instead. Yes, the .89% ratio is not cheap, and avoiding it makes plenty of sense. But use my last example. An investor uses up all their cash and still wants to buy, utilizing margin to do so. Sure, they saved the expense ratio on SSO, but they are going to pay a much higher cost to borrow from their broker. I personally use Merrill Edge, and here is the most recent lending rates for my cash-managed account:

Margin Costs (Merrill Lynch)

I think the example here is pretty clear, so I will wrap up by saying that SSO can be a preferred way to capture leverage, rather than borrowing. Yet, I am conscious of the fact that for many investors, using neither strategy may be the right move. Without the ability to withstand losses and above-average swings to your portfolio, I would advocate staying in your comfort zone and not amplifying risk.

Does This Market Have Bright Spots? Yes

Beyond the broader market drop and the use of leverage through SSO, one needs to have an optimistic outlook in order to buy anything right now. With inflation roaring, geo-political crises abounding, and central banks around the world (including the Fed) looking to raise interest rates, how can one be optimistic?

In fairness, there is a lot of risk out there in the market. So while I am a buyer here, I will keep cash on hand to add more if stocks keep dropping. My position in SSO will be relatively small to start, which I would build if stocks drift towards “bear market” range. With this mindset though, we should acknowledge that the risks in the market are not being ignored. There are good reasons for stocks to be down near 10% this year, but at least that drop did materialize. That suggests the market is pricing in some of the risks, making for a functioning / healthy market, and one I am comfortable buying.

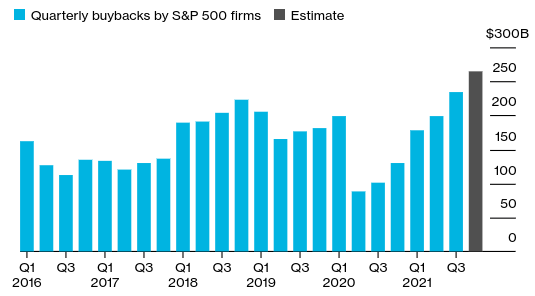

Beyond those negative headlines, we should also note there are some bright spots to consider. One in particular when discussing large-caps, and SSO by extension, are stock buybacks. While these took an understandable dip in 2020, buybacks roared ahead in 20201. They have eclipsed prior highs and are sitting near records:

Corporate Share Buybacks (S&P Global)

Ultimately, this bodes well for large-cap stocks in isolation. It suggests the underlying companies in the S&P 500 are flush with cash and are willing to use it to support share prices and return it to shareholders. While I prefer dividends, stock buybacks are nice to see as well.

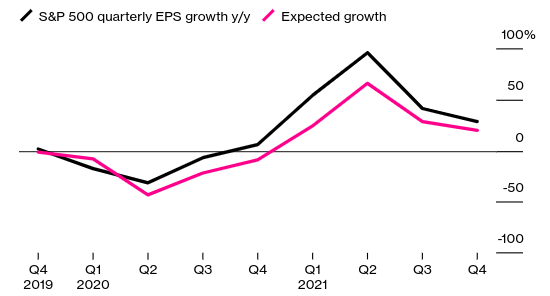

Looking ahead, there are reasons to suggest more buybacks will continue in 2022. Recent corporate announcements by giants like Wal-Mart (WMT) and others suggest management will be looking to continue the buyback streak in the current fiscal year. This is sustainable in my few, because earnings growth remains in positive territory. While growth is moderating, which is concerning, it remains about expectations, which is encouraging:

S&P Quarterly Earnings Growth (Bloomberg)

I use both of these graphics as support for why I continue to want large-cap U.S. exposure. Are there risks on the horizon? Absolutely. Will stocks definitely go up from here anyway? Absolutely not. But there is some underlying strength we can point to that keeps us grounded, and reminds us to tune out some of the short-term noise in light of the broader picture.

Risks Should Not Be Completely Ignored

Through this review I have painted a fairly rosy picture. However, I am not blind to the risks we face. I do think now is the time to start buying, especially for those like myself who entered 2021 with some cash on hand. But this doesn’t mean go all-in just because the S&P dropped 10%. Stocks can drop more, and there are real risks to the earning power of large-cap corporate companies.

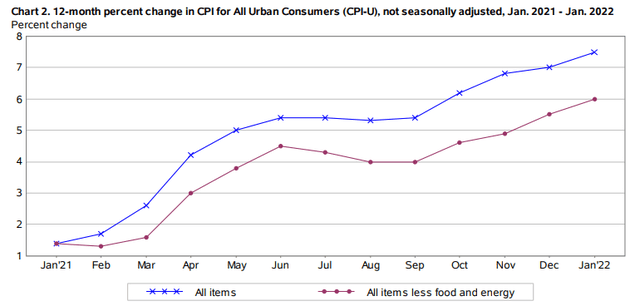

In my view, risks like an invasion in Ukraine and a Fed rate hike of .50 basis points are not reasons to sell stocks. These will moderate with time, and long-term investors are probably better served not making portfolio changes on those elements. The biggest risk I see, however, is one that we need to carefully monitor. This is inflation, and has been the elephant in the room since mid-2021 through today. As my readers know, I was not a believer in the “transitory” messaging we heard from the Fed, White House officials (who simply parroted the Fed), and other market participants. Unfortunately, I don’t really relish in being vindicated here, because inflation’s continued acceleration is posing a challenge for households and investors:

CPI Figures (Bureau of Labor Statistics)

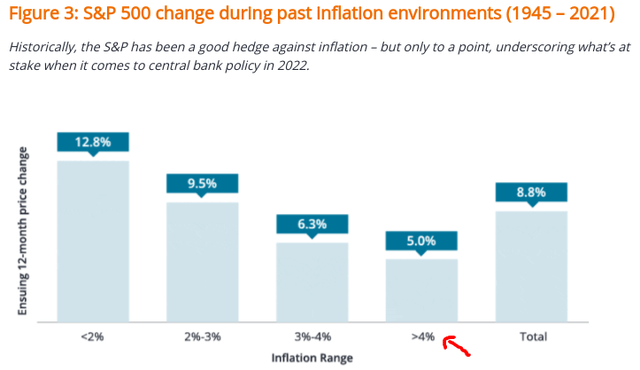

So, why does this matter? It is a concern because while inflation can be good for stocks, too much inflation can greatly pressure returns. Readers probably know that over the past decade cheap money and low levels of inflation have been a boon for their portfolios. Yet, if we examine history, inflation rates above 4% that are sustained for a while tend to create an environment where we see the lowest levels of returns for the S&P 500:

S&P Returns During Inflationary Periods (Janus Henderson)

My takeaway here is we really need to see inflation moderate if we are going to get strong returns in equities. While I had not expected inflation to be transitory last year, I think we are finally nearing the point where inflation has peaked. Central banks are going to act to raise rates, which will help to a large degree. Further, many countries are starting to loosen Covid-related restrictions further, we should help with supply-chains. More people working, more goods, fewer delays, and we can see input prices come down.

In fairness, while I expect 2022 to be a year where we finally see some progress on inflation, that is not a sure thing. Investors need to monitor this risk carefully and if inflation stays red hot or keeps accelerating, then the bull thesis is going to be seriously challenged.

Bottom-line

Stocks have delivered mostly pain in 2021 so far, after an initial burst of gains out of the gate. Personally, I view this recent weakness as a good chance to put idle cash to work. I was too cautious at the end of last year, but I feel vindicated now that I can get in at better prices. While an official correction can be understandably unnerving, we should remember that most corrections do not end up becoming bear markets, if we use history as a guide:

Corrections To Bear Markets (Charles Schwab)

My conclusion is that while this current pullback could become a bear market, due to geo-political strife, inflation, and a challenging consumer picture, I am willing to take a gamble it won’t. As a result, I have started to build a position in SSO, and suggest readers give this fund some consideration at this time.

[ad_2]

Source links Google News