[ad_1]

The Global X SuperDividend REIT ETF (SRET) is an interesting take on the classic high dividend yield investing strategy. In this iteration, it is being applied globally to the REIT sector. The Global X SuperDividend REIT ETF has done well over its short lifespan and could possibly warrant a look for investors looking for income. Just be aware the risk profile for the fund is a bit different than other REIT indices.

The Global X SuperDividend REIT ETF

SRET tracks the Solactive Global SuperDividend REIT Index, which is composed of 30 of the highest dividend yielding REITs globally. There is not a lot of information on the index available that we could find. Based on the holdings and the relative weight of each, it appears the index is equally weighted and rebalanced roughly quarterly (the holdings above 3.33% have performed well over the past three to six months, implying rebalancing is not done daily).

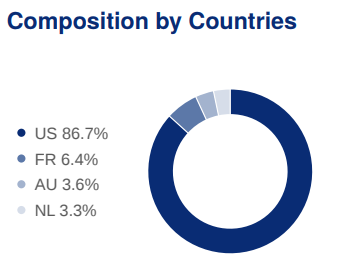

For such a simple strategy with only quarterly (or every few months) trading, it’s a bit surprising to see an expense ratio of .59%. Despite the global scale of the index, the fund is heavily focused on US REITs (not necessarily a bad thing), with almost 87% of assets invested domestically.

(Source: Fund index factsheet)

Again, given that a majority of the fund’s holdings are American stocks, we’d think the expense ratio for the fund would be lower since you can’t use the “international stocks are more expensive to buy/trade” argument.

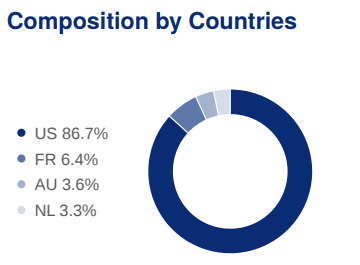

Typically, when we see funds that focus on generating high income, it comes at the expense of total return. That doesn’t seem to be the case here. Also, the strategy of investing in high dividend REITs has led to a portfolio with attractive volatility characteristics compared to the market as a whole. Beta is only about half of other major equity market indices.

(Source: Fund website)

The fund has a 12-month dividend yield of 8.12% but hasn’t lagged other major REIT index funds when looking at total return. In fact, over the past three years, it’s outperformed both domestic REITs (VNQ) and international REITs (VNQI).

|

Avg. annualized as of month end 5/31/19 |

1 Year |

3 Years |

|

SRET |

3.45% |

8.78% |

|

VNQ |

14.9% |

5.77% |

|

VNQI |

-.47% |

6.98% |

(Source: Fund websites)

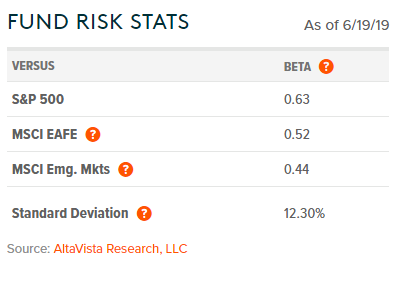

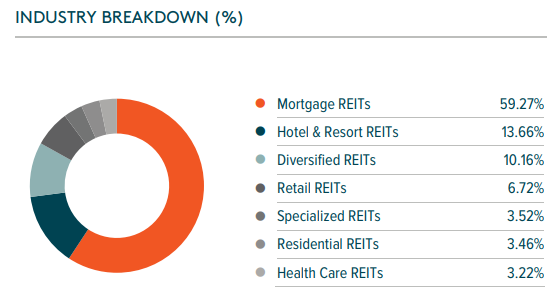

Of course, three years isn’t a long time in the investment world, but it’s a start! However, there is one thing worth noting. A majority (about 60%) of SRETs holdings are mortgage REITs not equity REITs.

That means that more of the fund is exposed to risks that are non-existent, less prevalent, or manifest themselves in a different form compared to equity REIT focused funds or indices. For example, mortgage REITs are more susceptible to credit risk. They are also subject to pre-payment risk if interest rates go down (which we’d note they are).

(Graphic source: Fund website)

Would a better benchmark be a mortgage REIT index fund? The iShares Mortgage Real Estate ETF (REM) returned 2.72% over the last year (from 5/31/2019) and 10.10% annual on average over the past three years. This bests SRET, but to some degree, it’s comparing apples to oranges as SRET is a blend of REIT types. If we built a composite fund index that was 13% international REITs, 60% of 87% domestic mortgage REITs, and 40% of 87% domestic equity REITs, SRET would still have a higher return than our custom fund index (8.78% versus 8.17%).

After seeing so many income-focused strategies provide poor risk adjusted total returns, it’s refreshing to actually see a fund focused on income that has produced decent returns. Three years isn’t a long time, but so far, investors don’t seem to have to choose between income or overall returns with this fund.

Summary

There are definitely some aspects of SRET that may appeal to income-oriented investors looking for REIT funds. The short history of the fund, lack of easily accessible index information, and high expenses for such a simple strategy prevent us from whole-heartedly recommending the fund. Additionally, the over-emphasis on mortgage REITs compared to traditional REIT indices is something investors should be mindful of as the two types of REITs have different risk profiles (e.g. credit risk, pre-payment risk, etc.). Investors with taxable accounts may also want to be aware of the funds high 41% turnover rate.

Disclosure: I am/we are long VNQ, SCHH. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: We hold both SCHH and VNQ for clients with VNQ primarily being held by clients with older, taxable accounts.

[ad_2]

Source link Google News