[ad_1]

allanswart

The first half of 2022 was a tumultuous period for technology and growth-oriented companies. Before this year, many large and small growth firms were trading at sky-high valuations following years of exuberant investor sentiment. The pandemic period was stellar for these firms as fiscal and monetary stimulus encouraged many new retail investors. Record-low interest rates dramatically boosted discounted cash-flow values in growth stocks. Further, as more people were at home, many technology firms saw their earnings expand due to increased demand for internet-oriented services.

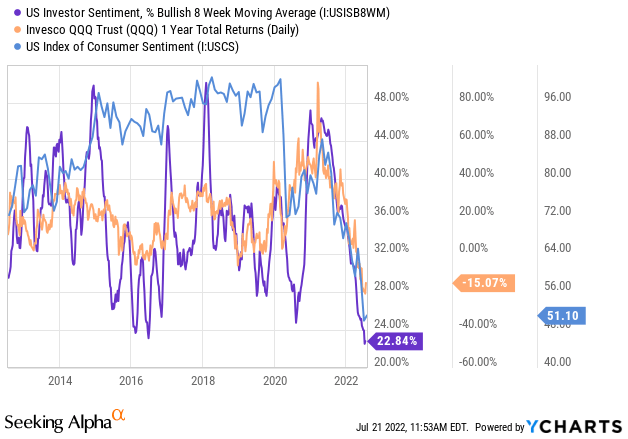

Of course, large booms often end in busts. The monetary and fiscal stimulus benefits to markets have reversed as the Federal Reserve pursues interest rate hikes and ended Q.E. Rising inflation, and falling real wages, have negatively impacted the economy, discouraging investment and consumption. Investor sentiment typically tracks one-year total returns on stocks. The popular Nasdaq 100 ETF (QQQ) has seen its annual returns slip into negative territory along with the sentiment indices. See below:

U.S Investor Sentiment, Consumer Sentiment, and Nasdaq 100 Performance (YCharts)

Low investor sentiment can be either bullish or bearish for stocks. Occasionally, as in 2020, the weak sentiment was somewhat bullish since it allowed for a buying opportunity. Of course, one of the Nasdaq 100’s best performance periods, the first half of 2021, occurred during extremely strong investor sentiment. However, in my view, the consistent decline in investor and consumer sentiment over the past twelve months is a moderately bearish signal as it suggests many investors may need to sell stocks to offset lost real income.

Growth stocks have seen a moderate bear market rally since June, with QQQ rising by around 12.5% from ~$270 to $375. Over this period, oil and gas prices have declined sharply, indicating a potential impending peak in inflation. The Federal Reserve has maintained its generally hawkish policy plan but has become somewhat cautious due to the ongoing rise in initial jobless claims and the sharp decline in its data-driven GDP growth outlook. Bad economic news can be good news, as poor economic data indicates a lower peak in interest rates. This factor is significant for interest rate-sensitive growth stocks.

That said, looking at all of the critical data points I follow, it appears growth stocks may not have cratered quite yet. Investor equity allocations and margin debt are somewhat high despite the slowing economy. Additionally, fund flows have remained positive, and there are very few technology stock short sellers, despite significant equity declines. On the economic front, many large technology firms are racing to cut hiring and employment, implying an effort to stave off a sharp decline in earnings. Many households are also looking to reduce spending, particularly on discretionary items sold by many top growth companies. Overall, I believe this situation does not bode well for the Nasdaq 100, creating a solid short-term opportunity to bet against the fund via the inverse ETF (NASDAQ:SQQQ).

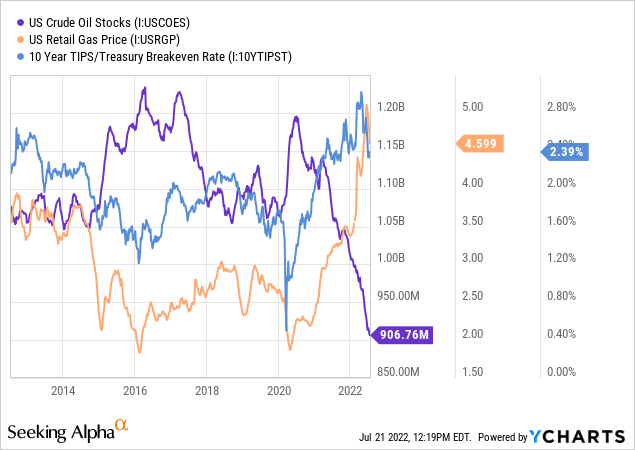

Inflation May Not Peak Soon

Key bullish catalysts, such as the decline in oil prices and the inflation outlook, may not persist. The “rise” in oil inventories over recent months is due primarily to the incredibly sharp decline in strategic petroleum oil reserves. A look at the EIA’s data shows that total oil storage (SPR and commercial) has consistently declined at a rapid pace. While this may seem unimportant for growth stocks, equity valuations are interest- and inflation-sensitive. If crude oil and gasoline prices spike even higher, the Federal Reserve will likely be forced to take more aggressive measures despite the economic slowdown.

As you can see below, gas prices and the long-term inflation outlook have tumbled in recent weeks, but the decline in oil storage has accelerated:

There is certainly some demand destruction in the energy market, but for now, it is not enough to stop the extreme declines in crude oil inventories. As oil storage falters, the possibility of a more considerable shortage grows. I believe this is a potentially highly inflationary factor many investors may not consider today. Generally, higher inflation is bad for growth stocks but somewhat positive for value stocks.

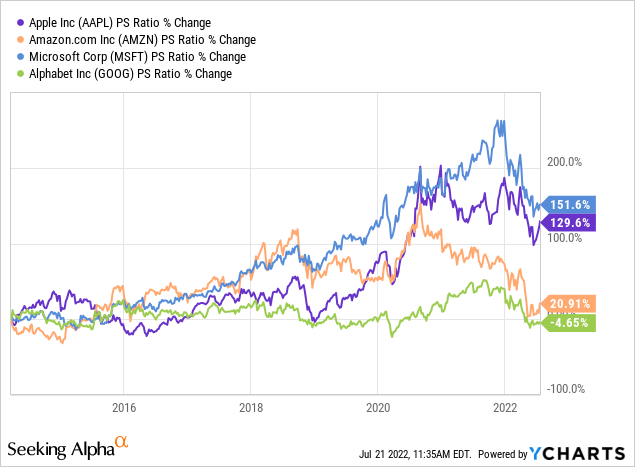

“Big Tech” Valuations Elevated As EPS Slows

Nearly 40% of the Nasdaq 100 is made up of just four companies: Apple (AAPL) (12.5%), Microsoft (MSFT) (10.9%), Google (GOOG) (GOOGL) (7.6%), and Amazon (AMZN) (6.1%). These four companies are almost always the largest in the fund, while holdings of the other ninety-six stocks fluctuate much more. The prospects of these four companies play a major role in driving the Nasdaq 100’s price. The relative valuations of these firms were extremely high last year, with most trading at price-to-sales 2-3X above normal levels. Price-to-sales is not an entirely useful valuation tool by itself. Still, I prefer it when measuring a company’s valuation to its past since more-fickle changes to margins do not impact it. Alphabet (or Google) and Amazon have seen their “P/S” valuation return to normal levels, but the larger Apple and Microsoft are still trading at a high relative premium. See below:

The Nasdaq 100’s “P/E” is currently at 25X, down from 38X a year ago. Since 2018, the index’s “P/E” has fluctuated from around 20X to 40X, so its valuation today is slightly lower. Of course, equity market valuations have been abnormally high over the past five years. Valuations are correlated with interest rates, so Nasdaq’s extremely high valuation before this year was due in part to record low-interest rates. Interest rates are rising fast today, so the Nasdaq 100’s fair valuation has declined dramatically. A “P/E” of 25X is not low when there are many trading at <5X (examples: 1, 2, 3, 4).

Of course, many of these firms’ earnings may likely decline over the coming years. Tesla (TSLA), Google, Microsoft, Netflix (NFLX), Apple, and Amazon have all pursued either mass layoffs or hiring freezes over recent months. Startups, a significant growth driver for acquisition-oriented technology companies, have seen new layoff events rise at an accelerating pace each month of 2022. Large and small growth companies are racing to reduce overhead to keep earnings afloat. In my view, this should not come as a surprise since many of these firms had low, and often negative, cash flow before 2022 and were dependent on an “easy money” monetary policy. Now that the cheap money era has ended, many growth companies are proving to be of little value.

For now, the most extreme losses are seen in smaller growth companies. Still, I expect the storm will continue to spread toward larger technology giants since their economic ecosystems are closely knit. From a macroeconomic view, rising prices and falling real wages will likely cause many people to reduce discretionary purchases. AT&T (T) recently had an abysmal quarter with a surge in non-paying customers. If people are struggling to afford their phone bills, it is doubtful they will race to buy the newest iPhone. On the other end, Apple’s (and peers) costs are rising as raw materials and freight become more expensive. In my view, the net result of this situation is likely to be years of negative changes to EPS and sales for most large technology firms, making them highly overvalued today.

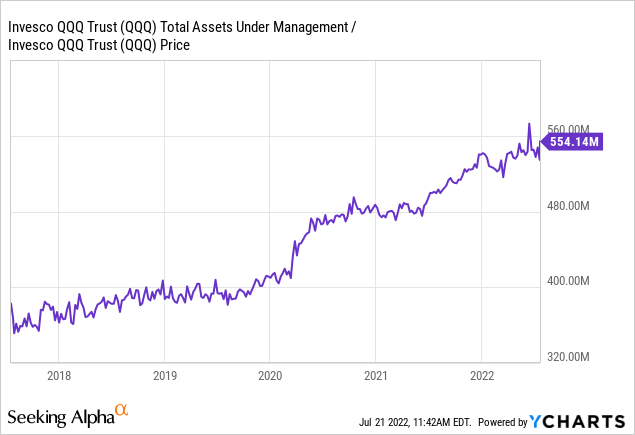

Investors Holding On Despite Losses

Low investor sentiment and negative total returns are usually met with sharp declines in flows and increases in hedging or short-selling activity. Investors have generally held on despite the Nasdaq 100 losing around a third of its value this year (before the recent rally). In fact, the total shares outstanding (measured by AUM/price) of the Nasdaq 100 ETF QQQ have risen slightly this year. See below:

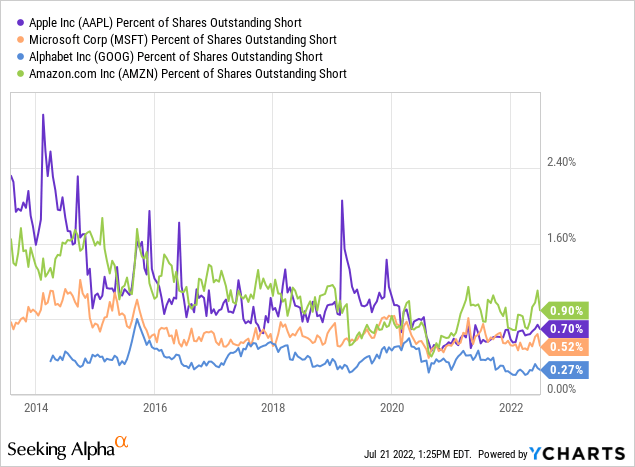

QQQ is the largest Nasdaq 100 ETF by orders of magnitude, so the fund’s positive flows this year indicate many investors are still looking to buy the Nasdaq 100. Few have sold despite losses. Further, sharp declines usually lead to a spike in short-selling activity, but few have sold the top growth stocks:

High short interest is often a bullish catalyst since it often results in “short-squeeze” price rallies. There has been a slight increase in short activity on these four firms, but historically very few traders are betting against them. In my opinion, this is a strong sign that most traders and investors remain too bullish on technology stocks despite their rapidly weakening fundamentals.

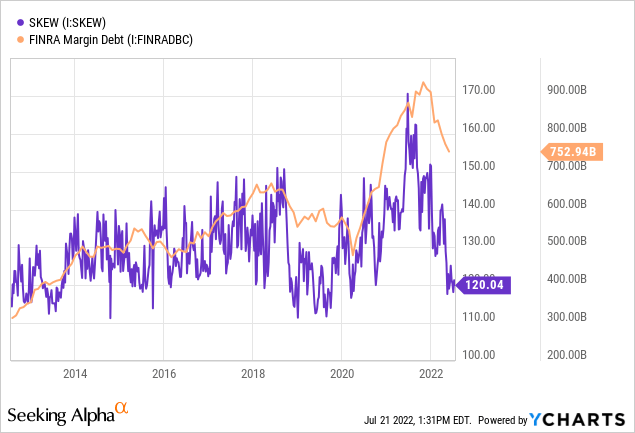

Similarly, hedging activity has decreased sharply throughout this year. A high SKEW index indicates many traders and investors are looking to buy “out of the money” put options to protect against downside risk. Historically, a high SKEW index does not indicate downside risk, likely because downside risk is limited when managers seek portfolio protection. Margin debt remains high as many investors are still using leverage. This measure is correlated to the SKEW index since levered traders often use options to hedge. See below:

Margin debt is declining, but a continued decline in equities may trigger a storm of margin calls. Overall, it appears that most investors are cautious regarding the stock market, particularly growth stocks. However, few are reducing exposure or hedging against potential losses. There is also considerable leverage in financial markets that could accelerate declines in the event of another downward move.

The Bottom Line

Overall, it appears there may be a solid bearish setup in the Nasdaq 100 today. Many “dip buyers” who were on the sidelines earlier this year have now had a chance to increase positions. While investors as a whole are concerned (from sentiment), very few are actively reducing exposure or hedging, and systemic margin debt remains substantial. Consumer data and most other economic indicators are firmly declining as higher interest rates, and inflation put the brakes on growth, meaning many technology firms may see valuations rise as their earnings outlooks slip.

As few traders bet against large technology firms, it may be a great time to make a contrary bet via the inverse Nasdaq ETF – SQQQ. The fund delivers -3X the returns of the Nasdaq 100 QQQ and has an expense ratio of 90 bps. Importantly, SQQQ is only suitable for short-term bets as its -3X inverse and leverage cause its value to decay over time. I believe the maximum holding period for an ETF such as SQQQ is around three months. As I expect, if the Nasdaq 100 experiences another downside wave soon, SQQQ can deliver very strong returns. It may be best to use stop losses on the position to avoid losses as the current bear market rally may extend further. Short selling is risky, but QQQ’s bearish setup appears strong, making SQQQ a strong speculative bet or hedging tool.

[ad_2]

Source links Google News