[ad_1]

Main Thesis

The purpose of this article is to evaluate the SPDR Portfolio S&P 500 High Dividend ETF (SPYD) as an investment option at its current market price. This is a fund that I have owned and recommend for some time, including earlier this year. While high yield dividend funds have struggled to keep up with the broader market as investors have been recently drawn back into riskier assets, I continue to see value in this ETF. I believe current investor sentiment is a bit too positive right now, and am recommending shifting into some more defensive holdings, which makes SPYD a natural option for new positions. The fund sports a dividend yield over 4%, and its top sector by weighting is Real Estate, which continues to outperform the broader market. Furthermore, investors are beginning to expect multiple interest rate cuts this year, which is a complete shift in sentiment from where we were six months ago. If interest rates do decline, SPYD’s income stream will look even more valuable than it does today. Finally, SPYD is markedly cheaper than the S&P 500 at current levels, which is a metric investors may find interesting as the major indices once again approach all-time highs.

Background

First, a little about SPYD. The fund is managed by State Street Global Advisors, and its stated objective is to “provide investment results that, before fees and expenses, correspond to the total return performance of the S&P 500 High Dividend Index”. SPYD currently trades at $37.52/share and yields 4.31% annually, based on the last four dividends. I have held a long position in SPYD for some time, and remained bullish on the fund during my last review in March. Since that time, however, the market has been met with some volatility, and SPYD has been an underperformer, only returning about 1%. Given this reality, I wanted to reassess the fund to see if it should remain one of my core dividend holdings or if it was time to find an alternative. After another review, I remain convinced SPYD should have a place in my portfolio, and I will explain why in detail below.

Index Provides Alpha

To start the review, I want to first look back at past performance to give a better understanding of why this is a fund I have held and recommended for some time. While there are many different dividend strategies and funds out there, and plenty of overlap between funds, each ETF typically tracks an underlying index. The performance of this index can vary widely, despite many ETFs seemingly offering similar holdings. A fund focused on “high yield” can track a very different index from another, and returns can and will be much different over time. Therefore, prior to initiating a position in any given ETF, I first determine if the underlying index both meets my objections and has been preforming well over time.

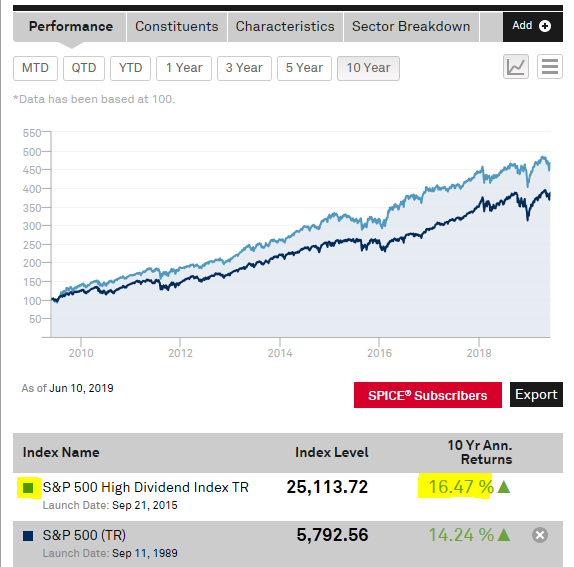

With the case of SPYD, both of my requirements are met. I am currently on the hunt for yield, with both equities and fixed-income, and find the S&P High Dividend Index attractive on the surface. Furthermore, after inspection of past performance, I remain confident this is indeed a wise choice for the longer term. To see why, consider that the underlying index has beaten the broader S&P 500 by over two full percentage points on an annual basis over the last ten years, as shown below:

(Source: S&P Global)

As you can see, this is very strong performance, and it is quite telling given how well the S&P 500 has performed over this time period.

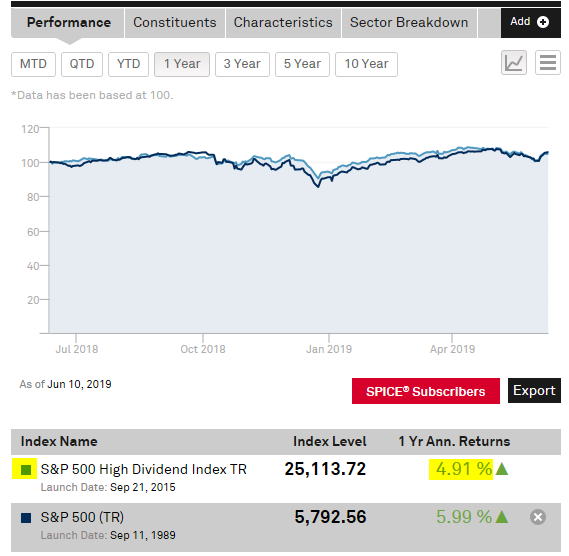

With this in mind, I have plenty of confidence that the underlying portfolio is something I want to be exposed to. However, it also has to match up with the current economic environment. This is an index that I imagine would underperform during periods of rising interest rates, as well as during periods when the “risk-on” trade is dominating the market. As luck would have it, these are two developments that have both happened over the past year, and unsurprisingly, the S&P High Dividend Index has indeed underperformed:

(Source: S&P Global)

With this in mind, investors will need to consider what the market has in store for us going forward. Will interest rates rise and pressure SPYD? Will investors remain in “risk-on” mode and buy equities with more of a growth focus? Or will we see more defensive positioning and neutral, or even lower, interest rates? All of these are important questions to consider when initiating new positions at current market levels, and in the following paragraphs, I will explain why I feel the conditions that will ultimately materialize will be positive for SPYD.

Declining or Neutral Interest Rates Are A Positive

During my review earlier in the year, I noted how a dovish interest rate outlook could benefit SPYD going forward. At that time (March 1), the outlook for rates suggested neutral levels for the first half of the year, with only a slight chance of either a hike or a cut by the July 31st Fed meeting.

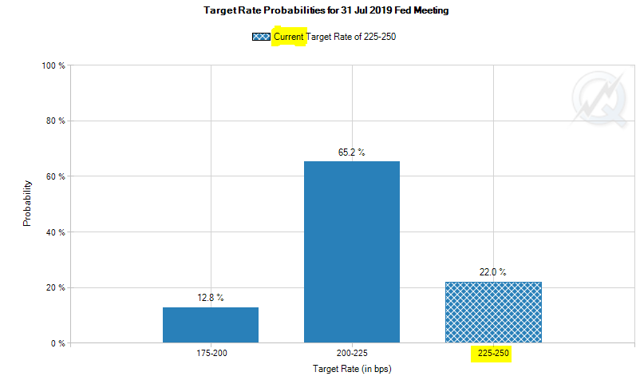

Since then, much has changed on a macro-economic level, and investors are currently expecting a very dovish Federal Reserve. In fact, the probability as it stands now, based on data from CME Group, is that we will see between 1-3 interest rate cuts by year end, which is a marked shift in policy. This is largely due to increased geopolitical tensions with Iran, trade disputes between the U.S. and China, as well as with Mexico and Europe, and slowing global growth.

All of these factors have weighed on sentiment, and investors have now begun to expect rate hikes sooner than later, in order to get to multiple cuts by year-end. To see the contrast, consider how I mentioned investors have previously placed almost a 95% chance of a neutral policy between March through the end of July. Based on today’s sentiment, the market is now predicting a 65% chance of a cut by the end of July, with a 13% chance of two cuts, as shown in the chart below:

(Source: CME Group)

My takeaway here is this is broadly positive for SPYD. Whether or not interest rates decrease over the next few months, investors are clearly expecting at least a neutral policy, and the likelihood of rate cuts is firmly in the minds of investors. This should continue to push investors into income-oriented assets, in order to lock in higher yields while they still exist. Investors have been doing this with bonds in the short term, and I would expect them to do the same with high-yielding stocks and funds (like SPYD) going forward.

I do want to reiterate that this is simply investor sentiment at the current moment. This can change quickly, and if it does, could negatively impact income products. Furthermore, my personal forecast for interest rates this year is that we may see one rate cut, so I expect the target rate to remain somewhere in the 200-250 range by the end of the year. I personally believe the market is anticipating more moves than the Fed has signaled, but only time will tell who is right in the end. However, as you can see from the March outlook and today’s outlook, sentiment can change on a dime. So, investors who are preparing for lower interest rates need to make sure they are hedging their bets in case that reality does not materialize.

Real Estate Continues To Lead

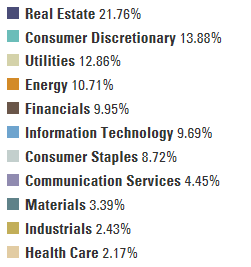

A primary reason for my continuous bullishness on SPYD has to do with it being the top sector by weighting, which has remained constant for some time. This is the Real Estate sector, at almost 22% of total fund assets, as shown below:

(Source: State Street)

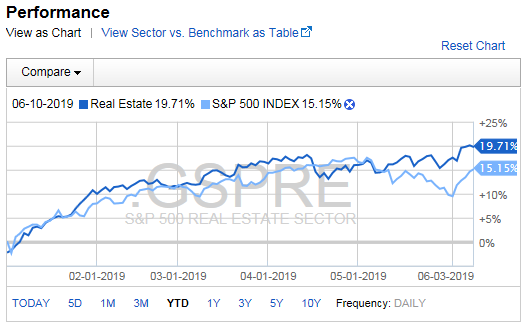

This exposure has been benefiting SPYD for a while, as the Real Estate sector was one of the top performers in 2018. The good news is this outperformance has continued in to 2019 as well, with Real Estate as a whole handily beating the broader S&P 500, as illustrated in the graph below:

(Source: Fidelity)

Clearly, this sector allocation has been a positive for SPYD. Now, the question is how likely is this sector to benefit SPYD for the second half of the year and beyond. While I believe the interest rate outlook will help high-yielding sectors as a whole, I believe the domestic focus of some of the top Real Estate holdings within SPYD will be of particular importance going forward, which is an area I will touch on in the following paragraph.

Top Holdings Have Domestic Focus

As I mentioned, I continue to recommend exposure to Real Estate for multiple reasons. While the sector is acting defensively at the moment, and providing above-average income while the rate outlook becomes more dovish, there is another added bonus due to the ongoing trade disputes between the U.S. and many of its top trading partners. The Real Estate sector as a whole can mean quite a few different things, from shopping malls to commercial real estate buildings and apartments, among many others. How domestically focused a particular holding is depends on its sub-sector. In the case of SPYD, two of the fund’s top ten holdings are in the Real Estate sector and are almost exclusively domestic-focused. These holdings are Public Storage (PSA) and Extra Space Storage (EXR), which collectively make up 3% of total assets.

The self-storage industry is actually an area I had been recommending during prior SPYD reviews, primarily because of the above-average yields, high occupancy rates, and steady revenue streams the companies within the space provide. In hindsight, this has been a very strong performing sector, with PSA and EXR being two of the top players in that category. In fact, these stocks have markedly outperformed the broader S&P 500 on a year-to-date basis and by a much wider margin than the Real Estate sector has as a whole, as shown in the graph below:

(Source: CNBC)

As you can see, even without factoring in dividends, EXR and PSA have seen their share prices rise at least 10% higher than the S&P 500 since 2019 started.

With these share gains in mind, it may seem a bit too aggressive to continue to recommend these holdings. However, I now see an additional reason to be long these stocks than I did previously, and that is their domestic exposure. With the trade dispute with China still unresolved, companies with foreign holdings and/or revenue streams continue to be concerned about future tariffs and/or slowing global trade. EXR and PSA do not have the same concerns. These companies operate self-storage units in the U.S. and are not impacted directly by tariffs because their revenue comes from domestic consumers who are looking to store goods they no longer want to keep in their homes. This reality has no doubt helped drive much of the outperformance we have seen this year, and with no clear signal that the dispute with China will end soon, I expect this to remain the case for the foreseeable future.

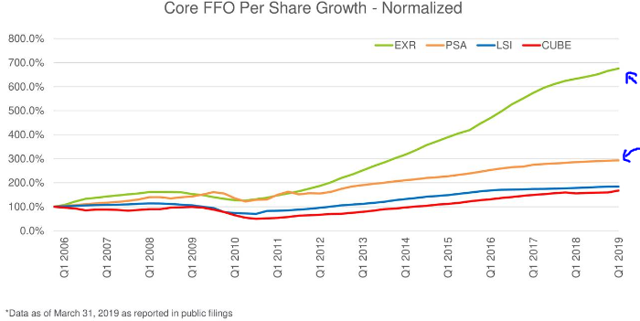

Furthermore, these companies have been improving their performance over time, so this is not just a short-term thesis. In fact, both PSA and EXR have seen impressive funds from operations (FFO) growth over the past decade, as shown below:

(Source: Seeking Alpha)

In summary, I see this sub-sector as an area that has been driving gains for SPYD and will continue to do so. Not only is this an area I want exposure to, but PSA and EXR are two of the top players in the space, so they are a welcome sign in SPYD’s portfolio.

The Value Is There

Another point on SPYD has to do with the fund’s current value proposition. While I do not believe the fund is “cheap”, it is noticeably less expensive than the broader market. While I see the fund’s holdings in Real Estate and Utilities as defensive in nature, the current P/E also suggests the fund could weather potential market volatility a bit better than the average index fund. To illustrate this point, consider the current P/E ratio and dividend yield for SPYD, against the S&P 500, as shown in the chart below:

| Asset | Current P/E | Current Yield |

| SPYD | 16.3 | 4.31% |

| S&P 500 | 21.4 | 1.90% |

(Source: State Street, Multpl.com)

As you can see, the differential is considerable. While this by no means guarantees any type of performance outcome going forward, it does help put my mind at ease that SPYD’s current valuation offers some downside protection compared to the overall market.

What Could Go Wrong?

While I have laid out a case for buying SPYD now, I do need to discuss potential pitfalls in this strategy. It should be clear that a primary reason for my bullishness is the strength in the Real Estate sector and some of the specific holdings SPYD has within that sector. This performance and the likelihood of continued positive performance rests largely with interest rate movements, as investors have rotated into this sector for the yields offered. If rate cuts do not materialize or, especially, if interest rates actually move higher, that will probably cause a disproportionate sell-off in Real Estate. Investors are piling in based on current sentiment and could be badly hurt if reality does not end up meeting expectations.

A second pitfall has to do with SPYD’s second-largest sector by weighting, which is Consumer Discretionary. While I noted how I like the Real Estate exposure due to the domestic focus (and thus isolating the fund somewhat from trade disputes), the Consumer Discretionary sector offers quite the opposite. While the holdings are all American firms which do a large percentage of their business domestically, slowing global trade will disproportionately harm this group. Furthermore, tariffs will undoubtedly make many of the products sold within this sector more expensive, which could stifle future demand.

To put this in perspective, consider some of the top holdings within SPYD in this category. Notable mentions include Target Corporation (TGT), Ford Motor Company (F), General Motors Company (GM), and Macy’s (M), among eight others. This mix of has two different set of obstacles in front of it. For companies like TGT and M, contending with potential tariffs is an issue, but so is the rise of e-commerce, which continues to impact foot traffic in traditional shopping centers. For companies like F and GM, potential tariffs represent a major headwind. While President Trump has called off Mexican tariffs for now, if this position is reversed it could have a major impact on these automakers. According to a recent report by Fox Business, GM and F shipped over 725,000 and 245,000 vehicles from Mexico last year, respectively. While this headwind has been avoided for now, I would not be surprised to see the threat of Mexican tariffs make headlines again at some point this year. If so, the impact on shares of GM and F, and by extension SPYD, would likely be negative.

Bottom Line

I reiterated my long position in SPYD earlier this year and continue to do so today. While the American economy continues to show signs of strength, I feel equity prices are banking too much on future interest rate cuts, and see the likelihood of a notable correction increasing by the day. With this mindset, I am shifting assets to cash, fixed-income, and defensive ETFs, and I include SPYD in the defensive category. With a 4% yield, a valuation well below the S&P 500, and top holdings I find attractive, I see plenty of reasons to add to this position. While the fund’s Consumer Discretionary weighting has me cautious in light of continuing trade battles, I still feel the overall fund make-up provides an adequate risk-reward balance. Therefore, I am endorsing SPYD and recommend investors give the fund consideration at this time.

Disclosure: I am/we are long SPYD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News