[ad_1]

Leonid Sorokin

The tactical buy opportunity

I was short S&P 500 (NYSEARCA:SPY) earlier this year, but decided to take advantage of the bullish setup in May/June and buy the (expected) summer rally, based on the simple thesis that the Fed potentially made the dovish pivot (the peak in Fed hawkishness thesis). That trade worked perfectly, but ended in August once we realized that the Fed is turning more hawkish, at which point I turned bearish again.

Just recently, I decided to cover the short position, and buy the expected bounce (or the year-end-rally), with the same thesis as in June – expecting the new peak in the Fed hawkishness.

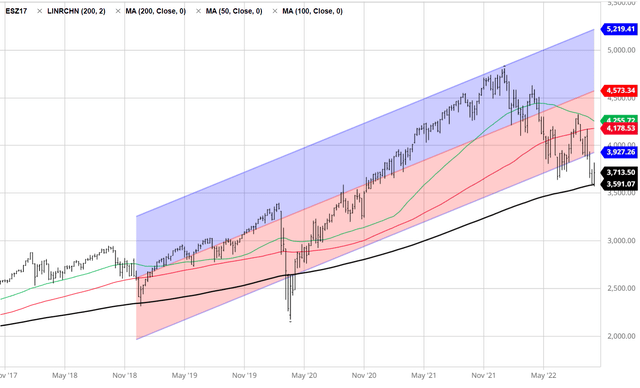

Here is the tactical buy opportunity I was anticipating – buy the major longer-term support (200wma) at around 3600 level, with the target profit at the resistance (200dma) in the area of 4150-4200 for S&P 500 futures (SPX).

Barchart

The fundamental support might not be there

However, the expected bounce must be supported with the fundamentals. The (temporary) peak in the Fed hawkishness was the main trigger for the summer rally. So, let’s look at “the peak Fed hawkishness” indicator – or the Federal Funds futures.

On June 16th, as you can see from the chart below, the market expected the Fed to hike to just above 4% by April 2023. However, after June 16th, those expectations were reduced to 3.1% by July 28th. We assumed that the Fed made a significant dovish turn, and this was the trigger for the 17% summer rally in SPY. In August, we realized after unexpected CPI surprise, that the Fed would have to tighten more aggressively – this ended the summer rally and triggered the new leg lower in SPY.

However, of September 26th, we potentially reached the new peak in the Fed hawkishness, when the expectations for the Federal Funds rate reached 4.80% by April 2023. These expectations decreased to 4.3% by November 4th – which supported the view that the September 26th was in fact the new peak in Fed hawkishness and supported the tactical buy trade to bet on another rally (like in June).

Unfortunately for the bulls, the Fed policy expectations are rising again, and there are good reasons, which I will explain, to believe that the Fed might have to tighten even more aggressively than expected on September 26th, which invalidates the new peak in the Fed hawkishness thesis.

Here is the chart of the Federal Funds futures April 2023 contracts. Deduct the contract price from 100 to get the implied Federal Funds rate. I am using the April 2023 contract as the reference because currently the market expects the Fed to stop hiking interest rates in April of 2023, so this is the cyclical high.

Barchart

Inflation forecast will not allow the Fed dovish turn

Thus, the fate of the year-end rally depends on whether the September 26th low holds for the Federal funds rate, which in turn depends on the CPI inflation.

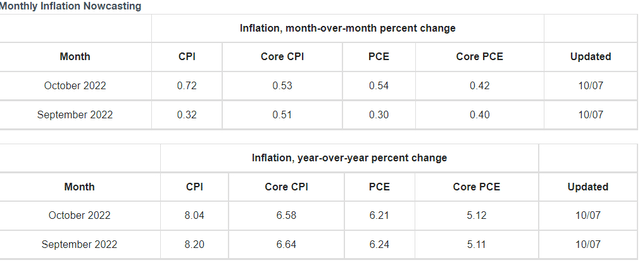

Unfortunately, based on the InflationNowcast forecast (see the table below), we still have not reached the peak in inflation. Specifically, the core CPI is expected to be 6.64% in September, which is above the 6.3% in August, and above the consensus of 6.5%. Thus, we still don’t have the peak core CPI inflation. This CPI report will be released on October 13th, so expect volatility next week.

The Cleveland Fed

More importantly, the core PCE inflation (the Fed’s preferred measure) is expected to be higher in October at 5.12% than in September at 5.11%. So, based on these forecasts, the peak in inflation is still at least several months off. Thus, the Fed is unlikely to make even the smallest dovish turn, and we will likely surpass the September 26th peak in the Fed’s hawkishness.

Even more problematic for the market are the expectations that the Fed tightening cycle will extend beyond April 2023. This would clearly mark the “no light at the end of the tunnel” scenario and push SPY below the long-term support.

How far will the Fed go, and what is the terminal rate? My expectation is that the Fed will have to increase the Federal Funds rate above the inflation rate. So, the most optimistic scenario would look at the core PCE inflation and suggest that the Fed will have to exceed the 5% level, at minimum.

Implication for short-term tactical trading

SPY is currently at the major support at 357 level, and down by nearly 25% YTD. The breakdown of the support level, and the continuation of the selloff will require the significant negative news, and the CPI report next week could be the trigger – if the InflationNowcast forecast is correct. Thus, I have covered the speculative long position, and currently evaluating the “breakdown” short trade, but also the possibility that the support holds.

Implications for longer-term investors

A more hawkish Fed increases the probability of a deeper recession. However, SPY is already pricing a modest recession with the forward PE ratio at 16, and the ttm PE ratio at 17. The first signs of deteriorating labor market will allow the Fed’s dovish turn, assuming there is a verifiable peak in inflation. The Fed is unlikely to allow the unemployment rate to increase past 4.4% – which is what the market is currently pricing.

As I previously outlined, the CPI inflation will significantly fall, due to the correction in the housing market and the shelter costs. However, there is a significant lag until the shelter costs show up in the core CPI.

Thus, any short-term downside volatility is the opportunity to allocate to SPY for investors with longer-term investment horizons. The absolute bottoms are impossible to predict and waiting for the bottom could be costly.

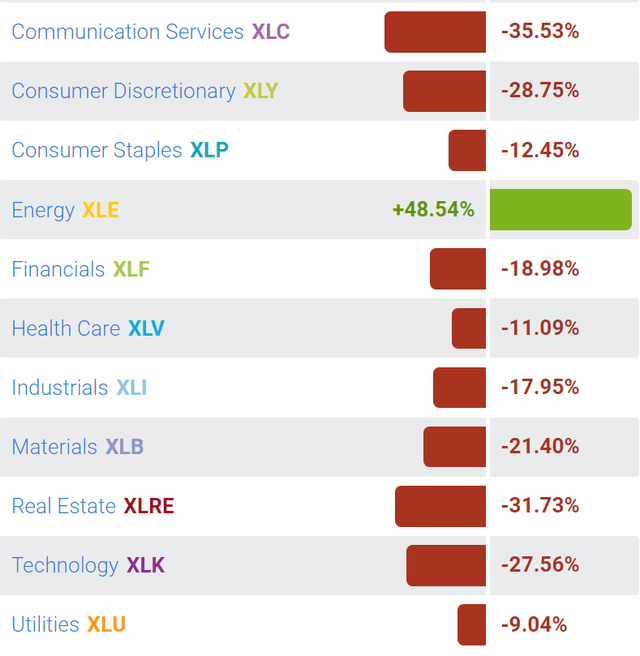

Specific SPY sector analysis

All SPY sectors are down YTD, except Energy (XLE). Given the expected volatility over the short term, investors looking to allocate to SPY sectors should be defensive, sticking with the picks from the Consumer Staples (XLP) and Healthcare (XLV) sectors. Note, Energy is a cyclical sector, and the expected recession will curve the demand, which is a negative, but currently offset with the geopolitical situation.

SelectSectors SPDR

[ad_2]

Source links Google News