[ad_1]

SusanneB

Thesis

ProShares UltraPro Short S&P 500 (NYSEARCA:SPXU) is a leveraged inverse ETF that seeks daily investment results that correspond to three times the inverse (-3x) of the daily performance of the S&P 500. The ETF falls in the trading tools category since a buy-and-hold investor should not hold to this instrument long-term. In today’s environment, the ETF comes in mightily handy, though.

We are currently experiencing a bear market in equities, which has brought the S&P 500 to a -23% performance year to date. While many market participants are of the opinion that higher rates are now priced in, some analysts do not think the earning deceleration is fully priced, with potential more downside to come:

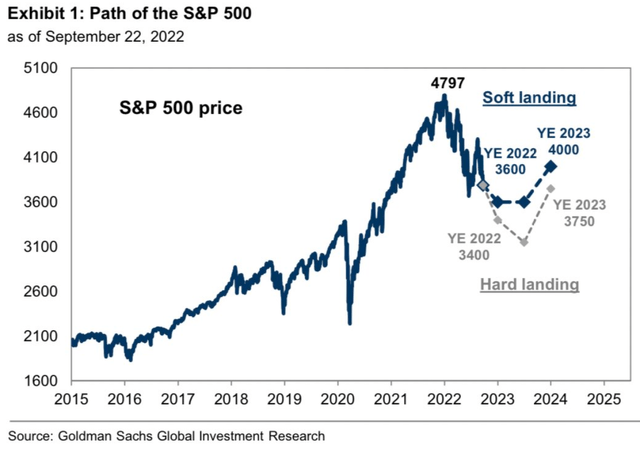

S&P 500 Potential Path (Goldman)

The above graph presents the latest take by Goldman Sachs (GS) on the potential S&P 500 path, with a full hard landing scenario bringing the index closer to a 3,100 price level. That is almost -15% down from current levels!

The basics of portfolio management advocate for a retail investor to always have an allocation to stocks, even during bear markets. Large asset managers have distinct mandates that do not allow them to have cash levels exceeding 5% to 10% of their portfolios (at the end of the day they need to justify the high fees they are charging), and thus allocate a high percentage of the holdings to defensive stocks such as Utilities and Healthcare. Retail investors have the flexibility to allocate their portfolio as they see fit, but if that cash allocation exceeds 50% there would definitely be a good amount of FOMO (fear of missing out) from a psychological standpoint.

Let us assume a savvy retail investor has done all the right things in 2022 and is now sitting on a 50% stock, 50% cash allocation. Knowing there is another potential -15% leg coming in the market, said investor has very few choices to capital protect their portfolios:

1) Buy puts

2) Utilize inverse ETF to immunize the portfolio from further losses

Buying Puts is Now Expensive

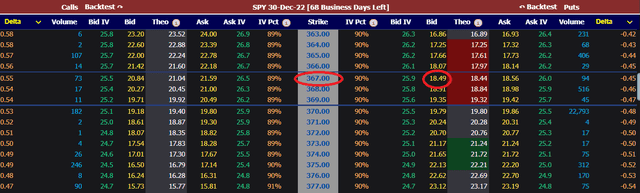

Let us have a look at the SPY options chain:

SPY Puts Chain (MarketChameleon)

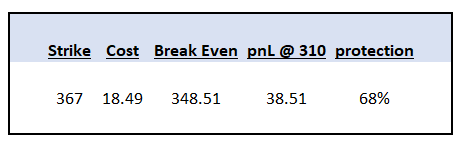

We can see that an at the money put with a December 30, 2022 expiration date now costs $18.49 per contract. Let us look at why we are saying the put is “expensive”. Firstly, if we assume the market is going to 310, then we can see that the respective option only protects us 68% of the way:

Put Protection (Author)

The higher the cost on day 1 for the option, the less upside provided. To that end, we can see that the breakeven at maturity is 348 for the SPY. That means if the SPY is at that level or above, you are either breaking even as an investor or losing money.

The second factor to look at is the “IV Pct” in the above table. We can see that number at 90%. That means that volatility is at a statistically very high level. When you buy options, you want volatility to be low, not high. Buying puts with high volatility is expensive.

SPXU is Capital Efficient

SPXU is an inverse ETF that provides -3x the daily return of the S&P 500. To that end, an investor who believes the market is going to move lower and wants to immunize their portfolio does not need to sell equities but buy SPXU for an amount to their movement-adjusted portfolio.

Let us look at an example: an investor with a $150k equities portfolio needs to protect the portfolio returns. We have now established puts are expensive. If conversely, we go via the inverse ETF route, a -1x instrument would require 150k in capital from said investor in order to immunize their portfolios. By utilizing SPXU the investor only needs a $50k amount, since the return profile equates to a $150k notional.

SPXU is a capital-efficient trading tool to be utilized in a down market in order to further insulate the portfolio from further losses. SPXU is a short-term trading tool, not a buy-and-hold instrument.

The only other item to be aware of when using inverse ETFs is the “drift” associated with these instruments, i.e. the basis from a true 3x movement. Another SA author, Fred Piard, wrote a good piece on drifts that you can find here.

Conclusion

SPXU is a leveraged inverse ETF that seeks daily investment results that correspond to three times the inverse (-3x) of the daily performance of the S&P 500. With some investment banks now seeing a distinct possibility for a hard landing that would bring the S&P 500 to a 3,100 level, investors should start thinking about tail hedges. The article highlights how puts are currently expensive with a high implied volatility. SPXU represents a capital-efficient instrument for a retail investor looking to immunize their portfolios from further losses but being capital constrained. SPXU is a short-term trading tool, not a buy-and-hold instrument.

[ad_2]

Source links Google News