[ad_1]

NicoElNino/iStock via Getty Images

This dividend ETF article series aims at evaluating products regarding the relative past performance of their strategies and quality metrics of their current portfolios. As holdings and weights change over time, I post updated reviews when necessary.

SPHQ strategy and portfolio

The Invesco S&P 500 Quality ETF (SPHQ) has been tracking the S&P 500 Quality Index since 12/6/2005. It has a distribution yield of 1.24% and an expense ratio of 0.15%. The fund invests in the 100 S&P 500 companies with the highest quality score, based on return on equity, accruals ratio and financial leverage ratio. It is rebalanced and reconstituted semi-annually.

The top 10 holdings, listed below, weight 43.3% of asset value. None of them weights more than 5.07%, so the risk related to individual stocks is limited.

|

Ticker |

Name |

Weight% |

EPS growth %TTM |

P/E TTM |

P/E fwd |

Yield% |

|

AAPL |

Apple Inc. |

5.07 |

62.83 |

28.62 |

28.43 |

0.51 |

|

V |

Visa Inc. |

4.96 |

26.04 |

38.70 |

32.05 |

0.66 |

|

BAC |

Bank of America Corp. |

4.92 |

90.69 |

13.52 |

14.85 |

1.74 |

|

JPM |

JPMorgan Chase & Co. |

4.89 |

72.70 |

9.94 |

13.47 |

2.62 |

|

MA |

Mastercard Inc. |

4.71 |

37.42 |

43.64 |

36.66 |

0.51 |

|

MSFT |

Microsoft Corp. |

4.70 |

39.98 |

32.55 |

32.61 |

0.81 |

|

PFE |

Pfizer Inc. |

4.45 |

118.17 |

15.73 |

12.59 |

3.02 |

|

WFC |

Wells Fargo & Co. |

3.76 |

1124.32 |

11.32 |

14.41 |

1.78 |

|

ADBE |

Adobe Inc. |

3.16 |

-7.60 |

51.25 |

37.26 |

0.00 |

|

ABT |

Abbott Laboratories |

2.69 |

57.44 |

32.84 |

26.62 |

1.45 |

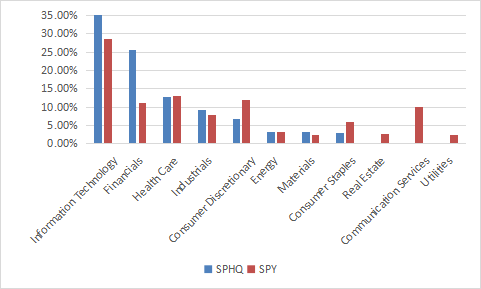

The heaviest sector is technology (35.07%), followed by financials (25.67%). Healthcare comes third with 12.79%, then other sectors are below 10%.

SPHQ sectors (Chart: author with Fidelity data)

SPHQ is cheaper than SPY regarding usual ratios (see next table). This is partly due to the weight of financials, whose valuation ratios are low, and also less reliable. As a reference, the Financial Select Sector SPDR Fund (XLF) has a P/E of 11.6.

|

SPHQ |

SPY |

|

|

P/E TTM |

18.22 |

23.05 |

|

Price/Book |

3.97 |

4.3 |

|

Price/Sales |

2.84 |

3 |

|

Price/Cash Flow |

15.6 |

17.22 |

Data: Fidelity

Performance

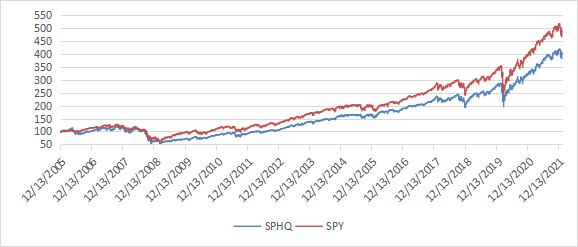

Since inception in December 2005, SPHQ has lagged SPY by about 1.3 percentage point in annualized return, with a slightly higher risk in drawdown and volatility (standard deviation of monthly returns).

|

Total Return |

Annual.Return |

Drawdown |

Sharpe ratio |

Volatility |

|

|

SPHQ |

300.58% |

8.97% |

-57.83% |

0.58 |

15.32% |

|

SPY |

385.52% |

10.28% |

-55.19% |

0.67 |

14.91% |

The next chart plots the equity value of $100 invested in SPHQ and SPY since SPHQ inception.

SPHQ vs SPY (chart by author)

SPHQ has slightly, but steadily underperformed SPY.

Comparing SPHQ with a reference strategy based on dividend and quality

In previous articles, I have shown how three factors may help cut the risk in a dividend portfolio: Return on Assets, Piotroski F-score, and Altman Z-score.

The next table compares SPHQ since inception with a subset of the S&P 500: stocks with a dividend yield above the average of their respective indexes, an above-average ROA, a good Altman Z-score and a good Piotroski F-score. It is rebalanced annually to make it comparable with a passive index.

|

Total Return |

Annual.Return |

Drawdown |

Sharpe ratio |

Volatility |

|

|

SPHQ |

300.58% |

8.97% |

-57.83% |

0.58 |

15.32% |

|

Large cap reference subset |

667.40% |

13.45% |

-39.93% |

0.88 |

14.54% |

Past performance is not a guarantee of future returns. Data Source: Portfolio123

SPHQ lags the S&P 500 dividend and quality subset by over 4 percentage points in annualized return. However, SPHQ performance is real, whereas the subset performance is hypothetical. My core portfolio holds 14 stocks selected in this subset (more info at the end of this post).

Scanning SPHQ with quality metrics

SPHQ holds 100 stocks, of which only 3 are risky stock regarding my metrics. In my ETF reviews, risky stocks are companies with at least 2 red flags among: bad Piotroski score, negative ROA, unsustainable payout ratio, bad or dubious Altman Z-score, excluding financials and real estate where these metrics are less relevant. Here, risky stocks have very small weights and are negligible in asset value.

According to my calculation of the weighted quality metrics reported in the next table, SPHQ quality is significantly superior to the benchmark. ROA is especially good.

|

Altman Z-score |

Piotroski F-score |

ROA% TTM |

|

|

SPHQ |

5.08 |

6.63 |

13.48 |

|

SPY |

3.75 |

6.48 |

7.38 |

Takeaway

SPHQ follows a quantitative strategy based on a quality ranking using return on equity, accruals and financial leverage. An evaluation based on other metrics (Piotroski F-score, Altman Z-score and return on assets) confirms the high quality of SPHQ portfolio. Moreover, its exposure to risky stocks regarding my criteria is below 1%. On the performance side, it has lagged SPY since inception by 1.3 percentage point in annualized return. However, it has beaten the benchmark in the last 12 months (18.2% vs. 15.7%). SPHQ is a good product for investors seeking a passive capital allocation in high quality US equities. It has a 5-star rating at Morningstar. For transparency, I have a passive allocation in quality-oriented ETFs (SPHQ is not part of it) and a dividend and quality active portfolio of 14 stocks (“Stability” model).

[ad_2]

Source links Google News