[ad_1]

JHVEPhoto

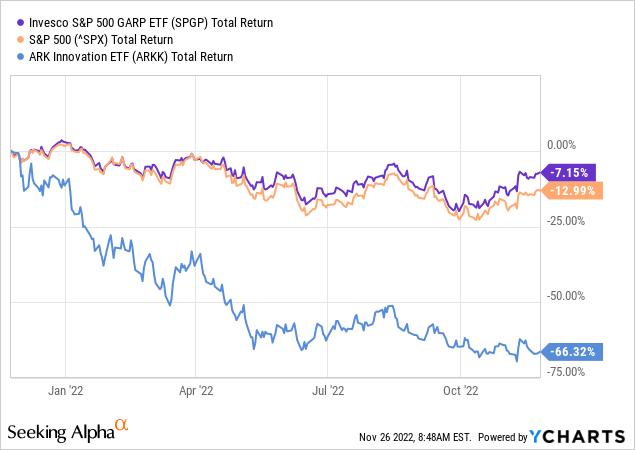

The Invesco S&P 500 GARP ETF (NYSEARCA:SPGP) has found a successful strategy to achieve “growth at a reasonable price”. I say that because the fund has an excellent long-term performance track record and has outperformed the S&P 500 by 5.5%+ during the 2020 bear market (see below). In addition, the SPGP ETF has absolutely creamed the ARK Innovation ETF (ARKK), which some investors (including myself) would describe as “growth at any price” – or “GAAP” – an acronym that I find to be both ironic and somewhat humorous. Today, I’ll take a close look at the SPGP ETF to see if it might be a good addition to the “growth” category within your portfolio.

Investment Thesis

As I explained in my recent Seeking Alpha article on year-end portfolio management (see Year-End Portfolio Management In A Bear Market), I advise investors to build and maintain a well-diversified portfolio and to hold it throughout the market’s up-n-down cycles in order to reap the returns the market is more than willing to give them. Part of that strategy is to adopt a top-down approach to allocating capital to various categories – one of which is “growth”. The rationale of “growth category” investments is to beat the overall returns of the broad market – which I consider to be defined by the total returns of the S&P 500. There are obviously various strategies on how to achieve “growth”, including owning individual growth stocks and/or a growth oriented fund. What we are looking for is not a flash-in-the-pan type fund (which is arguably what the ARKK ETF represents), but a growth fund that we can invest in over the long term and that will deliver above average returns as compared to the S&P 500. Today, I will look at a fund – the SPGP ETF – that has embraced the “growth at a reasonable price” strategy to see if it might be a good fit in your portfolio.

Top-10 Holdings

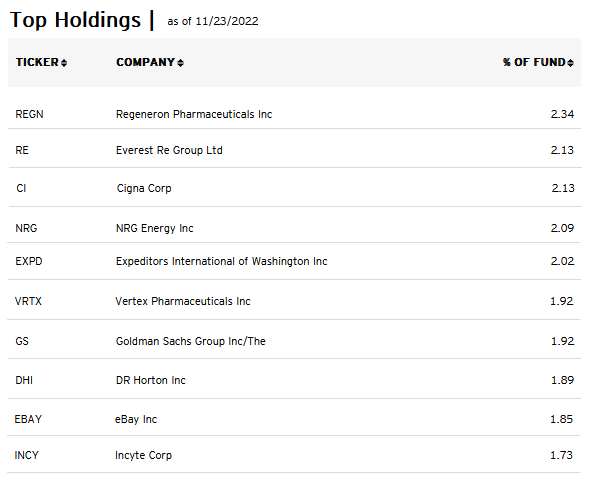

The top-10 holdings in the Invesco S&P GARP ETF are shown below and were taken directly from the Invesco SPGP ETF homepage. The top-10 holdings equate to what I consider to be a well-diversified 20% of the entire 77 company portfolio:

Invesco

The #1 holding with a 2.3% weight is Regeneron (REGN). Regeneron is a global pharmaceutical company that discovers, develops, manufactures, and commercializes medicines for treating diseases. These drugs include the EYLEA injection – which can treat a plethora of macular related eye disorders. REGEN also makes Dupixent – which treats atopic dermatitis and asthma in adults and children.

Regeneron released its Q3 results on November 3rd, and they were a strong beat on both the top- and bottom-lines. Non-GAAP EPS of $11.14 was a $1.52/share beat. Revenue of $2.94 billion was down 14.8% yoy, but that was an $80 million beat. On the development front, REGN reported a number of positive catalysts moving forward, including:

- Q3 Dupixent global net sales (as recorded by Sanofi) increased 40% yoy.

- Positive results reported in aflibercept 8 mg pivotal trials for diabetic macular edema (“DME”) and neovascular age-related macular degeneration (wet AMD).

- EYLEA granted additional six months of pediatric exclusivity by the FDA.

- The FDA approved Dupixent for prurigo nodularis.

- Inmazeb® won 2022 Prix Galien USA “Best Biotechnology Product” Award.

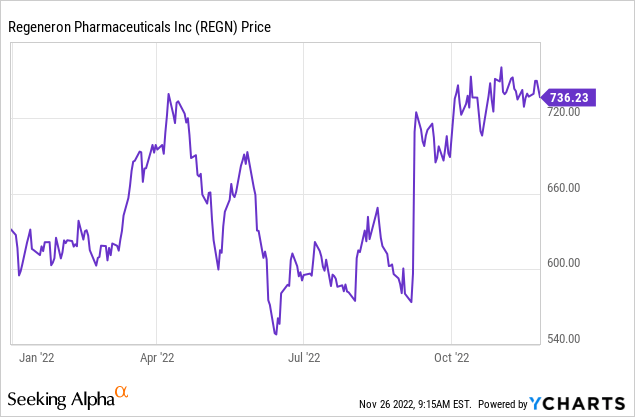

The stock is up 14%+ this year after popping higher on September 8th after the release of EYLEA pivotal trial results:

REGN trades with a forward P/E = 17.2x.

Cigna Corp. (CI) is the #3 holding with a 2.1% weight. Cigna is an insurance and healthcare related company that has solid track record of profitably growing revenue & earnings. Cigna trades with a forward P/E of only 14x while yielding 1.38%.

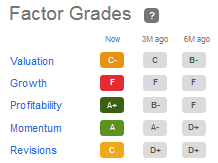

The #7 holding with a 1.9% weight is Goldman Sachs (GS). Goldman currently yields 2.57% and trades with a forward P/E of only 11.4x. The well-diversified financial services company is a rather odd pick for the SPGP fund considering the company’s growth profile is rather spotty. Indeed, according to Seeking Alpha, its “Growth” factor is rated an “F” while its “Valuation” factor is a “C-“:

Seeking Alpha

That said, note that GS does have excellent ratings for profitability and momentum.

Home builder D. R. Horton (DHI) is the #8 holding with a 1.9% weight. DHI is a somewhat counter-cyclical investment given the negative impact of higher interest rates on the domestic housing market. However, the company recently raised its dividend 11% and currently trades with a forward P/E of only 8.5x.

eBay (EBAY) is the #9 holding with a 1.9% weight. The stock is down 37% over the past 12 months and has been, according to Seeking Alpha contributor Paul Franke, Left For Dead with a forward P/E of only 11x.

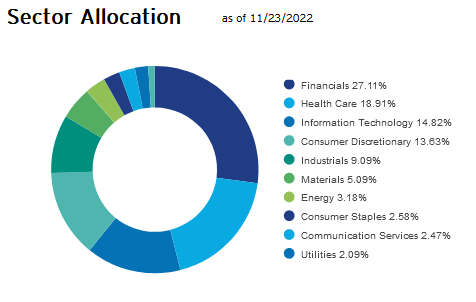

The SPGP ETF portfolio’s sector allocation is shown below:

Invesco

As can be seen, the portfolio is significant overweight in the Financials and HealthCare sectors (which equate to 11.7% and 15.2%, respectively, of the S&P 500). It is interesting to note that the Energy Sector equates to only 3.2% of the SPGP portfolio, which is under-weight in relation to its 5.2% weight in the S&P 500. That’s interesting because the Energy Sector has been one of the best growth sectors in the S&P 500 over the past couple of years while continually being one of the lowest valued sectors.

Performance

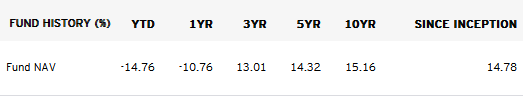

The long-term performance track record of the SPGP ETF is shown below:

Invesco

As I mentioned earlier, the SPGP’s 10-year average annual return of 15.2% is very impressive.

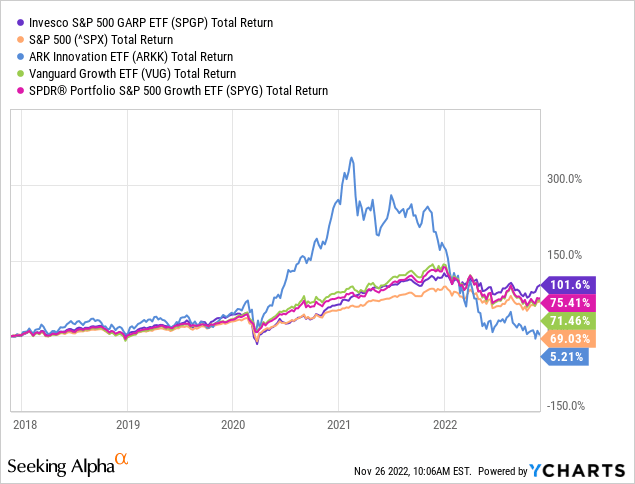

The following graph compares the 5-year total returns of the SPGP ETF versus those of the S&P 500, the ARKK ETF, the Vanguard Growth ETF (VUG), and the SPDR S&P 500 Growth ETF (SPYG):

As can be seen, and despite the 2022 bear market, the SPGP ETF is far-and-away the best performer of the group, beating the S&P 500 by over 30% and trouncing the ARKK fund, proving that GARP beats GAAP hands-down.

Risks

The SPGP ETF is not immune to the investment macro-environment of high inflation, higher interest rates, Covid-19 related shut-downs in China and lingering supply-chain challenges, as well as Putin’s horrific war on Ukraine that has arguably broken the global energy & food supply chains. Any of all of which could cause a slowing of the global economy and/or a global recession that would put downward pressure on stock prices.

Summary & Conclusion

I like this fund, very much. Despite the relatively expensive 0.33% fee, the returns speak for themselves. This ETF has certainly proven itself over the long term to deliver upside growth as compared to the S&P 500 – which is exactly the purpose of a “growth category” investment.

The SPGP ETF is a BUY.

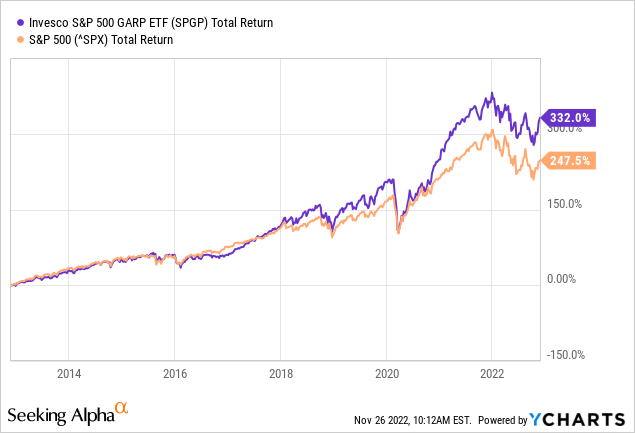

I’ll end with a 10-year total returns chart of the SPGP ETF versus the S&P 500:

[ad_2]

Source links Google News