[ad_1]

Investment Thesis

Dividend investors looking for exposure to undervalued dividend stocks within the euro area should consider the SPDR S&P Euro Dividend Aristocrats ETF (SPEUHDAN), which to some extent is the European equivalent of the American SDY; the fund, which offers relatively high and stable income and a tilt towards undervalued stocks, plus tax efficiency in collecting the dividends by virtue of being domiciled in Ireland, has beaten the European market since its inception in 2012. Nevertheless, investors should be careful of the less-stringent quality indicators that the fund applies compared to SDY; this, combined with its value approach, may bring additional risk compared to a market cap-based ETF.

The S&P Euro High Yield Dividend Aristocrats Index

The SPDR S&P Euro Dividend Aristocrats ETF tracks the performance of the S&P Euro High Yield Dividend Aristocrats Index, which is made of the 40 highest yielding stocks in the eurozone that have raised or maintained their dividends for at least 10 years; stocks are weighted by yield and not market cap, which gives this ETF a value investing approach. The 10-year dividend record, which would be quite lenient for American standards, is reinforced by a payout/earnings requirement of no more than 100%, and a minimum market capitalization of 1 billion USD; in addition, the index caps each stock at a maximum of 5%, and each sector at 30%.

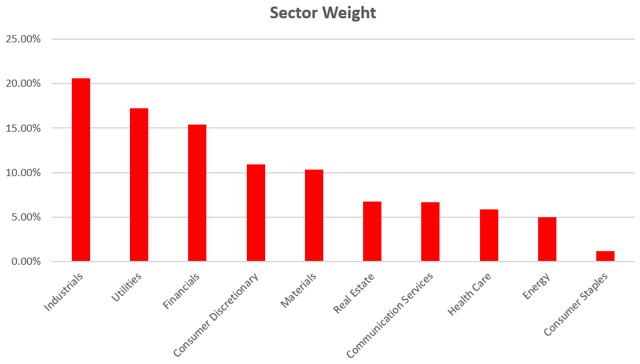

The largest sector in the fund is the industrial one, closely followed by utilities and financials; the technology sector, that before the June 2019 rebalancing made the smallest piece of the cake at 1.10%, has disappeared. Surprisingly, consumer staples occupy the smallest place in the portfolio, most likely because of their generally low dividend yield.

Source: Author based on State Street

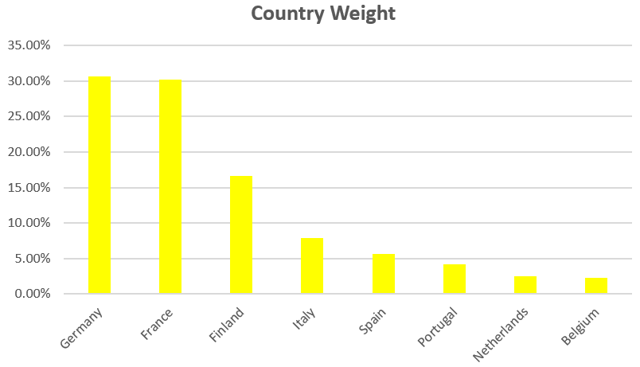

At the time this article is written, the S&P Euro Dividend ETF invested in 8 Eurozone countries, with the largest investments being in Germany (30.64%), and the smallest in Belgium (2.29%).

Source: Author based on State Street

Germany, Finland and Italy together make more than 55% of the assets; this is not a trivial aspect: these three countries are all but tax-friendly to dividend investors, as they apply their withholding tax in full (25.325% for Germany, 30% for Finland and 26% for Italy) on the dividends paid to non-residents, irrespective of the existence of tax treaty (which would impose a 15% limit), and even then they require a bureaucratic procedure for obtaining the refund. By being domiciled in Ireland, this ETF can take advantage of a favorable withholding tax treatment due to Ireland’s extensive and investment fund-oriented tax treaty network; therefore, this fund can be considered as a tax-efficient vehicle for investing into German, Finnish and Italian dividend-paying stocks.

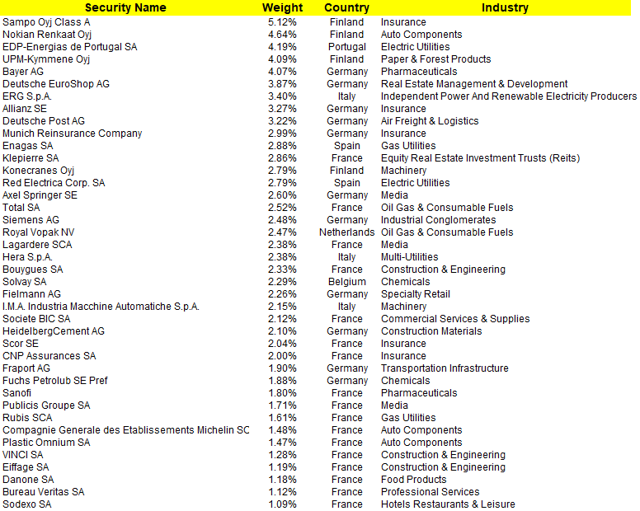

Below is the full listing of the 40 companies that make up the ETF’s portfolio, with the relative weight in the fund.

Source: Author based on State Street

Advantages of the SPDR S&P Euro Dividend Aristocrats ETF

Investors in this ETF will receive a good level of current income (the dividend yield stands at more than 3%) from reliable sources (due to the 10-year dividend requirement), and more capital stability than a market-based fund during tough times, which is one of the most important characteristics of dividend-paying stocks. This is apparent by comparing the performance of the SPDR S&P Euro Dividend Aristocrats ETF, since its inception in 2012, against the Stoxx Europe 600 (total return):

Source: Morningstar

A strikingly identical outcome occurs by comparing the SPDR S&P Euro Dividend Aristocrats ETF with the Euro Stoxx 50, which comprises the 50 largest companies in the eurozone weighted by market cap (total return):

Source: Morningstar

Part of the reason for the outperformance can be attributable to fees, which stand at 0.30% versus the 0.20% usually required for a European market-based ETF; therefore, the fee advantage that an American S&P 500 ETF would have against the SDY (0.35% for the latter against 0.07% or lower for the former) is much less significant in the case of the SPDR S&P Euro Dividend Aristocrats ETF and gives the fund a higher chance of beating the market.

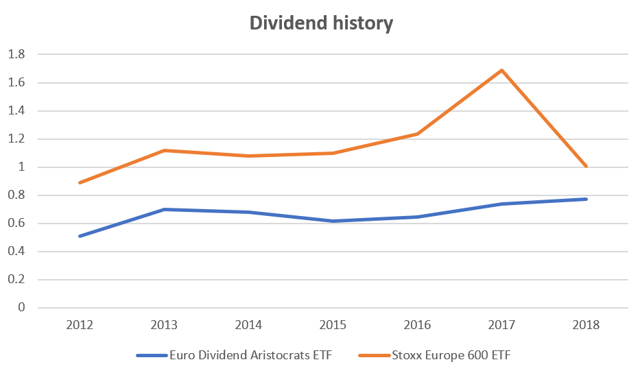

Whilst within a dividend history only 7 years long, the SPDR S&P Euro Dividend Aristocrats ETF has kept its dividend on a growing trend: there have been ups and downs, but not as much as with the overall European market. A dividend yield of 3.26% (based on the distribution for the last 12 months) compares favorably with the 2.90% dividend yield for the Stoxx Europe 600.

Source: Author based on Borsa Italiana. As a proxy for the Stoxx Europe 600, I used the data for the Ishares Stoxx Europe 600 Ucits Etf.

Another positive of the SPDR S&P Euro Dividend Aristocrats ETF is its value investing method: by weighting businesses based on dividend yield rather than market cap, the fund tries to bet more on companies that might be undervalued; this ensures a higher dividend yield than a market cap-based dividend ETF and could even provide for some level of growth, if the value thesis turns out to be true. An investor wishing to buy this ETF should be less concerned about the entry price, as the fund is already invested in under-priced stocks: this is a great advantage because it relieves the investor from the difficulties of market timing.

Risk Factors

While the SPDR Euro Dividend Aristocrats ETF has outperformed its European benchmarks so far, there are several downsides that an investor should consider before investing in this fund; the risks mainly stem from the fund’s tilt towards dividend stocks, small caps, and its value strategy:

- Dividend stocks: as per any fund pursuing a dividend strategy, especially when based on the historical dividend record, the risk is that the fund fails to invest in stocks with a strong growth potential, relying instead on businesses with a slow, incremental growth; however, given the absence of strong-growth, technological stocks on the European landscape, this risk is more contained than in the case of the American equivalent SDY; moreover, since growth companies are generally riskier than established and reliable dividend payers, their absence among the fund’s holdings is what income-oriented dividend investors might even be looking for;

- Mid-caps: mid-cap stocks make more than 50% of the fund’s assets; among the top 10 holdings, 4 are mid-caps. While there is no reason to believe that the mid-cap stocks that the fund invests in are riskier than large-caps that do not have the quality thresholds required by the S&P Euro High Yield Dividend Aristocrats Index, investors should be aware that mid-cap stocks are considered, in general, riskier than large-cap or mega-cap stocks;

- Value approach: the fund does not weigh its holdings by market cap, but by dividend yield, so that the stocks with the highest dividend yield make the largest positions; the rationale behind this mechanism is that, if a company with a 10-year record of increasing or not cutting its dividend comes with a high dividend yield, it means that it trades at a discount and it must be overweighted in the portfolio. While the fund uses two additional criteria (payout ratio not higher than 100% and market cap of at least 1 billion USD) and diversification requirements (no more than a 5% holding for a single stock and 30% for an entire sector), the selection process is based on too few fundamentals, set at standards that do not constitute a very high threshold for quality; therefore, there is no assurance that during a severe downturn the fund’s largest holdings will keep their dividends safe.

The Bottom Line

The SPDR Euro Dividend Aristocrats ETF is one of the best funds for investing in euro area dividend-paying stocks due to its selection requirements, value approach and tax efficiency. To some extent it can be considered as the Eurozone equivalent of the SPDR S&P Dividend ETF. Though it represents a convenient vehicle for dividend investors seeking exposure to eurozone dividend companies and it has outperformed the European market so far, this ETF entails additional risks compared to a market cap ETF: the value-based methodology of weighing stocks by yield might lead to its largest holdings being high yielding mid-cap companies; with a dividend record of just 10 years, it is not assured that these companies will continue to pay their dividends, especially during a severe downturn. For this reason, I use this fund as a secondary holding, ancillary to a broader market-based index fund.

Disclosure: I am/we are long SPEUHDAN. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News