[ad_1]

Nastassia Samal/iStock via Getty Images

Investors of all kinds like capital appreciation. Well, different investing strategies focus on various goals ranging from income, total returns, and capital preservation – capital appreciation is always a good thing.

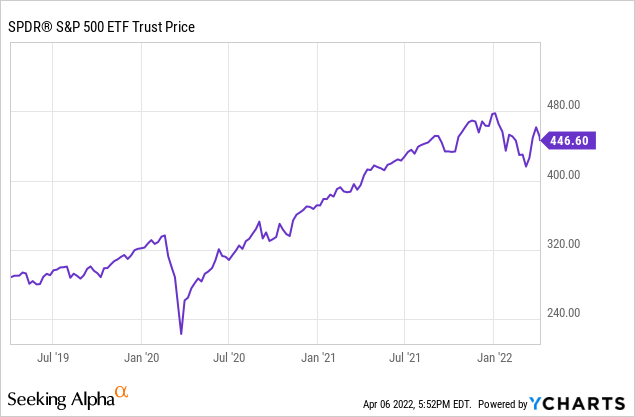

Today, with the S&P 500 (SPY) and most of the broader indexes at or near all-time highs, investing is more challenging. For income and dividend investors trying to get inflation adjusted returns in today’s more difficult investing environment, finding stock and funds with solid yields has also become harder.

As stocks and indexes rise and yields fall, committing new capital to funds that can offer inflation-adjusted returns becomes more challenging. Even more challenging for most dividend and income investors is finding investments that offer a good balance of steady distributions and low volatility.

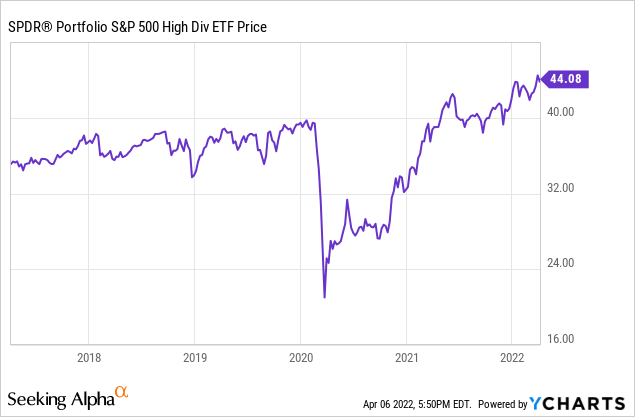

One exchange traded fund that is very well positioned for the current inflationary environment we are in that also still offers a 3.5% yield is the Spyder Portfolio S&P 500 High Dividend ETF (NYSEARCA:SPYD). This fund has also been a reasonably low volatility investment since the Pandemic that obviously impacted risk assets across the board.

This fund has performed reasonably well over the last 3 years, although the fund has underperformed the S&P 500 during that time period. Obviously, dividend and income investors are not usually as concerned about the overall performance of the broader indexes since these individuals are usually primarily focused on income and dividends. This fund tracks the 80 highest yielding companies in the S&P 500, and the fund has offered income and dividend investors solid distributions and total returns without excessive volatility over the last 3 years. The fund’s holdings are very well positioned for the current inflationary environment.

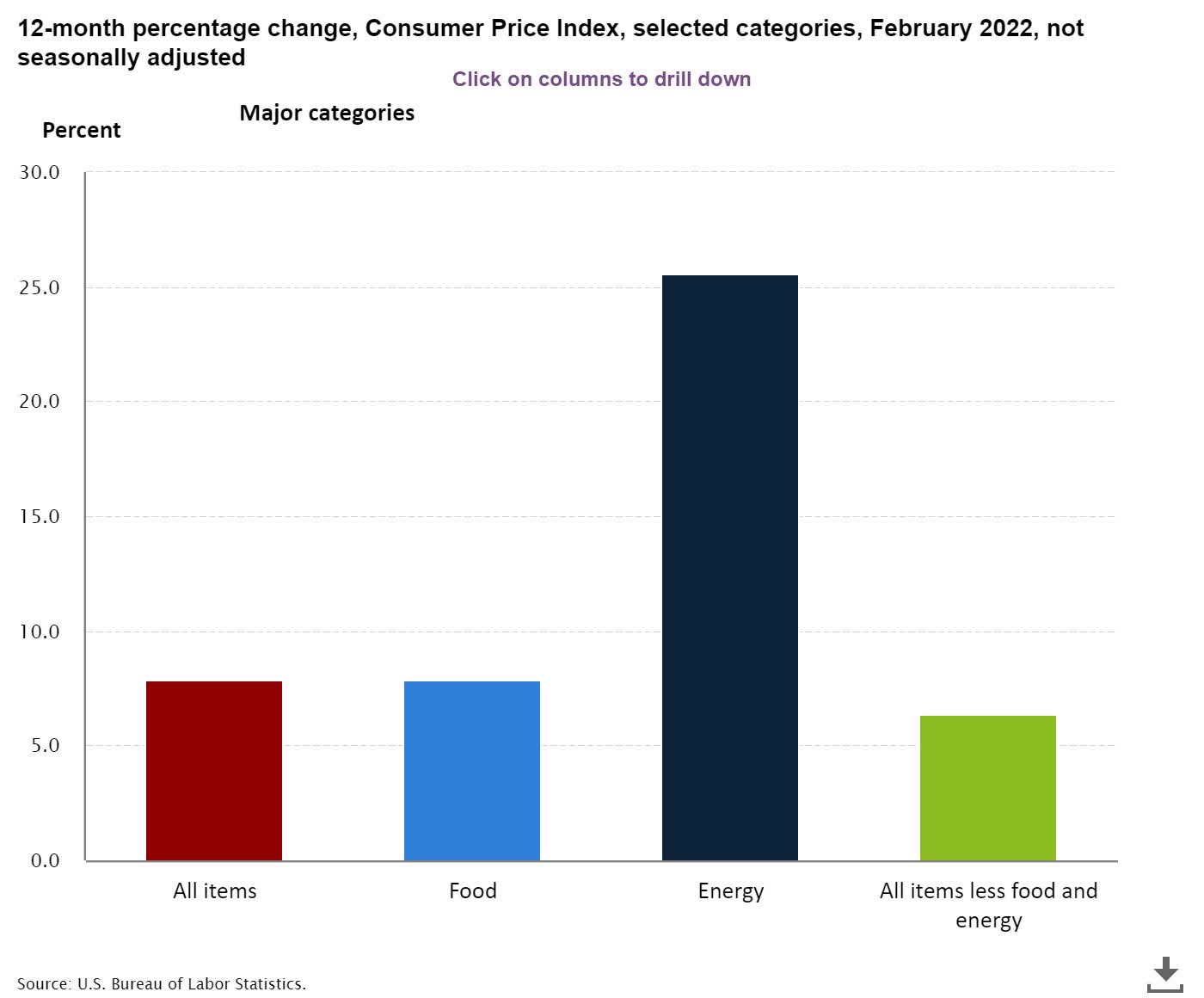

A Consumer Price Chart (U.S. Gov)

The consumer price index has consistently shown inflation levels of 5% or higher for over a year now, and with geopolitical concerns, the US still spending at very high levels, and labor shortage and supply chain issues still a problem, inflationary pressures on economies worldwide are likely to persist for some time.

This fund is effectively overweight inflation since 39% of the holdings of this indexed fund are in the energy, basic material, and financial sectors. This high dividend fund holds 18% utilities, 16% financials, 14% energy, 14% real estate, 11% health care, 10% consumer defensive, 6% communication, 5% basic materials, 2.5% technology, 2.2% consumer cyclical, and 1% industrial. The expense ratio of this fund is a very good .07%, and the fund’s assets under management are $6.5 billion.

The 5 largest holdings of this fund are Baker Hughes (BHI), Valero (VLO), Chevron (CVX), Sempra Energy (SRE), and Newmont Corporation (NEM). The fund is also invested in large cap companies with significant international holdings, so most of the fund’s holdings should benefit from a weak dollar as well.

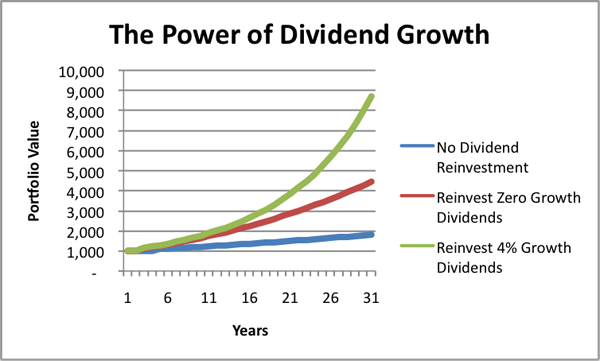

Dividend growth and reinvestment can be a powerful investing tool, and this fund has yielded over 5% on average for 5 straight years.

A Dividend Reinvestment Chart (Seeking Alpha)

Investors who reinvested these dividends over the last 5 years and compounded their returns would have had very nice returns during that time period. The fund should also offer investors significant growth this year because of the overweight holdings in the energy and basic material sectors the indexed fund has.

What makes this fund unique is that the holdings of this indexed investment vehicle should offer investors both inflation protection and low volatility. Low volatility is obviously often of more import to income and dividend investors since these individuals usually are less concerned with total returns than the average investor. This fund has a beta of 1.04 and has a standard deviation over the last 3 years of just over 28%, most of that of course from the impact of the pandemic.

The S&P 500 high dividend fund has been a fairly low volatility fund for a while, with the exception of a short period of heightened volatility during the pandemic in 2020. The selloffs in this indexed fund since 2020 have been very minimal even during a period of heightened volatility in the overall market. The fund is overweight historically low volatility sectors such as healthcare, consumer defensives, and the utilities, and those holdings provide good anchors.

No fund is perfect, and this fund does not have a track record of dividend growth. The indexed fund also has almost no exposure to many of what have been some of the best performing growth stocks in the market since the holdings are heavily underweight the technology sector. Obviously, most big cap tech companies focus on growth over dividends, so those companies wouldn’t be in a fund such as this one even if this fund wasn’t indexed to the S&P 500. This indexed fund also has exposure to some oil and gas companies such as Valero that focus on the lower margin downstream business.

Investors and investing strategies often have to evolve in a changing economic environment, and market conditions have changed significantly several times in just the last several years. Income and dividend investors trying to find inflation-adjusted returns in stocks and funds that offer solid current yields and reasonable levels of volatility aren’t having an easy time with many stocks and funds at or near all-time highs either. Still, the markets are offering investors more choice than ever before, and funds such as this S&P 500 High Dividend ETF are well positioned in the current inflationary environment to offer investors solid and steady income.

[ad_2]

Source links Google News