[ad_1]

Jae Young Ju/iStock via Getty Images

Invesco launched the Invesco PHLX Semiconductor ETF (NASDAQ:SOXQ) only in June 2021, which makes it quite young compared to the more matured iShares Semiconductor ETF (NASDAQ:SOXX).

Also as shown in the chart below, during the last month which has been particularly volatile for technology stocks, SOXQ has slightly outperformed SOXX.

Comparison of performance (www.seekingalpha.com)

Now, when looking at the longer-term one-year period, it is SOXX that has outperformed and, if someone strictly abides by historical performance, investment in the iShares ETF makes perfect sense. However, with SOXQ charging much lower fees of 0.19%, compared to 0.43% for its peer, it makes equal sense to look deeper at the newcomer’s potential. For this purpose, in line with the value strategy which is currently prevalent in the market due to interest rate hikes by the Federal Reserve, I will lay emphasis on the value versus growth aspect

I start by providing insights into Invesco’s ETF holdings.

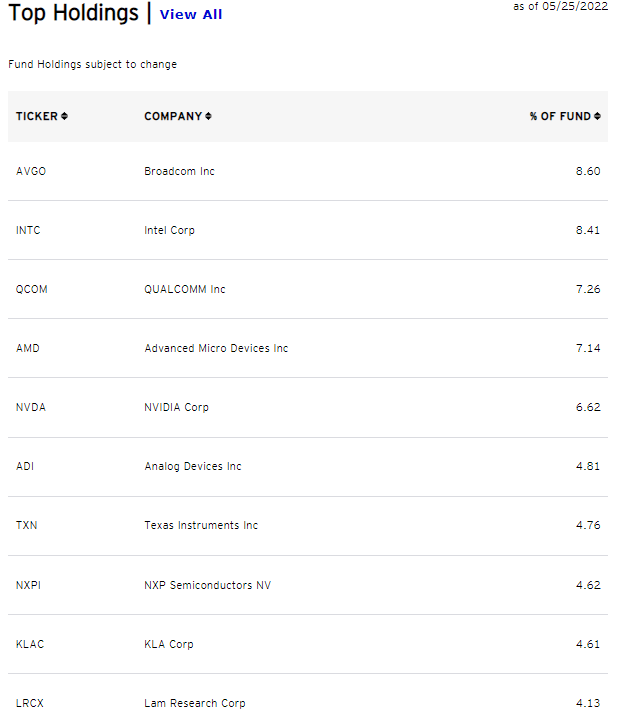

SOXQ’s top holdings

As per the table below, SOXQ’s first and most important holding at 8.6% of its total assets is Broadcom (NASDAQ:AVGO), a key supplier of chip components for 5G and WiFi communications. I recently covered this 200+ billion-dollar company in its bid to acquire VMware (VMW), which is an infrastructure virtualization play. If this acquisition makes it through the regulatory process, it has the potential to create a major cloud-on-a-chip company and will considerably help Broadcom in its software tilt.

SOXQ’s top holdings (www.invesco.com)

This is more of vertical integration with Broadcom aiming to play a key role along the semiconductor value chain, right from production to use in intelligent software applications. This move should stimulate others within the industry to think laterally by acquiring expertise in adjacent areas.

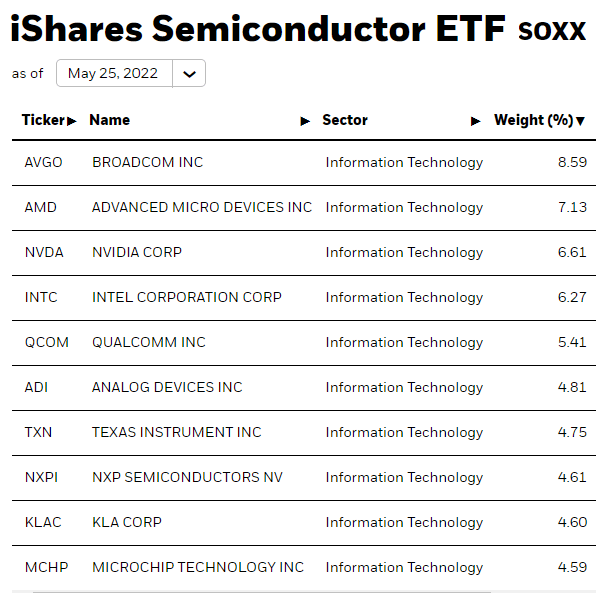

Now, Broadcom which exhibits higher profitability than its peers is also at the top spot of SOXX’s holdings, a place that was previously occupied by NVIDIA (NASDAQ: NVDA) as shown in the table below.

SOXX holdings

Looking further, the second and third holdings differ. For SOXQ, it is Intel (NASDAQ:INTC) and Qualcomm (NASDAQ:QCOM) respectively while for SOXX, it is Advanced Micro Devices (NASDAQ:AMD) and NVIDIA. The order of these holdings partly explains why SOXQ has performed better during the last month than its peer in line with the value strategy as I will explain later on, but before, that I focus on Intel and the supply chain.

SOXX’s holdings (ishares.com)

Intel’s strategy is also to expand horizontally across the semis ecosystem, but this time, it is more on the production side, namely with massive investments forecasted for foundries in the United States and Europe.

This brings us to the supply chain problem currently impacting electronics goods which have many chip components embedded deep inside them. With most of the passive chips used in power supplies produced in China, and that country locking down its ports to avoid the propagation of Covid, there has been a huge bottleneck in the supply of raw materials reaching companies like Cisco (NASDAQ:CSCO). As a result, the communications equipment supplier has suffered from a shortfall in sales compared to expectations. These should later also impact smaller peers as they report second-quarter results.

Thinking strategically, it is important for the U.S to build resilience in its supply chains and Intel should play a major role in on-shoring manufacturing. At this stage, it is important to adopt a cautionary posture.

Some words of Caution amid longer-term Optimism

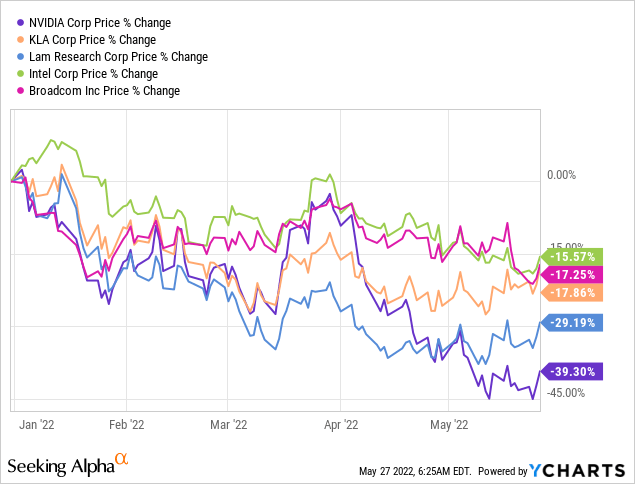

Semis are highly cyclical, and while it is true that demand has been growing for a long time in every sector of the economy from IT networking, and domestic appliances to automobiles, the industry is also at risk of an economic downturn caused by an inflation-induced rise in costs. Here, due to wage inflation, companies like NVIDIA which provided weak guidance recently, may not produce the same revenue growth figures in the future. Hence, its stock has been suffering the most compared to some of SOXX’s other holdings, namely by 39%, as shown in the chart below.

Along the same lines, with inflation remaining on the high side, there may be similar cases of companies like KLA Corp (KLAC) or Lam Research (LRCX) delivering weak guidances, albeit for the short term. As manufacturers of the very equipment which are used by foundries to make semis, any weakness from their side may be contagious to the whole semiconductor ecosystem.

Shifting to a more positive note, congestion at Chinese ports cannot last forever and there is always a possibility of the U.S. administration amortizing the tariffs imposed on goods originating from China. Also, with the recent moderation from outright condemnation of Chinese aggressive actions in the Indo Pacific region in December 2021 to cooperation this month during U.S. Secretary of State Antony Blinken’s policy speech this month, the possibility of an easing of geopolitical tensions should not be excluded.

Also, after the Chinese industrial production index fared badly, Chinese leaders are increasingly vocal about the need to bring back growth. Thus, there appear to be a number of conducive factors which could play in favor of the wider trading environment including semis.

The Value rationale

Thus, semis are a fine investment, and, after the above-25% correction in the Nasdaq composite, many semis stocks and by ricochet, both SOXQ and SOXX are trading at lower valuations. Thus, after the worst of the supply chain, there should be some improvement in the supply chain in H2-2022, resulting in the upside of semis stocks.

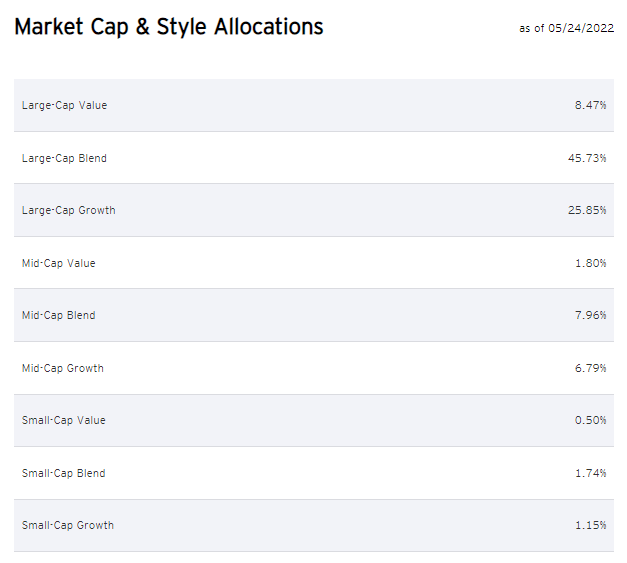

However, this upside should be more skewed towards SOXQ which provides relatively more exposure to names like Intel (8.41%) and Qualcomm (7.26%) compared to 6.27% and 5.41% for SOXX. These two stocks have lower valuations and pay higher dividend yields too. As a result, the Invesco ETF pays a higher dividend at a yield of 1.13% compared to only 0.90% for iShares. Thus, it can be viewed as more of a value ETF, and for this purpose, according to MorningStar’s Style Box, it seems to have slightly more of a “Value” style compared to SOXX. SOXQ’s slightly more value tilt is also confirmed by metrics like Price to Book and Price to Cash flow. Tellingly, the issuers (Invesco) themselves also go to the point of classifying holdings into Value, Blend, and Growth as shown in the table below.

Market cap & style allocations (www.invesco.com)

To further substantiate my point, in a stock market where investors are no longer rewarding high-growth names in the same way as in 2021 as evidenced by NVDIA’s recent price performance, it is the value strategy that has had the upper hand since the beginning of 2022, after it became evident that inflation would not be transitory and that several rate increases would be required. I further elaborated on how high-interest rates are detrimental to growth stocks in my recent thesis entitled “Using SPYG And SPYV To Chart A Dual Growth And Value Strategy”.

In these circumstances, it is better to choose SOXQ, which has about 54% allocation dedicated to a blended portfolio including 8.47% large-cap value. This said it has a larger allocation (25.85%) to high-growth large caps too, but the very fact that Invesco has highlighted this classification (above diagram) signifies to me that its fund managers are working according to the value strategy prevalent in the market.

Conclusion

Thinking aloud, I am not going to the point of advising those who hold SOXX to sell their shares, but rather add to their semiconductor asset allocation by performing investment in SOXQ after the dip. It also charges less and pays more distributions to shareholders. At this stage, some people can argue that inflation has eased slightly, in turn implying that the Fed could be less aggressive in tightening monetary policy, but, I remind them that inflation still remains high.

Looking at differences, SOXX tracks the ICE Semiconductor Index, while it is the PHLX Semiconductor Sector Index for SOXQ. As a result of being more recently incepted, the latter has total assets under management of less than $100 million which may imply less of a cushion in case of a large redemption from the fund.

Finally, for the longer term, the shortage of semiconductors worldwide should persist, but, just like for any cyclical sector, also expect flat years mixed in with the good ones. Also, chips are basically the commodities for tech, and as such, they depend on the health of companies like Microsoft (NASDAQ:MSFT), Apple (AAPL), Cisco, and others.

[ad_2]

Source links Google News