[ad_1]

Aguus/E+ via Getty Images

Introduction to Semiconductors within Tech Investing

Within tech investing, the highest-beta/highest-reward investment ideas are usually found in the semiconductors space.

Semiconductor companies, also known as “Chip stocks”, are among the companies that are responsible for fueling the next-generation evolution in machine learning, artificial intelligence, and advanced software in electric vehicles.

I would classify investing in Chip stocks as a distinct investing strategy within tech stocks given this sector’s boom/bust cycle, and I also believe Chip stocks usually lead the Nasdaq technology sector. A rally in Chip stocks is likely to indicate that a broader market technology rally could also be coming, and vice versa.

To help investors navigate the current tug of war between growth and value stocks, and to identify the best opportunities within growth, I will dive into a beginner’s guide to semiconductor stocks.

In this article, I will discuss one of the best ways to get direct exposure to semiconductor companies and chip stocks through the iShares Semiconductor ETF (NASDAQ:SOXX).

The Semiconductor ETF choices available in the market: SOXX, SMH, and XSD

If you are a growth or tech investor interested in Semiconductor exposure, there are several ETFs that can give you equity exposure: the SOXX ETF, the SMH ETF, or XSD ETF.

I’m going to give a beginner’s breakdown so that you understand the difference between these ETFs.

ETF #1: SOXX ETF (iShares by BlackRock):

-

Expense Ratio: .43% (equivalent to $43 in fees for $10,000 invested)

-

Number of Holdings: 30

-

Top 3 Holdings (in this order): Broadcom (NASDAQ:AVGO), QUALCOMM (NASDAQ:QCOM), NVIDIA (NASDAQ:NVDA)

ETF #2: SMH ETF (VanEck Semiconductor ETF):

-

Expense Ratio: .35% (equivalent to $35 in fees for $10,000 invested)

-

Number of holdings: 25

-

Top 3 Holdings (in this order): Taiwan Semiconductor (NYSE:TSM), NVIDIA, Broadcom

ETF #3: XSD ETF (State Street Global Advisors Semiconductor ETF)

-

Expense Ratio: .35% (equivalent to $35 in fees for $10,000 invested)

-

Number of Holdings: 40

-

Top 3 Holdings (in this order): Micron (NASDAQ:MU), Power Integrations (NASDAQ:POWI), Intel (NASDAQ:INTC)

If you are interested in semiconductor ETFs, you have to at the very least understand the metrics I described above so that you understand the fees and expenses involved with holding the ETFs as well as these ETFs’ biases in terms of their top holdings. Even though these 3 ETFs are all semiconductor ETFs, their positioning is very different.

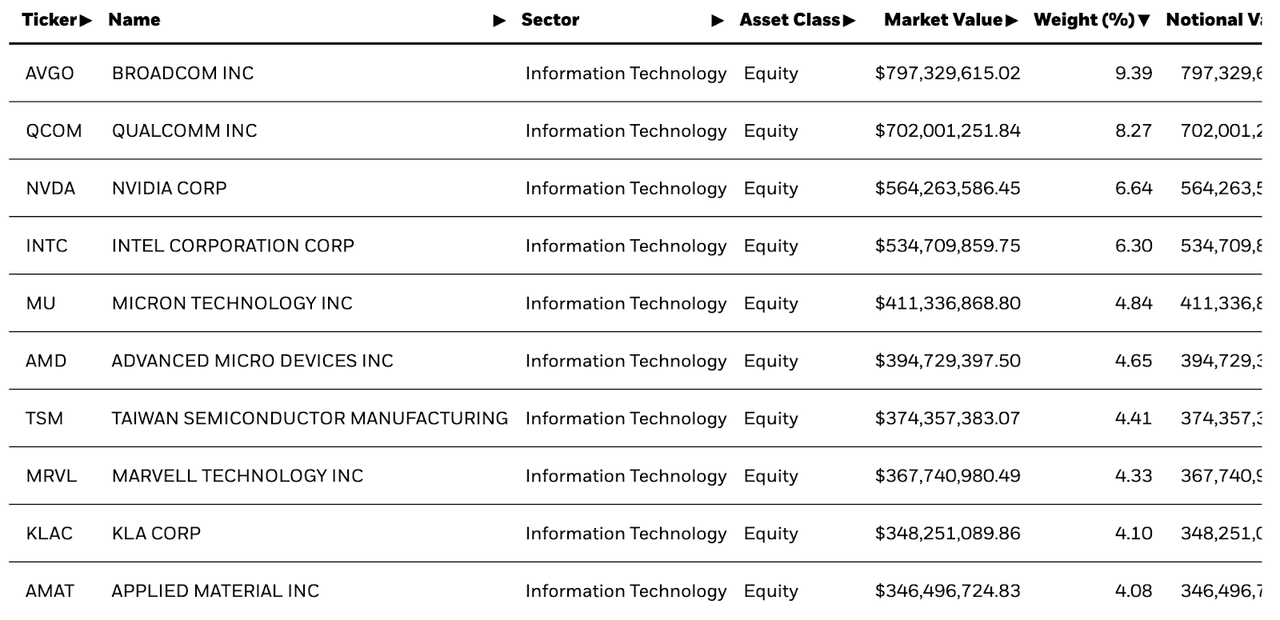

The SOXX index’s top 3 holdings Broadcom, Qualcomm, and NVIDIA indicate that the ETF weights its largest component with a very diversified conglomerate Broadcom, followed by network infrastructure Qualcomm, and then data-center leader NVIDIA.

This type of positioning is actually less aggressive than the other 2 ETFs and designed to weather market volatility better than the type of positioning in SMH and XSD. This is because SMH is heavily weighted in Taiwan Semiconductor Manufacturing, and any elevated military hawkishness on China-Taiwan relations can severely impact TSM’s ability to operate. As a result, SMH takes on more geopolitical risk that investors must be comfortable with if they want to invest in semis in this fashion.

The XSD ETF has its primary position in Micron, which is a very strong company with a positive outlook within the semiconductor space. Micron is responsible for creating memory solutions for its end markets by focusing on Dynamic Random Access Memory (DRAM) and Flash Memory via its NAND and NOR solutions. In the past, Micron’s stock has been highly cyclical as the sales volume of its DRAM and NAND products are dependent on high average selling prices that fluctuate with spot market pricing. Micron’s business model, and therefore stock price, is more cyclical than that of Broadcom and Qualcomm.

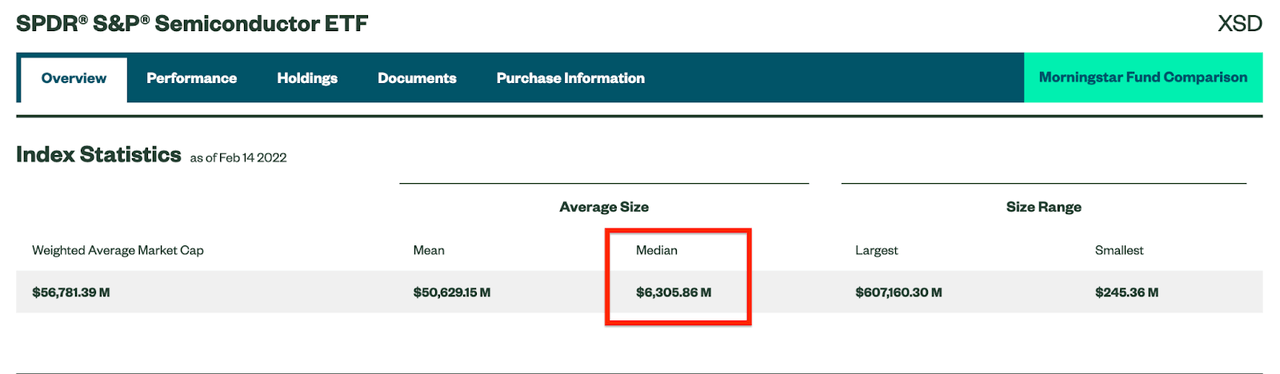

A closer inspection of XSD would also reveal that its median holding is approximately $6 billion in market cap. That makes XSD much more vulnerable to higher-beta declines when risk sentiment is weak because its holdings have smaller market caps, and small caps are less equipped to manage weak economic conditions.

SPDR S&P Semiconductors

A deeper analysis into SOXX Component Analysis

One of the reasons I believe the SOXX index is the best Semiconductor ETF for beginner investors, despite its higher expense ratio is that its positioning is more appropriate in today’s investment environment.

The current investment narrative that both retail and institutional investors must grapple with is a combination of increased Federal Reserve hawkishness, increased geopolitical uncertainty, and moderating global economic growth.

The combination of these three factors is likely to increase the uncertainty (and therefore volatility) in growth investing.

As a result, it’s important to be more selective with the way you allocate investment capital towards the growth theme. I believe the growth trade will outperform the value trade over a longer period of time, but it is more important than ever to be selective with stock-selection or ETF selection.

The SOXX places two less volatile and more diversified companies in its top two holdings, Broadcom and Qualcomm. Broadcom’s business model is very diversified and they essentially serve the end markets in data centers, networking, broadband, wireless, and storage and industrial markets. Qualcomm’s business model is also diversified with its focus on wireless technology and 5G infrastructure. Within the semiconductor industry, I would rate AVGO and QCOM as lower-risk names while still having moderate/high upside.

The SOXX ETF also owns the popular retail Semi stocks AMD and NVDA, but these two names add up to only 10% of the ETF. The fundamental outlook for both AMD and NVDA is very positive but given these two stocks’ high volatility, allocating 10% of the ETF to these names is an appropriate strategy.

Near the bottom of its top 10 holdings are the semiconductor equipment stocks, Applied Materials (NASDAQ:AMAT) and KLA Corp (NASDAQ:KLAC). Semiconductor equipment stocks are even more cyclical than AMD/NVDA and certainly more volatile than diversified names such as AVGO/QCOM. Placing AMAT/KLAC at the bottom of the top 10 holdings makes the ETF relatively safer for risk-averse investors who wish to gain exposure to semiconductors. I personally have a positive outlook on semiconductor equipment stocks AMAT and LRCX and own these names directly in my growth investment portfolio, but I would not recommend these names to new investors who are only beginning their journey in tech investing.

Top 10 Holdings of SOXX ETF (iShares Semiconductor ETF Website)

Outlook for the Semiconductor Industry:

According to WSTS Semiconductor Industry data, the semiconductor industry grew approximately 26% (excluding memory) in 2021 to $556 billion in sales. Most of this growth comes from strong unit sales and favorable pricing trends due to strong demand and relatively tight supply.

Many companies within the semiconductor space are still supply constrained and shipping and supplying 20-30% below current demand levels. The chip shortage caused by COVID has resulted in very tight inventory and distribution channel inventories that are 30-50% below pre-Covid levels as well as direct customer inventories at 15-35% below pre-pandemic levels.

Demand continues to be strong and the supply chain issues currently present will take a minimum of 3-4 quarters to fully address themselves. Semiconductor companies are in a unique position where aggregate demand is above trend, the chip shortage is still present, and therefore they have elevated pricing power throughout the next several quarters.

Portfolio Strategy

I believe that Chip stocks are appropriate for investors who have a stronger appetite for risk and can handle larger swings in their portfolios. I believe that the SOXX ETF is most likely the best way to gain broad exposure to semiconductors because I believe its positioning is more appropriate for growth investors in today’s investment environment.

In January, I had mentioned on Social Media that the recent tech correction was most likely a unique buying opportunity for long-term investors.

I believe this recent dip caused by increased Fed hawkishness along with the Russia-Ukraine situation has created new opportunities for investors who wish to gain exposure to high-growth tech names that have reasonable valuations relative to the high-multiple names in ARKK.

In future articles, I will discuss specific semiconductor companies for investors who wish to gain direct exposure to these stocks.

Thanks for reading, and I’ll see you in my next research article.

[ad_2]

Source links Google News