[ad_1]

Justin Sullivan/Getty Images News

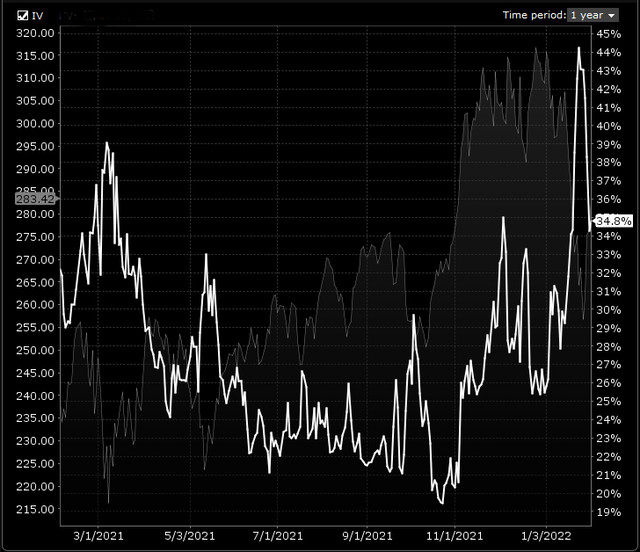

Recent share-price action in VanEck Vectors Semiconductor ETF (NASDAQ:SMH) means that implied volatility is trading well above average levels in this name. In fact, as we can see below, implied volatility surpassed 44% in January before finally retracing back to the 35% level. At the 35%, IV level in SMH, delta-neutral options strategies (where we sell premium) look attractive to us here. Whereas many investors see elevated volatility as more risk, we aim to take advantage of this fear by selling overpriced premium in the ETF’s associated options. SMH’s options are liquid and there are plenty of strike prices available in both monthly and weekly expirations which give us more flexibility for the duration of our position.

Elevated Implied Volatility In SMH (Interactive Brokers)

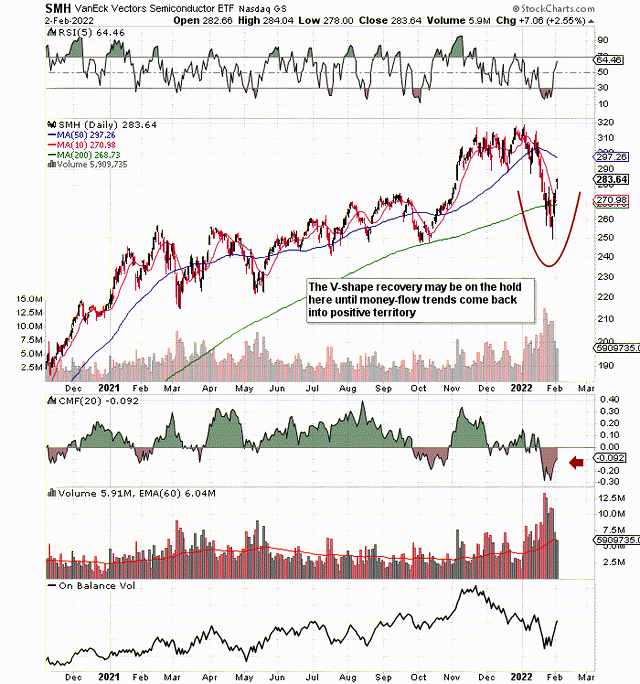

With shares of the ETF down well over 2% in pre-market on the 3rd of February (which should boost implied volatility some more), there is every possibility that SMH trades in a range for the next period of time. We state this because although the long-term trend is obviously still bullish in this space, money flow and volume trends are still pretty bearish on the near-term chart as we can see below. Despite the fact that SMH has returned close to 20% on strong AUM gains over the past 12 months and continues to charge a rather low expense ratio of 0.35%, the negative money-flow reading leads us to believe that the ETF may stagnate in the initial part of 2022.

Money flow trends still bearish in SMH (StockCharts)

Before putting anything on in here with respect to selling volatility, however, we need to have our checklist ready to ensure we are ready for the fight. Essentially, most of the work involving a position should be done before the trade is initiated. We have certainly paid our dues by being burnt on multiple occasions when trading volatility in past times which is why we must always keep these “common mistakes” to an absolute minimum when managing a position. For the record, our normal timeframe with respect to volatility trading is 4 to 6 weeks. Furthermore, the learnings below can be tailored to many strategies in the trading and investing world and not just the volatility play we currently are eyeing up in SMH.

- The number one way to avoid getting burnt when trading volatility is to reduce the position size. An iron condor, for example, I normally look to achieve a 68% to 70% probability of success in the position. Sometimes when this comes in higher (by utilizing strikes that are further out of the money), I have the tendency to ramp up size which consequently increases risk. Solution – Diversify. Take the time to find similar setups with the same probability so I always can have the same capital in each position.

- Have a plan before the trade is initiated. What we mean by this is that we need to have down on paper what the plan is for the trade. Do we let the position sit or do we adjust by rolling the untested side down? Do we close the position two to three weeks before expiration irrespective of whether we have a profit or not? Do we roll the position on to the next cycle if implied volatility has remained elevated or has even increased? We need to have these concerns down on paper before we open the position to ensure the trade plan is 100% being stuck to.

- The above two points lead nicely into the third which is the following and probably the most important. My number one enemy when trading the markets is me. If I am winning, I have the tendency to become too greedy. If I am going through a losing streak, I have the inclination to become fearful by trading much less and by taking profits far too early. Suffice it to say, if a trader cannot control his or her emotions, mistakes (which ultimately cost money) are going to rachet up. A mechanical-orientated trader follows the rules and not his emotions. If a loss needs to be taken, it needs to be taken, period. If greed needs to be controlled by taking profits off a position, then this is what must be done. If my size is too big, I know over time I will become emotional. If I am making too many unforeseen adjustments, I know I will become emotional before long. Remember, the best traders are unstressed and unemotional operators, so my aim always has to be to set myself up to win from the outset.

Therefore, to sum up, we like the idea of a delta-neutral trade in VanEck Vectors Semiconductor ETF at present due to its high implied volatility and liquidity. Although we see price recovering, we believe this will take some time which will obviously benefit a delta-neutral strategy. We look forward to continued coverage.

[ad_2]

Source links Google News