In developed markets, it’s easy to take a smartphone for granted given that it’s almost become a daily necessity in terms of connecting users with the rest of the world, including their own. In emerging markets (EM), smartphone adoption in certain parts of the world is just hitting the tip of the iceberg in terms of economic growth via ecommerce, according to a report by mobile network trade group GSMA.

The increased adoption of the smartphone is allowing certain companies to thrive, which is opening up opportunities for investors to get a piece of the action via exchange-traded funds (ETFs) like the Emerging Markets Internet & Ecommerce ETF (NYSEArca: EMQQ).

“The rapid growth of smartphones has helped the growth of ecommerce,” the fund wrote in an email. “The expected continued growth of smartphone adoption in the region offers the potential for ecommerce to continue to grow. Currently, MercadoLibre (MELI) is one of the leading ecommerce platforms in Latin America. Continued smartphone adoption may help MELI to continue to grow.”

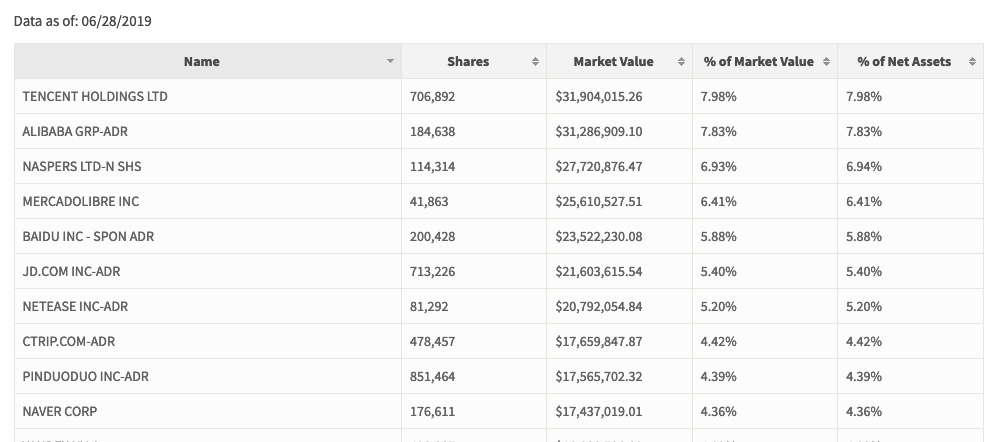

EMQQ is exposed to the aforementioned companies to capture this potential opportunity for growth in Latin America. Just take a look at its top 10 holdings:

The U.S.-China trade impasse heavily discounted a lot of U.S. equities the past week, but it also put the red tag sale on EM. Combine the tariff battles with a cautious U.S. Federal Reserve, and it puts the EM space at an attractive valuation relative to its peers.

While most investors might have been driven away by the losses in EM during much of 2018, savvy investors who were quick to see the opportunity viewed EM as a substantial markdown. From a fundamental standpoint, low price-to-earnings ratios in emerging markets ETFs have made them prime value plays as capital inflows continue in 2019.

EMQQ invests in companies with exposure to the ecommerce and Internet sectors in emerging markets. Purchasing EMQQ provides exposure to companies that are positioned to benefit as emerging economies mature, the consumer class expands, and their populations increase their utilization of the internet and ecommerce.

To the outside world, these names may not be familiar, but in the global marketplace, they represent the equivalent of the Googles and Amazons in the U.S. In a late market cycle, it could be these equities investors look international once the U.S. exits out of this extended bull run.

For more market trends, visit the Innovative ETFs Channel.