By Kevin Flanagan

Head of Fixed Income Strategy

Follow Kevin Flanagan @KevinFlanaganWT

While 2022 was arguably one of the worst, if not actually the worst, years for the U.S. bond market in modern history, a silver lining has emerged. Indeed, with yield levels surging across the asset class spectrum, one could conclude that a semblance of ‘normalcy’ has returned to the fixed income arena.

Up until this year, the one major question I was always asked was: Where can I find yield in the bond market? To be sure, with U.S. rates being dragged down by zero interest rate (ZIRP) central bank policies, negative sovereign debt yields abroad and a lack of inflation, to name a few key factors, investors had been left with historically low yield levels, a new normal for the bond market.

UST & U.S. IG Corporate: Yield to Worst

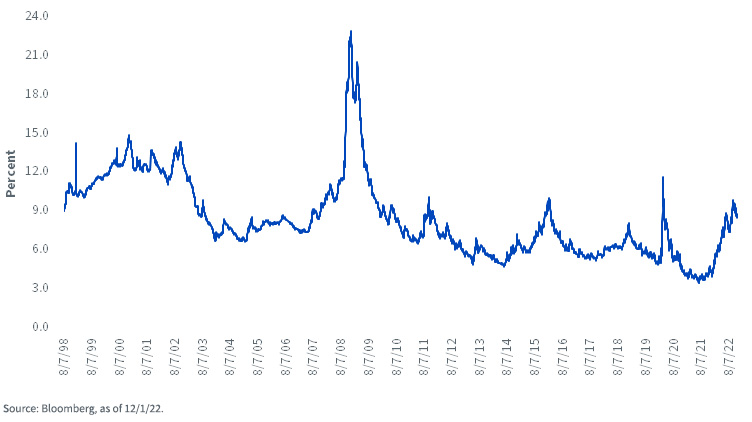

U.S. High Yield: Yield to Worst

As we are about to embark on a new calendar year, the fixed income landscape has changed dramatically. As I mentioned in a prior blog post, I would argue that the historically low yield levels of the last 10 to 15 years were “abby normal,” to quote the movie Young Frankenstein, and that investors are now witnessing what normal looks like when central banks are no longer pursuing ZIRP and are actually tightening monetary policy because of inflation.

This new rate regimen has brought Treasuries (UST), investment-grade (IG) corporates and high-yield (HY) corporates all back to familiar pre-global financial crisis territory, arguably the genesis of the abnormal yield structure for the last decade or so (see graphs). For Treasuries, that means a yield to worst reading at or around 4%, and for U.S. IG corps, levels over the 5% threshold. Perhaps one of the more intriguing developments has been the rise in HY into the 8%–9% range. Compare these readings to where they were just a year ago: UST 1.12%, U.S. IG corps 2.29% and HY 4.74%.

Conclusion

From an investment backdrop, investors now have some definitive options within the fixed income arena. In fact, even though Fed Chairman Powell has signaled the potential for some slowing in the pace of rate hikes, perhaps as soon as next week’s FOMC meeting, he also emphasized that rates could be heading higher for longer, with no apparent appetite to reverse course anytime soon. So, if I was asked the aforementioned question about where to find yield in the bond market now, my answer has now become a much easier one.

Indexes:

Originally published by WisdomTree on 7 December, 2022.

For more news, information, and analysis, visit the Modern Alpha Channel.

U.S. investors only: Click here to obtain a WisdomTree ETF prospectus which contains investment objectives, risks, charges, expenses, and other information; read and consider carefully before investing.

There are risks involved with investing, including possible loss of principal. Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, currency, fixed income and alternative investments include additional risks. Please see prospectus for discussion of risks.

Past performance is not indicative of future results. This material contains the opinions of the author, which are subject to change, and should not to be considered or interpreted as a recommendation to participate in any particular trading strategy, or deemed to be an offer or sale of any investment product and it should not be relied on as such. There is no guarantee that any strategies discussed will work under all market conditions. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This material should not be relied upon as research or investment advice regarding any security in particular. The user of this information assumes the entire risk of any use made of the information provided herein. Neither WisdomTree nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax or legal advice. Investors seeking tax or legal advice should consult their tax or legal advisor. Unless expressly stated otherwise the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or component of any financial instruments or products or indexes. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each entity involved in compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties. With respect to this information, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including loss profits) or any other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Brian Manby, and Scott Welch are registered representatives of Foreside Fund Services, LLC.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

You cannot invest directly in an index.