[ad_1]

Phynart Studio

The VanEck Vectors Steel ETF (NYSEARCA:SLX) provides targeted exposure to companies involved in steel production and iron ore mining. As a critical industrial alloy, the steel industry is a good representative of shifting economic conditions. Indeed, steel prices surged at the start of the year amid supply chain disruptions and inflationary pressures while the momentum has reversed since Q2 amid concerns of a broader global slowdown. While SLX is down more than 20% from its high, the fund continues to hold onto a positive return year to date highlighting its broader market outperformance.

The current setup considers significant macro uncertainty including weaker trends out of China although we see room to turn bullish on the SLX ETF. With core holdings among some major mining stocks, we like the high-dividend profile of the fund ahead of its year-end annual distribution which may yield above 7%. We are bullish on SLX with a sense that the recent current level offers a new buying opportunity following its correction over the last several months.

What is the SLX ETF?

SLX technically tracks the “NYSE Arca Steel Index”, which features a modified market capitalization weighting methodology. The underlying index and ETF only include stocks listed on a major U.S. exchange with a minimum market value of $100 million.

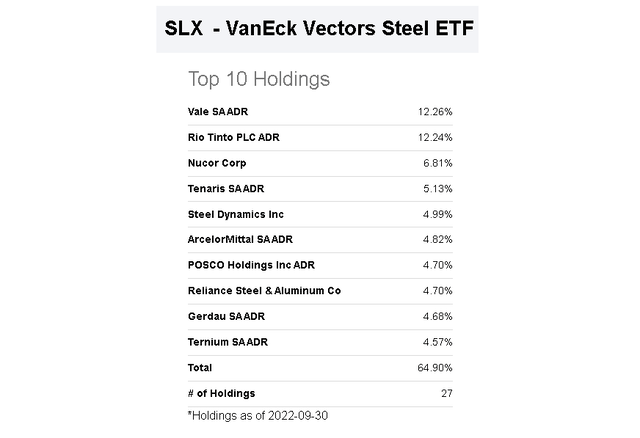

With a portfolio of 26 stocks, the largest current holdings are Vale SA (VALE) and Rio Tinto (RIO), each with a 12% weighting in the fund. The two miners are global leaders in iron-ore production which is the primary raw material used to process steel. Nucor Corp. (NUE), Tenaris S.A. (TS), Steel Dynamics, Inc. (STLD), and ArcelorMittal S.A. (MT) are direct steel manufacturers, each focusing on different geographical markets and value-added applications.

Keep in mind that while coal is recognized as an integral component of steelmaking given its role in heating blast furnaces, SLX does not include coal miners within the ETF. While there is a good argument to include coal as part of the steel industry, the exclusion likely reflects that coal prices are often driven by external factors including energy demand and electrical power generation trends. By this measure, SLX works as more of a “pure play” on steel and iron ore.

Seeking Alpha

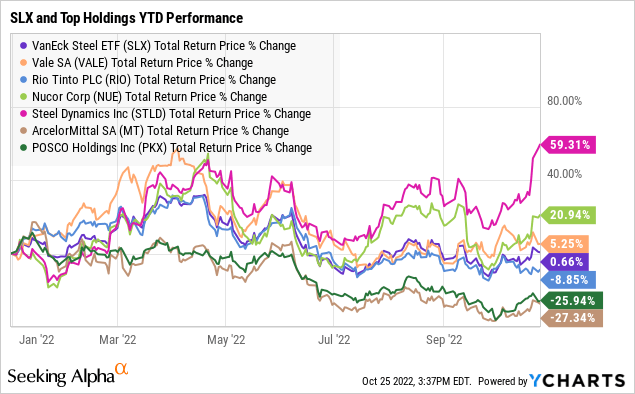

In terms of the fund’s performance this year, SLX is up about 1% with a relatively wide divergence among big winners and losers. STLD and NUE have outperformed, up 59% and 21% in 2022, against laggards like ArcelorMittal and POSCO Holdings Inc. (PKX), both off by more than 26%. In this case, steel makers with operations in Europe like MT and weaker local demand. The spread highlights the appeal of an ETF based on diversification among the leading companies in the market segment.

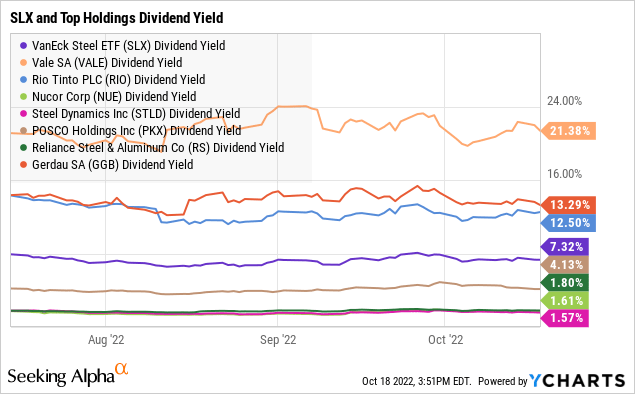

As mentioned, one of the attractions to the group is the high dividend yield with miners like Vale and Rio Tinto distributing record profits to shareholders based on the elevated pricing dynamics in 2021 and at the start of the year. With SLX, the fund historically distributes a single annual payout in late December as an aggregate of the underlying portfolio income. By this measure, while an amount has not yet been confirmed, we can expect a yield above 5% considering the contribution of top holdings.

Steel Market Outlook

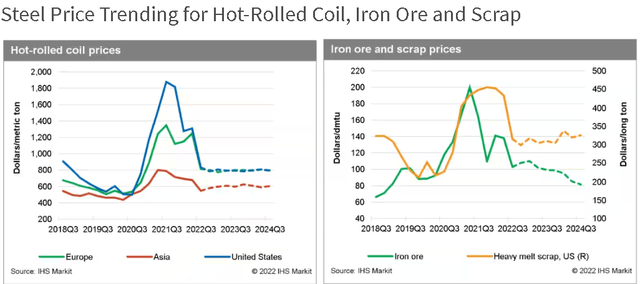

Benchmark steel prices in terms of rebar futures priced in Yuan are down to 3,700 per ton (compared to a high near 6,000 in Q4 2021). The market trends we’re looking at consider an ongoing normalization of steel and iron-ore pricing through 2023 compared to exceptional dynamics at the end of last year and the start of 2022.

According to IHS Market, prices have declined sharply as supply-side fears faded relatively to the early stages of the Russia-Ukraine crisis defined by significant uncertainty. At the same time, steel prices remain among long-term averages which means the operating and financial environment is still positive for most producers. The other dynamic at play is potential electricity rationing in certain regions, like Europe, that could impact still production adding to pricing volatility.

source: IHSMarkit

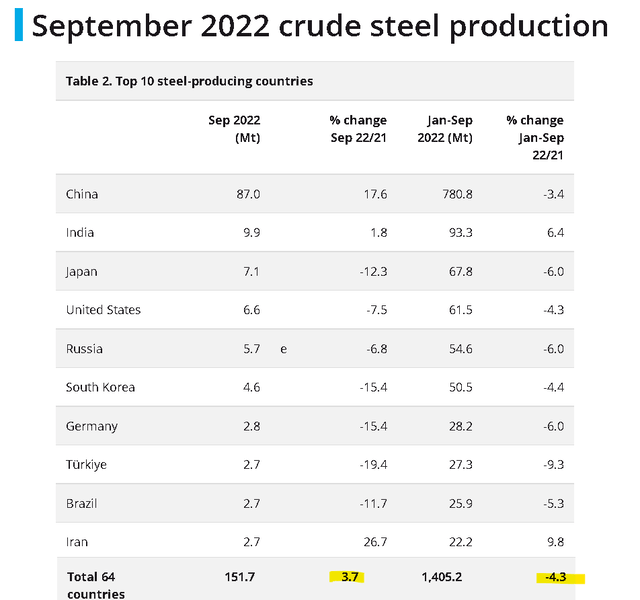

Based on data from September, global steel production climbed by 3.7% y/y in the month although the context here considers weaker figures in the prior months. China, for example, posted an 18% increase in September, sort of catching up from depressed levels in the first half of the year, with the year-to-date total still down by -3.4%. The country accounts for nearly 50% of global consumption and 57% of global production and has faced weaker economic growth along with disruptions from its zero-Covid policy forcing factory shutdowns.

Outside of China, the rest of the world faced lower production last month reflecting softer demand. We mentioned the energy challenges in Europe, with the dynamic reflected in a 15% y/y drop in steel output from Germany during the month. Overall, total steel production down -4.3% year to date is at least balancing some of the weaker demand side headwinds which we believe can play into higher prices for steel going forward.

source: World Steel

SLX Price Forecast

The call we’re making is that the selloff in steel and iron ore has largely already priced in the softer global demand outlook. Ongoing production disruptions including from conditions in Europe along with the potential that higher energy prices add to supply chain pressures can both limit the downside from here and support a rally higher.

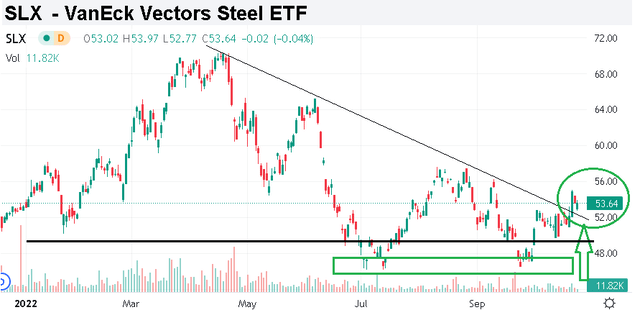

As it relates to the SLX ETF, the fund is currently sitting above $50.00 per share which has acted as an important level of support going back to 2021. Notably, a bounce creating a double-bottom in September has put the bulls back in control with the pricing action in the sector turning positive, and breaking out of a long-running downtrend. To the upside we see the fund retesting $60.00 as a first price target while the year-end dividend will further add to the total return potential.

Seeking Alpha

A bullish view on SLX sort of needs the macro picture to cooperate. A scenario where global growth outperforms into 2023 and trade sentiment improves, possibly driven by indications of inflation trending lower over the next couple of months can add momentum to commodity names. We’d also like to see the Dollar pullback as supportive of commodities including steel demand.

On the other hand, the risk here is for a further deterioration of economic conditions including in China. The prospect of a deepening recession would hit demand forecasts for steel, opening the door for a leg lower in the related steel producers and iron ore mining stocks.

Final Thoughts

SLX is a high-quality ETF and a good option to capture tactical or strategic exposure to important steel market names. While the environment has been defined by macro pessimism, we believe the risks are tilted to the upside with steel stocks offering good value at the current level.

[ad_2]

Source links Google News