[ad_1]

Since the early parts of August 2016, the iShares Silver Trust (NYSEARCA: SLV) has lost 29.58% in a financial markets period that has been broadly characterized by strong economic data in the U.S. and a bullish rally in each of the main stock benchmarks. But we are now seeing an emerging confluence of technical and fundamental signals which suggests that these extended declines may be coming to an end. Since we are only 5.87% from the September 2018 lows (at $13.11), there are still plenty of opportunities to get long the iShares Silver Trust in anticipation of a significant run higher.

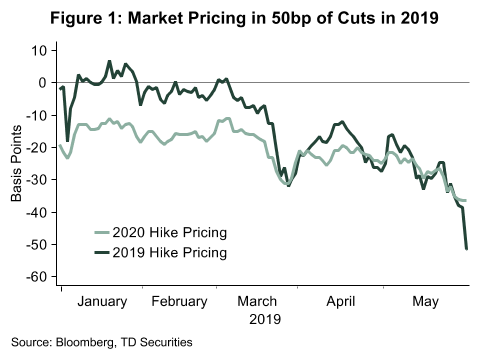

(Source: Bloomberg, TD Securities)

In 2019, we have seen drastic revisions in the market’s consensus expectations for interest rates. In January, we actually had periods where the market was still pricing in the possibility of an interest rate hike from the Federal Reserve. Of course, those expectations were short-lived and things began to change quite dramatically in the period encompassing March, April, and May. Fed Chairman Jerome Powell recently explained that the U.S. central bank will act “as appropriate” in the face of renewed risks resulting from the U.S-China trade war and faltering economic data showing increasingly troublesome weaknesses.

ADP employment data (which shows private hiring activity in the U.S. economy) indicated that employers made 27,000 new hires during the month of May 2019. This is the lowest rate of growth that has been visible in the market since the first half of 2010, and it suggests that we may be on the verge of encountering disappointment in U.S. nonfarm payroll data.

The nonfarm payrolls report is often the most impactful and market-moving survey in the financial markets, so if the ADP figures prove to be accurate in forecasting future weaknesses, it could have a massively bearish impact on equities markets. The S&P 500 is still trading within relatively close proximity to its record highs, so there is plenty of room to fall if the economic data indicate a conclusion is coming for the bull rally. As a traditional safe-haven asset, SLV could benefit from changes in these underlying trends.

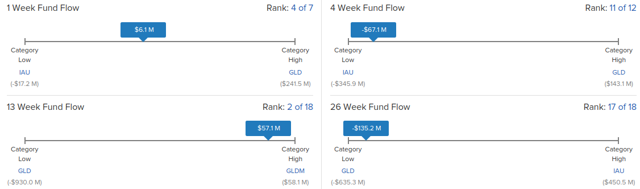

(Source: ETFdb.com)

Over the last four weeks, the iShares Silver Trust has been negatively impacted by outflows of -$67.1 million and this number roughly doubles to -$135.2 million when we look at the investor activity which has been directed toward SLV over the last 26-week period.

In both cases, this puts SLV near the bottom end of its category averages and this suggests there may be a limited number of market participants capable of sending the fund to lower valuations. Already during the last week, we are seeing changes in direction as the fund has benefited from inflows of $6.1 million. Given the shifts visible in the fundamental picture, a gravitation in sentiment toward the positive end of the spectrum would not be much of a surprise and this seems to be what is occurring when we look at the basic investor activity which has become apparent in the fund.

(Source: Author, TradingView)

Other factors which are supportive for the bullish argument can be found in the currency markets. The Dollar Index appears to be in the early stages of a “head and shoulders” chart pattern, which has become visible at the weekly level. Understandably, many investors and traders are skeptical about the true power of technical analysis. But, when the charts’ patterns are this clear, they can be very difficult to ignore.

(Source: Author, TradingView)

However, the opposite scenario appears to be developing in SLV. With valuations holding near long-term support levels, bearish momentum is slowing as the number of available sellers in the market has decreased. There is a lot of evidence here which suggests SLV has the potential to start making significant rallies. The ETF is trading far below its historical averages, chart activity is flashing reversal signals, outflow activity has reached extreme levels, and the traditional fundamental drivers which typically support precious metals ETFs appear to be growing in magnitude.

Of course, there is still a significant amount of bearish momentum present in the market and SLV is trading lower by almost 30% when viewed in relation to the August 2016 highs. But the economic environment that led to those declines may be changing course. Major changes at the Federal Reserve have become apparent as critical economic data in the U.S. have shown rising levels of weakness. A clear break of $14.60 may indicate an end to the downtrend in SLV and usher in a new wave of bull momentum for those long the ETF.

If this occurs, the bear trend from August 2016 would become invalidated and prices would then find themselves above the 200-week moving average. As valuations are currently less than 6% above the September 2018 lows, we could still see plenty of opportunities to get long the iShares Silver Trust in anticipation of a significant run higher.

Thank you for reading.

Now, it’s time to make your voice heard. Reader interaction is the most important part of the investment learning process! Comments are highly encouraged. We look forward to reading your viewpoints.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News