[ad_1]

Gold and silver on the back of dovish comments by the Fed are rallying aggressively as I write. Although we were early in timing our positions in this asset class recently, all of our positions are now fully in the green which is encouraging. In fact, we believe there is little chance now that the iShares Silver Trust (SLV) will ever break below the lower trend-line on the long-term monthly chart below.

The recent dovish stance by the Fed has led to some weakness in the dollar. A weaker dollar is obviously bullish for silver as the white metal is priced on the commodity markets in US dollars. Therefore SLV investors will be keeping an eye on whether this trend will continue or not.

The recent dovish stance by the Fed has led to some weakness in the dollar. A weaker dollar is obviously bullish for silver as the white metal is priced on the commodity markets in US dollars. Therefore SLV investors will be keeping an eye on whether this trend will continue or not.

If we look at a more recent chart, we can see that the price of SLV attempted to break above resistance at the start of this year. It failed but we believe, we will have another attempt here pretty soon somewhere around the $14.50 region on the SLV chart. We expect a different result this time around.

Let us explain our reasoning by means of going through how silver has been cycling on the SLV chart.

SLV bottomed last on the 28th of last month. This clearly was a daily cycle low because it satisfied the requirements.

- It was in its timing band.

- Price broke below and then consequently broke above the 10-day moving average of SLV.

- Price broke above the down-cycle daily trend-line.

The weekly chart though also shows that May 28th was also an intermediate cycle low. Price finally bottomed on week 37 from the preceding intermediate cycle low. The rally out of the May 28th lows has now closed above the 10-week moving average which confirms a brand new intermediate cycle. Investors should be aware that we are only on week 3 of this broader intermediate cycle in silver. Realistically we should not be seeing a top until at least week 15 to 20.

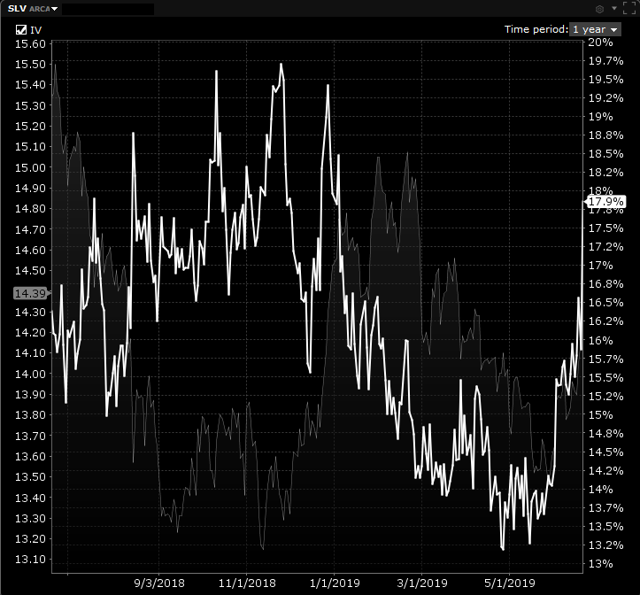

With respect to trading and investing in silver through SLV, this ETF has its advantages and disadvantages. On the trading side, we favor SLV over the competition due to how liquid the fund is. Being able to enter and exit a trade at attractive spreads is essential when trading over a shorter-term time -frame. Furthermore, the recent up-move has spiked implied volatility for example (see below) to almost 18% for July. This gives us the opportunity to sell option premium if this were a strategy for example which would interest us at present.

Source: Interactive Brokers

On the long-term side, the expense ratio of 0.5% is much higher than the alternatives out there in this space. Again though, if one was to buy a LEAP (Long Term Equity Anticipation Security) or a long-term call option for example, the spread on those options would be most likely closer than alternative funds. So whilst one may be losing long term with respect to holding SLV on the expense ratio due to the fees, one would actually be gaining on the liquidity side which would mean more favorable prices would be able to be attained.

Furthermore, many times we favor ETFs due to the reduced risk involved. SLV gives us direct exposure to the metal and nothing more. Silver mining companies, for example, could experience internal problems even in the face of a booming spot price of silver which would consequently affect their share prices most likely adversely.

We remain long SLV in this space. Between gold, the miners and silver, we believe silver holds the most potential due to how cheap its price is from a historical basis. Remaining long.

———————-

Elevation Code’s blueprint is simple. To relentlessly be on the hunt for attractive setups through value plays, swing plays or volatility plays. Trading a wide range of strategies gives us massive diversification, which is key. We started with $100k. The portfolio will not stop until it reaches $1 million.

Join Us here

———————–

Disclosure: I am/we are long SLV. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News