[ad_1]

I am not a fan of holding long-term silver exposure through the iShares Silver Trust (SLV) for many reasons. I believe there are good alternatives for those opportunities to add exposure to silver, but that it is not yet a good time to do so, as silver is still declining.

About SLV

SLV is a trust that provides exposure to the spot price of physically-backed bullion. SLV “is not a standard ETF.” As the SLV website explains:

The Trust is not an investment company registered under the Investment Company Act of 1940 or a commodity pool for purposes of the Commodity Exchange Act. Shares of the Trust are not subject to the same regulatory requirements as mutual funds.

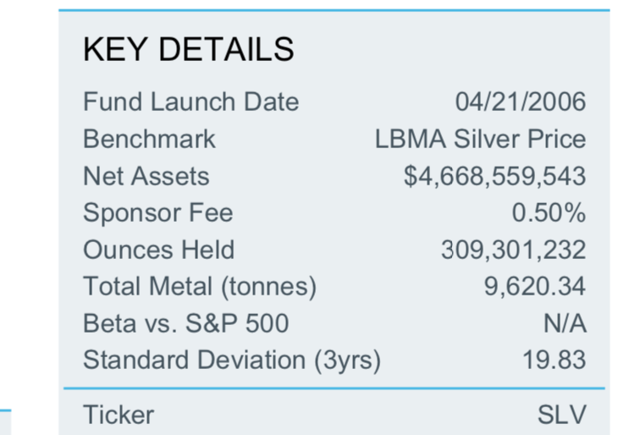

The physically-backed trust currently holds over 311 million ounces of silver.

(Source: iShares SLV Fact Sheet)

While SLV’s setup prevents investors from getting burned by contango, as is often the case for commodity-linked ETFs and ETNs that are based on a basket of futures contracts, SLV shareholders do end up paying a 0.50% sponsor fee, which is too high for a core holding that does not distribute income or employ a complicated strategy. The only real advantage that SLV provides to holders is the liquidity of a stock.

There are alternatives to SLV in the equity universe. The Sprott Physical Silver Trust (PSLV) is a very similar alternative with possible tax differences, when held in taxable accounts. Special U.S. federal income tax rules could apply to some holders of PSLV, because it is classified as a Passive Foreign Investment Corporation by the IRS. In any event, I think PSLV also has too high of a fee for a long-term holding of silver.

(Source: PSLV Fact Sheet)

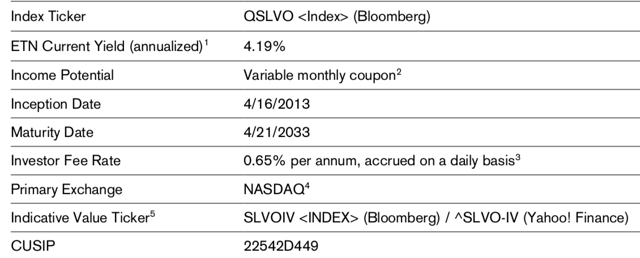

Another possible choice for holding a silver security is Credit Suisse’s Silver Shares Covered Call ETN (SLVO). This exchange traded note buys silver and sells covered call options contracts against it in order to generate income. While this method allows an investor to generate income from a silver holding, there is the risk that the silver position could get called away if the price of silver spikes. SLV has a 0.65% annual fee.

Another possible choice for holding a silver security is Credit Suisse’s Silver Shares Covered Call ETN (SLVO). This exchange traded note buys silver and sells covered call options contracts against it in order to generate income. While this method allows an investor to generate income from a silver holding, there is the risk that the silver position could get called away if the price of silver spikes. SLV has a 0.65% annual fee.

(Source: Credit Suisse X-Links SLVO notes)

Recent Silver Performance

Recent Silver Performance

Silver and SLV are in a clear downtrend that started in the first quarter. Silver appears to be suffering as less of a safe haven than usual, possibly due to crypto strength, and also due to industrial exposure on account of its use.

According to Kitco, industrial demand makes up 50% of the silver market and was slightly down last year. Reasons for the decline included that the solar sector is requiring less silver as technological advancements allow for less silver in manufacturing photovoltaic panels. Continued strength in the silver coin sales market indicates we are near market support, but that is the retail haven market and has little to do with future demand for industrial use.

Also, one of the primary reasons investors consider silver is because it is usually not highly correlated to the equity market. If we look at the 2-year chart comparing SLV and the S&P 500, there is a very loose correlation, with the two sometimes moving in unison and at other times there is a negative correlation and the two are going in opposite directions.

But over the last two months, SLV and the broader market have become very tightly correlated. Much of this recent decline in both the broader market and SLV is speculatively based on upon the expected slowing of global growth, which should have a negative effect upon industrial silver demand, as well as demand for other industrial commodities.

But over the last two months, SLV and the broader market have become very tightly correlated. Much of this recent decline in both the broader market and SLV is speculatively based on upon the expected slowing of global growth, which should have a negative effect upon industrial silver demand, as well as demand for other industrial commodities.

Given this recent silver weakness, and the current uncertainty about global growth and industrial demand, it appears as though silver is likely to decline to the low $14s and possibly breach even $14 per ounce. This would put SLV into the low $13s. Nonetheless, I believe there will be significant support at about $14 per ounce, as occurred in November of 2018.

Conclusion

Silver coins and household items are a great way to get long-term exposure to silver, but SLV and its 0.5% fee are a little lacking. If you must hold silver as a security, consider the lower fee alternative of PSLV or the income-producing ETN, SLVO. Nonetheless, recent market momentum is to the downside, with silver looking likely to test recent support at around $14 per ounce. A possible recession or bear market that may be coupled with a continuing strong dollar could prolong this recent move down. As a result, investors should consider waiting for a $14 per ounce retest before accumulating a physical silver position.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News