[ad_1]

Last month, I presented my bullish investment thesis on the iShares Silver Trust (SLV). SLV had been lagging well behind gold for the last few years, and many assumed that it wouldn’t participate in this gold bull market.

SLV has been in turmoil as silver is both an industrial and precious metal. You have concerns about global economic growth, which could curb demand for silver since it’s widely used in many industries. But then you have gold breaking out in a bull market, and silver has never been left out of a gold bull run.

The precious metal side was always going to win out for SLV. That is the real driver as investment demand determines if there is a deficit or surplus in the annual supply of the metal.

The same thing happened in the early 2000s. Silver lagged for years and was showing zero gains even though gold had risen by 50% from its bear market lows. By late 2003, investment demand for silver overwhelmed the market, and silver doubled in just a matter of months.

Gold doesn’t have the same leverage. Silver is a tiny market compared to gold and a $10-20 billion increase in silver investment demand would create a significant spike in price. It’s like trying to fit Niagara Falls through a garden hose.

My summary thesis on SLV was simple:

Not only would SLV soon catch up to the price performance of gold, but it will also far surpass gold’s performance over the next 12-24 months. The longer an investor’s time horizon, the stronger the gains, as I foresee a multi-year bull market unfolding. The downside risk for SLV last month was only 7%, as if it fell by that much, it would break below critical support and would be a clear sell. It was unlikely that SLV would breach the previous lows, especially given the strength in gold. I believed the next 7% move for SLV would be higher, not lower. In fact, that’s all SLV needed to be in a position to surge in price.

SLV Is Quickly Closing The Performance Gap

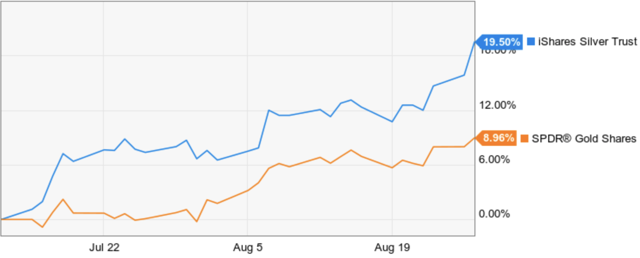

Since mid-July, SLV has sprung to life and is showing a gain of ~20% compared to a 9% return for gold. I believe the tide has officially shifted and SLV will outperform for the remainder of this multi-year bull market.

(Source: YCharts.com)

When I showed SLV’s performance vs. gold from the start of 2017 to July 2019, SLV was still down over 5% while gold was up 22%. SLV has finally reversed course and is swiftly closing the gap. It only took a few months for silver to catch up with gold in the previous bull market, and at this pace, SLV will be on par with the performance of gold within that same time frame.

Data by YCharts

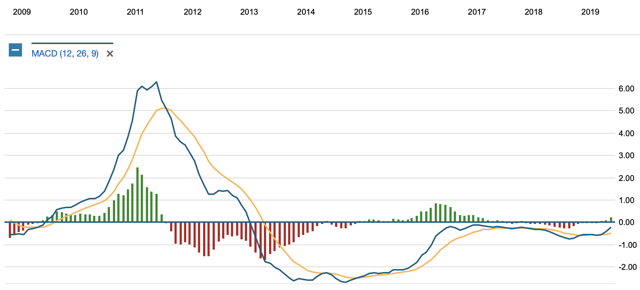

Data by YChartsI wanted to see the SLV surpass its 200-week moving average and get a bit of daylight between itself and its MA (200). That would confirm it would finally be not only participating in this gold bull market but likely outperforming. You can see in the chart below how SLV had attempted to get above this key technical level for years but failed each time. Over the last month, SLV has overcome this significant resistance and is pulling further away as each day passes.

(Source: Schwab)

The monthly MACD shows significant shifts in trends that investors shouldn’t ignore. The MACD on the monthly chart will usually spend years in positive or negative territory and it turned positive on SLV’s chart a few months ago. A change like this doesn’t happen often and signals SLV has more gains on the horizon.

(Source: Schwab)

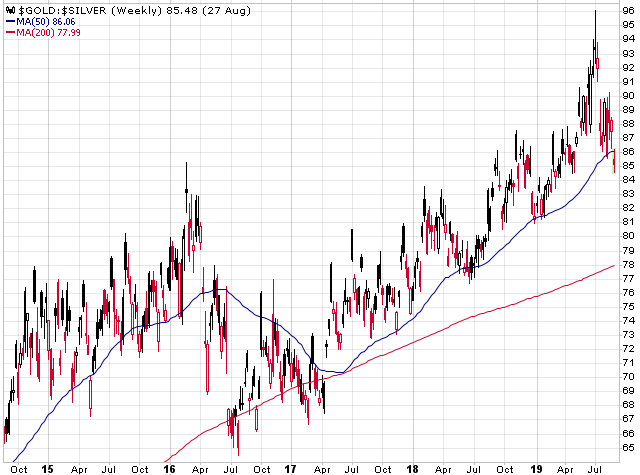

The gold to silver ratio has also finally declined from multi-decade highs, and certainly appears that it peaked at the beginning of July 2019. There wasn’t much room to the upside for this ratio, and silver would catch up with gold, or gold would collapse in value. To get this ratio back in the 60s, and assuming gold stays flat, SLV would need to increase ~25%. In 2011, this ratio bottomed at just over 30; SLV would need to increase 180% to equal that reading. Either way, there is a long way to go for SLV, especially considering I believe gold’s run is only in its infancy.

(Source: StockCharts.com)

A Review Of The Key Fundamentals For Silver

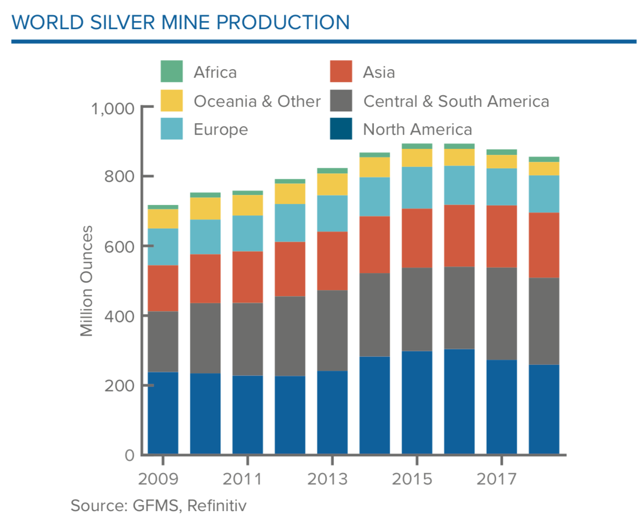

World silver production hit a 3-year low last year due to a combination of factors, the depressed price being the main one in my opinion. Silver is often a by-product of gold and base metal production, and while gold has jumped in price, copper and other base metals have been on the decline. Combined with the recent struggles of silver, all of these were offsetting the positive price action in gold. It’s unlikely that silver production is about to reverse course unless the price of silver gets back above $20 and consistently remains above that level for the foreseeable future. Base metals like copper and zinc also need to reverse higher to impact the silver market.

(Source: GFMS, Refinitiv, The Silver Institute)

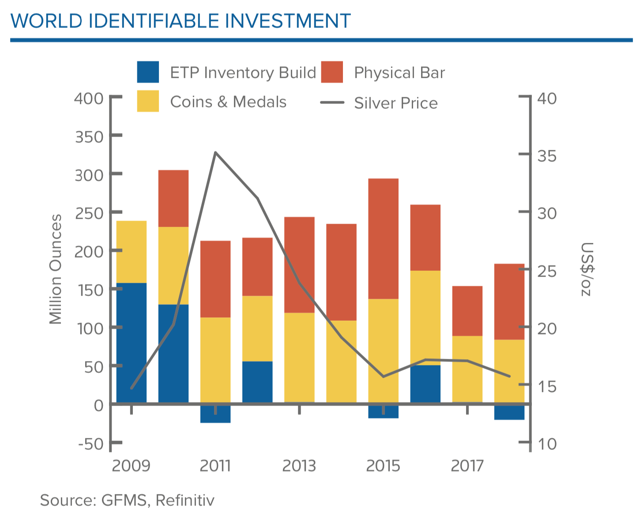

Industrial demand has been steady over the years, and despite the economic headwinds, I don’t see that changing. Even during the Great Financial Crisis, demand for silver from various global industries declined a little over 100 million ounces (something the investment side can easily make up), and I don’t foresee the world on the verge of GFC II. As I mentioned above, what’s going to determine whether there is a supply or deficit in silver is the investment side of the equation. Demand for silver in the form of exchange-traded products, coins, and physical bars was near decade-lows in 2018. However, this graph doesn’t show the true decline in investment demand, as silver was at much higher prices in 2010-2011. If you put it in dollar terms (i.e., over 200 million ounces of investment demand at $35 silver in 2011 vs. just over 150 million ounces at $16-17 in 2018), then the decline in demand is even more significant. It’s this lackluster investment demand that has hurt silver, but that is now changing as momentum is entering the silver market. A tiny push by investors into silver (say 50 million ounces, or $1 billion worth of the metal) can have a substantial impact on price. We are starting to see that take place now, but it’s still just the beginning.

(Source: GFMS, Refinitiv, The Silver Institute)

Why I Prefer SLV To Physical Silver

I still favor SLV over buying the physical metal itself, for the following reasons:

- There is a hefty premium paid when an investor purchases physical silver. That premium can vary, but it’s typically around 5-6% above the spot price for a 100-oz bar and can increase if demand surges.

- If silver does reverse and start to head lower again, then trying to liquidate a physical silver position will be much more arduous, and the premium gets added to the total loss percentage as well.

- Physical silver is more of a long-term investment commitment compared to an easily tradable ETP like SLV. SLV gives greater flexibility as it can be used by both traders and long-term investors.

- The minimal fees (0.50% per year) for SLV are typically less than one would pay on storage and insurance costs for physical silver.

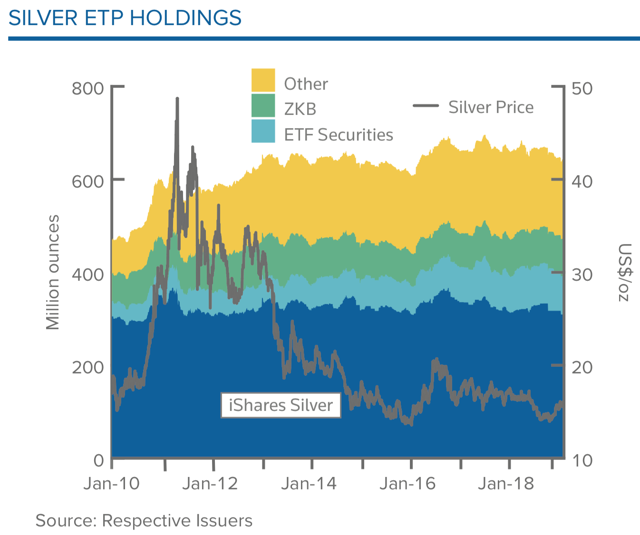

SLV is the largest holder of physical silver amongst the other ETPs on the market and has excellent liquidity. It’s the best option.

(Source: GFMS, Refinitiv, The Silver Institute)

The downside to SLV is it doesn’t give you that same safety and security as being the actual owner of the metal, but that’s the trade-off.

The VelocityShares 3x Long Silver ETN (USLV) is an option as well if one is looking for leverage to SLV, but these are two entirely different animals and their usage depends on an investor’s time horizon and risk tolerance.

I continue to view SLV as the best (non-leveraged) way to play physical silver. The 20% increase since July is just the beginning. In the short term, SLV could retest the 2016 highs of just under $20 (or a ~15% gain from current levels). Over the next year or two, I expect percentage gains to either be close to triple-digits or at that mark.

Subscribe To The Gold Edge – Current Free Trial Offer

To keep up to date with how I’m playing this bull market in gold and gold stocks, just click the “Follow” button below. If you would like additional in-depth analysis of the sector, including all of my top picks, subscribe to The Gold Edge, which is my research-intensive service that provides extensive coverage of the sector. Click here for details.

Here is the latest review:

Disclosure: I am/we are long USLV. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News