[ad_1]

cokada/E+ via Getty Images

One might think that the past year, with QQQ up a total of only 3%, would have been good for a covered call fund like QYLD (NASDAQ:QYLD). This has not been the case for QYLD, which has a total return of -2.8% over the past 12 months. The outcomes from buy-write strategies (buying a stock or index and selling / writing a call against that stock or index) are quite sensitive to the specifics of the strategy. The most common approach, and the one used by QYLD, sells call options that expire over the next month. When these expire, the strategy simply sells more monthly calls. In addition, this strategy must pay out to settle the calls that expire if the price of the stock or index has exceeded the option strike price. The rules for maintaining a portfolio with components that decay in time are referred to as the roll strategy. Any roll strategy is sensitive to the specific ups and downs of the underlying stock or index over time. Selling a covered call has a far more predictable outcome. In technical terms, the short-term covered call strategy is much more path dependent than simply selling a long-term covered call.

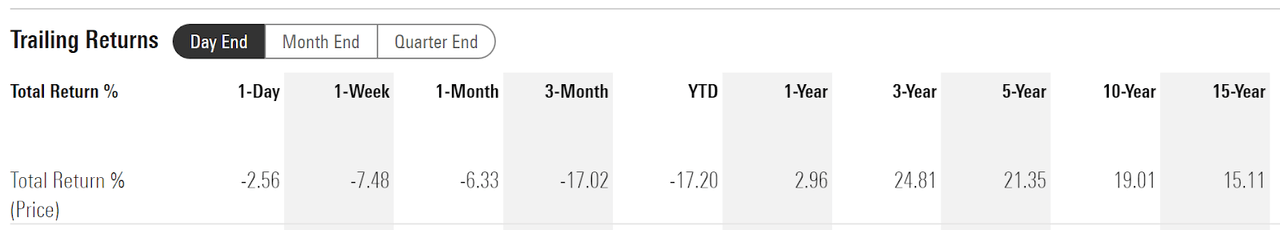

Morningstar

Trailing total returns for QQQ (Source: Morningstar)

Morningstar

Trailing total returns for QYLD (Source: Morningstar)

One expects that a covered call strategy will have a lower annualized return than the underlying index as well as lower risk. The ultimate appeal of covered call strategies is that they have the potential to deliver higher risk-adjusted return (Sharpe ratio) than simply holding the underlying index. Over the past 3- and 5-year periods, QYLD’s Sharpe ratio (0.73 and 0.72, respectively) is substantially below that of QQQ (1.43 and 1.28). These are short periods, of course, when QQQ has delivered high returns but it is important to understand that mechanical covered call implementations can underperfom, even on a risk-adjusted basis, over long periods.

A little over a year ago, on February 19, 2021, I wrote an article about QYLD titled Turning QQQ Into an Income Engine. In that post, I concluded that it made more sense to sell covered calls against QQQ yourself rather than investing in QYLD. With this post as a reference, we can examine the outcomes from both. I recorded the relevant information about available call option premiums for selling a call that expired on January 21, 2022. Looking at the outcomes from selling a single long-term covered call, as I proposed, and from buying QYLD helps to illustrate the mechanics.

On Feb 18, 2021, the day that I analyzed the calls, QQQ was trading at $330.60 and it was possible to sell a January 21, 2022 (expiration date) call option on QQQ with a strike price of $331 and receive a premium of $33.56 (this was the bid price). Selling this call option against a position in QQQ provided 10.15% in income ($33.56/330.60) over the next 11 months. With the dividend, the total income came to 10.6%.

On January 21, 2022, the option expiration date, QQQ closed at $351.69. QQQ had a total return (including the dividend) of 6.3% from the close on February 18, 2021 to the close on January 21, 2022. Because QQQ closed higher than the strike price at option expiration, settling the options means that you are selling your shares of QQQ to the option buyer at the strike price and then must buy the shares back in the open market. In effect, this means that you are realizing a return of -6.3% because you are selling the shares at less than the current value (($351.69-$331)/$330.60 = -6.3%). Your total return for this period is +10.6% from selling the covered call and the dividend ($1.69 paid out over this period, 0.51% realized yield) minus the 6.3% that you lose when you buy the QQQ shares back in the open market. The total return over this period is +4.4%.

The sequence of events is:

Buy QQQ at $330.60

Sell covered call and receive $33.56 in option premium

Receive dividends of $1.69

Sell QQQ at $331 to the call option owner when the option settles

Buy back QQQ at current price of $351.69

QQQ options are American style, which means that the buyers of the call option might have exercised the option before the expiration date. In general, it is a mistake to exercise early because you waste the remaining time value of the option.

QYLD returned a total of 0% from February 18, 2021 to January 21, 2022. I double checked the adjusted closing prices on Yahoo! Finance against the reported distributions to verify this result.

In summary, for the sample period from February 18, 2021 through January 21, 2022:

QQQ returned a total of 6.3%

QYLD returned a total of 0%

Buying QQQ and selling the at-the-money covered call returned a total of 4.4%

It is important to remember that these results are just one example of possible outcomes. The purpose of going through these numbers is to illustrate one key point. Buying QQQ and selling the covered calls provides an outcome that is simple to calculate in terms of the future value of QQQ. This is not the case for a covered call strategy because of the path dependency.

Today, with QQQ trading at $327.43, it is possible to sell a January 20, 2023 call option with a strike price of $330 for $33.24 (this is the bid price on ETrade as I write this). Selling this call provides 10.2% in income ($33.24/$327.43) over the next 10.8 months. Because of the timing of the dividend payments from QQQ, the dividend yield will be 0.5% over this 10.8-month period.

The implied volatility of the options expiring on January 20, 2021 is 29% (annualized) according to ETrade. I calculate annualized implied volatility of 28% (26.5% for the 10.8 month period). This level of expected volatility is very close to the value from a year ago (29%) although this is notably higher than the trailing 3- and 5-year realized levels of volatility for QQQ, 19.4% and 17.8%, respectively.

Discussion

Covered call strategies can be an important part of the investment toolbox, but they are not a free lunch. In addition, as I hope that I have explained, the realized performance from covered call funds can be hard to understand and even harder to predict. This is largely because of the interplay of rolling the strategy through time and market movements. QYLD implements what appears to be a standardized covered call strategy against an underlying holding in QQQ. I am neutral on QYLD, as I was a year ago, because (1) the performance is hard to understand because of path dependency, (2) the realized risk-adjusted performance has not been compelling, and (3) selling covered calls provides more control and more understandable outcomes.

.

[ad_2]

Source links Google News