- Gold prints a fresh five-year high after dovish Fed policy.

- Silver breaks above the 200-day moving average.

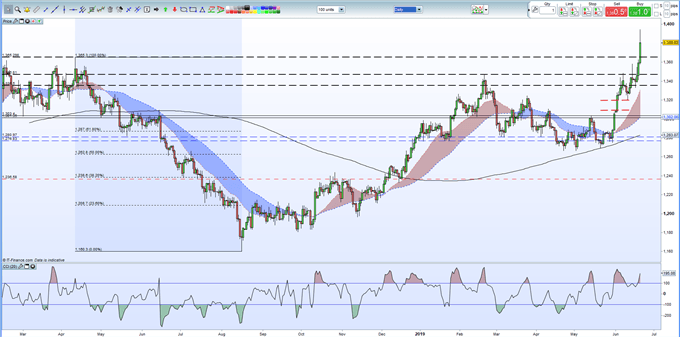

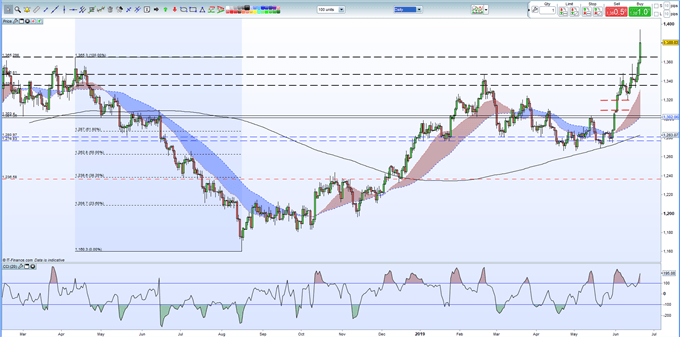

Gold traded as high as $1,395/oz. late Wednesday – its highest level since March 2014 – after US Federal Reserve Chair Jerome Powell paved the way for interest rate cuts in 2019. The market has already ready fully priced-in a 0.25% rate cut at the July meeting with one and potentially two more cuts penciled in before the end of 2019. Gold is expected to perform strongly in the coming months as a weaker US dollar, falling bond yields and lower inflation expectations make the precious metal an attractive asset to hold.

Gold baulked at $1,400/oz. yesterday and has sold off back to its current level around $1,383/oz. Initial support is likely to be seen around the old April 2018 high around $1,365/oz. but yesterday’s spike move needs to build more volume and find a base before the next move higher. The $1,400/oz. psychological level needs to be broken and closed above to open the way to the August 2013 high at $1,436/oz.

GOLD (XAU) DAILY PRICE CHART (MARCH 2018 – JUNE 20, 2019)

IG Client Sentimentshows that retail traders are 56.5% net-long gold, a bearish contrarian indicator. Recent daily and weekly sentiment shifts however give us a stronger bearish contrarian trading bias.

SILVER FINALLY BREAKS RESISTANCE

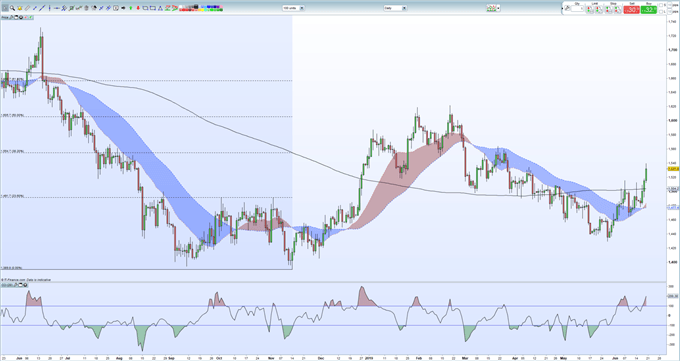

After battling with resistance off the 200-day moving moving average over the last two months, silver followed gold sharply higher late Wednesday and not just broke higher, but more importantly closed above the 200-dma. To the upside a cluster of previous highs and the 38.2% Fibonacci retracement level between $15.55 and $15.64 while to the downside, the 200-dama now turns to support around $15.04 ahead of the 23.6% Fibonacci retracement at $1,492.

SILVER DAILY PRICE CHART (MAY 2018 – JUNE 20, 2019)

The gold/silver ratio has turned marginally lower overnight, post-Fed to around 89.50, and now trades around 90.

The iShares Silver Trust (SLV) was trading at $14.52 per share on Thursday afternoon, up $0.35 (+2.47%). Year-to-date, SLV has declined -9.19%, versus a 11.07% rise in the benchmark S&P 500 index during the same period.

SLV currently has an ETF Daily News SMART Grade of C (Neutral), and is ranked #9 of 34 ETFs in the Precious Metals ETFs category.

This article is brought to you courtesy of DailyFX.