[ad_1]

blackdovfx

The SoFi Select 500 ETF (NYSEARCA:NYSEARCA:SFY) looks like a zoot suit in the current environment, meaning wildly out of fashion. Its top holdings reflect FANG era sensibilities in a market where rates could credibly and enduringly reach the 6% mark, which means a tectonic shift in what multiples can be considered reasonable given the earnings potential. Where earnings potential is affected in the medium-term by recession risks, all the more reason to look brutally at your holdings. SFY does some things right, but it also does a whole lot wrong. Pass.

SFY Breakdown

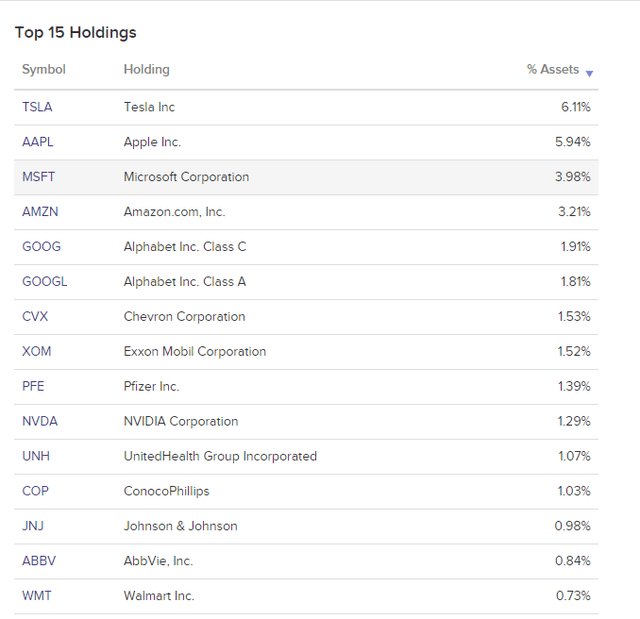

The first blemish comes in the top holdings.

Top Holdings (etfdb.com)

Some could stay rather resilient. Apple’s (AAPL) mettle hasn’t fully been tested yet, but we do see it staying well ahead of consumer products peers. However, even there, cracks are showing. Microsoft (MSFT) continues to see strength on the corporate side of things, but this is in contrast to falling consumer confidence that will eventually dictate the corporate mood, as it must in order for the rate hikes to work by increasing misery. Alphabet (GOOG) (GOOGL) stays solid but does depend on ad spending, and in a severe enough recession even budgets directed to Google will fall. Energy companies can go several ways, although disintegration of supply chains is secularly supporting those prices. Healthcare will be solid no matter what, although AbbVie (ABBV) and Pfizer (PFE) are in the sights of the US government.

While healthcare may be immune, among these non-cyclicals, we believe there is exposure to latent effects from falling consumer confidence, and eventually falling consumer budgets once the recession is in.

But there are plenty of exposures that are cyclical, and perhaps one of the most concerning is the top holding of Tesla (TSLA). TSLA is still in growth mode, so earnings growth is possible, but durables will be hit in a recession. The multiple is also 100x. That implies very strong earnings growth. Issues of profitability in the broader automotive industry have seen criticisms levelled at Tesla many times, and they are in principle true and will eventually matter for the company as incremental improvements may be difficult to achieve especially if volumes begin to suffer on more real evidence of recessionary forces taking effect, for now, kept at bay by persistently low unemployment. In other words, the multiple is high for an environment where we may soon have 6% rates on the safest instruments in the markets.

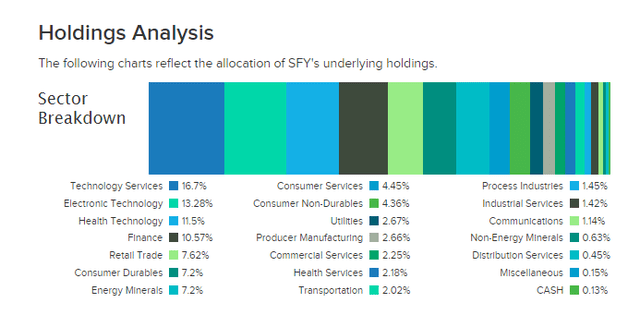

Tesla is 6% which is already a concern, but the consumer durables exposures go much further to account for 7% of the portfolio (Tesla is considered tech here). Retail trade is also 7.62%, and overall, the more macroeconomically levered exposures are about 50% of the sector allocations.

Sectors (etfdb.com)

Remarks

The PE of the ETF is about 27x. This implies just about a 3% earnings yield, already 1% behind risk-free rates. With 50% of the exposures being in industries where growth is at risk, if not already visibly peaked, and latent concerns even among the mega-cap tech companies in delivering incremental earnings improvement, a less than risk-free rate cannot realistically be justified. Tesla, admittedly, may be among the few exposures capable of producing strong earnings growth on a go-forward basis. There are concerns for example about how much further Apple can go with scalping activity not so impressive, and the Chinese exposure being a major weight on the earnings of the next couple of quarters. It’s a guessing game here, but the current environment means that if you have to be hopeful to justify holding it further, it’s probably a sell.

While we don’t often do macroeconomic opinions, we do occasionally on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

[ad_2]

Source links Google News