[ad_1]

stevecoleimages/E+ via Getty Images

Main Thesis & Background

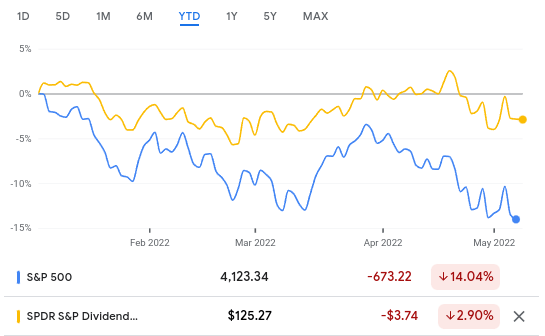

The purpose of this article is to evaluate the SPDR S&P Dividend ETF (NYSEARCA:SDY) as an investment option at its current market price. This is a fund I have owned and recommended for a long time, was a thesis I reiterated when 2022 got underway. In hindsight, I probably should not have placed a “buy” rating on this fund, but that is relative. If one had moved to cash instead, they would have saved a few percentage points. But if an investor had chosen SDY over the broader S&P 500, then the alpha speaks for itself:

YTD Performance (Google Finance)

Clearly, this has been a difficult year so far. As a result, I wanted to take another look at SDY to see if I should adjust my rating. Given the macro-headwinds facing the market, I think a downgrade to “hold” is warranted, because alpha-generation will be difficult in the short-term, in my view. I believe that there is a good chance we see more pain in equities and, if not, a rebound is probably going to reward risk-on plays that have suffered the most since January. Yet, SDY will offer investors a chance to ride out any forthcoming storm with less volatility (and hopefully lower losses) if markets continue to trend downward. So while upside may be limited, downside is relatively limited as well.

A Shift To Quality Makes Sense When The S&P Is This Volatile

One of the reasons for SDY’s relatively strong performance (I know it has gone down, but it has handily beaten the market) is because of the characteristics of the High Yield Dividend Aristocrat index it tracks. To be included on this list of companies is not easy. To be included in SDY’s portfolio a stock must:

- Have consistently increased their dividend for at least 20 consecutive years

- Be a member of the S&P 500 Index

- Maintain a total market capitalization of $3 billion

Because of these characteristics, SDY is certainly seen as a more stable fund. It is an income-generator in part, but its yield is really not “high”. This is more a play on established, battle and time tested companies that have survived in all types of markets. For this reason, it can come in handy when investors are skittish, or simply don’t know where else to put their cash.

Case in point is the current environment we are in. While I am a big proponent of the S&P 500 (and it represents the majority of my portfolio), it is also a volatile index in reality. Sure, over time it produces strong and sustainable returns. But in shorter time periods it can really move fast. Our current calendar year is a great testament to that. In times like these it makes me welcome SDY’s inclusion in my portfolio, and justifies why I build up the position when times are good – to prepare for the down times.

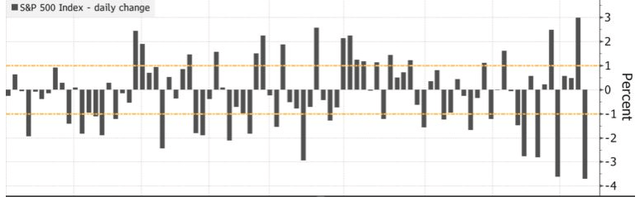

To understand why this matters at present, let us look at the S&P’s trading history since January. While the macro-story is that the index is down and in correction territory, there is more to it than that. On a daily basis, we have seen major swings in both directions, with a sizable portion of the year seeing 1% moves or greater:

S&P Daily Moves (2022) (Bloomberg)

In these environments, having the stability of SDY offers investors a chance for sanity. In my opinion, this volatility is not done, not by a long shot, so having SDY as a core holding makes as much sense now as it did when the year started. As the opening graphic shows, SDY is down, but its performance has been relatively steady. It hasn’t seen the volatile swings, and that is precisely why I own it.

A Chart That Keeps Me Up At Night

Of course, a part of me is leaning towards the argument that it is time to divest some of the stable performers and move into a riskier mentality. After all, part of the point of having bonds, dividend payers, and other less risky assets is that they provide protection during down times. Then, when those down times occur, it can make logical sense to move those funds into a more risk-on play. In this case, the S&P is in correction territory, so it could very well make sense to capitalize on this reality by going long the S&P 500 at the expense of the defensive options.

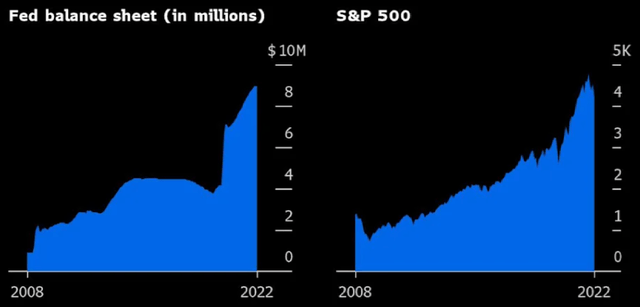

Yet, I am reluctant to do this right now, which begs the question – why? To answer this has to do with the potential for Fed tapering and general unwinding of Fed easing programs that markets have become so addicted to over the past decade. While the index is down in 2022 it is still up handsomely over the longer term. This rise has coincided with a rising Fed balance sheet in an almost perfect correlation:

Fed Balance Sheet vs. S&P 500 (Yahoo Finance)

With the Fed beginning to start its tapering / roll-off actions, this should concern investors. If the market has risen consistently as the Fed’s balance sheet has expanded, it stands to see stocks are going to come under some pressure as the balance sheet retracts.

Now, I don’t want to seem overly alarmist here. Stocks have already sold-off and are approaching bear market territory. At these levels, one generally does want to be a buyer. I have been buying the dips too, so I am not advocating outright selling. Importantly, my rating on SDY is “hold”, not “sell”. But my buys have been small and selective (only on down days – of which we have been seeing many!). I am trying to stay disciplined on the way down, in case the dip buying opportunities stretch on over the next few months. In this vein, I don’t think it is the environment to start selling off the funds offering stability for more risk. If the Fed’s tapering sparks a wider sell-off, then I will revisit that idea.

SDY’s Holdings Balance The Tech-Heavy S&P

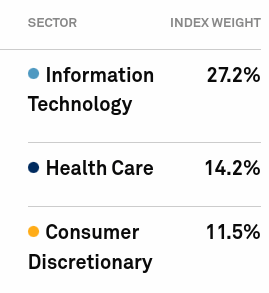

Expanding on the point above, there is a key reason why SDY is able to balance out a portfolio that is long the S&P 500. This has to do with the underlying mark-up of the two indices these track. As readers are surely aware the S&P 500 is very Tech-heavy, and its top three sectors make up over half the index:

S&P 500 Sector Weightings (S&P Global)

There is nothing “wrong” with this make-up, but the reason I bring it up is that SDY has a very different composition. In fact, the top three sectors are completely different:

SDY Sector Weightings (State Street)

To me, this emphasizes why I hold SDY to begin with. It may not help when everything is tanking across the board, but it provides some balance and relative safety when growth stocks are feeling the brunt of the pain.

Inflation Remains A Risk Across The Board

As my readers know, I have been harping away about inflation for a while. This was the primary factor behind my decision to divest most of my fixed-income holdings last year. Unfortunately, I couldn’t resist the ensuing sell-off and higher yields that resulted from the draw-down, and have taken positions again and recommended buying back in. This has been premature, and bond CEFs and ETFs continue to take it on the chin. While I do believe there is value to be had now, the market disagrees. I am optimistic this tide will reverse soon, but one can never know for sure.

By the same token, this inflation factor has driven equities down as well. The S&P 500 and the NASDAQ have felt the brunt, as growth stocks flashier trends tend to perform worse as yields rise. The theory goes that as recession fears mount and investors can earn a higher yield in “safer” assets, the attractiveness of growth lessens. Of course, in 2022, this has meant a broad equity decline, impacting SDY as well as the S&P 500 and the NASDAQ, albeit at a lesser extent.

The reason for bringing this up is because inflation is not going away. It remains a serious headwind, one that is to last longer than most market participants expected. While I see a smoothing out of inflation over the next twelve months, that may even be too optimistic of a forecast. Time will tell.

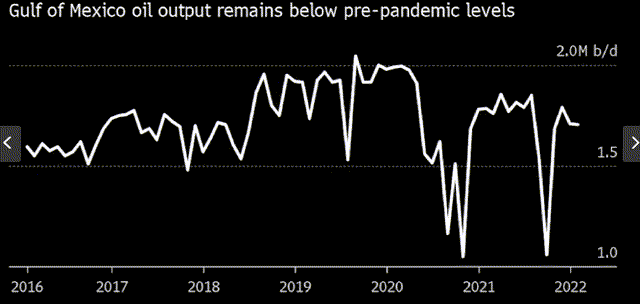

The problem is that the factors driving inflation are not easing. For example, energy and oil prices are rising steadily, and that is a primary component of inflation at the moment. As energy rises, so do expenses for consumers and households, as well as businesses. Those costs are absorbed and passed on at varying degrees, but the end result is people and companies are all paying more. While there have been calls for greater oil production, the fact is that OPEC+ is still making only modest increases. In addition, readers should be mindful that U.S. production is still below pre-COVID levels:

Oil Output in the Gulf (EIA)

My takeaway here is that until we see more production, whether domestically, internationally, or both, we will have a hard time riding ourselves of the inflation problem.

And it is not just energy. The labor market in the U.S. has been surprisingly resilient over the past few years. That has resulted in higher wages and a tighter labor market. While this is “good” for consumers and households, its impact for investors is more mixed. This is because as the labor market tightens the cost of labor for employers goes up. This can dent net profits and, as a result, stock prices.

This is also a more long-term problem, similar to the imbalance in oil markets. Right now, the U.S. has a low unemployment rate and a rising number of job openings, a trend that has been consistent since 2022 got underway:

U.S. Labor Market (Lazard Asset Management)

The conclusion again is that another driver of inflation is unabating. The labor market could soften, but the trend has been pretty resilient in one direction for the past two years.

To tie this back to SDY, inflation is real, stubborn, and not at all transitory. For the next few quarters investors are going to have to accept that a .50 basis point rate hike from the Fed is not enough to turn the tide against these other powerful market forces driving inflation. This could push stocks lower, and SDY along with it. This is paramount to why I am not building to my position here, but rather just holding on to my current one.

Bottom-line

I have always been partial to dividend paying ETFs. I have found my three favorites over the years that I stick with, and SDY is one of that select group. As 2022 has progressed, I have been very pleased with the results, even though it is in the red for the year. While that may be counter-intuitive, we have to appreciate the broader indices are all in correction territory, making SDY’s minor drop look all the better. Going forward, I see a difficult climate for stocks as the Fed is tightening, inflation is not subsiding, and markets are getting more volatile. Still, I like SDY’s relative stability, and see it as a place to shelter while the market sells off further. Until that time, a “hold” rating seems appropriate, and I would suggest readers approach any positions carefully at this time.

[ad_2]

Source links Google News