[ad_1]

William_Potter/iStock via Getty Images

Author’s note: This article was released to CEF/ETF Income Laboratory members on January 14th, 2022.

The Global X SuperDividend Emerging Markets ETF (SDEM) is an emerging markets equity index ETF, which invests in the 50 highest-yielding emerging market stocks. The fund offers investors a strong, growing 8.1% dividend yield, and a cheap valuation. On the other hand, the fund’s holdings are significantly riskier than average, and have significantly underperformed since inception. In my opinion, the fund’s benefits outweigh its positives, and so the fund is a buy, but it is only an appropriate investment for more aggressive investors.

SDEM Basics

SDEM Overview

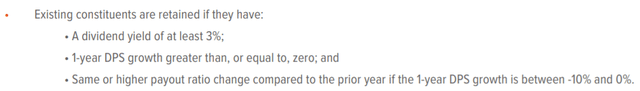

SDEM is an emerging markets equity index ETF. It tracks the MSCI Emerging Markets Top 50 Dividend Index, a pretty self-explanatory index, which includes the 50 highest-yielding emerging market equities. SDEM’s investment manager provides a simple index methodology summary, which I think all interested investors should read. The index includes the highest-yielding emerging market equities meeting the following conditions.

The last two criteria are meant to exclude stocks with unsustainable dividends. Although there is a lot of merit to this goal and approach, the index has laxer criteria for existing constituents, blunting the impact of the above.

SDEM Corporate Website

Finally, it is an equal-weighted index, with rules meant to ensure a modicum of diversification.

SDEM Corporate Website

In general terms, SDEM’s underlying index seems reasonable enough, but a greater focus on dividend sustainability would have been ideal.

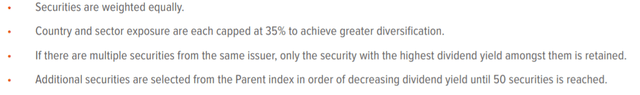

SDEM itself is a moderately diversified fund. It has exposure to most relevant industry segments, but is overweight the comparatively risky materials and energy sectors, as well as real estate and financials, which are of average risk and volatility. These four sectors currently sport above-average dividend yields, hence their increased exposure.

SDEM Corporate Website

SDEM’s focus on materials and energy serves to increase the fund’s commodity price exposure, significantly increasing portfolio risk and volatility. Expect the fund to moderately outperform when commodity prices increase, as has been the case the past month.

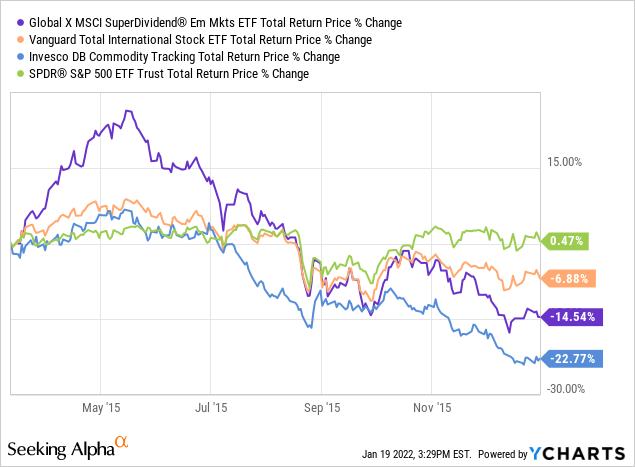

Expect the fund to moderately underperform when commodity prices decrease. Commodity prices have mostly trended downwards these past few years, so there are many time periods one could point to, but 2015, the last major commodity / oil price crunch seems like a particularly telling example.

As commodity prices are inherently quite volatile, SDEM’s increased exposure to these makes the fund a relatively risky investment.

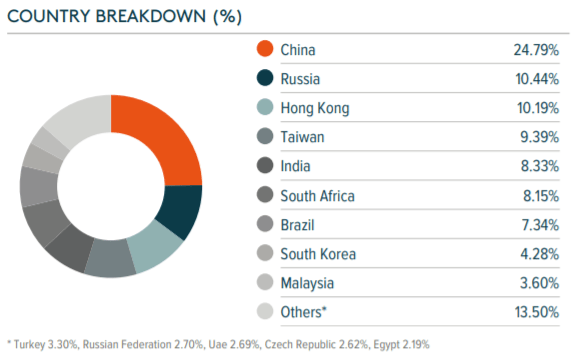

SDEM invests in securities from fourteen different countries, but is overweight Eastern Asia, especially China. There is comparatively little exposure to Latin America, Eastern Europe, or the Middle East. SDEM’s country diversification is reasonably good, but below-average for an emerging markets equity index ETF.

SDEM Corporate Website

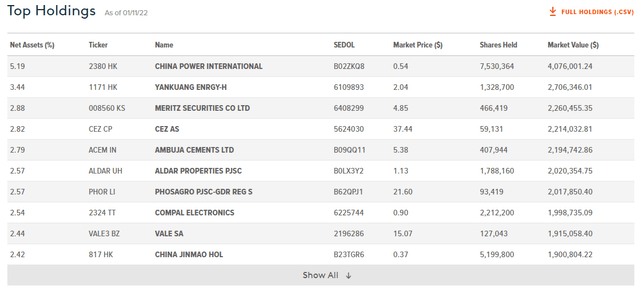

As SDEM is an equal-weighted fund, its largest holdings are not particularly informative or material. Still, for reference, the fund’s largest holdings are as follows.

SDEM Corporate Website

SDEM is a reasonably well-diversified fund, but definitely not as much as most comparable equity index funds. SDEM’s low diversification is due to its comparatively low number of holdings, 50, and due to focusing on high-yield stocks. As SDEM focuses on emerging market equities, a relatively small market niche, and as the fund is lacking some diversification, small position sizes are ideal. I would not go above 5%.

Although SDEM’s underlying index has some issues, it does result in a fund with a two clear advantages. Let’s have a look.

SDEM – Investment Thesis and Benefits

Strong, Growing 8.1% Dividend Yield

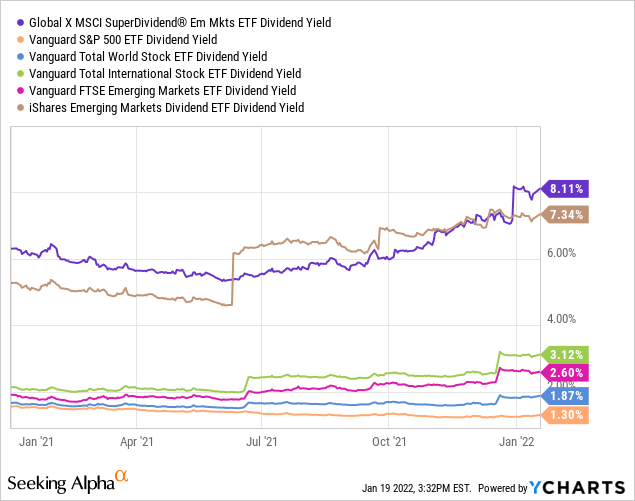

SDEM invests in the 50 highest-yielding emerging market equities, which, understandably, leads to a very high dividend yield for the fund. SDEM itself sports an 8.1% trailing twelve months yield, quite strong on an absolute basis, and much higher than that of most broad-based equity indexes and peers.

SDEM’s strong 8.1% dividend yield is a significant benefit for the fund and its shareholders, and the fund’s core investment thesis. This is an income vehicle which investors buy for the yield.

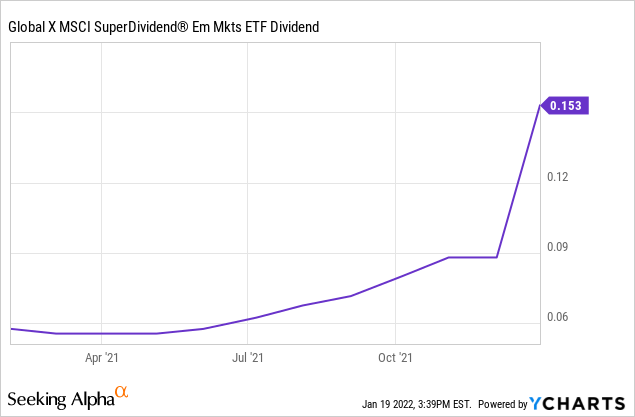

SDEM’s dividend has also seen some growth since inception, although the situation is somewhat complicated. SDEM paid a special, return of capital distribution in December 2021. Due to structural and regulatory issues, it is rare for ETFs to make these distributions. There are, however, exceptions, mostly centered on the distribution of excess returns in niche asset classes, including derivatives and foreign equities. As returns were particularly strong during 2021, some ETFs were forced into issuing special distributions at the end of the year, including SDEM. Disregard said special distribution, and we can say the following.

SDEM has seen positive dividend growth since inception, with the fund’s dividend growing at a 1.0% annualized rate since 2015. It is a relatively lackluster growth rate, but positive, and a small benefit for the fund and its shareholders. Importantly, growth has accelerated this year, with the fund’s dividend growing a massive 53% during 2021 alone, going from $0.0575 to $0.0880. As such, and assuming the fund’s current dividend will be sustained throughout 2022, SDEM currently sports a 9.4% forward dividend yield, quite strong. Excluding the fund’s special distribution, these dividends are fully-funded by underlying generation of income too, and so are (currently) sustainable. We’ll have to wait and see how the fund’s dividend evolves in 2022, but I do think a +8.0% forward dividend yield is a reasonable expectation, and a significant benefit for investors.

On a more negative note, the fund’s dividends are neither stable nor safe. Volatility and dividend cuts are both quite common, especially during downturns and recessions. SDEM’s dividend was cut by slightly over 30% in the aftermath of the coronavirus pandemic, although dividends have since recovered.

SDEM’s strong, growing 8.1% dividend yield is a significant benefit for the fund and its shareholders, but these are relatively risky dividends.

Cheap Valuation

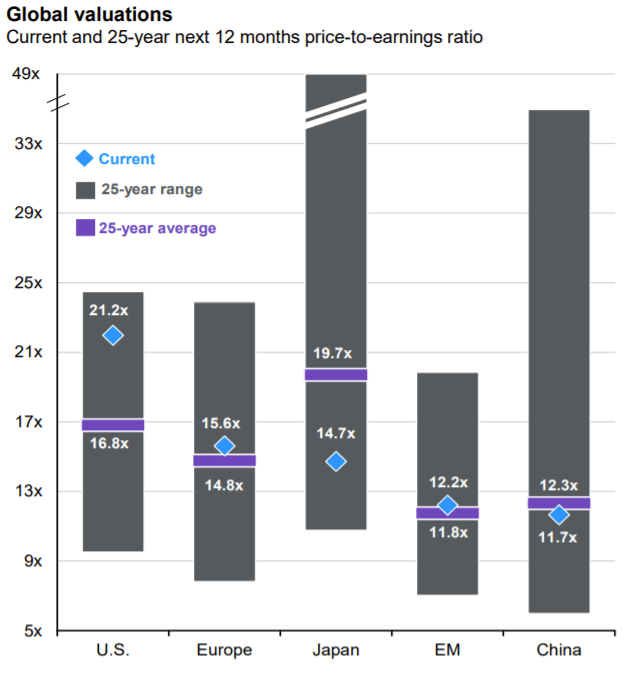

SDEM focuses on emerging market-equities, which offer some amount of relative value. As per J.P. Morgan, emerging market equities currently trade with significantly cheaper valuations relative to U.S. equities. U.S. equities are also trading at historically above-average valuations, while emerging market equities are trading at about average valuations.

J.P. Morgan Guide to the Markets

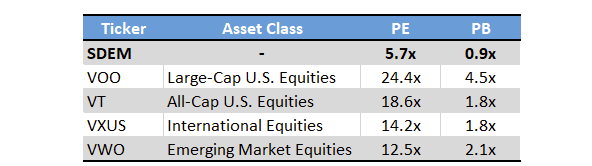

SDEM itself sports an incredibly cheap valuation, with a PE ratio of 5.7x, and a PB ratio of 0.9x. Both are incredibly low ratios, and much lower than those of most broad-based equity index funds, including those focused on emerging market equities.

Seeking Alpha – Chart by author

SDEM’s extraordinarily cheap valuation could lead to significant capital gains if valuations were to normalize, a significant benefit for the fund and its shareholders.

SDEM – Risks and Negatives

SDEM is a strong fund and investment opportunity, but it is also one with significant risks, negatives, and drawbacks. Two stand out: its risky holdings, and its long-term underperformance. Let’s have a look at these two issues.

Risky Holdings

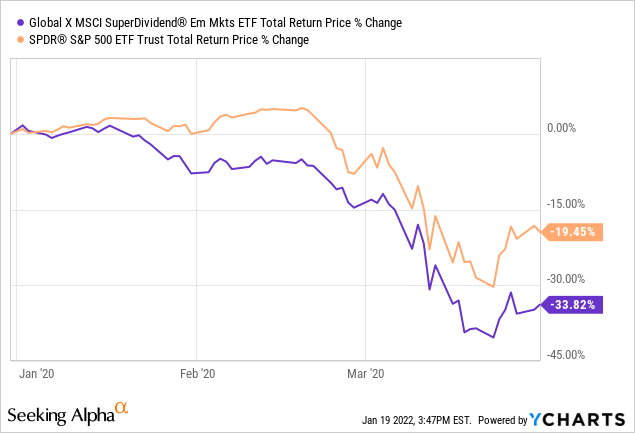

SDEM focuses on emerging market equities. These securities tend to be riskier than comparable U.S. equities due to foreign currency risk, corporate governance issues, and weak economic fundamentals. SDEM further focuses on high-yield stocks, which tend to be riskier than average: yields would not be high otherwise. The fund further focuses on the volatile materials and energy sector, which see wild price swings due to commodity price movements. These three characteristics or focuses result in an incredibly risky, volatile fund. Investors should expect wild swings in the fund’s share price, as well as significant losses during downturns and recessions. As an example, SDEM significantly underperformed during 1Q2020, the onset of the coronavirus pandemic.

Due to the above, SDEM is only appropriate for more aggressive income investors and retirees.

Long-term Underperformance

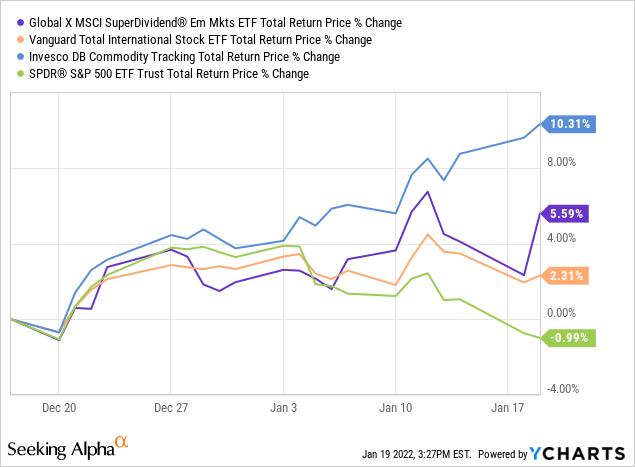

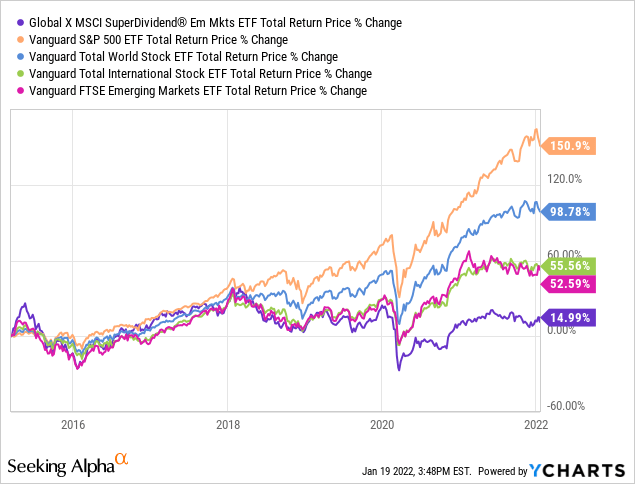

SDEM focuses on emerging market equities, high-yield stocks, and on the materials and energy industries. Each of these individual sectors has moderately underperformed for years. Their combination / intersection in SDEM has, understandably, underperformed since inception as well, and by quite a large margin.

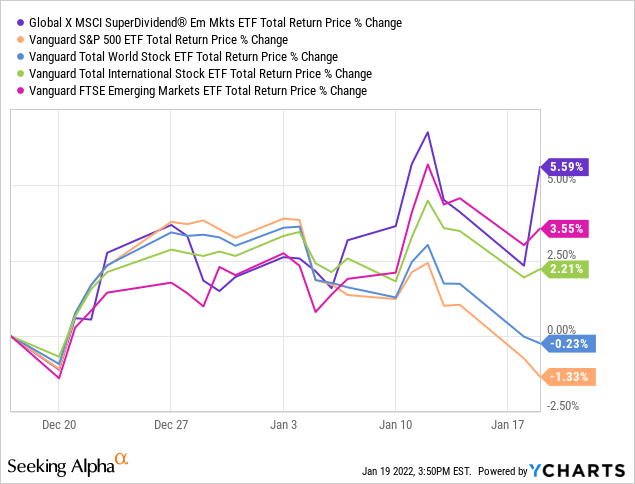

SDEM’s long-term underperformance is a significant negative for the fund and its investors, but might not necessarily have an impact moving forward. Higher commodity prices, shifting investor sentiment, and increased investor flows to cheaply valued sectors and industries have caused the fund to outperform this past month or so. I think these trends are likely to hold, and that the fund is likely to outperform moving forward, but this is obviously far from certain.

Conclusion

SDEM’s strong, growing 8.1% dividend yield and cheap valuation make the fund a buy. Due to the fund’s risky holdings and long-term underperformance, it is only appropriate for more aggressive income investors and retirees.

[ad_2]

Source link Google News