[ad_1]

Max Zolotukhin/iStock via Getty Images

I hardly ever issue a “strong buy” rating on a stock or ETF. So much is uncertain about the future price behavior of any risk asset that I try to avoid “pounding the table” on too many of my investment ideas.

However, for the reasons that I present below, I think that the Schwab Short-Term U.S. Treasury ETF (NYSEARCA:SCHO) deserves to be a rare exception. In my view, this short-to-intermediate term treasury fund has one of the most compelling risk-reward profiles of any instrument that I track.

What is SCHO?

Before diving any deeper into the investment thesis, it helps to take a quick look at the Schwab Short-Term U.S. Treasury ETF.

This is a very low-cost (4 bps annual fee), $8 billion portfolio of 90-plus fixed income instruments with maturities that currently range from one to nearly nine years. The ETF has an effective duration of 2 years, and the SEC yield is currently 2.3%. Monthly distributions to shareholders have added up to only 19 cents per share over the past 12 months, reflecting an environment of very low yields in 2020 and 2021.

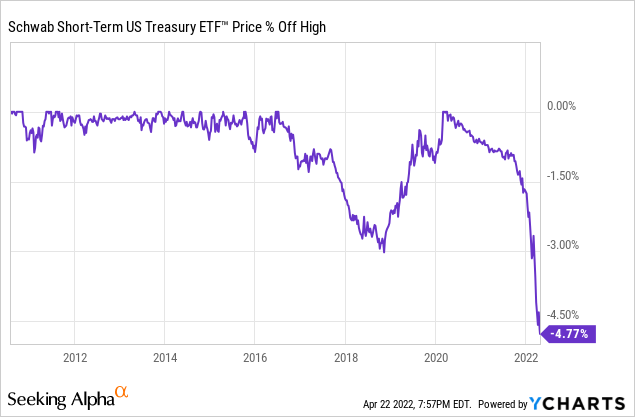

SCHO trades an average of about 2 million shares per day, according to Yahoo Finance, which makes it a liquid ETF. The fund is currently in its worst drawdown since the 2010 inception, as the chart below illustrates.

A quick word on predictions

Thankfully, I am not in the business of predicting the future. This is why my investment philosophy is to not rely often on my ability to forecast what happens next in the economy or the markets. Will inflation finally stabilize? Will the Fed raise interest rates more aggressively than expected? Will the economy grow as anticipated despite monetary tightening, lingering supply chain challenges, and geopolitical instability?

For what it’s worth, I believe that the expansionary cycle that was supported by lavish monetary and fiscal stimuli in 2020 and part of last year is coming close to an end. The cost of borrowing has been rising sharply. Consumer spending has slowed down. Confidence has declined in the US and approached record lows elsewhere around the world. Expectations for economic growth and global profits have been hovering around 2008 levels, as they did during the worst of the COVID-19 crisis in 2020.

All of the above, coupled with the fact that treasury prices are at the bottom of one of the worst bond selloffs in history, tells me that owning a fund like SCHO on the dip makes sense today. However, I don’t have to be right about my economic and market outlook to appreciate this treasury ETF.

Expect 2% to 3% annual return

Assuming no default risk, US treasuries of short maturity are about as safe an investment as one can find in the market. This is the case because the future cash flows are known, and the short time horizon means that the bonds are not heavily exposed to interest rate risk.

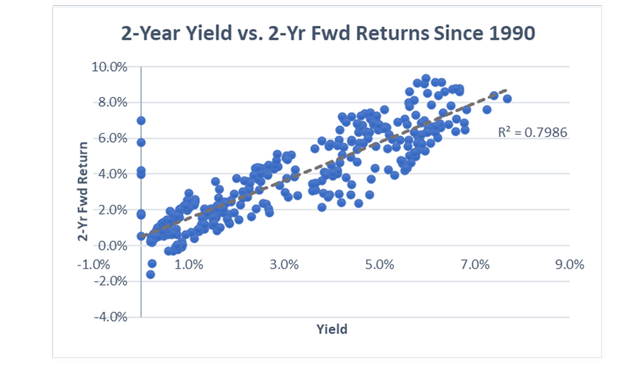

The scatter plot below shows how the two-year treasury yield has correlated very tightly (r-squared of +0.8) with the forward two-year return in a fund like SCHO — note: in order to go further back in time in my analysis to the early 1990s, I have used here the comparable Vanguard Short-Term Treasury Fund (VFISX) with effective duration of 1.9 years as a proxy. The observation below is intuitive, in line with the idea of guaranteed future cash flows, and not at all dependent on economic or market cycles.

Therefore, the expected annual return of a fund like SCHO between now and the first half of 2024 should be very close to the two-year treasury yield, which is 2.7% today.

2-Year Yield vs. 2-Yr Fwd Returns in SCHO Proxy Since 1990 (DM Martins Research)

Bearable risks

The recent environment of rapidly rising yields has caused treasury prices to fluctuate more wildly than usual. However, again because of the certainty of future cash flows and lower exposure to interest rate risk, I do not expect SCHO to pose significant risk of losses to a portfolio or to produce unreasonably high levels of volatility.

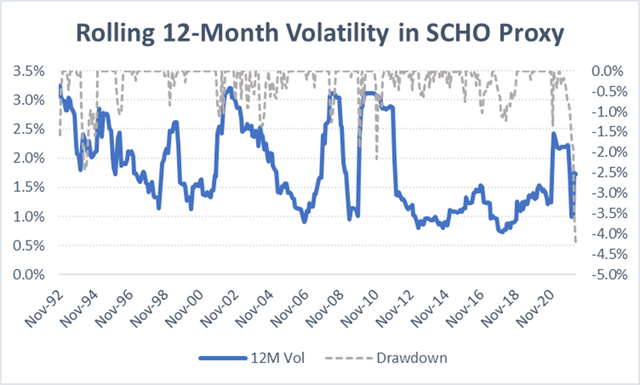

Once again, my convictions are supported by historical data. The chart below shows that the twelve-month rolling volatility in VFISX, my chosen proxy for SCHO, has generally hovered around 2% annualized (left axis). The risk metric has rarely exceeded 3%, even during periods of rising interest rates like 1994, 2005 and 2017-2018. The steepest drawdowns (right axis) have rarely breached 2%, with today’s historical record selloff probably best explained as a correction to the unusual spike in bond prices in early 2020.

Drawdowns and Rolling 12-Month Volatility in SCHO Proxy (DM Martins Research)

The bottom line is that, given today’s highly uncertain economic environment, I think that 2% to 3% annualized return over the next couple of years and volatility that is unlikely to breach 3% sounds like a great deal to me. I don’t think that I can find better risk-adjusted performance anywhere in the markets, be it in fixed income, equities, commodities or elsewhere.

Extra credit: how to improve returns

Some may understandably think that the low single-digit returns presented above may be a bit too modest for their goals and aspirations. One solution to boost expected returns without taking on disproportionate risks is to use leverage through deep-in-the-money call options.

Because volatility in a fund like SCHO is so low, one can probably find a contract with very high deltas without having to pay too much in premium. In this case, an investor can establish a leveraged position in SCHO by going long these derivatives.

Those who choose to go down this route should pay attention to liquidity and bid-ask spreads to ensure that the options approach is not too costly and easy to set up.

[ad_2]

Source links Google News