[ad_1]

Alistair Berg/DigitalVision via Getty Images

Investment Thesis

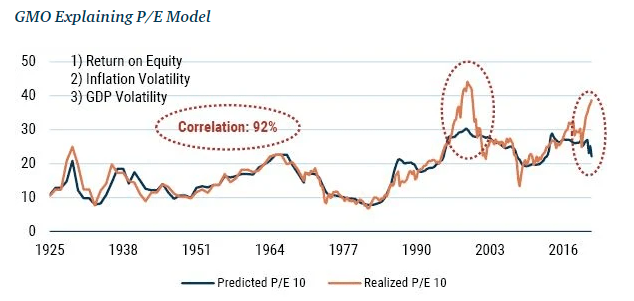

The S&P 500 is at an inflection point at the moment. The fear of tapering and rising interest rates puts tremendous pressure on equity valuations, which are stretched on a cyclically adjusted basis. Jeremy Grantham from GMO is one of those concerned by the current state of the market in the US. In a recent letter, he outlined the divergence between the realized P/E and GMO’s model P/E based on inflation data. In his own words:

GMO’s model to explain P/E is dominated by two factors: inflation, which multiples hate, and profit margins, which they love. Since the data starts in 1925, inflation surges had always hurt multiples badly…until now. Currently, inflation is 100% ignored…for now.

GMO

Therefore, the risk of holding a basket of US stocks seems high at the moment. According to Grantham, the best way to mitigate a pullback in US equities is to have a diversified portfolio across asset classes and issuers, with a focus on emerging and cheap developed markets:

GMO has a detailed set of recommendations available that I agree with. A summary might be to avoid U.S. equities and emphasize the value stocks of emerging markets and several cheaper developed countries, most notably Japan. Speaking personally, I also like some cash for flexibility, some resources for inflation protection, as well as a little gold and silver.

In this article, I will review the Schwab International Equity ETF, which provides exposure to a basked of fairly valued equities in developed markets, ex-US.

Strategy Details

The Schwab International Equity ETF tracks the total return of the FTSE Developed ex-US Index. This is a straightforward, low-cost fund offering potential tax efficacy and can serve as part of a diversified portfolio. It provides exposure to a basket of large and mid-capitalization companies in developed countries outside the United States.

If you want to learn more about the strategy, please click here.

Portfolio Composition

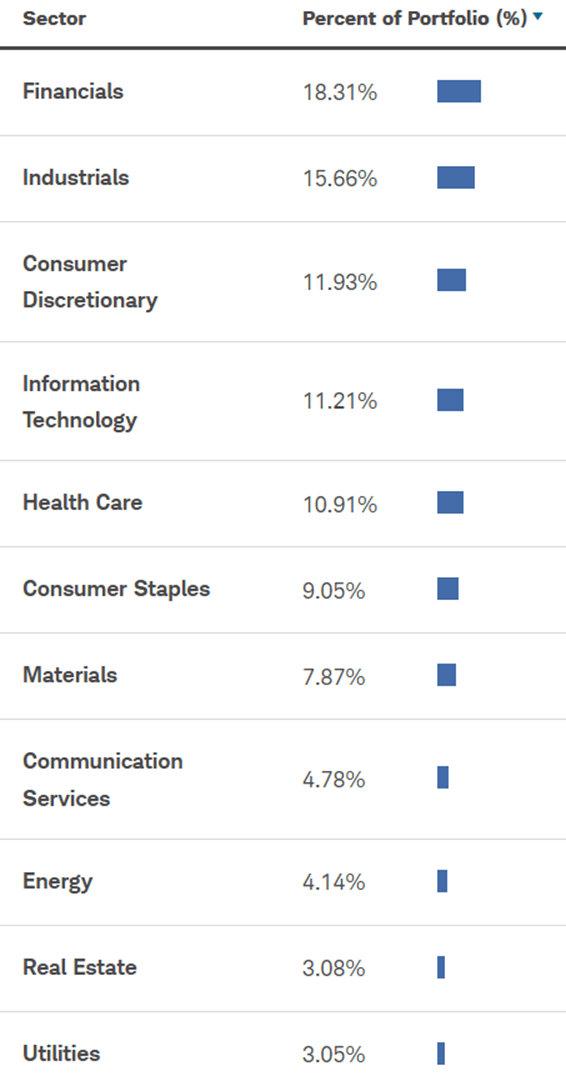

From the sector allocation chart below, we can see the index places a high weight on Financials (representing around 18% of the index) followed by Industrials (accounting for 15.7% of the index) and Consumer Discretionary (representing around 11.9% of the fund). The largest three sectors have a combined allocation of approximately 45.09%.

Schwab AM

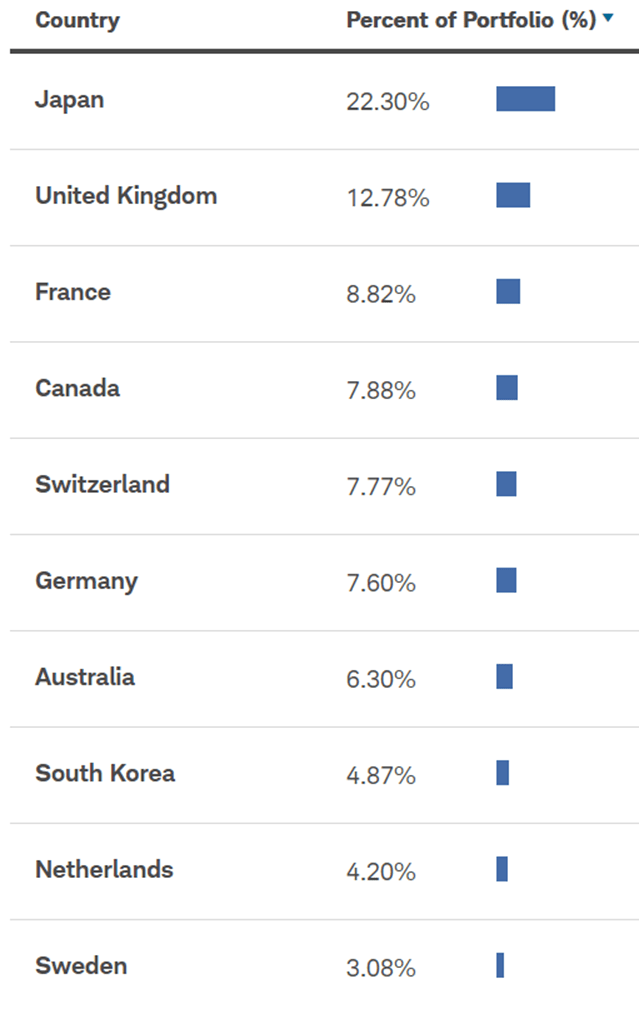

In terms of geographical allocation, the top ten countries represent approximately 82.5% of the portfolio. Japan accounts for 22.30% whereas other countries such as Sweden seem to be underrepresented given the low weight (only a 3.08% allocation to Sweden).

Schwab AM

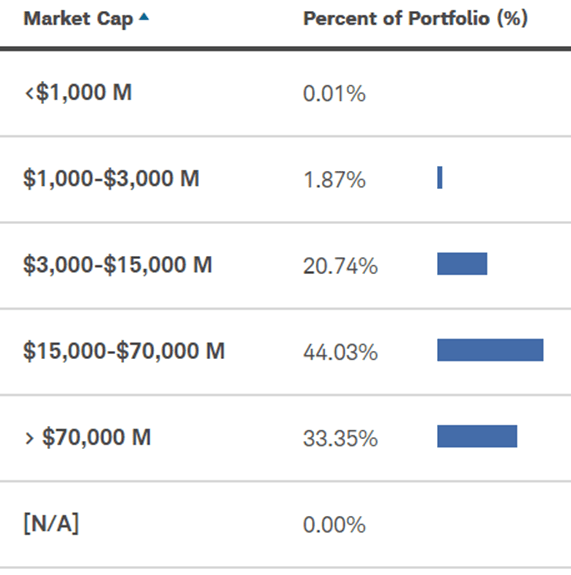

SCHF invests over 98% of the funds into mid and large-cap issuers. Moreover, it allocates less than 2% to small caps, which generally have a longer runway to compound. I think it is important to see how that fits your investment goals.

Schwab AM

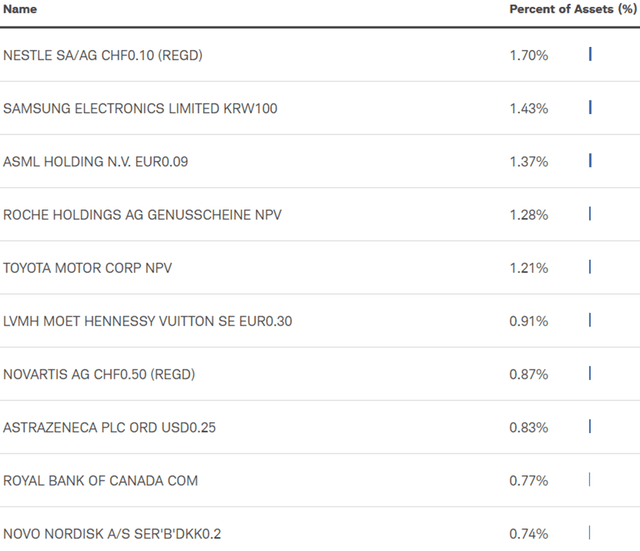

The fund is currently invested in 1,548 different stocks. The top ten holdings account for 11.11% of the portfolio, with no single stock weighting more than 1.70%. I like the fact that SCHF offers good diversification across issuers.

Schwab AM

Since we are dealing with equities, one important characteristic is the valuation of the portfolio. According to Schwab, the fund currently trades at an average price-to-book ratio of 1.78 and an average price-to-earnings ratio of 16.28. In addition to that, the portfolio has a return on equity of 11.31%, which is decent. SCHF is, therefore, cheaper than a plain vanilla S&P 500 ETF like the SPDR S&P 500 Trust ETF (NYSEARCA:SPY).

Is This ETF Right for Me?

SCHF has a distribution rate of 3.18% and provides a good level of income compared to SPY or a plain vanilla treasuries ETF. I have compared below the price performance of SCHF against the price performance of the iShares Core MSCI Total International Stock ETF (NYSEARCA:IXUS), the iShares MSCI ACWI ex-U.S. ETF (NYSEARCA:ACWX) and the SPY over 5 years to assess which one was a better investment. Although SCHF closely matched ACWX’s and IXUS’ performance over that period, it clearly failed to outperform SPY. SCHF provided mediocre price returns in the past 5 years. To put it into perspective, a $100 investment in SCHF five years ago would now be worth $132.55. This represents a CAGR of 5.8%.

Refinitiv Eikon

If we take a step back and look at the performance from a 10-year perspective in the below chart, it is worth noting that the situation didn’t change much. SPY came on top once again by a wide margin, whereas SCHF slightly outperformed IXUS and ACWX. Over 10 years, SCHF delivered ~40% stock price returns, which is an average performance in my opinion. I think it is important to see how that fits your investment goals and if you are comfortable with this level of expected returns going forward.

Refinitiv Eikon

Key Takeaways

SCHF offers exposure to a basket of equities from developed markets, excluding the US. As a result, I think that SCHF can be used to diversify efficiently some portion of the portfolio away from US stocks, which are now at an inflection point. I like the fact that the ETF is well-diversified, both across sectors and constituents. Moreover, SCHF offers a better value for money than a plain vanilla S&P 500 ETF like SPY, offering a lower valuation and a higher dividend yield.

[ad_2]

Source links Google News