[ad_1]

Bet_Noire/iStock via Getty Images

Author’s note: This article was released to CEF/ETF Income Laboratory members on February 28th, 2022.

The Schwab U.S. TIPS ETF (SCHP) is an index ETF investing in U.S. Treasury Inflation-Protected Securities, or TIPs. SCHP yields 4.8%, is an effective inflation hedge, and should see rising dividends and strong returns if inflation remains elevated. On the other hand, the fund should see lower dividends, capital losses, and lackluster returns once inflation normalizes. Although the fund is a reasonable investment opportunity, especially so for investors concerned about inflation, I believe that the magnitude and possibility of losses once inflation normalizes to be excessively high. As such, I would not be investing in the fund at the present time.

SCHP and TIPs – Overview

SCHP is an index ETF investing in U.S. treasury inflation-protected securities, or TIPs. The fund’s underlying index and holdings are representative of these securities, so let’s start our analysis by explaining what these securities are, and their performance.

Treasuries, including TIPs, are the safest assets in the world, backed by the full faith and credit of the U.S. governments. Treasuries offer investors ultra-safe, dependable, albeit low, interest rate payments and dividends.

TIPs have the added benefit that their dividends, capital, and returns, are protected against inflation.

TIPS are protected against inflation, as their face value and coupon rate payments are indexed to the Consumer Price Index, or CPI, an inflation index, for positive values of said index. In simple terms, TIPs returns are roughly equal to their interest rate plus inflation.

Let’s explain the above with a quick example.

Say you invest $1,000 in TIPS at a 1% yield, equivalent to an interest payment of $10 per year.

If inflation increases to 10%, so would the value of your investment and interest. Your investment would increase in value from $1,000 to $1,100, while your interest payment would increase from $10 to $11.

Total returns would be equal to $100 plus $11, effectively equivalent to inflation plus interest rate (10% + 1%). Returns are generally distributed to investors in the form of dividends, but higher rates of inflation would lead to greater gains and vice versa.

Deflation, on the other hand, has no effect on the value of your investment, interest, or shareholder returns/losses.

If inflation decreases to -10%, your investment would retain its $1,000 value, and your interest payment would remain at $10. This holds true for all rates of deflation.

SCHP and TIPs – Overview and Investment Thesis

SCHP is a relatively simple, broad-based index fund investing in TIPs. The fund provides investors with diversified exposure to said securities, and shares their same behavior, performance, benefits, and drawbacks. With few exceptions, what is true of TIPs is true of SCHP.

SCHP offers investors two key benefits: strong current yields and returns, and an effective inflation hedge. Expected returns are strong, and could significantly increase if inflation continues to increase, as has been the case for more than a year. Let’s have a look at these two points.

Strong Current Yields and Returns

SCHP’s returns are basically equivalent to inflation plus interest rate.

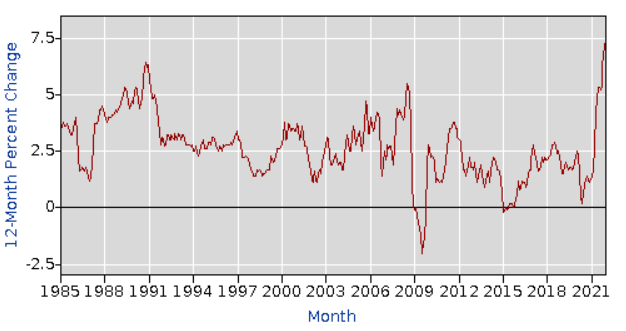

Inflation is currently quite high, with prices rising at a 7.9% annual rate as of February 2022. Inflation is at a multi-decades high, and sees no sign of abating. Inflation has, if anything, accelerated these past few months.

BLS

Inflation seems likely to persist, and could even accelerate, due to higher oil prices, consequence of the Russian invasion of Ukraine, and deteriorating supply chains and logistics. Higher energy prices increase input costs for most manufactured goods, while supply chain issues increase costs for most consumption goods, leading to a generalized increase in prices.

Elevated inflation should lead to strong returns and yields for SCHP, benefiting the fund and its investors.

On a more negative note, current TIPs interest rates are quite low, negative in fact. As per the U.S. Treasury, TIPs of all maturities currently sport negative interest rates. The 10Y TIPs, the segment benchmark, currently stands at -0.8%. SCHP’s holdings closely track the TIPs market, and so the fund’s underlying holdings almost certainly have an interest rate of about -0.8%.

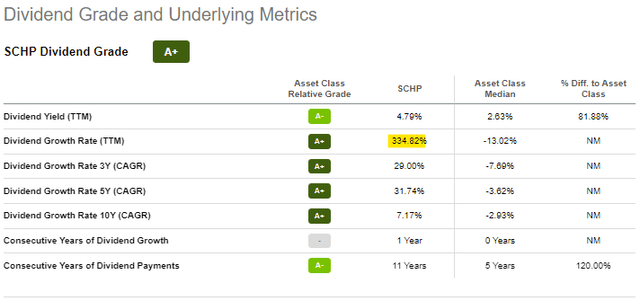

Combine prevailing TIPs interest rates with inflation, and it seems that SCHP’s returns should hover around 7.1% (7.9% – 0.8%) moving forward, assuming inflation remains at 7.9%. Returns should mostly consist of dividends. SCHP currently yields 4.8%, quite a bit less than expected. In my opinion, and taking into consideration current market conditions, this means that SCHP’s dividend should see strong growth in the coming months. This has been the case for the past year or so, as expected.

SeekingAlpha

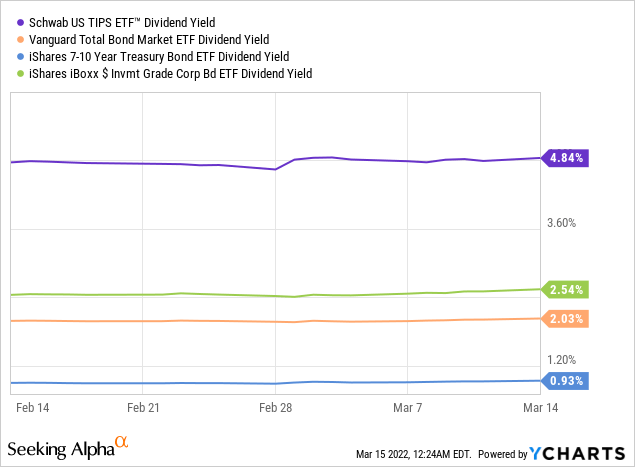

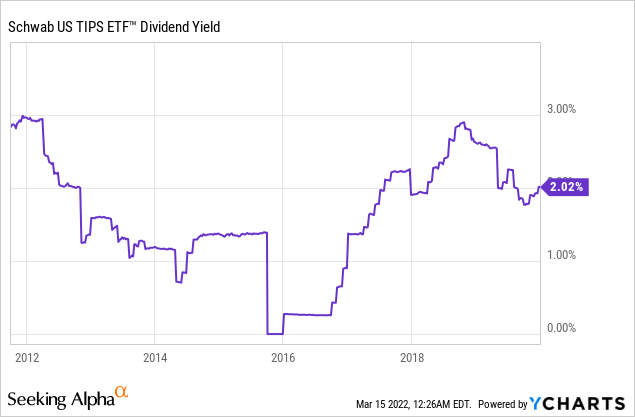

SCHP’s current yield is quite a bit higher than average. The fund yields about five times as much as normal treasuries, and more than twice as much as bonds in general. Strong yields are almost always a benefit for a fund and its shareholders, and SCHP is no exception.

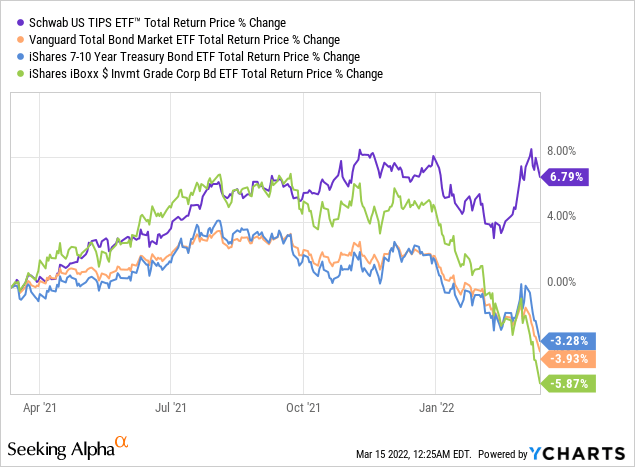

SCHP’s returns have also been quite a bit higher than those of its peers for the past year or so, and by quite a large margin.

SCHD has outperformed relative to its peers due to rapidly increasing inflation. Which brings me to my next point.

Effective Inflation Hedge

SCHP’s returns are strongly linked to inflation rates, and so the fund functions as an effective inflation hedge: returns increase when inflation is high and rises. Investors can invest in SCHP to protect their portfolios against inflation, a significant benefit. Said protection has value in and of itself, as a risk-reduction measure, and for the peace of mind it provides.

SCHP – Drawbacks

Significant Losses if Inflation Normalizes

SCHP’s returns are strongly linked to inflation rates. Although this has been a benefit in the current inflationary environment, it could turn into a negative if inflation were to normalize. Lower inflation would harm the fund and its shareholders in three different ways.

Lower inflation would significantly, and directly, reduce SCHP’s yield and returns. SCHP’s yield oscillated between 1.75% and 2.25% before the pandemic, not too dissimilar from the Fed’s long-term inflation target of 2.0%. SCHP’s yield should normalize to these levels if inflation were to normalize, which would mean a 60% dividend cut. Such a large reduction in the fund’s yield and expected returns would be a significant negative for the fund and its shareholders.

Lower inflation would also reduce demand for the fund’s underlying securities, ultimately leading to capital losses for the fund and its shareholders. Investor demand, and hence prices, for TIPs is currently quite high, as investors seek to protect their portfolios from skyrocketing inflation. Investor demand, and hence prices, would be significantly reduced if inflation were to normalize, resulting in capital losses for SCHP and its shareholders. There has not been a period of rapidly decreasing inflation since the fund’s inception, so we can’t analyze its actual performance during said economic environment. Still, I’m quite confident in my analysis.

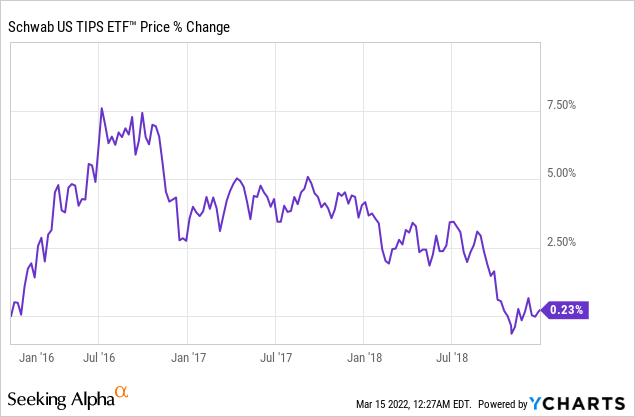

Finally, lower inflation would occur, in part, due to higher interest rates. These would reduce demand for TIPs further, leading to even lower prices and higher capital losses. SCHP’s current 4.8% yield is quite attractive relative to treasuries, bonds, savings accounts, and other similar investments, but that might not be the case after the Federal Reserve hikes rates to combat rising inflation. If investors sell TIPs to buy higher-yielding bonds after Fed hikes, TIPs prices should decrease, leading to capital losses for SCHP and its shareholders. SCHP did not suffer capital losses last time rates were hiked, between 2016 and 2019, although economic conditions were materially different last hiking cycle.

Lower inflation would be a significant negative for SCHP and its shareholders, and is the fund’s key risk and drawback. Although I don’t see any short-term catalyst for lower inflation, I do believe that inflation will almost certainly normalize in the coming years. The Federal Reserve does target a 2.0% annual inflation rate, and the Fed, under Volcker, did succeed in bringing down inflation last time it was this elevated. Once inflation normalizes, and I do think this will happen, sooner or later, SCHP should experience significant losses.

Conclusion

SCHP offers investors a comparatively strong 4.8% yield, and is an effective inflation hedge. On the other hand, the fund should underperform once inflation normalizes. In my opinion, SCHP’s risks and drawbacks outweigh its benefits. As such, I would not be investing in the fund at the present time.

[ad_2]

Source links Google News