[ad_1]

Main Thesis

The purpose of this article is to evaluate the Schwab U.S. Large-Cap Growth ETF (SCHG) as an investment option at its current market price. While growth has been a winning strategy (compared to value) for the majority of the time post-recession, Q4 of 2018 showed this trend can reverse, and quickly. Growth names, many of which trade at above-average P/E ratios, saw some of the steepest declines during the market rout. Despite this, had investors stayed the course, they would have made their losses back and then some. However, staying the course through market corrections can be a challenge, and stomaching such volatile swings may not be for everyone. With that in mind, it may be time to begin rotating out of the more expensive names or growth funds, as stocks have begun trading close to their all-time highs again.

SCHG, which is very tech-heavy, has a lot of exposure to cyclical sectors. In fact, about half of the fund’s exposure is to the Information Technology, Consumer Discretionary, and Industrials sectors, all of which are reliant on economic growth to drive gains. With economic forecasts for both the U.S. and the globe expecting slower growth this year than last year, investors may want to consider taking some profits. With the recent rally in the equity markets, now could be the opportune time some were waiting for.

Background

First, a little background on SCHG. The fund is managed by Charles Schwab, and its stated objective is “to track as closely as possible, before fees and expenses, the total return of the Dow Jones U.S. Large-Cap Growth Total Stock Market Index.” Currently, SCHG is trading at $78.80/share and yields .93% annually, based on its last four distributions. I reviewed SCHG in early November, and reiterated a bullish outlook. While the timing was not ideal, given the Q4 market rout we experienced, it has actually registered a positive return just under 4% since that time. While the fund was indeed hit hard, it has rebounded sharply, showing that even investors who bought in right before the market correction would have turned a profit.

That said, I am now looking to take some risk off the table, as economic headwinds remain and earnings growth, especially in the technology sector, may be peaking. I believe investors would be currently better served to rotate into more defensive names, as well as companies with cheaper valuations than the average growth stock, and I will explain why in detail below.

Growth Has Beaten Value, But Has Seen Sharp Drops

To start, I want to first emphasize that over the long term, growth has tended to be the winning strategy. As the U.S. and global economies grow, companies that are best-positioned to profit from changing consumer preferences have seen their earnings grow faster, along with the premiums investors are willing to pay to own those companies. Given that equity markets have more good years than bad, growth investing has offered investors better returns over time, with the previous decade a prime example of this, as illustrated in the graph below:

(Source: Bloomberg)

However, while growth investing has clearly been more profitable, that does not mean it is “better”, since investors are likely taking on more risk to achieve that spread. Furthermore, many companies that are considered “growth stocks” are aggressively trying to gain market share and expand their businesses. While this can be a positive, it can come at the expense of cash management and dividends, so investors looking for a reliable dividend income stream may not want this type of exposure, even if there is a potential for greater market returns. One would have to look no further than SCHG’s dividend yield, at under 1%, to see why this type of investing would not be the preferred choice of a “dividend seeker”.

With this in mind, I do feel that growth investing has an important place in most portfolios. While a lack of income could be concerning, this exposure gives investors a chance to profit from the fastest-growing, in-favor companies, which can boost the returns of a more defensive portfolio.

While SCHG is my preferred vehicle for such a strategy, I have rotated out of the fund for a couple of reasons. One, as the trend above indicates, growth has been beating value for some time, but the swings are sudden and sharp. SCHG was the hardest hit of my ETFs last year, and this was a painful reminder that valuations matter. With the market inching back towards previous highs, I would not be surprised to see value stage another comeback in the near future, and I want to get ahead of that potential to protect recent gains.

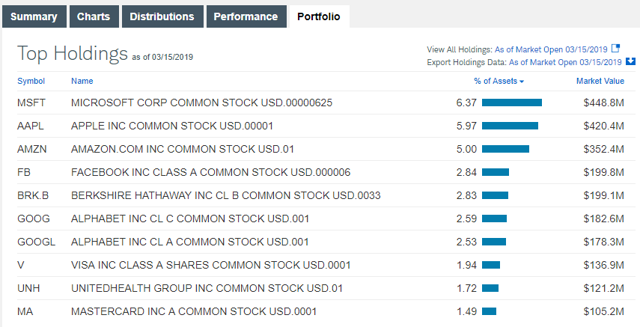

Top Holdings Could Be Repetitive

Looking deeper into SCHG specifically, a second reason why I exited the fund has to do with the stock exposure. The top holdings of the fund are largely weighted towards technology and include heavy-weights such as Microsoft (MSFT), Apple (AAPL), Amazon (AMZN), Facebook (FB), and Alphabet (Google) (GOOG, GOOGL), as illustrated in the chart below:

(Source: Charles Schwab)

As you can see, these five companies make up roughly 25% of SCHG’s portfolio, which is quite substantial. Now, I want to emphasize that these are all companies I want to own, and previously viewed their inclusion in SCHG as a huge positive. However, as I reviewed my portfolio heading in to the new year, I felt uncomfortable with the amount of exposure I had in just a few names. While it is not surprising that these firms make up a large percentage of SCHG, investors need to realize that they probably already own these firms in their broad market funds as well.

To illustrate my point, consider two of the largest and most popular broad market ETFs available today: the Vanguard Total Stock Market ETF (VTI) and the SPDR S&P 500 Trust ETF (SPY). Given how well the above companies have performed over time, they are all well-represented in broad market funds as a result. In fact, the percentages within SPY and VTI are actually fairly similar to that of SCHG, as the chart below displays:

| Company | VTI | SPY |

| MSFT | 3.10% | 3.75% |

| AAPL | 2.60% | 3.51% |

| AMZN | 2.40% | 2.94% |

| FB | 1.40% | 1.73% |

| GOOG + GOOGL | 2.40% | 3.06% |

| Total | 11.90% | 14.99% |

(Source: Vanguard and State Street)

As you can see, while SCHG has slightly more tech exposure and higher individual weightings for each of those stocks, VTI and SPY hold a fairly high amount. Similarly, VTI and SPY each have Technology sector exposure around 20% in total, which makes it to the top sector by weighting in each fund.

My takeaway here is not that the names are bad. On the contrary, they have been some of the best performers post-recession. My principal point is that I, and many investors, already have a significant amount of exposure to these names by just buying the broader market. Tech, and specifically the largest names in the space, are making up a disproportionate amount of index funds, to the point where there is not much of a distinction between the top holdings in a growth fund like SCHG and an index fund that tracks the S&P 500, like SPY. Essentially, while I like SCHG and its top holdings in isolation, buying the fund more than doubles my exposure to names that I already own quite a bit of already.

IMF Forecasts and Q4 Earnings Growth: Not Encouraging

Now, I want to shift gears and detail the reasons why I don’t want to be overexposed to these particular names in 2019. Namely, this has to do with growth concerns, both in the U.S. and abroad. While I am expecting market gains this year, and the U.S. markets have proved themselves resilient in even the worst of times, there are plenty of headwinds on the horizon. Slowing global growth, continuous Brexit concerns, and on-going trade dispute between U.S. and China are all weighing on market sentiment. But while news stories come and go, these particular headwinds have very real implications for growth. A slowdown of global growth will hurt trade and export demand, Brexit uncertainty will pressure European markets, and increased tariffs between the U.S. and China will pressure corporate profits, as the expense of the tariffs is unlikely to be passed wholly to the consumer.

Add up all these headwinds and the economic outlook for the next few years is not as rosy as the past few years have been. In fact, concerns over the topics I mentioned above (among others) led the International Monetary Fund (IMF) to lower its global growth projections in its World Economic Outlook Update. Specifically, the IMF expects the global economy to grow 3.5% and 3.6% in 2019 and 2020, respectively. While this is decent growth, the discouraging sign is these figures are down from 3.7% in the IMF’s October projections. Concurrently, while the growth forecast for the U.S. was unchanged from the previous publication, the rate of growth is expected to decline to 2.5% this year, before falling further to 1.8% growth in 2020.

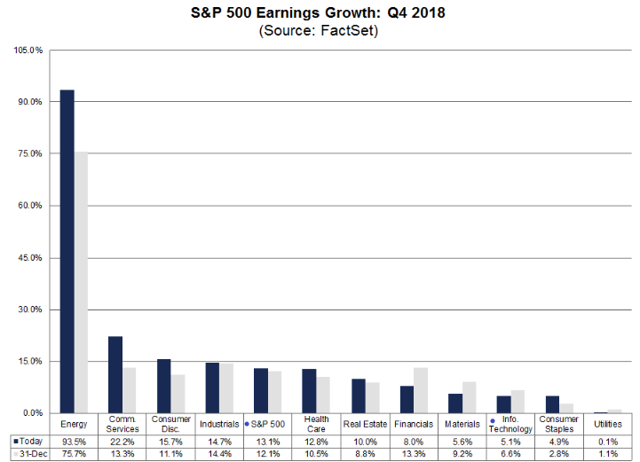

Furthermore, there are signs that slowing economies are starting to take their toll on some of the faster-growing sectors. For instance, the Q4 earnings out of the Information Technology space showed a slowdown in earnings growth. According to data compiled by FactSet, Information Technology saw some of the smallest growth of all sectors, which was well below the average of the S&P 500, as illustrated in the graph below:

(Source: FactSet)

While positive earnings growth is typically a good sign, we have to be especially critical of slowing growth in a sector that commands a premium price to own. For example, the S&P 500 has a current P/E just above 21. While this is not “cheap”, it compares to a current P/E of almost 26 for the Information Technology sector. Clearly, an investor is paying up for this exposure, and one would want to see the sector outperforming the S&P 500 in order to justify that premium. With growth concerns setting in and earnings growth within the tech space slowing, divesting some of this exposure seems like a prudent move to me.

Bottom line

SCHG is a fund I owned, and recommended, for some time. While it provided me with a decent level of return, it was not without volatility, and the recent market correction had me re-thinking this exposure. In deciding to sell the fund, I analyzed my entire portfolio and found that my broad market ETFs were more exposed to tech than I realized, to the point where SCHG had a lot of overlap with my more diversified funds. While I want the exposure of the big tech names, I want to make sure I am not overexposed, as these names can get hit hard and fast. In order to take some risk off the table, I decided to divest SCHG. Simply, it was a riskier fund, and also because it was duplicative to some of my other holdings.

With the strong performance of the Technology sector post-recession, the big names in that space are starting to have an oversized impact on the funds they are in. This had me, and likely many other investors, less diversified than we probably think we are. As a substitute, I have rotated back in to some higher-yielding dividend ETFs, which I have discussed in other articles. This has provided my portfolio with a more defensive positioning, as well as a more attractive future income stream through dividends. With the Fed reacting to muted economic growth by stalling further interest rate hikes, I continue to see value in dividend stocks, and have added to those positions at the expense of SCHG at this time.

Disclosure: I am/we are long AAPL, AMZN, VTI, SPY. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News