[ad_1]

Khanchit Khirisutchalual/iStock via Getty Images

Main Thesis & Background

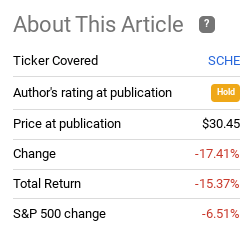

The purpose of this article is to evaluate the broader emerging markets equity market, with a specific look at the Schwab Emerging Markets ETF (NYSEARCA:SCHE). This is a passive ETF for emerging markets exposure, and one I have dabbled with in the past. I covered SCHE about a year ago, suggesting investors should keep it on their radar and add on weakness. I did just that myself, and the results have generally been poor:

Fund Performance (Seeking Alpha)

Eventually, I took the hit on SCHE and got out earlier this year. I simply wasn’t happy with the performance and I decided to take a tax-loss and redeploy the cash elsewhere. So far, I have been happy with this decision, but the year-to-date drop for the fund has been steep enough that it warrants another look:

YTD Performance (Seeking Alpha)

While a rebound may be forthcoming due to this weakness, after review, I am not so sure. I see too many headwinds to really get comfort around building up a position again. I will prefer to focus on developed markets, at home and abroad, and will choose to sit on the sidelines with respect to SCHE for now. I will explain why in more detail below.

Geo-Political Risks Dominate My Outlook

To start this review, I will focus on the number one reason why I want to be under-weight funds like SCHE at this time. Primarily this has to do with geo-political concerns, which shouldn’t be too surprising given the year we have had. However, most of the year has been focused on Russia and Ukraine, causing me to have a cautious outlook on continental Europe. I have feared a spillover from the military conflict, as well as the corresponding supply issues that have resulted from it.

With respect to EM, however, the risks have been amplified in the short-term and it has nothing to do with the military conflict that dominated the first half of the year. This is tensions between China and Taiwan. While this has been a reality for a long time, House Speaker Nancy Pelosi recently decided to visit the island over the past week, sparking renewed tensions and clouding the role the U.S. has in the region.

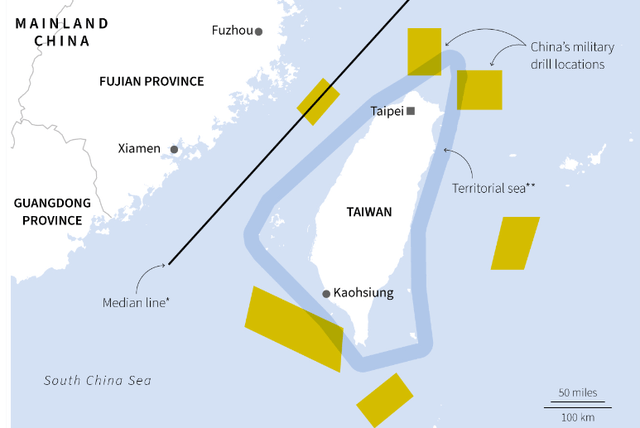

This has escalated my concerns in the immediate term. China viewed this as a “provocation” and responded by deploying planes and firing live missiles near Taiwan yesterday (Thursday) in the Taiwan Strait, as reported by Reuters.

What I am getting at here is this is bad for business in a number of ways. Heightened tensions create uncertainty, and that is precisely what investors and business leaders do not want. While there has always been a somewhat contentious political nature between the two countries, full out military conflict did not seem likely in 2022. While I still see that as an unlikely scenario, the odds have certainly been increasing. China could create a justification out of this latest visit, and also take advantage of the developed world’s current focus on Ukraine. With Taiwan’s proximity to mainland China, it wouldn’t be too far-fetched to suggest the Chinese military could encircle and isolate Taiwan very easily:

Map of Chinese Military Points Around Taiwan (United Nations)

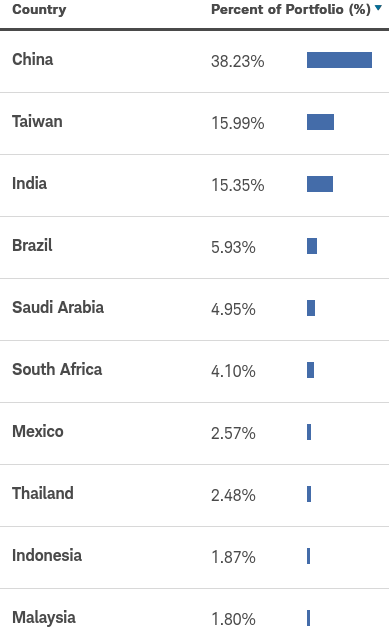

In fairness, readers may be thinking I am over-hyping this risk. That is a valid argument to make and I’m not trying to be alarmist. But when evaluating SCHE, we have to consider that over half of the fund’s assets are directly tied to either China or Taiwan:

SCHE’s Exposure (Charles Schwab)

The conclusion I draw here is this is not the right fund at this time. Is there opportunity if the headwinds blow over? Absolutely. But I don’t see that happening any time soon. At the very least, we can expect some ups and downs over the next few months. That tells me there is no real need to rush into a fund that is overweight China and Taiwan at the moment.

Inflation Is A Major Pain Point Across EM

My next topic also focuses on a global issue. This is inflation, which is something I probably don’t have to go into too much detail on for American readers. We are experiencing rapid, sustained inflation right now, and it is certainly presenting a challenge for equity markets and household expenses that is not letting up.

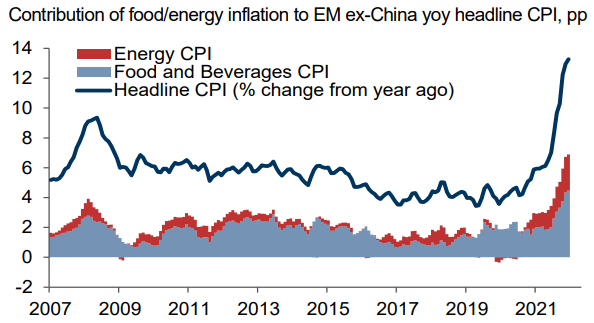

However, as difficult as it is for Americans to fill up their shopping carts and fuel tanks, we have to put this in perspective. The developed world and especially the U.S. are disproportionately well-off. While we complain about rising prices, a good percentage of households across the country simply cope with it. In less fortunate countries, inflation is even more difficult to handle. This is especially true in emerging markets, where consumers have less disposable income to begin with. Compounding the problem is that food and energy inflation is actually worse in EM, on average, presenting a big issue:

Inflation Stats (EM ex-China) (Goldman Sachs)

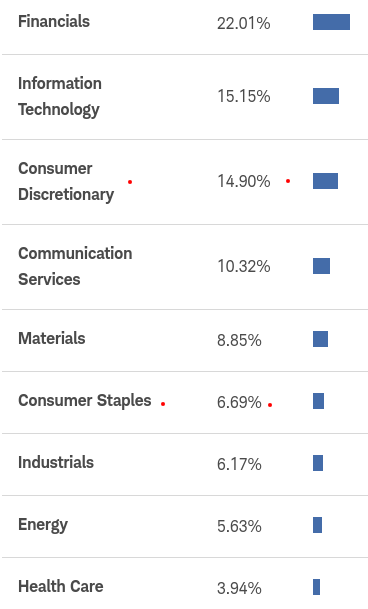

The problem here is two-fold. One, this has the potential to create a real humanitarian crisis across the globe – especially as food costs remain elevated. Two, from an investment perspective, more money spent on necessities means less available for discretionary spend. This again is relevant to SCHE because the fund has roughly 20% of its exposure in Consumer-oriented sectors:

SCHE Sector Breakdown (Charles Schwab)

This is an important signal for me to be cautious. The EM world is facing immense cost pressures, and that will mean consumer spending will be softer than normal. This supports a “hold” rating on SCHE in my view.

EM Is A Potential Contrarian Play

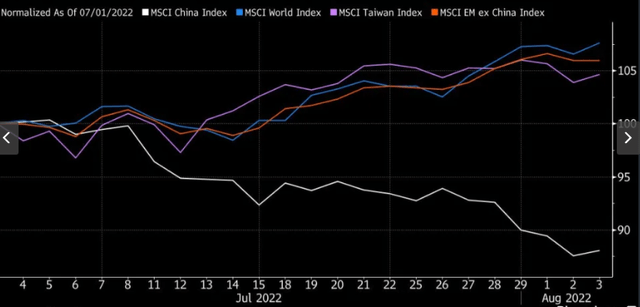

With geo-political risks and surging inflation, EM seems like a no-brainer avoid right now. But in fairness to the buy investment thesis, these problems have been known for a while now. Inflation is not new and, while Pelosi’s trip to Taiwan sparked renewed tension, this was telegraphed in advance and was not a shocking revelation. What I am getting at is that equities across the EM space have already begun to tumble. This means a good deal of bad news is baked in. With SCHE being over-weight China and Taiwan in particular, we should recognize that both the Chinese and Taiwanese indices have seen under-performance over the past few months. They have lagged both the World Index and also an ex-China Index, as shown below:

Various Index Performance (Yahoo Finance)

What this means to me is that contrarian alarm bells should be going off. This is an unloved corner of the world, and it has under-performed markedly. In particular, Chinese equities have fallen hard. This means the market is fearful, and we all know the line that follows. A contrarian buy argument could indeed be made here, if an investor believes the market has sold-off too far, too fast.

This is a key point and reason why I am not “bearish” on SCHE, opting instead for a “hold” rating. There is a lot of bad news yet, but equity prices reflect that in part. While I personally do not believe the worst is over yet, which supports my hesitation to buy, the drop in prices means a rebound could be in the cards. This is a very real possibility if tensions between China and Taiwan de-escalate, or if we see inflation moderate. I don’t see either occurring in the short-term, but others can disagree. If they do, SCHE is a reasonable option.

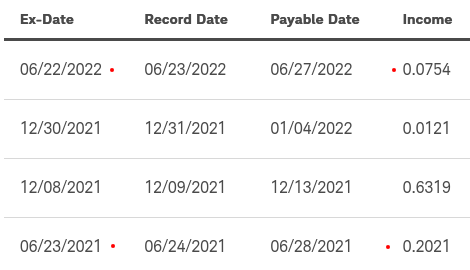

The Dividend Story Ain’t Pretty

My next focus area is on the fund’s dividend. I will point out first that investors do not necessarily buy EM for the income. This is a growth-oriented play, often one that comes with below-market valuations. But if a fund does pay a dividend, which SCHE does, then reflecting on it should be a consideration.

On this note, I am concerned with the underlying health of the fund’s holdings. The June 2022 distribution has come in dramatically lower than what we saw in June 2021, as shown below:

SCHE Distributions (Charles Schwab)

This decrease in payout could be a temporary blip or something more fundamental. I wouldn’t rule out positions in this fund on this metric alone. We could see a make-up for it in the December distribution. But given all the other headwinds I see facing SCHE, this doesn’t provide me with a lot of comfort. As a result, I cannot view the yield as a compelling enough reason to put my other concerns aside.

Rising Dollar Remains A Headwind For EM

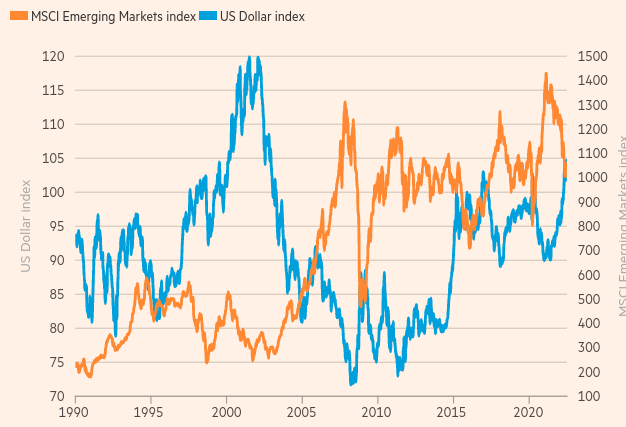

The last attribute I want to discuss is the rising U.S. dollar, as this has particularly negative implications for EM. This is broad generalization, and a relationship that is not always correlated. But readers should recognize that a strong U.S. dollar often makes life more difficult for EM countries. In fact, the rise of the dollar lately has been correlated almost precisely with declines in the EM index:

U.S. Dollar vs. EM Equities Index (IMF)

Readers may be asking now – why does this matter? To answer, let us consider a few key points to understand how a rising U.S. dollar can pressure the growth outlook for EM, and therefore cause outflows from EM equities.

Generally speaking, a stronger U.S. dollar can negatively impact global trade growth. The purchasing power of non-US currencies declines when the dollar strengthens. So, naturally, a rising dollar will make the rest of the world poorer, all other things being equal. This can result in less demand buying and less overall trade.

Another issue is a stronger dollar tends to hurt the creditworthiness of developing countries that have debt denominated in the US currency. Issuing dollar-denominated debt is a preferable strategy for many EM issuers, but the downside is that when the dollar rises it makes servicing that debt more expensive. This can put pressure on a nation’s budget and/or foreign currency reserves. Essentially, money that could have been routed elsewhere now goes to servicing debt. This is money that likely could have been used for economic growth initiatives.

Finally, we need to recognize that EM tend to be more reliant on foreign investment and foreign capital to grow and sustain their economies. When the dollar rises, fixed-income assets offered in the U.S. (or in dollars) suddenly offer higher yields. This can attract investment dollars away from EM opportunities and into U.S. bonds and debt (such as treasuries). Similar to the second point, this limits the tools at the disposal for EM governments to grow their economies.

At this point, readers should be contemplating that the worst is over here. Similar to the under-performance by Chinese and Taiwanese equity indices, buying into EM now after the dollar has appreciated could be a contrarian play. However, I would caution against that line of thinking for the time being. The reason being is that the dollar has risen largely because of Fed rate hikes, and all signs suggest the Fed is not done hiking yet.

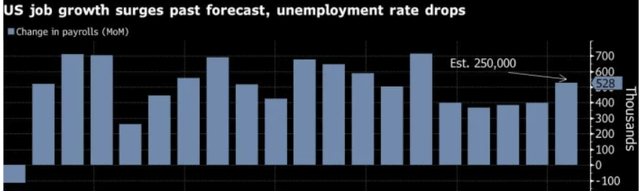

For support, consider that today (8/5), the U.S. saw impressive job growth and a decline in the unemployment rate:

U.S. Job Figures (Bloomberg)

While this is inherently good news, if also means the hope the Fed may slow down on rate hikes is probably just that – hope. With inflation remaining elevated, these job figures are going to force the Fed to keep on raising rates. It is safe to assume another .75 basis point hike is in the cards when the meets again in September (since that is the level it raised rates in both June and July).

My takeaway from all this is that the forces behind the rising dollar remain as relevant as ever. I would surmise the dollar will therefore keep rising, and that spells potential trouble for EM, and SCHE by extension.

Bottom Line

SCHE has had a rough 2022 so far. Rather than view it as a contrarian play, I believe investors should stay patient and look elsewhere for value. I still like U.S. large-caps that are flush with cash, the energy sector, and diversifying overseas through developed markets outside of the Euro-zone. I will keep SCHE on my radar and re-consider it if it sees another meaningful drop. But for now, caution reigns supreme, and I would encourage readers to be very selective on any potential buys at this time.

[ad_2]

Source links Google News