[ad_1]

da-kuk/E+ via Getty Images

The Schwab US Dividend Equity ETF (NYSEARCA:SCHD) is one of the more popular dividend ETFs. It has performed almost as well as the S&P 500 over the past five years, providing a total return of 107.14% compared to the S&P 500’s total return of 110.65%. This sets it apart from its competitors, which tend to lag when growth stocks excel. SCHD follows the Dow Jones US Dividend 100 index. Note that it is the only ETF that directly tracks that index, though there is an ETN, ETRACS 2x Leveraged U.S. Dividend Factor TR ETN (SCDL) that leverages that index.

The Dow Jones US Dividend 100 index rebalances quarterly and changes its holdings once a year, at the end of the second week in March. I have been tracking its holdings daily and comparing them to its holdings in February so I could become aware of how much of a change the annual reconstitution might be.

SCHD has been gradually adding and subtracting stocks so as to match up with the index it follows. The reconstitution may not be entirely complete, but SCHD’s holdings have changed enough, a week after the index changed, that we can see what stocks have been added and which ones deleted.

The 14 Stocks SCHD Added

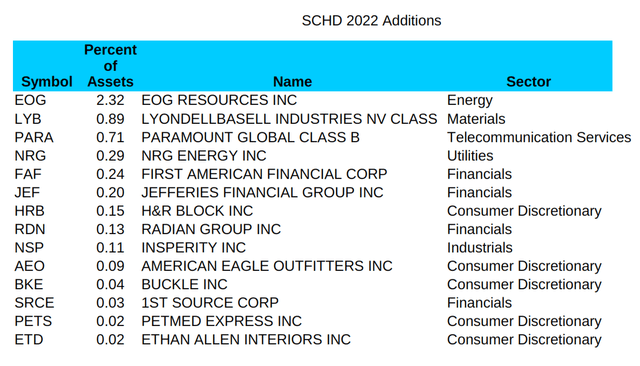

Below you see the list of the 14 stocks that have been added as of the opening of the Market on March 22, 2020, along with their individual weights in the ETF at that time and their sectors.

Fund data from Schwab Asset Management analysis and table by the author

EOG Resources is the Most Significant New Add

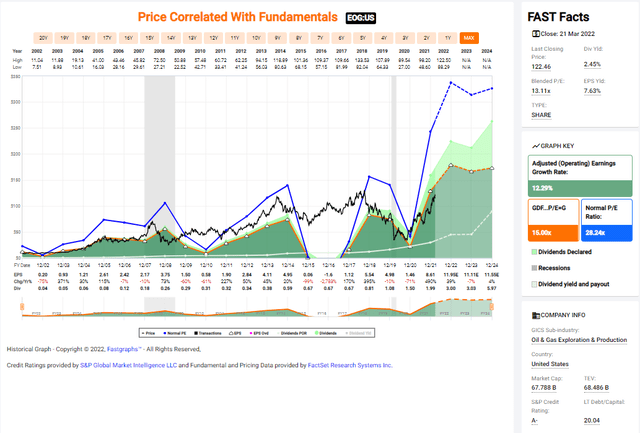

As you can see, the most significant addition to the ETF is EOG Resources (EOG), which is in the Energy sector. It appears to be the only new stock added to SCHD from that sector. This is what EOG’s Fastgraph looks like:

EOG Resources’ Price, Earnings, and Dividend History

fastgraphs.com

Obviously, a history of consistent earnings is not among the criteria used to select stocks for SCHD. Nor is a consistently rising dividend. EOG froze its dividend between 2015 and 2017. However, EOG Energy does have an excellent credit rating, rising earnings, and low debt. It also pays a higher dividend, as we will see, than does Emerson Electric (EMR), the far more consistent Dividend King that appears to have been eliminated to make room for EOG in SCHD.

Other Additions Are Mostly Consumer Discretionary and Financial Stocks Held in Very Small Amounts

The most new stocks added came from the Consumer Discretionary sector, but each of these stocks makes up only a very small proportion of SCHD’s total value. The largest new addition from that sector is tax processor H&R Block (HRB), which though listed in the Consumer Discretionary sector is functionally more like a Financial company. The rest of the Consumer Discretionary stocks just added are retailers: American Eagle Outfitters (AEO), Buckle (BKE), PetMed Express (PETS) and Ethan Allen Interiors (ETD). None of these stocks’ weights are greater than 0.10%. Together these retailers make up only 0.17% of the value of the entire ETF.

Fewer Financials were added, but together they make up more of the weight of the ETF. They are First American Financial (FAF), Jeffries Financial Group (JEF) , Radian Group (RDN) and 1st Source Corp (SRCE). Their combined weight is 0.60% of SCHD’s total value. This is a heavier weight than what was contributed by the retailers, but the Financials’ combined weight is still less than the weight of the single new Industrial added, LyondellBasell Industries (LYB), which makes up 0.89% of SCHD’s weight now.

Rounding out the new additions is a single Utility, NRG Energy (NRG) which makes up 0.29% of SCHD’s weight and a single Industrial stock, Insperity (NSP) which currently only contributes 0.11% of the value of the whole ETF.

The 13 Stocks SCHD Eliminated

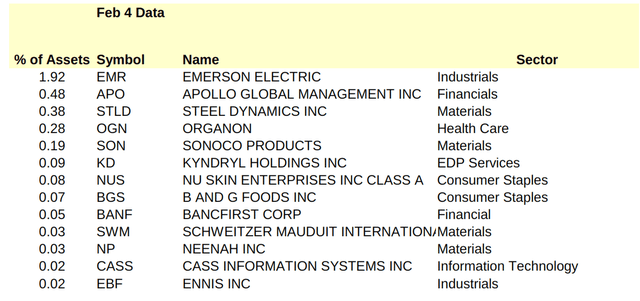

Below you see the list of the 13 stocks that were on the list Schwab Asset Management provides of SCHD’s holdings when I downloaded it back on February 4, 2022 but which are no longer in the listing I downloaded on the morning of March 22, 2022. I have also included information about what their individuals weights were in SCHD back on February 4.

Stocks Deleted from SCHD as of March 22, 2022

Data from Schwab Asset Management table by the author

Of these eliminated stocks, the most important is Emerson Electric. This company is both a Dividend Aristocrat and a Dividend King, which means it has had 50 straight years of consecutive dividend increases. It made up a significant part of SCHD’s value back in February. So its being dropped now suggests that something about that stock did not make it rank high enough to be included after being processed through the very complicated algorithm used to pick stocks for SCHD.

If you are interested in learning exactly how SCHD picks stocks, please refer to the S&P Global Methodology document. You can find the entire process there, which is too lengthy to be reproduced here, but is worth looking at if you are invested in SCHD or thinking of buying into it.

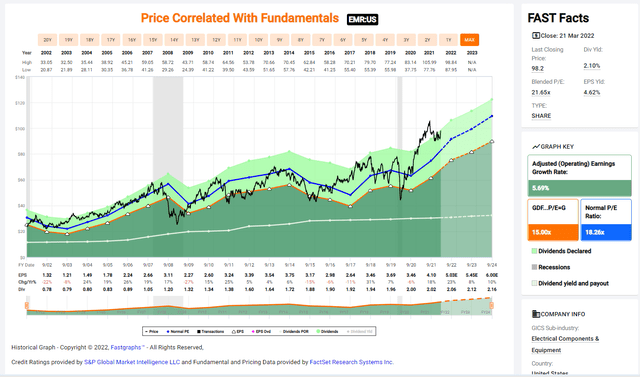

Emerson Electric’s Fastgraph suggests it might be only slightly overvalued right now based on its usual P/E ratio. But that P/E ratio has always been far higher than its modestly growing earnings would support. Over the past 20 years that annual earnings growth rate has only averaged out to 5.69%. However, analysts are predicting a double digit growth rate for EMR going forward. This suggests that there is nothing wrong with Emerson Electric. Investors in that stock have no reason to worry even if it has been dropped from SCHD.

Emerson Electric Price, Earnings, and Dividend History

fastgraphs.com

Some Other Eliminated Stocks Have Low or No Dividends or Worsening Credit

Apollo Global Management (APO) cut its dividend last year, which explains its elimination. I can find no reason for the elimination of Steel Dynamics (STLD) save that its price has shot up dramatically this year, significantly reducing its dividend yield.

Organon (OGN) was spun off from Merck and Kyndryl (KD) was spun off from IBM last year. Both were dropped. OGN pays a 3.22% dividend but has no track record. Kyndryl does not pay a dividend, so it makes sense that it no longer has a place in SCHD.

Sonoco Products (SON) pays a good dividend and is expected to grow its earnings by over 30% next year and to raise its dividend. The only negative I can see is that Standard & Poors downgraded its credit rating in 2020.

The rest of the stocks eliminated together made up a very small part of the weight of SCHD. Together their weight was just 0.30% of SCHD’s total value. They probably dropped off as a result of being very marginal and have been replaced by the equally marginal retail stocks that possibly have better dividend yields than the dropped stocks do.

How SCHD’s Top 10 Has Changed

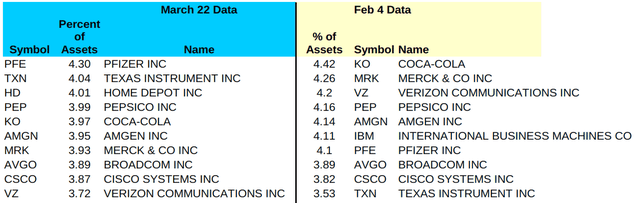

Below you can see how the Top 10 stocks in SCHD as of market open on March 22, 2022 compared with the Top 10 stocks in SCHD back in February.

SCHD’s Top 10 Stocks Now and Before Reconstitution and Rebalancing

Schwab Asset Management SCHD holdings listing 3/22/2022 and 2/04/2022

Currently, these top 10 stocks make up a whopping 39.68% of the total value of SCHD.

As you can see the rebalancing is not quite complete, as the Dow Jones US Dividend 100 Index’s methodology document states on Page 19:

No single stock can represent more than 4.0% of the index and no single Global Industry Classification Standard (GICS®) sector can represent more than 25% of the index, as measured at the time of index construction, annual rebalancing, and quarterly updates.

But as you can also see, most of the other stocks that previously made up more than 4% of the index’s value have had their positions trimmed. Amgen (AMGN), Merck (MRK), Broadcom (AVGO), and Coca Cola (KO) all were held in amounts greater than 4% at market open on March 21, 2022 but are now trimmed as of March 22.

Bottom Line: No Really Significant Changes Have Been Made in SCHD’s Holdings

You can expect to see a bit more rebalancing to bring the amounts of Pfizer (PFE), Home Depot (HD), and Texas Instruments (TXN) held in SCHD below 4%. This will probably be balanced by buying more shares of the new stocks being added to SCHD. If so that their weights will rise a bit more. ETFs buy and sell carefully when rebalancing or reconstituting so as not to have too heavy an impact on the market.

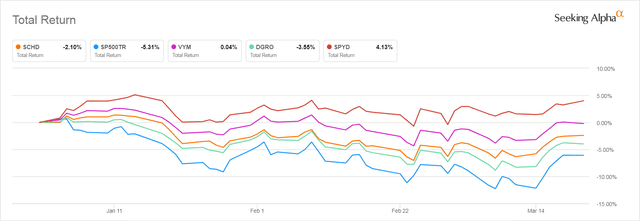

Since SCHD follows a market cap weighted index, the tops stocks in this ETF are likely to remain the top 10 stocks. Those Top 10 are likely to continue to account for most of SCHD’s performance, which should therefore not be all that different from what it has been over the past few months during which it has seen its total return drop by 2.10% which is better performance than that of the S&P 500 and the iShares Core Dividend Growth ETF (DGRO) but worse performance than the Vanguard High Dividend Yield ETF (VYM) and the SPDR Portfolio S&P 100 Dividend ETF (SPYG) all of which show gains YTD.

SCHD Return YTD Compared to Other Dividend ETFs and the S&P 500

Seeking Alpha

[ad_2]

Source links Google News