[ad_1]

undefined undefined/iStock via Getty Images

Investment thesis: the SCHB is a good SPY substitute. It’s comprised of similar companies but has a higher yield.

Introduction: ETFs now form the backbone of most portfolios. For example, a standard portfolio is composed some ratio of SPY (for the S&P 500) and TLT (for the long-end of the treasury market). In addition, due to low cost and high liquidity, an increasing number of investors and managers are now favoring ETFs that track broad averages over large mutual funds. Hence, an analysis of a large index-tracking ETF such as the Schwab U.S. Dividend Equity ETF (SCHD) is warranted on Seeking Alpha as this is now a standard investment tool used by many investors.

Before jumping further into an analysis of the ETF, let’s first look at the macroeconomic backdrop to ensure that the economy is growing so that an equity investment is appropriate. This is my standard methodology when analyzing an ETF like the SCHD.

I’ll be using the long-leading, leading, and coincidental indicator methodology developed by Arthur Burns and Geoffrey Moore of the Federal Reserve.

Long-Leading

One of the primary goals of the long-leading indicators is to locate financial stress, which is usually a precursor to economic problems.

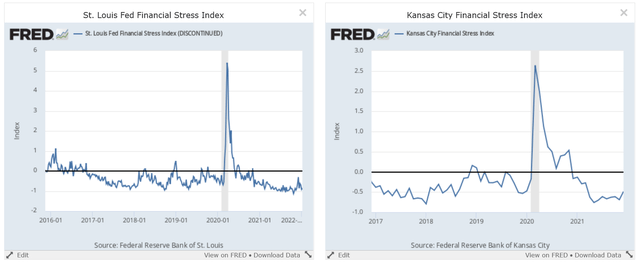

St. Louis and Kansas City Financial Stress Indexes FRED

Both the St. Louis (left) and Kansas City (right) financial stress indexes are low.

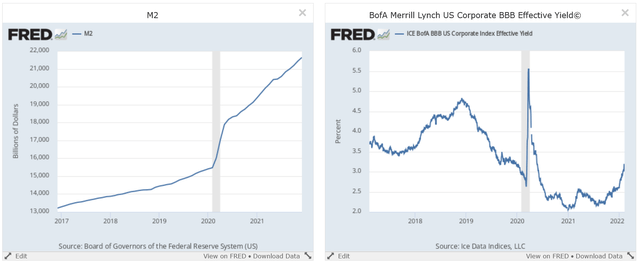

M2 and BBB yield FRED

There is ample liquidity as seen in the rising M2 figure (left). However, BBB yields have ticked higher this year in sympathy with the broader bond market.

The corporate earnings picture is strong (emphasis added):

The picture emerging from the Q4 earnings season is one of continued strength and momentum. Despite the well-known headwinds of cost pressures and logistical bottlenecks, an above-average proportion of companies have been able to beat estimates.

In fact, the proportion of companies beating consensus revenue estimates is actually tracking above what we had seen in the preceding earnings season from this same group of companies, with the earnings beats nearly the same.

Leading Indicators

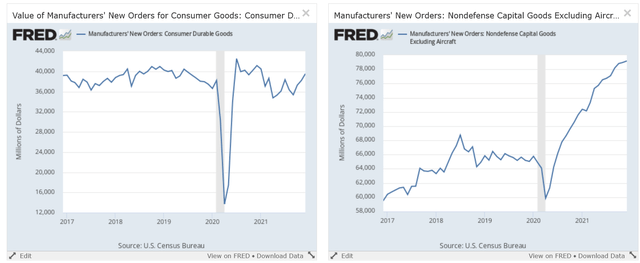

New orders of consumer durables (left) and capital goods (right) FRED

Consumer durable goods orders (left) are at strong levels while new orders for non-defense capital goods (right) are at their highest level in five years.

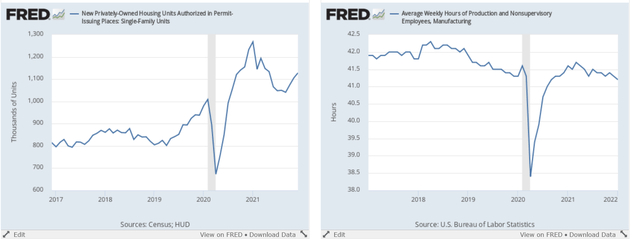

1-unit building permits and average weekly hours FRED

1-unit building permits are once again rising (left). Average weekly hours of production workers are trending modestly lower, however.

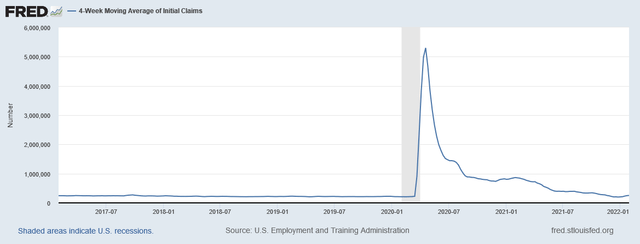

4-week moving average of initial unemployment claims FRED

The 4-week moving average of initial unemployment claims has declined substantially.

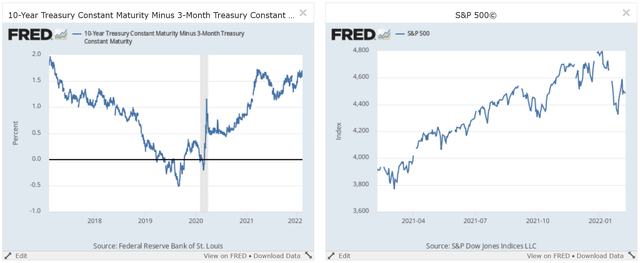

Yield spread and S&P 500 FRED

The yield spread is positive (left) while the S&P 500 is still in a rally.

Coincident Indicators

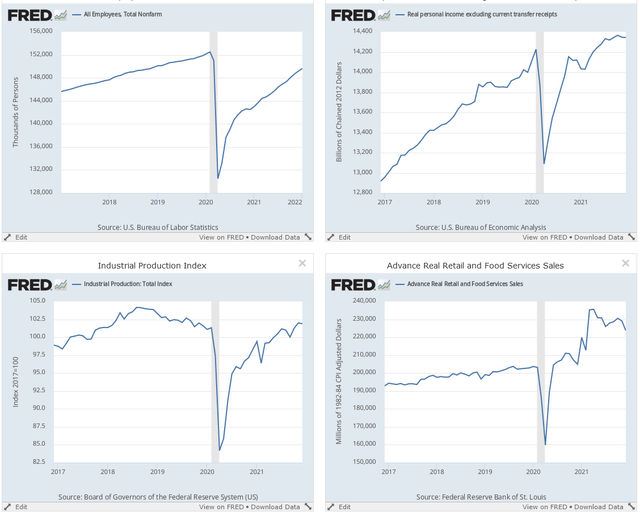

Payrolls, income, industrial production, and retail sales FRED

Total payrolls (upper left) are still rising. Income (upper right) recently peaked but ticked lower in the latest report. Industrial production (lower left) is still rising. Retail sales (lower right) peaked at a very high rate last year and has been trending lower since. However, the overall level is still very high.

Economic conclusion: the overall picture is still very strong. However, there are a few areas of weakness — BBB yields, the S&P 500, the softening income picture, and retail sales. Combined with the recent hawkish Fed tone, it’s now an appropriate time to shift into larger, more established companies.

This is exactly what I argued earlier this week (emphasis added):

What should investors do?

1.) If you were in small caps and haven’t taken profits, start doing so. The index has dropped more than 20% from November highs (although it has bounced back recently), meaning it’s in a bear market.

2.) Think a lot about major tech positions. The QQQ is also taking some hits. As of this writing, it’s below the 200-day EMA with the shorter averages about to cross over in a bearish move.

3.) Shift into higher dividend stocks and/or ETFs. These companies will have lower betas and the dividends will help to stabilize the stocks in a downturn.

The SCHD fits nicely into this strategy:

SCHD is a market-cap-weighted fund whose selection universe only includes firms with a 10-year history of paying dividends. Within that universe, SCHD uses fundamental screens (cash-flow to debt ratio, ROE, dividend yield, and dividend growth rate) to build its portfolio. The objective is to focus on quality companies with sustainable dividends. As such, this approach gives the fund a modest large cap tilt and excludes REITs entirely. Individual securities are capped at 4% and sectors capped at 25% of the portfolio. Its overall composition is reviewed annually, while the portfolio is rebalanced quarterly.

The dividend focus gives the ETF a current yield of 2.84%, which compares favorably to the SPY’s 1.3% yield. And the SCHD’s overall performance tracks favorably with the SPY.

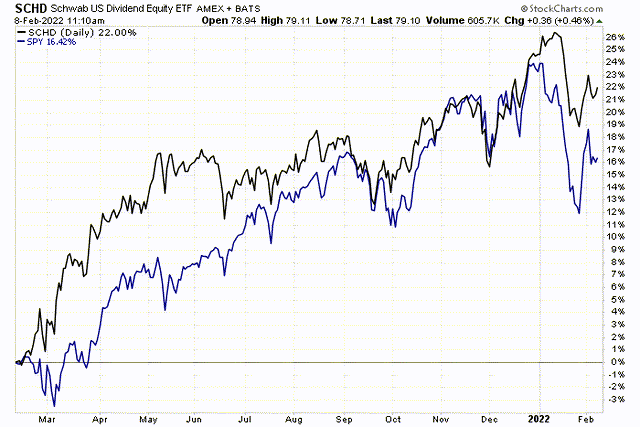

SPY and SCHD 1-year comparison (Stockcharts)

For the last year, the SCHD’s performance has tracked that of SPY. But in the last few months, the SCHD has started to outperform the SPY most likely due to its higher yield.

The SCHD is a good SPY substitute. It has similar overall performance, has the same style of companies (mature, more stable), which should perform better in a rising rate environment. And the ETF has a higher yield than the SPY.

[ad_2]

Source links Google News