[ad_1]

imagedepotpro/E+ via Getty Images

Today, we will cover two popular funds from the Global X family. Both funds are rather similar in structure and scope and only differ in terms of which index they use their strategy on.

The Funds

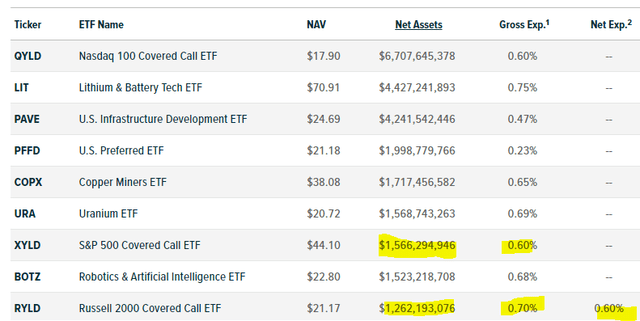

Global X S&P 500 Covered Call ETF (NYSEARCA:XYLD) and Global X Russell 2000 Covered Call ETF (BATS:RYLD) are similar in size and both identical fees. We would note here that RYLD does have a higher gross expense ratio but it has a waiver in place till March 2023. That reduces the net expense ratio back down to that of XYLD.

Global X

XYLD has been around for almost nine years (Inception June 2013). RYLD on the other hand has a more recent conception (April 2019). We will be hence relying a little bit on XYLD to get a glimpse of how the longer term performance will be for RYLD.

Strategy

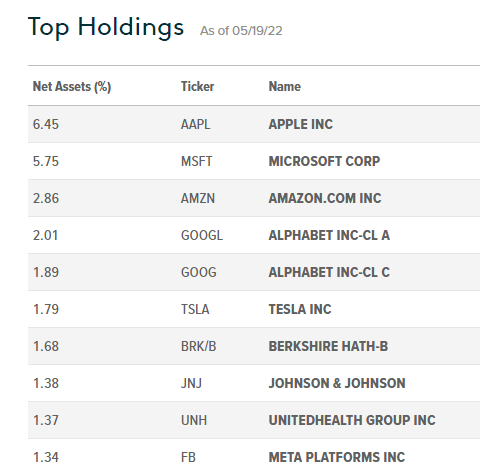

The two funds follow a covered call or “buy-write” strategy, in which the funds buys exposure to the stocks in the S&P 500 and Russell 2000 Indices and “writes” or “sells” corresponding call options on the same index. XYLD’s holdings look identical to that of SPDR S&P 500 Trust ETF (SPY), with familiar names of Apple Inc. and Microsoft (MSFT) starting things off.

XYLD Holdings (Global X)

The Russell 2000 Index is a small-cap stock market index that makes up the smallest 2,000 stocks in the Russell 3000 Index. Interestingly, here RYLD’s primary holding is another ETF, Vanguard (VTWO).

RYLD Holdings (Global X)

Why would RYLD not replicate holdings by themselves? A key reason may be efficiency of creating and redeeming units. It is easier to sell and buy small amounts of VTWO on a daily basis when trying to meet fund flows. The split though, between stocks and the ETF is still unusual. One would assume that all dollars could be dedicated to the ETF or even Russell 2000 Futures perhaps, could offer an alternative.

Performance

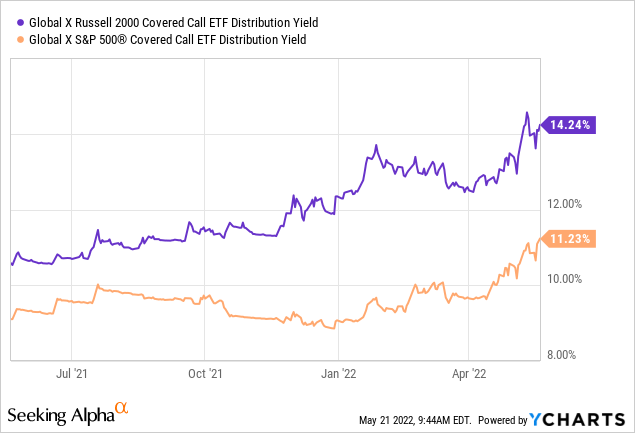

The main attraction for these funds has been the extremely high distribution payouts.

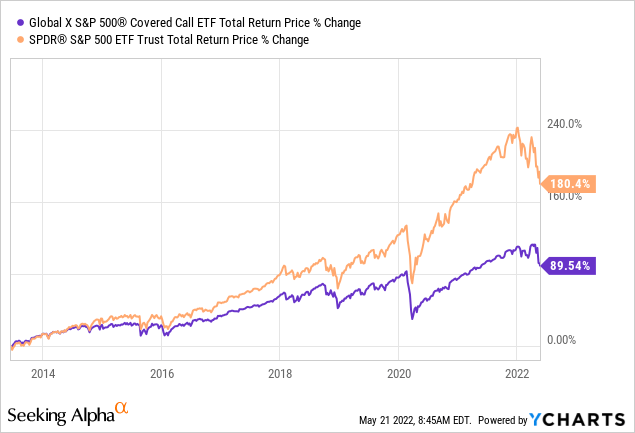

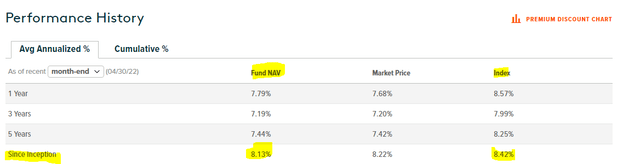

As with all other covered call funds we have seen, total return (which includes that large payout) has lagged rather notably for XYLD.

This is of course a characteristic of these funds which squander upside in lieu of regular income. The fund has done quite nicely relative to its benchmark index though. The CBOE S&P 500 Buy-Write Index delivered 8.42% total returns since inception and XYLD was right on its heels.

Global X

This is a superb feat when you consider that XYLD should lag by 0.6% annually at least based on fees. Additionally you would expect tracking error in conditions like March 2020 or even in the last 3 months. So, XYLD has certainly done its job well.

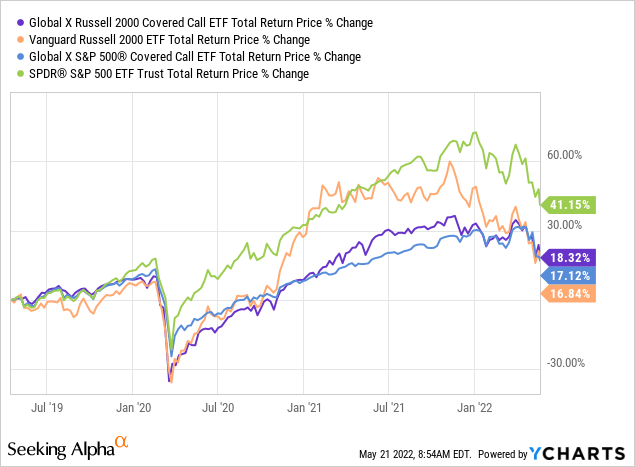

Moving on to RYLD, the fund has tracked its non-option counterpart VTWO rather closely and now is running ahead of it by a small percentage. We have also thrown in XYLD and SPY for the same timeframes, so you can see what those look like.

Outlook

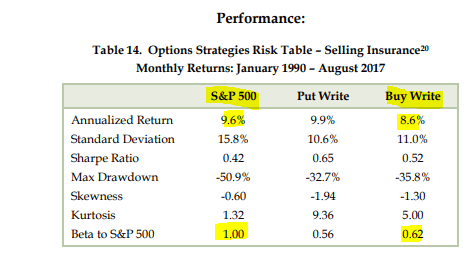

Selling volatility is a brilliant concept. We like it as a strategy. In general, we have been critical of funds that purchase volatility, as those are destined to do poorly over the years. We actually identified that volatility purchase as the key negative factor of Amplify BlackSwan Growth & Treasury Core ETF (SWAN). CBOE data over a 27-year time frame validates that selling volatility via covered calls reduces beta quite nicely while stealing only a small portion from total returns.

CBOE

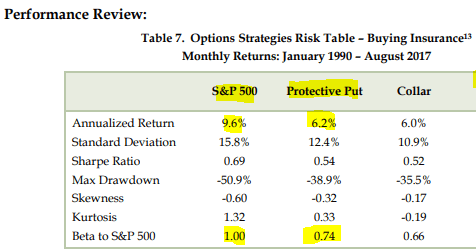

Buying volatility on the other hand, reduces returns quite significantly, while not lowering beta as much.

CBOE

Hence, both funds are on the right side of the strategy at least. While that may sound like a small victory, there are plenty of funds out there, that use volatility purchase or collar strategies. We still have two issues with both these funds that prevents us from going long.

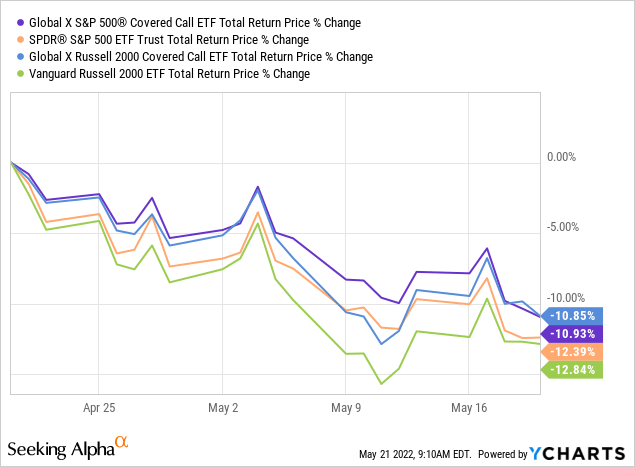

The first is that the downside protection is less than what we like. Both these funds sell options just a month out. This does fine in mild-to-moderate declines but provides poor buffer in larger moves. We don’t have to look to far for this. Just the last one month is enough to make this point.

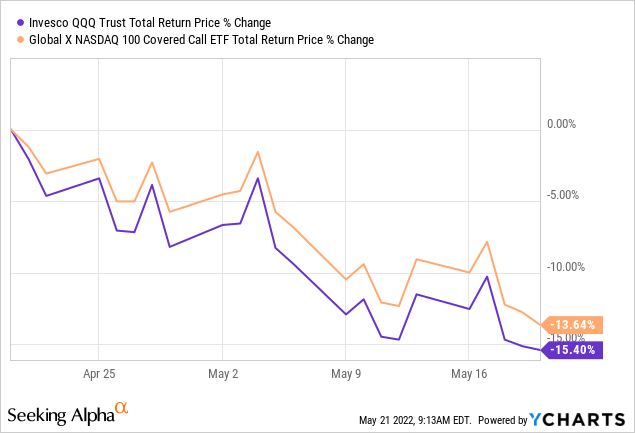

This level of extra protection (RYLD and XYLD did do better) is not sufficient for us when the lost upside in bull markets is generally far larger. We have seen this same pattern with Global X NASDAQ 100 Covered Call ETF (QYLD).

So yeah, this may be ok for some investors, but that level of drawdown is not fun when you give up a lot of upside in bull runs.

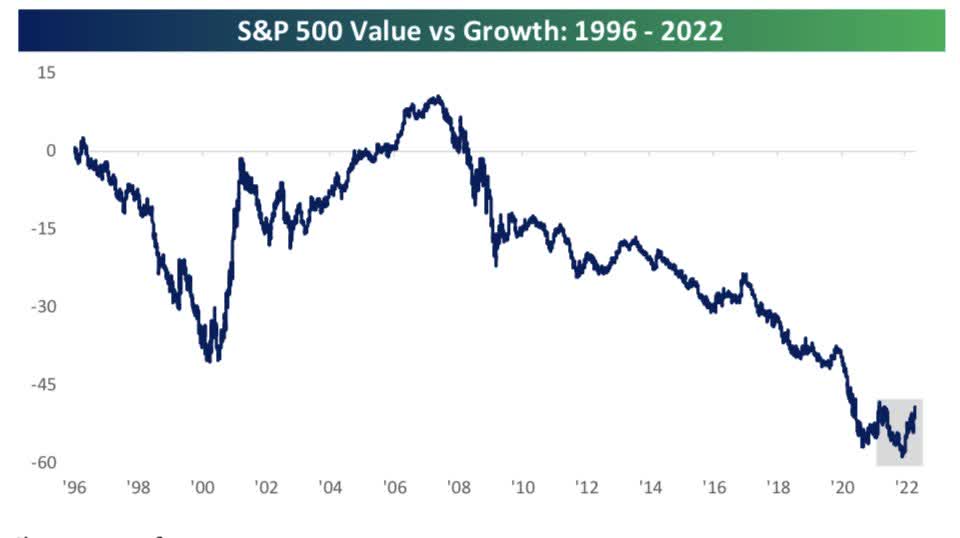

The second reason here is that stocks are incredibly expensive at an index level. Indices are loaded up with “growth” stocks and those are now just in the second innings of their underperformance.

Bespoke Group

In our opinion, when we are done here, we will take out the 2007 peak by a mile and you will have to rescale this chart.

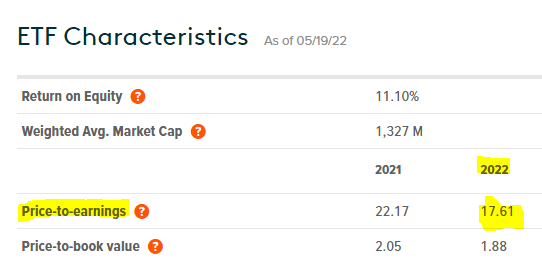

Even stocks that fit the value definition, are not actually “value stocks”. What we mean by that is when you look at metrics like this for RYLD, you might think the valuations are not too bad.

RYLD P/E Ratios (Global X)

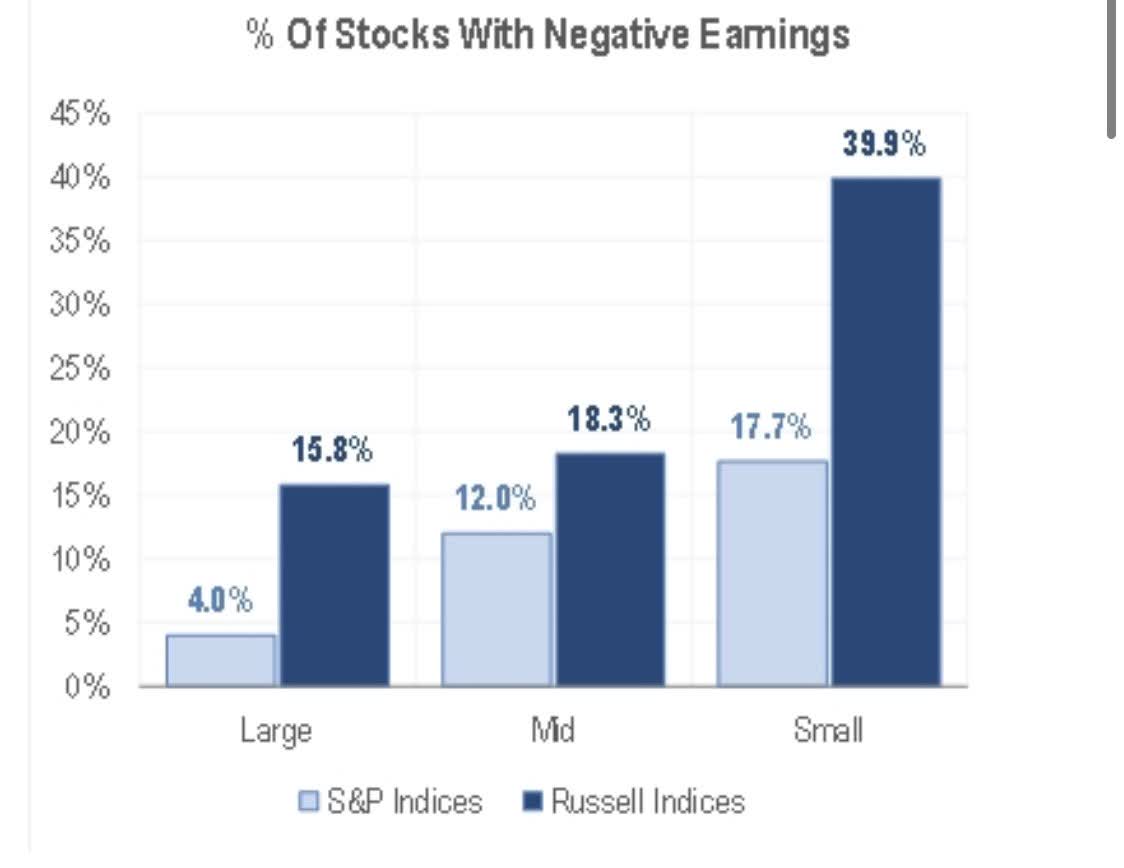

Unfortunately, those are obtained by removing all stocks with negative earnings from the equation. How many of those are there? We are glad you asked.

9 out of 10 investors don’t know that 4 out of 10 stocks in the Russell 2000 index are not making money at present.

Michael Kantrowitz, CFA

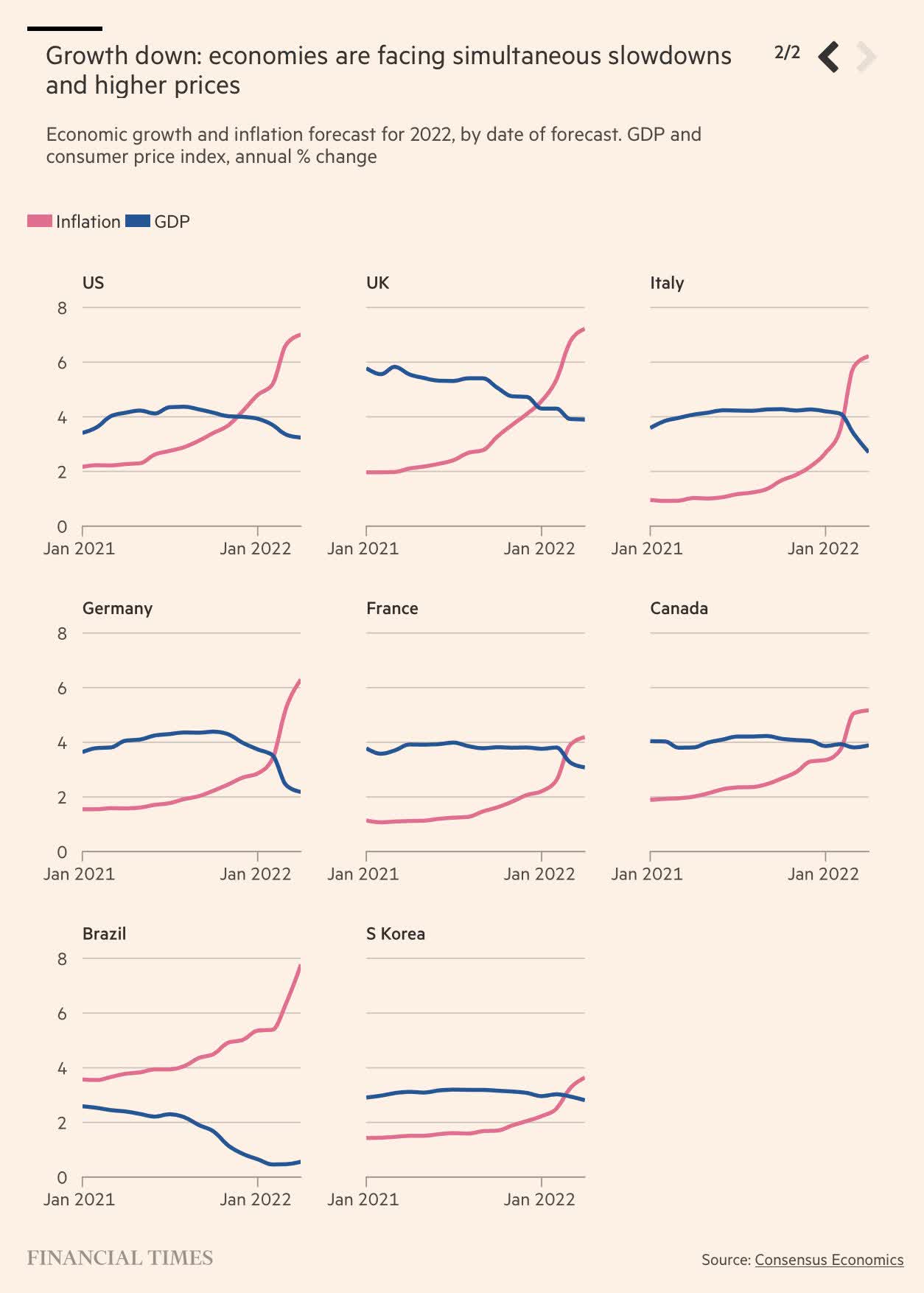

We guarantee this percentage will move up in the current stagflationary environment.

Financial Times

Verdict

Both the above characteristics makes these funds a hard pass for us. That said, the covered call nature makes them relatively more attractive for the outlook we have. We think XYLD should outperform SPY and RYLD should outperform VTWO. RYLD should also outperform iShares Russell 2000 ETF (IWM), an ETF almost identical to VTWO. So, at a relative level, yes, covered calls will offer some protection against the ravages of stagflation and horrible valuations. You have that going for you, which is nice.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

[ad_2]

Source links Google News