[ad_1]

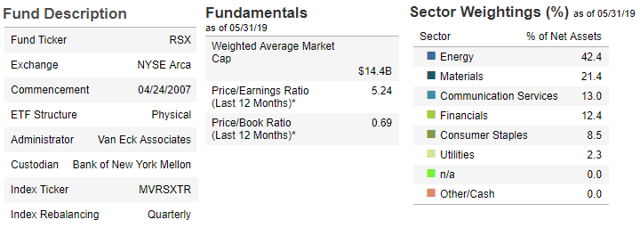

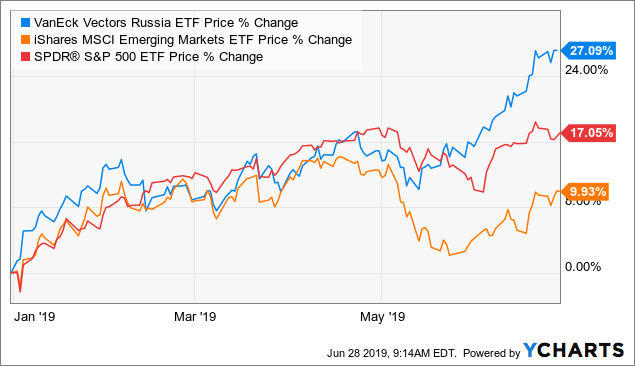

The VanEck Vectors Russia ETF (NYSE:RSX) is the largest Russia country-specific equity exchange-traded fund on a U.S. exchange. Total assets under management at $1.6 billion and average daily trading volume of 8 million shares highlights relatively good liquidity, offering investors exposure to trends and themes in the Russian market. Russian stocks have been hot this year with RSX up 27% year to date in 2019, outperforming the broader emerging markets benchmark, the iShares MSCI Emerging Market ETF (NYSE:EEM), that is up about 10% this year. RSX is benefiting from a strengthening Ruble currency and overall positive sentiment with the economy. This article covers the current macro outlook for Russia and the performance of some of the leading stocks in the group.

RSX ETF daily price chart. Source: FinViz.com

Russia’s Macro Outlook

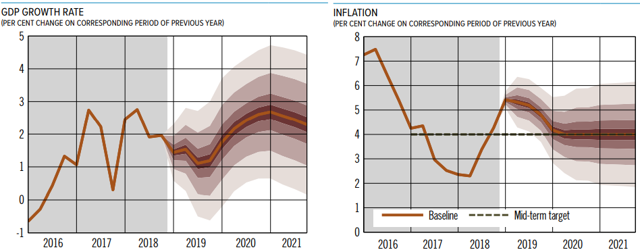

Russia GDP Growth Forecast. Source: Central Bank of Russia Federation

The Central Bank of Russia is forecasting GDP growth between 1% and 1.5% for 2019, down from a stronger 2.3% last year. The apparently tepid forecast is in part based on the increase of the national value-added-tax (“VAT”) from a previous 18% to a new 20% rate. The impact here is seen dragging consumption, although that effect is expected to be transitory. On the other hand, the government intends to use those added proceeds to fund large scale national infrastructure projects among a number of stimulus measures that should support growth going forward. Some of the reforms are aimed at boosting investment demand and an increase in the retirement age for social security and public pensions are seen as supporting the fiscal outlook. For this year, the central bank also sees a slowdown in export growth compared to an exceptionally strong 2018. Looking ahead at 2020-2021, GDP is forecast to rebound above 2% per year driven by positive effect of planned fiscal stimulus measures and structural reforms. The overall economic growth remains moderate but resilient in the context of the current environment. The central bank highlights that a more meaningful upside to the growth trajectory in the near term will require a sustained move in higher energy prices that would boost investment demand.

The inflation outlook is more positive. Consumer prices were reported at 5.1% but are expected to trend lower towards the 4% target level through 2020, driven by four factors.

- A preemptive rate hike in the second half of 2018 is having a lagged effect on credit conditions that are holding down inflationary pressures.

- The implementation of the VAT in January resulted in a short-term pressure on consumer prices but the central bank believes it has “run its course”.

- Current economic slack has limited demand pressures on consumer prices.

- Stronger currency is holding down energy prices in Rubles and inflation from tradable goods.

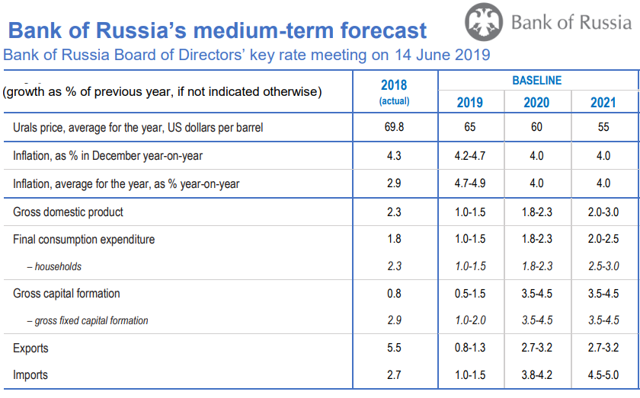

The lower inflation outlook gave room for the central bank to cut the monetary policy rate by 25 bps to 7.5%. Lower interest rates are seen supporting credit demand and growth through monetary easing. The bank issued an update on its macro forecasts through 2021 presented below. A scenario of higher energy prices from the current baseline would result in upside to GDP of approximately 0.2%.

Central Bank Macro Forecasts. Source: Central Bank of Russia Federation

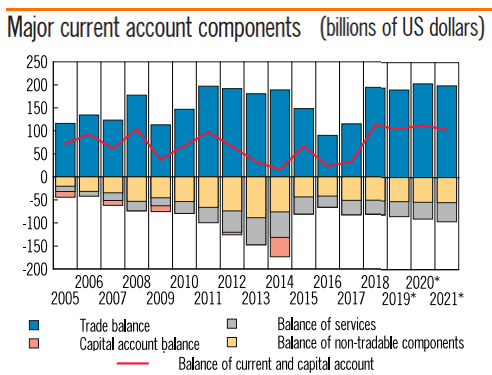

More positive aspects of the current macro outlook include a strong external account position with current account surplus of nearly $100 billion or 6% of GDP. The trade surplus remains near record levels based on elevated oil exports while the expectation is that expanding imports going forward would moderate the current account surplus to 3% of GDP by 2021.

Russia Current Account. Source: Central Bank of Russia Federation

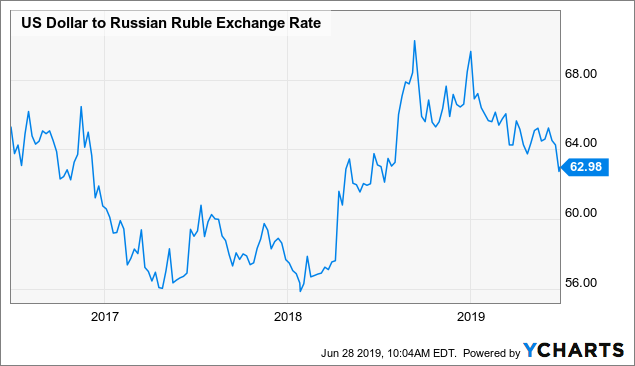

Separately, a fiscal budget surplus ending 2018 at 2.8% is a strength for the Russian macro outlook, limiting external vulnerabilities. This was achieved by a combination of not only higher oil related revenues but also a surge in non-oil revenues, up 15% for the year. This is the highest result since 2007. The Russian government has made impressive efforts at fiscal accountability through relative austerity measures. Here a combination of stable inflation dynamics, a strong external account position, and fiscal account surplus are among the key drivers of the Russian Ruble currency against the U.S. Dollar. The Ruble has appreciated about 10% YTD in 2019.

Data by YCharts

Data by YChartsETF Analysis

The outperformance of RSX this year can largely be explained by the combination of the resilient macro outlook, and the stronger Ruble currency. The VanEck Vectors Russia ETF has a 42.4% weighting in the energy sector that has benefited from higher energy price, particularly compared to the depressed levels from where oil ended in 2018. The exchange-traded fund has 28 equity holdings and the concentration among energy and material sector stocks is a weakness while other sectors have more exposure to local trends in the economy. The stated P/E ratio for the ETF is published by VanEck at 5.2x, although this level is skewed by the larger number of energy, materials, and financial sector firms that typically present lower multiples.

RSX ETF Key Stats. Source: VanEck

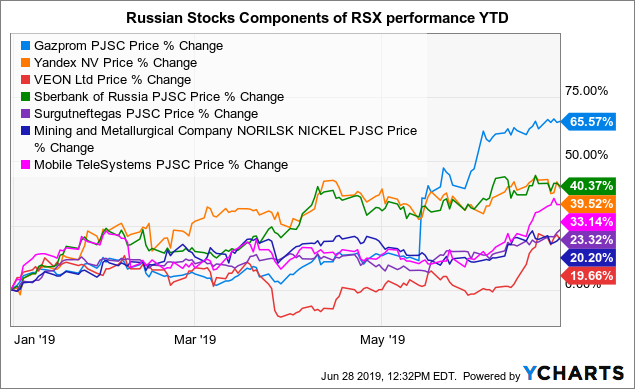

Among Russian ADR shares that are underlying components of the VanEck Vectors Russia ETF, Gazprom PJSC (OTCPK:OGZPY) has been a big winner, up 65.6% YTD. The state controlled energy producer has benefited from higher sales and export volumes. It’s worth pointing out that Gazprom revenues from the domestic Russian market between gas and electricity represent approximately 50% of the total so the company does have exposure to local domestic trends in demand and is not simply an exporter. Gazprom announced a new dividend policy along with a management shakeup that was well received among shareholders. Gazprom has a 7.88% weighting in the ETF so the strength in RSX is more widespread among the positive domestic themes.

Data by YCharts

Data by YChartsState controlled bank Sberbank of Russia PJSC (OTCPK:SBRCY) has also performed well, up 40% this year. The bank is the largest holding in RSX with a weighting at 7.9%. Here the story has been the combination of improved domestic growth and macro outlook along with better sentiment. In recent years, U.S. sanctions on Russia targeting the financial system as a response to the annexation of Crimea region of Ukraine along with negative headlines based around the 2016 U.S. election drove otherwise poor sentiment and a pullback of investment flows. Fast forward to today and many of the most pessimistic or bearish scenarios have largely been dismissed.

RSX Top 10 Holdings. source: Seeking Alpha

Forward Looking Commentary and Conclusion

I believe the Ruble has more room to climb against the U.S. Dollar which is supportive to Russian stocks and the RSX ETF in particular. The combination of the positive macro outlook for the Russian economy and rising commodity prices sets up a continued outperformance for the Russian market. Monitoring points going forward should nevertheless be the global growth outlook and energy prices, particularly as they impact the major holdings of the ETF. Valuations among some of the stocks still present a discount relative to developed markets, highlighting still potential value here. RSX is also worth considering as an income play as the ETF has a dividend yield of 4% over the past year.

Data by YCharts

Data by YCharts

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News