[ad_1]

TomasSereda/iStock via Getty Images

The recent rally in gold mining stocks suggests they are no longer cheap relative to the current gold price, even after the gold price itself has risen. With this in mind I have scaled back my position in the iShares MSCI Global Gold Miners ETF (NASDAQ:NASDAQ:RING). I continue to expect long-term outperformance relative to the broader market, and remain long, but the risk-reward outlook has deteriorated in recent weeks, particularly relative to international equity benchmarks.

The RING ETF

The RING ETF provides exposure to gold mining companies, as classified by GICS, from developed and emerging markets. A minimum of at least 30 securities that do not hedge to gold prices are selected from the MSCI ACWI Investable Market Index. Compared to the VanEck Gold Miners ETF (GDX), RING has a slightly higher weighting of the two major components Newmont and Barrick, and therefore a lower weighting of smaller companies, making the ETF slightly less volatile. However, after a 25% rally from its September lows, and with the underlying index market cap close to all-time highs. now seems like a good time to pare back some exposure to the ETF.

Miners No Longer Cheap Relative To Gold

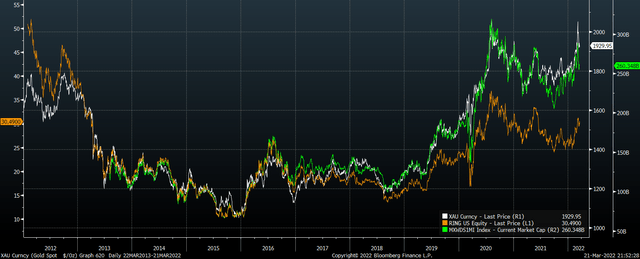

When looking at the long-term chart of the performance of RING relative to the price of gold, one would be forgiven for believing that the miners are significantly overvalued relative to the metal. The chart below, for instance, suggests that RING should be trading around a third higher based on the correlation seen over the past decade.

XAU, RING ETF, and MSCI World Gold Miners Market Cap (Bloomberg)

However, what the ETF does not take into account is the huge increase in share issuance in the underlying MSCI Global Gold Miners index, which has seen its market capitalization increase by 50% more than its price over the past decade. When taking this into account, the picture changes significantly making RING no longer undervalued at all relative to the gold price.

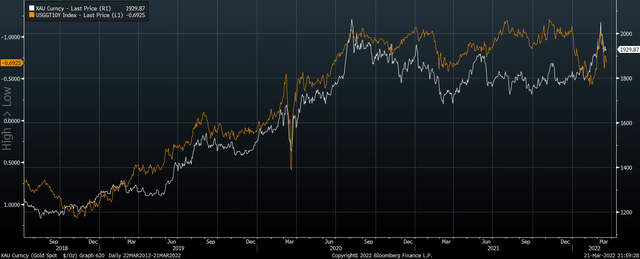

An additional reason for some caution regarding RING is the overbought nature of gold prices currently. As I argued in Gold: Staying Long Despite Short-Term Downside Risks, rising geopolitical risk and the surge in the commodity complex have left gold prices overextended relative to their most important short-term driver; real bond yields. As the chart below shows, despite a surge in inflation expectations over the past month, the rise in nominal bond yields has left real bond yields largely unchanged, suggesting there maybe some short-term headwinds for the metal.

Gold Vs 10-Year Inflation Linked Bond (inverted) (Bloomberg)

A drop in the price of gold would lead to a much larger drop in gold mining stocks if history is any guide, particularly with oil prices – a major cost to the sector – likely to remain elevated (see VDE: Still Relatively Cheap Despite The Russia Rally)

Miners No Longer Cheap Relative To Broader Market

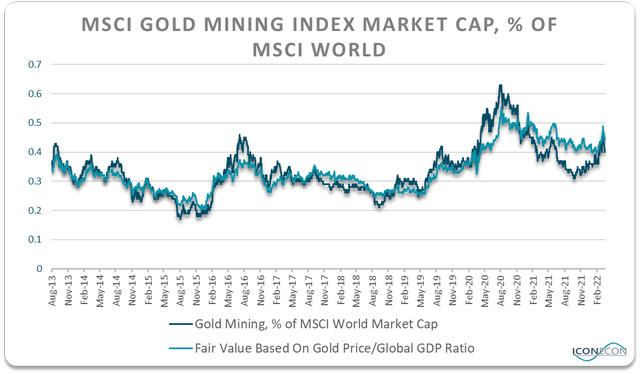

An additional reason to suggest a shift away from mining stocks is that they have outperformed non-mining stocks to a significant degree, meaning that at current gold prices the mining sector is no longer particularly attractive.

This can be seen on the chart below which shows the market capitalization of the MSCI Global Gold Miners index as a share of the MSCI World versus its fair value based on the ratio of gold prices to global GDP. At the September 2021 lows, gold miners were trading around 25% below this measure of fair value, but the combination of rising gold mining prices and declining global stock prices has closed this gap to less than 10%.

Bloomberg, Author’s calculations

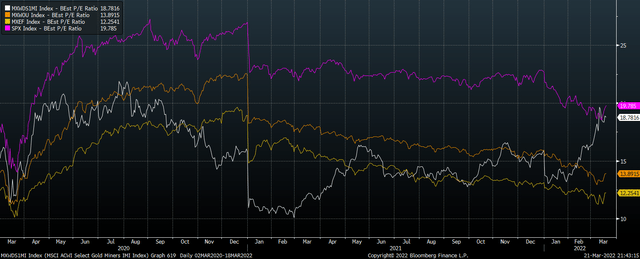

Considering that the MSCI World is dominated by the U.S., which has fared much better than global markets during the recent selloff, this suggests that gold miners are not cheap at all relative to international non-mining stocks. This can be seen in the chart below, which shows forward price/earnings ratios of the MSCI Global Gold Miners index versus the MSCI US, the MSCI World Ex-US, and the MSCI EM.

While the mining sector remains slightly cheaper than the U.S. market on this measure, it is significantly more expensive than developed international stocks as well as emerging stocks. From a risk-reward perspective, therefore, I believe that the outlook for RING and gold mining stocks in general has deteriorated over recent months.

Forward PE Ratios (Bloomberg)

[ad_2]

Source links Google News